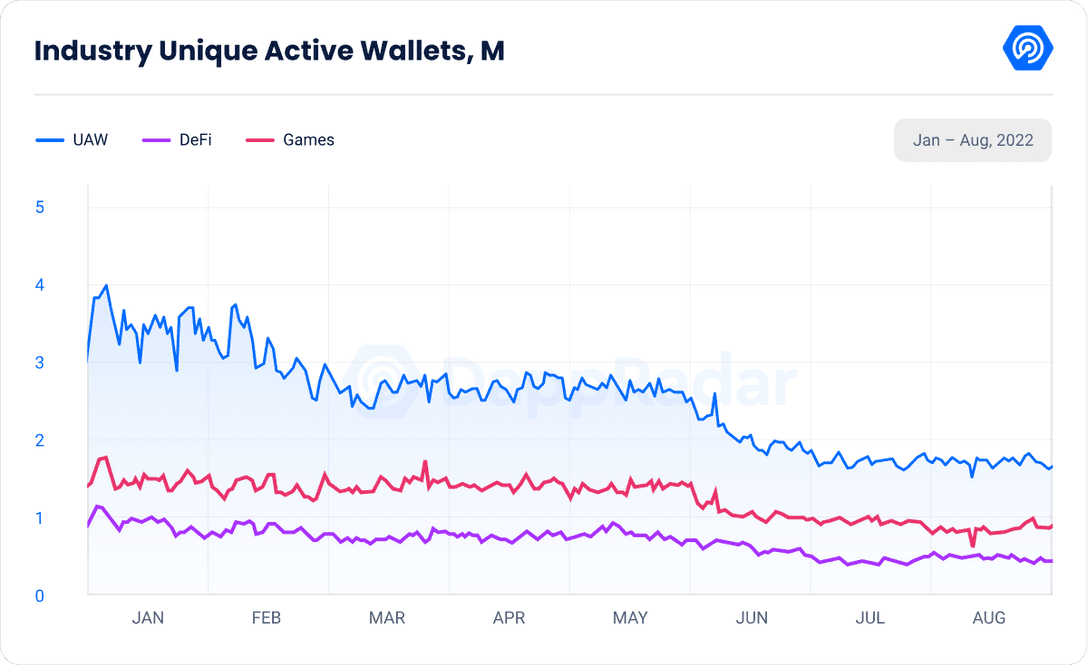

DeFi dapps demonstrated a small recovery the very first time since May, using the daily average of unique active wallets (UAWs) growing 3.7% on the month-over-month basis, according to a report from DappRadar.

An upswing was partly driven through the Flow protocol, which rose 577% United auto workers leader because of Instagram’s support of their NFTs and also the game Solitaire Blitz. However, Solana United auto workers leader shrank by 53% in August in the previous month, while transactions came by 68%, the findings demonstrated.

There have been 1.67 million unique wallets linked to blockchain DApps in August, lower 3.52% from recently, and lower 14.73% when compared with August 2021.

Source: DappRadar

Among industries, gaming taken into account 50 plusPercent from the activity usage, with 847,230 daily United auto workers leader, even though it is lower 11% and the amount of transactions declined 12.7% month-to-month to $698 million. Around the NFT side, United auto workers leader fell by 16.7% to 114,542 — the cheapest since June 2021, per the report.

Regardless of the DeFi rise in unique active wallets, the general DeFi total value locked (TVL) still demonstrated a substantial drop from $250 billion at the outset of 2022 to $74.21 billion in August.

“The final time the TVL was this low is at April of 2021, once the space only agreed to be starting to get momentum. This signifies the DeFi TVL has decreased by 56% or even more since August 2021.”

The report highlighted that August was “particularly hard for the marketplace due to the Tornado Cash crisis,” which dropped the TVL by 10.47% to get rid of $8.7 billion. On August. 8, the U.S. Treasury Department accused the crypto mixer platform of washing greater than $7 billion in cryptocurrencies, including $455 million allegedly stolen by North Korean online hackers.

Following a sanctions, the Tornado Cash (TORN) cost plummeted by 45% in 2 days, losing nearly half of their market price.

Ethereum chain controls 69% from the DeFi TVL with $51.47 billion, based on the report — even though it has lost 11% recently, and dropped 56.63% since August 2021. Layer-2 protocols according to Ethereum demonstrated signals of growth “mainly driven through the approaching Ethereum Merge,” with Optimism growing 57.61% in August for any $1 billion total locked value, Arbitrum rising 14.36%, and Polygon gaining 6.50% month-to-month.