It’s been an unpredictable yet positive week for cryptocurrencies, as traders overlooked the warnings from crypto winter veterans there was more downside available and leaped into the market in the first manifestation of rising prices.

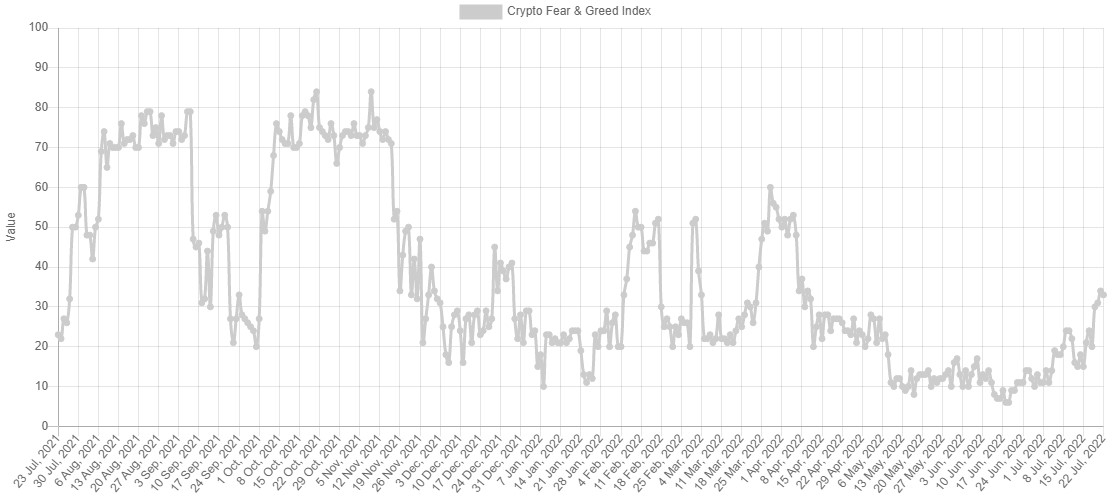

Evidence for that reversal in sentiment could be found within the Crypto Fear & Avarice Index, that has rose in to the fear zone after working an archive amount of time in the ultimate fear territory because of collapsing prices in May and June.

For what sparked the rally from extreme fear, a closer inspection in the timeline suggests the announcement from the expected date for that Ethereum Merge, which came on This summer 15.

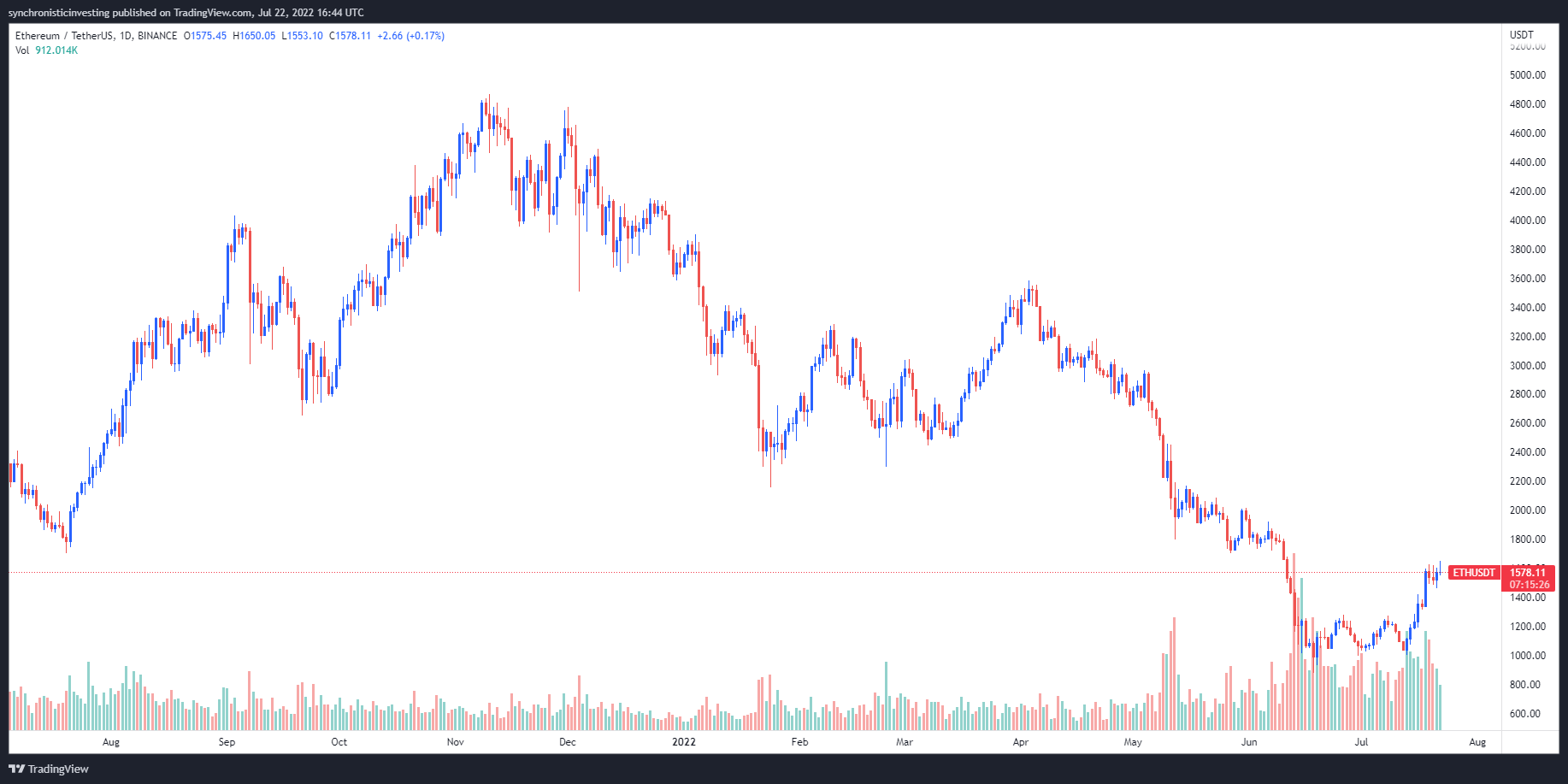

Data from Cointelegraph Markets Pro and TradingView implies that, following a Merge date thought, the cost of Ether (ETH) has rose 38.5% from $1,190 to some daily a lot of $1,650 on This summer 22 among a general eco-friendly day on the market.

Combined with the climbing cost of Ether, the entire cryptocurrency market capital has elevated 15% in the last week to the current worth of $1.051 trillion.

Ethereum-connected projects obtain a boost

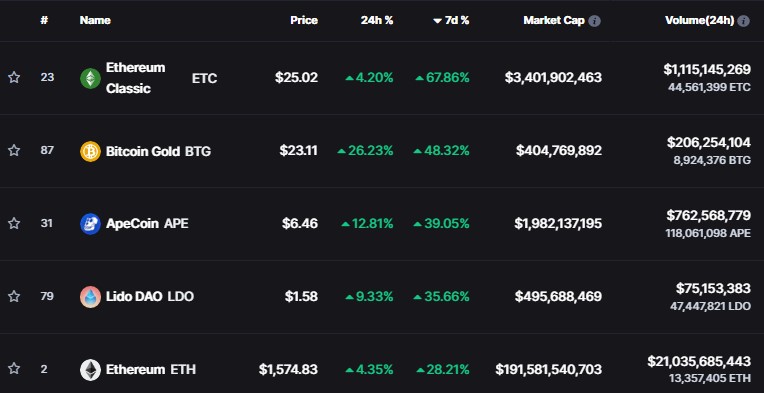

Further evidence the excitement around Ethereum’s transition to proof-of-stake (PoS) is what’s fueling the rally are available by searching at the very top gainers in the last week, including multiple projects connected using the leading smart contract protocol.

As Ethereum switches to PoS, the vast mining network that presently safeguards the network is going to be orphaned and looking for a brand new chain to mine.

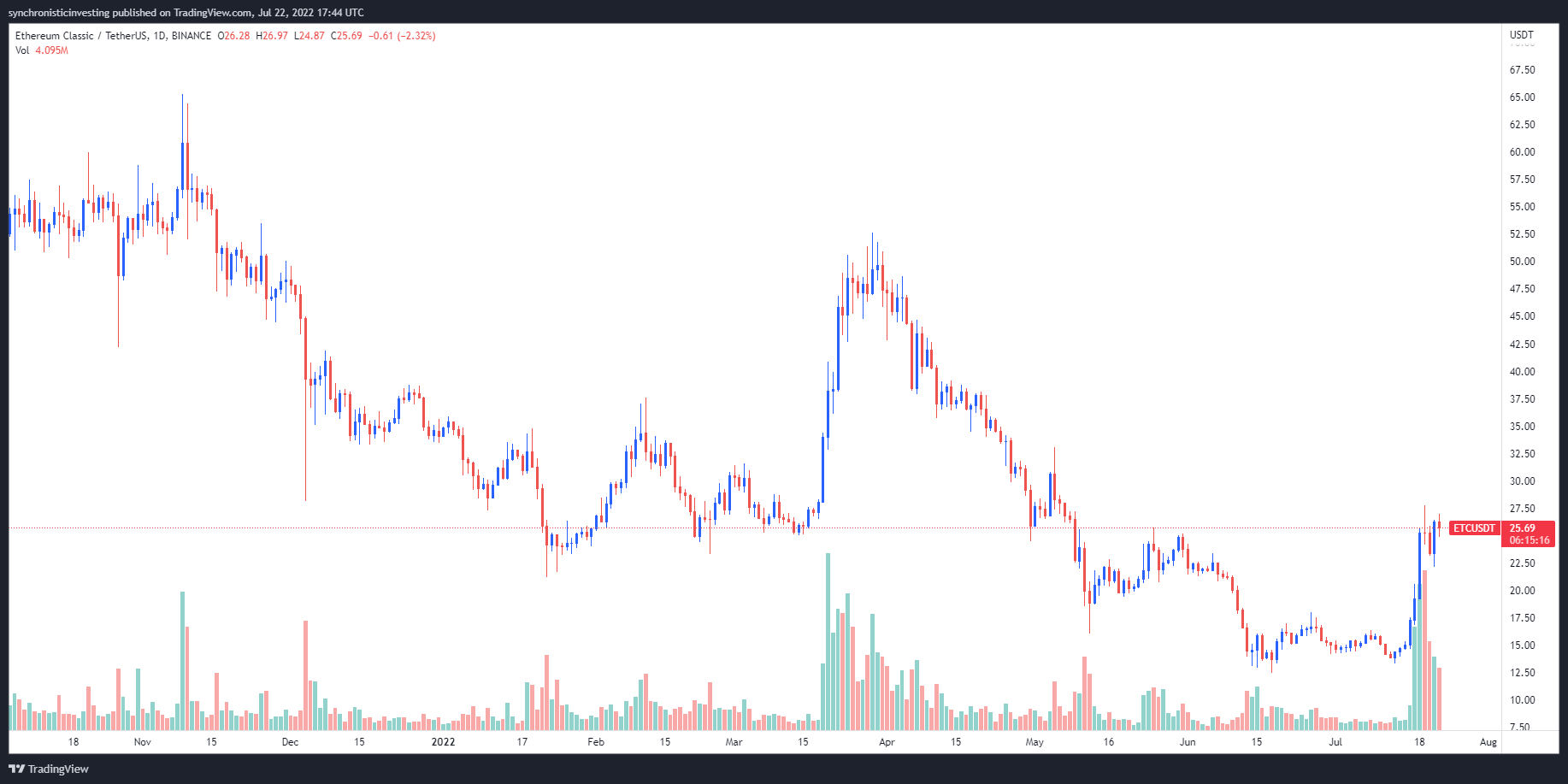

Ethereum Classic (ETC) is among the best options when it comes to network design and compatibility becasue it is technically the original Ethereum proof-of-work chain.

The ETC cost has acquired 100% in the last nine days, suggesting that there’s a sizable contingent of traders who also anticipate a miner migration to Ethereum Classic, that could bode well for that tokens cost within the lengthy term.

Related: Bitcoin wobbles on Wall Street open as Ethereum hits $1.6K in 6-week high

Liquid staking regains its mojo

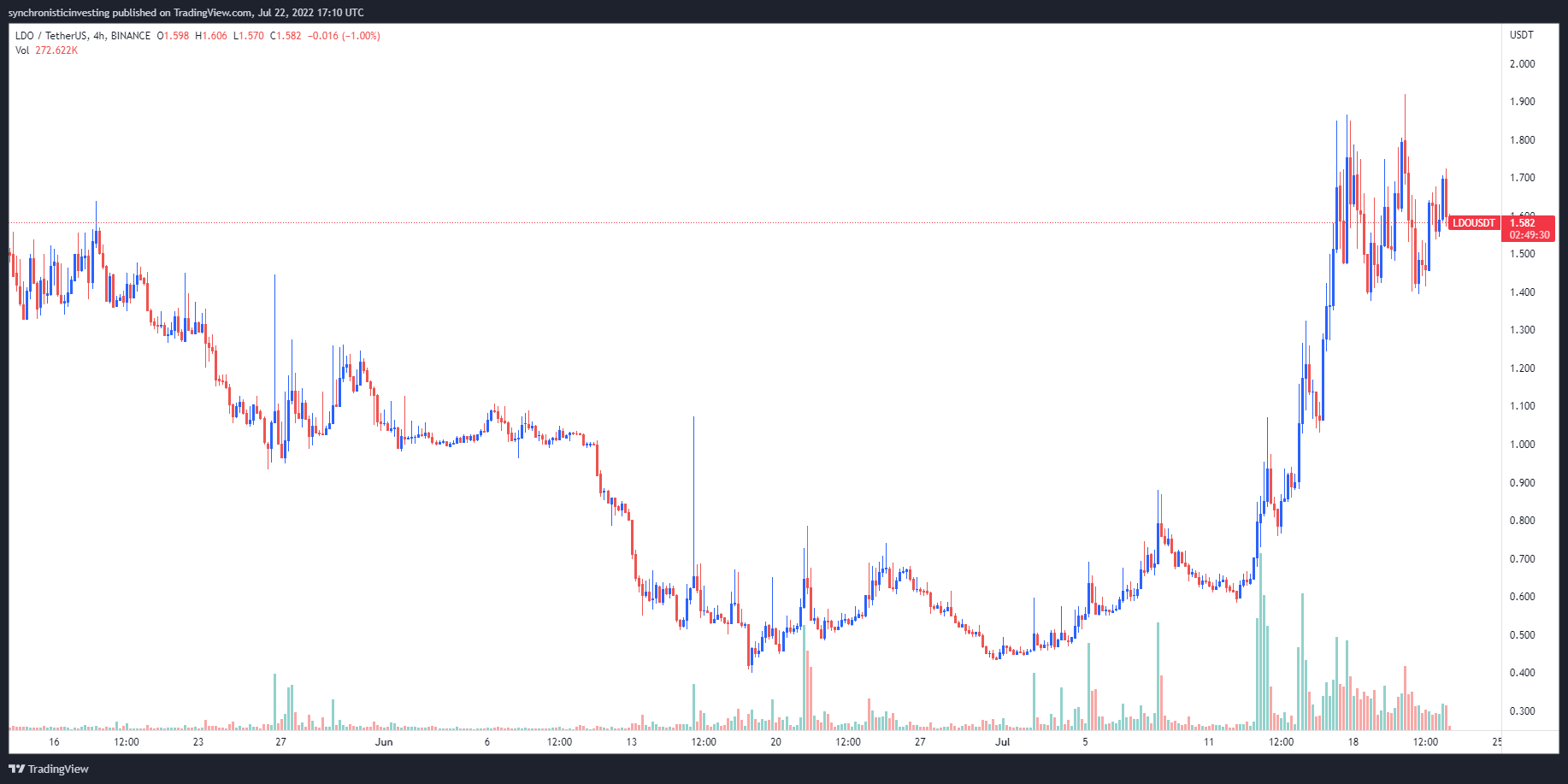

Another notable gainer taking advantage of Ethereum-related developments is Lido DAO (LDO), a liquid staking platform that enables depositors to stake their Ether in return for stETH, that is a one-for-one representation you can use as collateral in decentralized finance.

Data from Cointelegraph Markets Pro and TradingView implies that, because the Merge data was revealed, the cost of LDO has rallied 80% from $.885 to the current cost of $1.59 after briefly spiking to some a lot of $1.92 on This summer 20.

On the top from the momentum acquired from the connection to the Ethereum Merge, the cost of LDO has additionally taken advantage of adding support for other protocols like Solana (SOL) and Polkadot (Us dot), along with its expansion to layer-2 protocols.

Lido is launching stETH on Layer 2 ️

Ethereum is scaling, and thus is Lido.

Lido stakers will quickly have the ability to use their stETH assets in DeFi on Layer 2.

On it here: https://t.co/QCsQry4V41

— Lido (@LidoFinance) This summer 18, 2022

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.