Stablecoin projects happen to be thrust in to the limelight in the last month because the recognition of algorithmic stablecoins and also the collapse from the Terra project place a spotlight around the natural part dollar-pegged assets participate in the crypto market.

As a result of the void left by UST, multiple protocols have released new stablecoin projects in order to attract new users and capture liquidity. In most cases, the DeFi sector is filled with gimmicks that can lure user participation and it is entirely possible that the current stablecoin launch programs are merely the following trending tactic getting used to improve TVL on DeFi platforms.

Let us check out a few of the newest stablecoins to hit the industry and just what impact they might or might not be getting within DeFi.

USDD

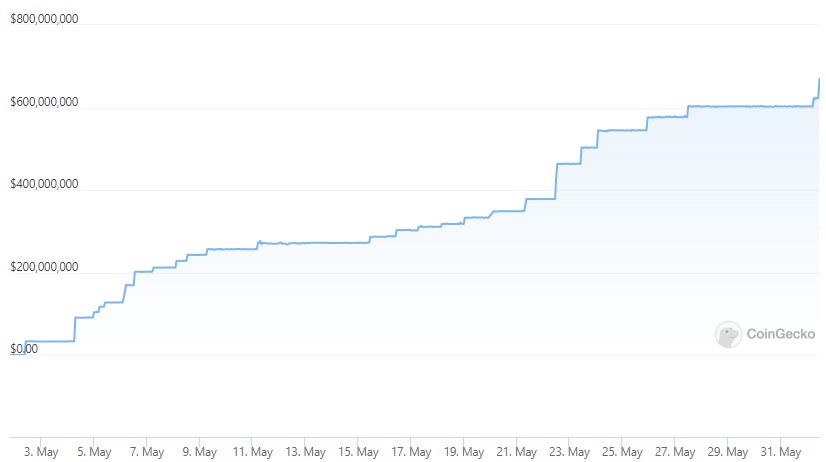

Among the greatest stablecoin projects to produce lately is USDD, a decentralized algorithmic stablecoin around the Tron (TRX) blockchain. Since launching on May 5, USDD has experienced rapid growth when it comes to its circulating supply, which presently sits near 601.86 million and it is integration inside the Tron ecosystem is comparatively prevalent.

USDD can also be on the Ethereum (ETH) network and also the BNB Smart Chain (BSC), that has helped to improve the tokens distribution together with supplying additional yield possibilities.

You will find multiple liquidity provider pools open to USDD holders that provide 20% APY or even more across various protocols, including JustLend, SunSwap, Ellipsis and Curve. Within the time since USDD launched, the cost of TRX has elevated 17% from $.07 to the current cost of $.0818 after briefly hitting a higher of $.092 on May 31.

fUSD

Fantom lately released fUSD, its first native stablecoin, that is an over-collateralized and could be minted using Fantom (FTM), USD Gold coin (USDC), Dai (DAI), SpiritSwap (SPIRIT) and wrapped Tether (fUSDT) as collateral.

The brand new @FantomFDN‘s native stablecoin, $fUSD…

Brings all of the goodness of decentralization while delivering stability:

✅Governed through the community.

✅Full transparency.

✅Overcollateralized stability.Plus, new collateral assets you’ll gladly see!

— Stader.Fantom (@stader_ftm) May 25, 2022

In order to get more liquidity, the Fantom Foundation set the fUSD staking reward at 11.3% and produced a fUSD to USDC swap interface that enables users to buy fUSD and pay back their positions to prevent liquidations.

During the time of writing, the circulating way to obtain fUSD is 60,993,403 which is buying and selling in a cost of $.7112, that is considerably below its $1 peg.

aUSD

Following a official launch from the first parachains inside the Polkadot ecosystem, the Acala decentralized finance platform released aUSD because the first native stablecoin for Polkadot projects.

aUSD is definitely an over-collateralized stablecoin that may be minted by pledging Polkadot (Us dot), staked Polkadot (LDOT), Kusama (KSM), staked KSM (LKSM), Acala (ACA) or Karura (KAR) as collateral.

Pledging LDOT and LKSM as collateral enables Us dot and KSM holders to carry on earning staking rewards while concurrently having the ability to borrow collateral against their holdings.

On March 23, Acala became a member of with nine other parachain teams to produce a $250 million “aUSD Ecosystem Fund” that is made to support early-stage startups intending to build strong stablecoin use cases on any Polkadot or Kusama parachain.

Acala, nine parachain teams, and several venture funds have launched the $250 million ‘aUSD Ecosystem Fund’ ️

The fund needs early-stage projects from the @Polkadot or @KusamaNetwork parachain with strong $aUSD stablecoin use cases https://t.co/OJ2V47ZUry pic.twitter.com/NDgLg2bG8N

— Acala (@AcalaNetwork) March 23, 2022

By May 31, 6.31 million aUSD happen to be minted and the quantity of promised capital locked on Acala is $91.53 million.

Related: United kingdom government proposes additional safeguards against stablecoin failure risks

OUSD

Origin protocol’s OUSD is really a stablecoin that’s fully supported by more recognizable stablecoins like USDC, USDT and DAI.

Users can mint OUSD by pledging their stablecoin collateral around the Origin Dollar protocol and produce a yield of 12.79% by holding OUSD inside a wallet. Yields which are compensated to OUSD holders originate from automated strategies managed by smart contracts that place the deposited funds to operate in DeFi.

After briefly shedding to some low of $.967 on May 12 throughout the height from the UST fallout, OUSD has, typically, maintained a cost above $.996 and it has a present circulating way to obtain 63,605,444.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.