Cred Protocol, a decentralized credit rating startup has unveiled the outcomes of their first automated credit rating system for users of decentralized finance (DeFi).

Cred Protocol Chief executive officer Julian Gay outlined the produces a Twitter thread, which demonstrated how Cred effectively utilized past transaction behavior around the Aave protocol to evaluate the creditworthiness of future borrowers according to on-chain behavior within the DeFi space.

1/ During the last couple of several weeks, we have been trying to build among the first credit ratings for DeFi.

Today, we are excited to talk about the outcomes in our first credit rating using the world!

Find out more below

— Julian Gay (@juliangay) This summer 14, 2022

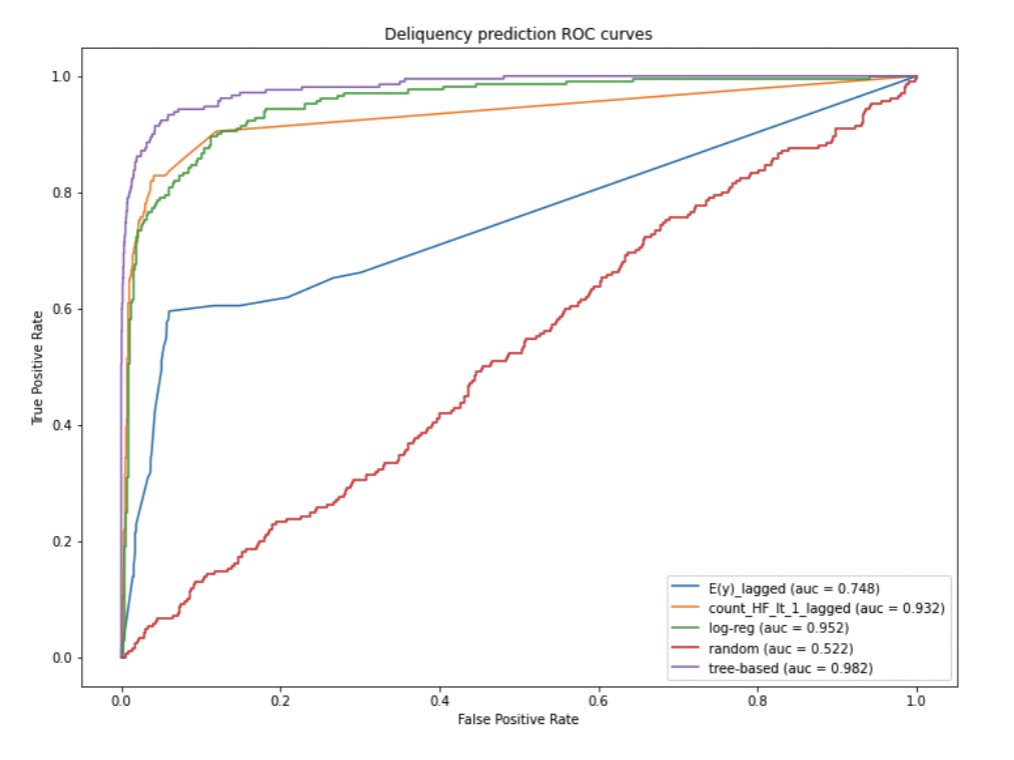

By utilizing machine understanding how to assess time-based account attributes and evaluate the user’s past transaction behavior, Cred Protocol generates any adverse health factor score that predicts the probability of future liquidation for any single address, which, based on Gay, was among the most powerful baseline creditworthiness predictors.

Cred Protocol states make decentralized finance readily available around the world by applying reliable credit ratings that will see “anyone by having an internet connection” and “a good financial reputation” get access to loans.

Where borrowers and lenders get their loan worthiness assessed with a central authority like a credit agency, DeFi assists you to run financial services having a peer-to-peer (P2P) system, eliminating the thought of a middleman or central authority.

Prominent DeFi investigator Chris Blec elevated concerns that the customer could use multiple Ethereum addresses to skirt credit rating — that Gay responded that the potential solution is at Beta.

Therefore it is just a fico score for your 1 Ethereum address? Let’s say someone uses 10 different addresses?

— Chris Blec (@ChrisBlec) This summer 15, 2022

Cred Protocol is really a small nine-person team resides in Bay Area with a lot more “hubs” in New You are able to and London. However, Gay states he aims to create DeFi technology to several billion people.

Inside a Medium publish, Cred outlined its intends to grow in the Aave protocol and expand its data analysis with other lending protocols like Compound and MakerDAO.

2 yrs ago, blockchain lending protocol Teller elevated $a million inside a seed funding round to include traditional credit ratings into DeFi.

Related: Decentralized credit ratings: Just how can blockchain tech change ratings

In November 2021, Credit DeFi Alliance (CreDA) formally launched a credit score service that will determine a user’s creditworthiness with data from multiple blockchains. CreDA was created to operate while using CreDA Oracle by evaluating records of past transactions transported by the user across several blockchains with the aid of artificial intelligence (AI).

Lately, P2P lending protocol RociFi labs concluded a seed funding of $2.seven million together with asset management firm GoldenTree, that is geared toward expanding on-chain credit scores for decentralized finance.