What we should have today when it comes to Web3 gaming isn’t working. Play-to-earn hasn’t labored nor will have-to-earn or any X-to/and-earn. On the top of this, traditional gamers view nonfungible tokens (NFTs) with suspicion. They dunk on costly apes and therefore are skeptical of huge game publishers using the lipstick of NFTs for more monetization.

Nobody knows exactly what a effective Web3 game may be like yet. To obtain there, we want more developers to test out more models. We want infrastructure which will lower the barriers to Web3 game development and allow developers to experiment. That is why it’s imperative to purchase developing the actual infrastructure instead of getting transported away through the speculative hype.

The Web3 gaming infrastructure could be damaged into two phases:

- Pre-release: Infrastructure for pre-game launch

- Publish-release: Infrastructure for publish-game launch.

Across both development phases, Web3 gaming needs technical infrastructure (blockchains, analytics and toolings), financial infrastructure (marketplaces and launchpads) along with a third category that cuts across both kinds of infrastructure, for example metaverse platforms and guilds.

Navigating the mint in pre-release development

Game developers have a diverse range of options to select from when deciding how and where to mint the game’s NFTs. Specialized gaming blockchains for example ImmutableX and Klaytn offer low-to-no gas charges and throughput.

Many games will also be establishing their very own blockchains to savor maximum versatility and scalability. Axie Infinity launched the Ronin sidechain, and DeFi Kingdoms comes with an Avalanche subnet known as DFK Chain. However, launching a completely independent chain isn’t technically simple.

Emerging players like Saga are attempting to capture this latest demand by providing a simplified experience for developers trying to launch their very own chains.

Later on, besides building out their very own chains, Web3 game developers will choose the easiest knowledge about full-stack Web2.5 integrators that merely offer SDK and API toolkits. Forte, Stardust and Particle Network are types of full-stack infrastructure suppliers that focus on the developer experience.

Inflationary tokenomics are on its way out

Web3 games can finance the first development by pre-selling in-game tokens and game assets. We’ve observed the fall and rise from the inflationary token economic model.

Continuing to move forward, selling tokens and game assets, especially individuals with equity-like governance and possession features, will end up more selective. Projects will whitelist or prioritize clients who are players or significant contributors for example content creators, infrastructure providers and community managers.

Social engagement mechanisms must increase

Infrastructure for Web3 gaming growth and engagement is within a difficult chicken-and-egg situation since the traction continues to be relatively low, which is a result of the possible lack of compelling games.

But when a couple of Web3 games hit critical mass, the network effects from identity data will enable these platforms to bootstrap and with each other innovate faster.

Related: GameFi developers might be facing big fines and difficult time

Besides the insufficient compelling games, familiar aspects for example reviews and social features are missing from Web3 games. There’s huge room for competition and innovation as users can certainly port to new entrants without losing their assets.

Unlocking asset (NFT) utility

Web3 games generally share value capture using their players and community. Rather of purchasing from the sport creators, players can earn or purchase in-game assets and currency from each other, developing a player economy.

For mature Web3 gaming economies, productive digital assets become a beautiful supply of yield through rental, loans or staking. Actually, effective games might even choose to capture their very own financial layer by creating in-house substitutes, given how lucrative it may be, as with the situation of Axie Infinity’s marketplace or StepN’s new decentralized exchange.

Guilds and metaverse platforms

Lastly, you will find guilds and metaverse platforms that provide the games funding, integrations and partnerships. They’re inside a good position to get points of interest for Web3 gaming, like major publishers and distributors in traditional gaming. The important difference would be that the players and creators can own significant stakes and lead via governance through decentralized autonomous organizations.

The Sandbox and Decentraland would be the leading metaverse platforms. But each of them require creators to buy land upfront, so lots of land was offered to speculators who don’t lead anything significant towards the ecosystem. Going for a different approach is Mona, that is free for creators upfront until an area is minted and offered.

Related: Prepare for the feds to begin indicting NFT traders

Meanwhile, Web3 gaming guilds for example Yield Guild Games and Merit Circle have on-boarded a large number of players to assist support approaching games, most particularly, Axie Infinity.

The guilds are compelled to distinguish themselves among growing competition. Snack Club, for instance, taps into Brazil’s largest esports and gaming lifestyle group Loud, with 300 million supporters. Jambo is building an African super-application which includes telco services and decentralized finance alongside gaming.

Games play an important role within our lives and also have lengthy been a frontier of human experimentation. What we’ve observed in Web3 gaming to date belongs to that experimentation. Unquestionably, the pitfalls are lots of.

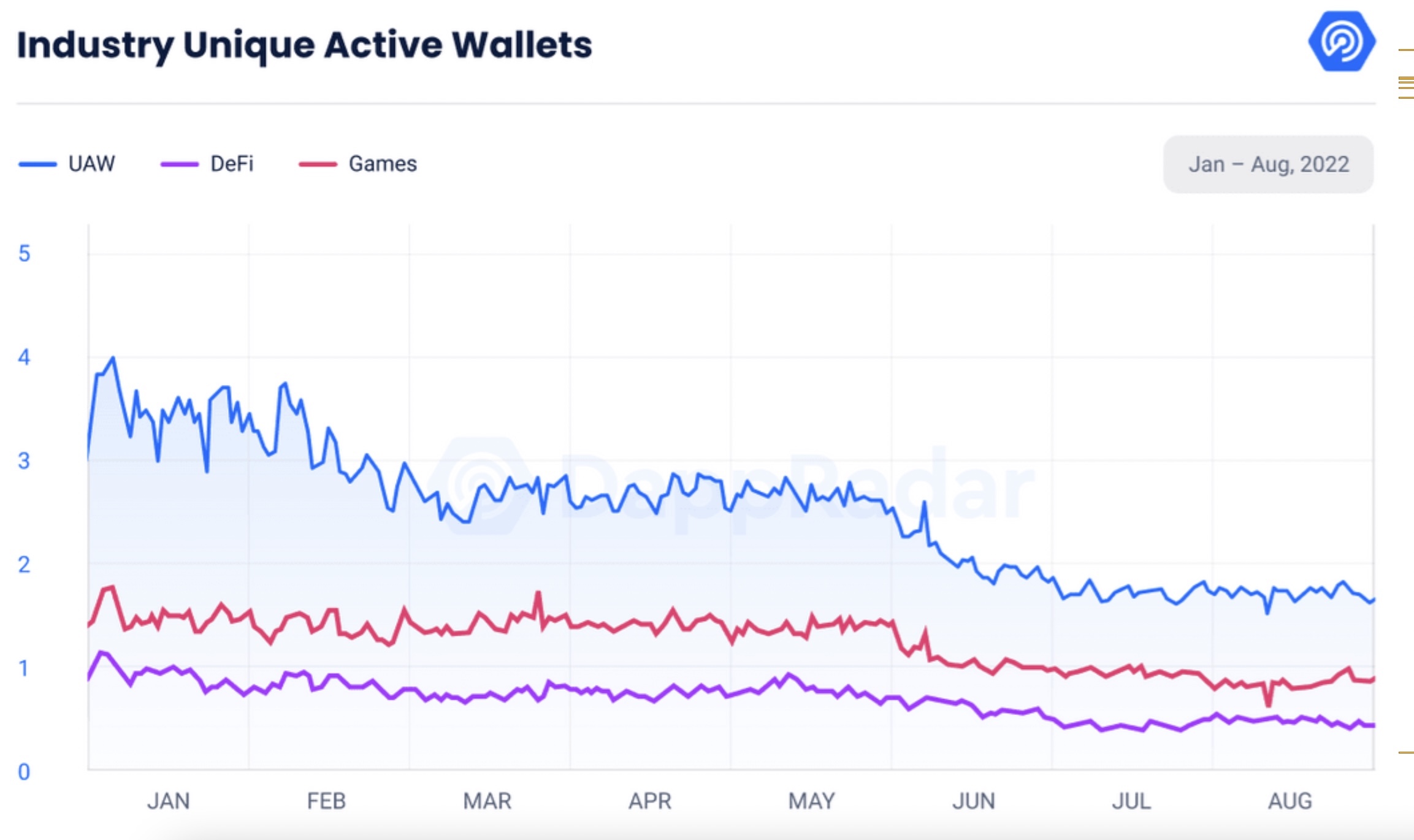

Most iterations of Web3 game financial aspects today are problematic because everyone assumes they’ll earn money doing offers. That isn’t how economies work. So, don’t forget confuse speculative hype, that is volatile and unpredictable, with actual adoption and retention.

Shi Khai Wei may be the general partner and chief operations officer of LongHash Ventures, a Web3-focused venture fund and accelerator. In 2021, Shi Khai was awarded Forbes 30 Under 30 in recognition of his achievements. He was formerly an administration consultant at McKinsey & Company, having a concentrate on digital transformation and analytics over the financial and telecommunications sector in Southeast Asia.

Saga, Particle Network, Mona, and Jumbo — pointed out within this piece — are LongHash portfolio companies. This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations. The views, ideas, and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.