May was a remarkably challenging month for that cryptocurrency market since most of tokens booked heavy losses like a bear market was confirmed, although not every project dropped to pre-bull market lows.

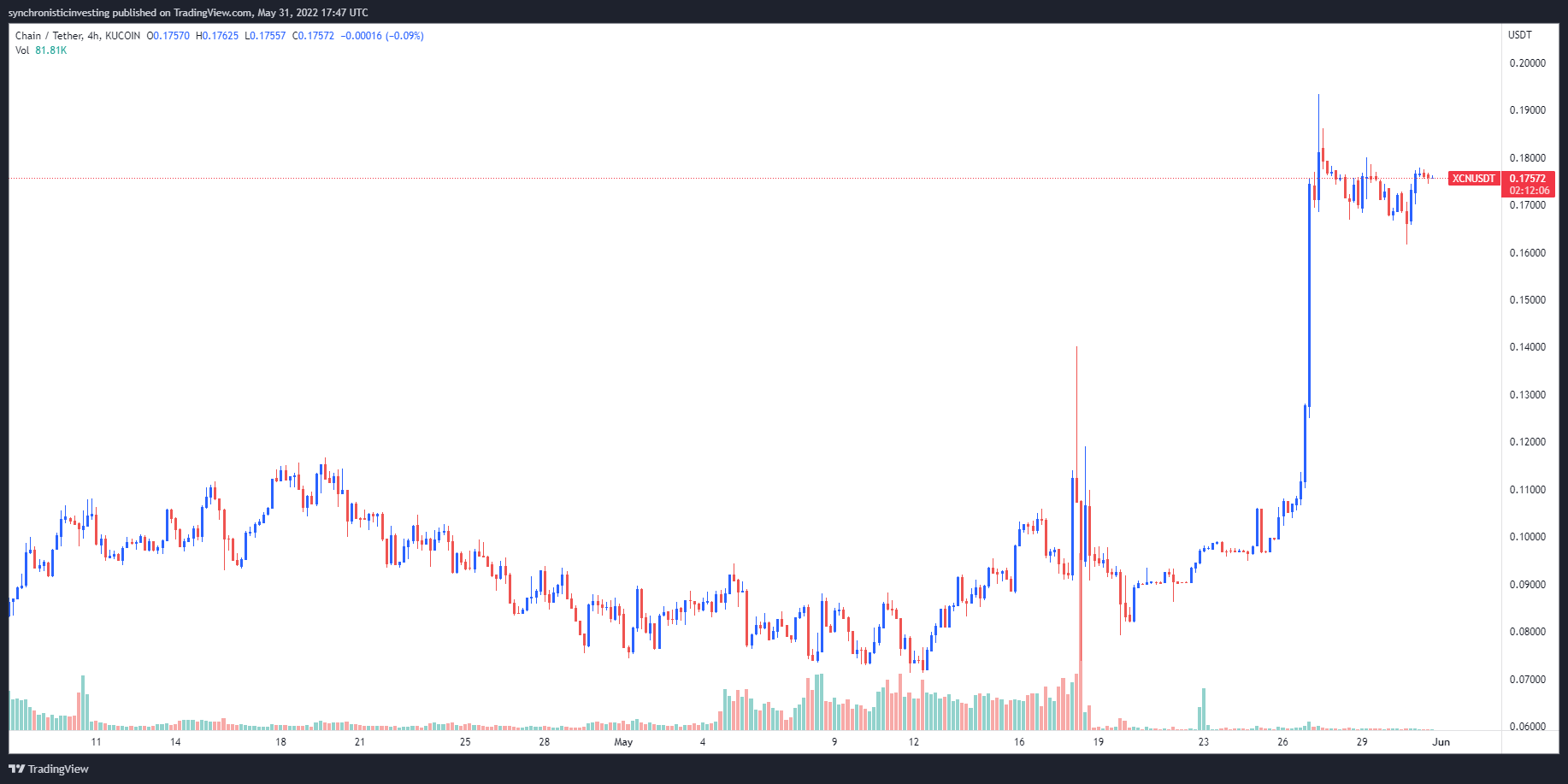

Chain (XCN), a protocol made to help organizations launch their very own blockchain network or interact with various other established systems, has were able to rally greater than 120% since May 19.

Data from Cointelegraph Markets Pro and TradingView implies that since hitting a minimal of $.0712 on May 11, XCN has reversed course hitting an archive-high at $.176 on May 31.

The 3 causes of the strong showing from XCN are multiple exchange listings, launching on BNB Chain and several notable partnerships, together with a lengthy-standing collaboration using the Stellar Foundation.

Exchange listings power up the amount

In March 2022, Chain deployed a brand new smart agreement for its token and rebranded from CHN to XCN. Following a rebrand, XCN for auction on KuCoin and subsequent listings on Huobi, Gate.io, Bitrue and Hotbit were supported by sharp upticks in buying and selling volume.

Some of the supporting exchanges also have launched perpetual contracts for that XCN token, including Gate.io, Huobi, Bybit and Poloniex, that has helped generate elevated awareness for that project and initially brought to some spike in buying and selling volume.

XCN can also be a part of a mix-chain integration with BNB Chain, which helps affordable token transfers and buying and selling on PancakeSwap, where holders can earn yield for supplying liquidity towards the exchange.

Following a integration with BNB Chain, the cost of XCN rallied from $.0712 on May 11 to $.14 within the in a few days.

Related: BNB Chain releases year-lengthy technical roadmap to build up ecosystem

Notable partnerships

Since 2014, Chain has already established several notable partnerships and funding models, including a preliminary fundraise well over $40 million from Khosla Ventures, Pantera Capital, Capital One, Citigroup, Fiserv, Nasdaq, Orange and Visa.

In 2018, the work was acquired and grew to become area of the commercial arm from the Stellar Foundation referred to as Interstellar. Chain was reacquired in 2020 included in a ledger-as-a-service platform known as Sequence.

It’s possible the current developments using the Stellar protocol, including its partnership with MoneyGram to produce a stablecoin-based platform for the money transfers, might have results around the cost of XCN because of their partners.

In April 2022, Chain also announced a proper partnership with Alameda Research, which established the non-public equity and quantitative cryptocurrency buying and selling firm as Chain’s primary market maker. While none of those partnerships seems significant enough to describe XCN’s current gains, it’s notable the altcoin’s cost action has diverged in the wider crypto marketplace for nearly a whole month.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.