Crypto capital markets platform Walnut Finance has expanded support towards the Solana blockchain and it has deployed a $45 million fund to spur ecosystem growth.

Walnut provides undercollateralized loans for institutional borrowers on Ethereum (ETH) and today Solana (SOL) from the 3 pool delegates. The work mentioned within an Apr. 25 blog publish it has “originated over $1.2 billion in loans and presently count over $900 million in TVL towards the platform.”

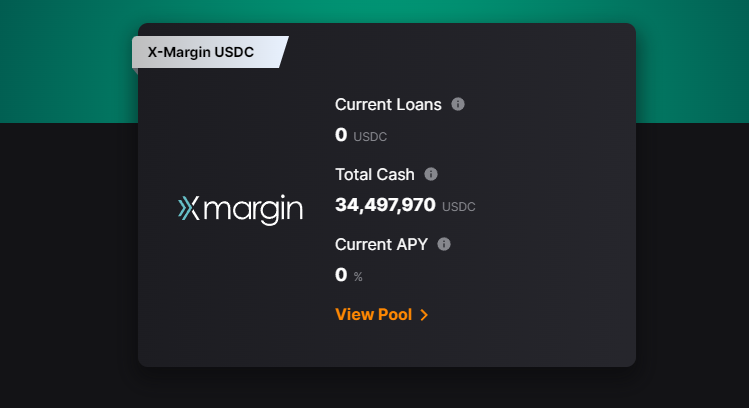

The ecosystem fund premiered together with decentralized finance (DeFi) lending platform X-Margin, with capital being supplied by USD Gold coin (USDC) issuer Circle, digital asset manager CoinShares and many unnamed projects indigenous to Solana.

Walnut SOLANA Has Become LIVE.

With partners @xmargintrading @circlepay @CoinSharesCo and Solana natives, starting with $45M to issue uncollateralized towards the thriving @solana ecosystem.

By EOY we’ll grow this pool to $300M, and issue $1BN loans through Walnut Solana. pic.twitter.com/RTNuk3eV3A

— Walnut Solana & Ethereum (@maplefinance) April 25, 2022

Maple’s goal because of its Solana arm (Walnut Solana) would be to “bring Maple’s on-chain capital-market infrastructure to scale the Solana ecosystem” and address financing needs around the network.

Walnut is expecting the proceed to immediately drive strong activity on Solana, using the mind of Walnut Solana Quinn Craig outlining that:

“Over the following three several weeks, we predict to create over $300 million of liquidity to Solana. We’ll soon welcome another credit-expert towards the platform, and share more information on how liquidity protocols happen to be using Maple’s infrastructure like a launchpad onto Solana.”

Supplying an additional update the very next day, Craig also tweeted that Walnut promises to launch a permissioned pool and also to allow protocols, decentralized autonomous organizations (DAOs), and real-world entities to gain access to funds through the finish of 2022.

Walnut Solana may also issue the SYRUP governance token in 2022, which is similar to Maple’s MPL governance token on Ethereum.

X-Margin can serve as the very first pool delegate on Walnut Solana. The swimming pool presently has $34 million as a whole cash, but there aren’t any active loans and deposits aren’t yet generating interest. Through the finish of 2022, X-Margin expects the swimming pool to manage $300 million.

Institutions might find appeal in Maple’s platform since it conforms with needed know-your-customer/anti-money washing (KYC-AML) standards, like merely a couple of DeFi lending protocols.

Platforms for example Celsius (CEL) requires users to submit KYC information and is a pool delegate on Maple’s Ethereum application since February. Lending protocol AAVE (AAVE) launched its permissioned Aave Arc pool in The month of january which requires users to submit KYC information.

Related: The numerous layers of crypto staking within the DeFi ecosystem