Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

Decentralized applications, or DApps, finally demonstrated a glimmer of recovery in August because the daily average of unique active wallets rose by 3.7% when compared with May.

With only within week left for that Merge, SEBA Bank has opened up Ethereum staking services for institutions. On the other hand, layer-2 scalability solutions are hopeful of visiting a significant decline in their carbon emissions publish Merge.

Earlier this week, two DeFi protocols grew to become victims of coordinated flash loan attacks. On Wednesday, Avalanche-based lending protocol Nereus Finance grew to become the victim of the crafty hack that saw a person internet $371,000 price of USD Gold coin (USDC) utilizing a smart contract exploit. In the morning, on Thursday, New Free DAO, a nonfungible token- (NFT)-focused project, lost nearly $1.25 million in another similar flash loan attack.

Top-100 DeFi tokens by market cap finally saw per week of eco-friendly after nearly two days of dominant bearish cost action. The majority of the tokens recorded double-digit gains, with Luna Classic (LUNC) — formerly Terra (LUNA) — making an entry in to the top 30 with more than 100% gains previously 7 days.

DApp activity increases 3.7% in August the very first time since May: Report

DApps demonstrated a small recovery the very first time since May, using the daily average of unique active wallets (UAWs) growing 3.7% on the month-over-month basis, based on a study from DappRadar.

An upswing was partly driven through the Flow protocol, which rose 577% United auto workers leader because of Instagram’s support of their NFTs and also the game Solitaire Blitz. However, Solana United auto workers leader shrank by 53% in August in the previous month, while transactions came by 68%, the findings demonstrated.

SEBA Bank to supply Ethereum staking services to institutions

Because the Ethereum network moves from a proof-of-work (Bang) to a proof-of-stake (PoS) consensus, an electronic asset platform initiated something for institutions to dive into Ether (ETH) staking.

Within an announcement delivered to Cointelegraph, Swiss digital asset banking platform SEBA Bank stated it has launched an Ethereum staking service for institutions that are looking to earn yields from staking around the Ethereum network. Based on the firm, the move is really a reaction to the growing institutional demand. for DeFi services.

Degens borrowing ETH to obtain fork tokens create headaches for DeFi platforms

The growing quantity of speculators getting Ether loans to maximise their possibility to earn forked Ether proof-of-work tokens (ETHPoW) continues to be causing headaches for DeFi protocols.

The problem continues to be gaining traction in the last month approximately like a significant quantity of Ether miners are anticipated to continue focusing on a forked Bang chain or even even multiple chains publish the lengthy-anticipated Merge.

Avalanche flash loan exploit sees $371K in USDC stolen

Avalanche-based lending protocol Nereus Finance continues to be the victim of the crafty hack that saw a person internet $371,000 price of USD Gold coin utilizing a smart contract exploit.

Blockchain cybersecurity firm CertiK was among the first to identify the exploit on Tuesday, indicating the attack impacted liquidity pools on Nereus associated with decentralized exchange (DEX) Trader Joe and automatic market maker Curve Finance.

DeFi protocol token NFD crashes by 99% following a flash loan attack

New Free DAO, a DeFi protocol, faced a number of flash loan attacks on Thursday, producing a reported lack of $1.25 million. The cost from the native token has came by 99% within the wake from the attack.

Unlike normal loans, several DeFi protocols offer flash loans that permit users to gain access to considerable amounts of assets without upfront collateral deposits. The only real condition would be that the loan should be came back in one transaction inside a period of time. However, this selection is frequently exploited by malicious adversaries to collect considerable amounts of assets to produce pricey exploits that concentrate on tarDeFi protocols.

DeFi market overview

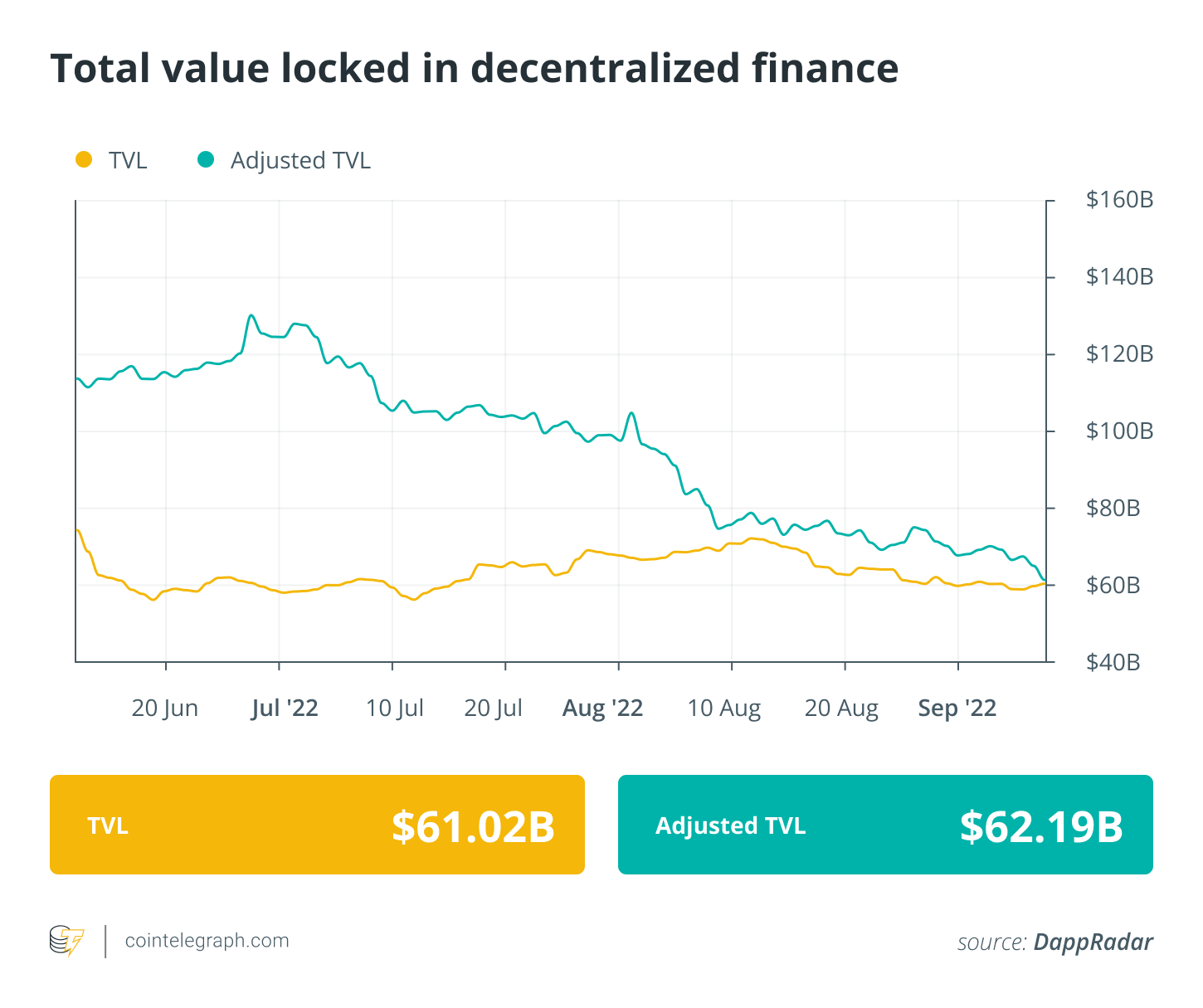

Analytical data reveals that DeFi’s total value locked registered a small vary from yesteryear week. The TVL value involved $61.02 billion during the time of writing. Data from Cointelegraph Markets Pro and TradingView reveal that DeFi’s best players tokens by market capital were built with a bullish week with a lot of the tokens seeing double-digit gains, while a couple of others still trade at a negative balance.

LUNC was the greatest gainer around the weekly basis, registering a 101% gain in the last seven days, adopted by Chainlink (LINK) with 14.8% gains. Compound (COMP) rose by 7.71% and PancakeSwap (CAKE) registered a 6.24% gain around the weekly charts.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.