The persistent challenges faced by decentralized finance have been extensively recorded by a number of analysts and also the recent collapse from the Terra ecosystem re-enforced the truth that something is critically wrong with DeFi.

I believe DeFi today is totally damaged for 99% of people.

The commitment of a far more transparent economic climate continues to be surpassed by avarice.

UST/LUNA is only the latest inside a string of bad developments:

— Peter Yang (@petergyang) May 11, 2022

Let us check out what experts say DeFi must do in order to have another revival.

Improved usability

Up to now, the commitment of open and uncensored use of a worldwide decentralized economic climate continues to be largely hampered through the complicated interface, confusing multi-step staking processes and too little clearness all around the yields on various tokens.

What is your opinion DeFi must achieve mass adoption?

a) Better simplicity of use

b) Greater education about DeFi

c) Less exploits and rugpulls

d) Greater liquidity as well as on-ramps

e) Obvious government regulation pic.twitter.com/dX4Qpd2Dsh— Rugdoc.io (@RugDocIO) The month of january 9, 2022

The consumer experience for many platforms is sub-componen as to the could be expected when confronted with multi-billion dollar platforms and also the layouts could be complicated, together with poor documentation that leaves users frustrated.

Contributing to the confusion, a constantly-growing listing of blockchain systems using their own DeFi environments can appear formidable to newcomers and also require not used at all an application wallet before.

Ultimately, a much better system of training the general public about DeFi inside a reliable setting is one thing that is required to assist the mass process of adoption. Otherwise, you face exactly the same problem of the present economic climate where merely a small area of the population reaps the advantages.

Security must become priority #1

The DeFi sector is frequently known as nature west because anybody can launch a task with flashy promises simply to pull the string on naive investors and give them a useless token.

Well-meaning projects also become a victim of smart contract vulnerabilities that see their liquidity drained. A current illustration of it was the Feb 2022 hack from the Wormhole token bridge, which led to losing 120,000 wrapped Ether (wETH) tokens.

For additional individuals to feel safe going through the expanding DeFi ecosystem and also to keep governments off the rear of the, a larger degree of protection and security from malicious actors and protocol exploits is going to be needed.

Related: Buterin: How you can create algo stablecoins that do not become Ponzis or collapse

Self-regulate, or perhaps be controlled

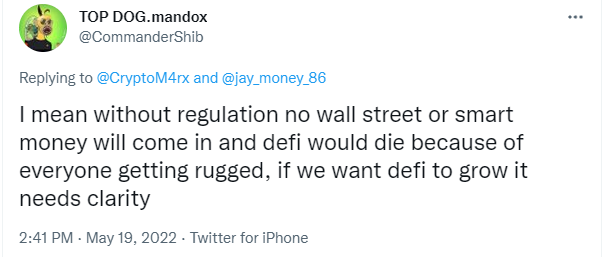

Another component that is towards the top of their email list for a lot of DeFi analysts is the requirement for greater regulatory clearness.

As the mere reference to this type of factor generates a slew of objections from many crypto investors who value its unregulated nature, a lot of the public who aren’t yet associated with cryptocurrencies and DeFi will probably remain wary before the government provides the asset class a stamp of approval.

Because of the recent Terra ecosystem collapse, regulation might be among the first challenges that DeFi needs to resolve.

What individuals rules eventually seem like is unknown, but they’ll assistance to set up a beginning point that may assist the DeFi sector evolve and mature.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.