Ease of access is really a discomfort point for cryptocurrency adoption that’s been discussed for a long time, but still, it’s pertinent as always. This problem was most lately identified by the U . s . States government as you’ve seen Treasury Secretary Jesse Yellen discuss during her remarks on digital assets policy and regulation. You will find barriers which are restricting ease of access to cryptocurrencies, for example financial education and technological sources, which is our duty as developers and leaders within this revolutionary industry to deal with them.

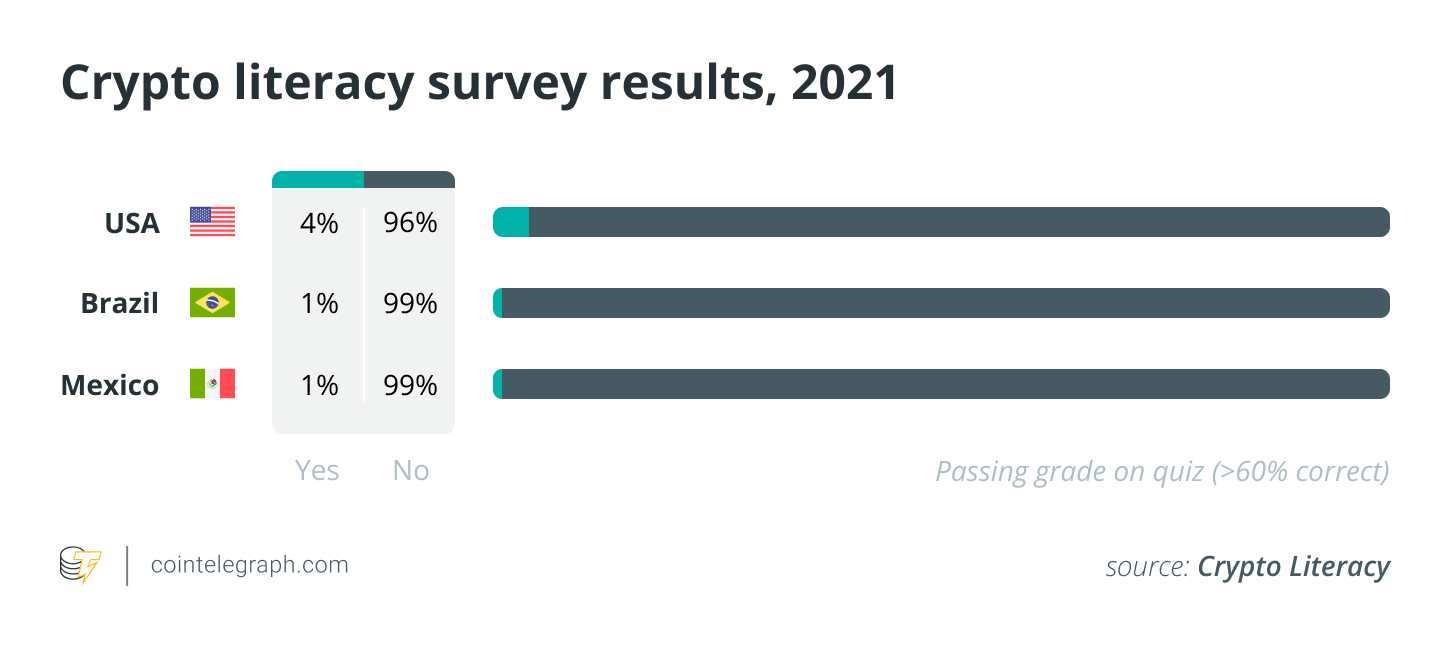

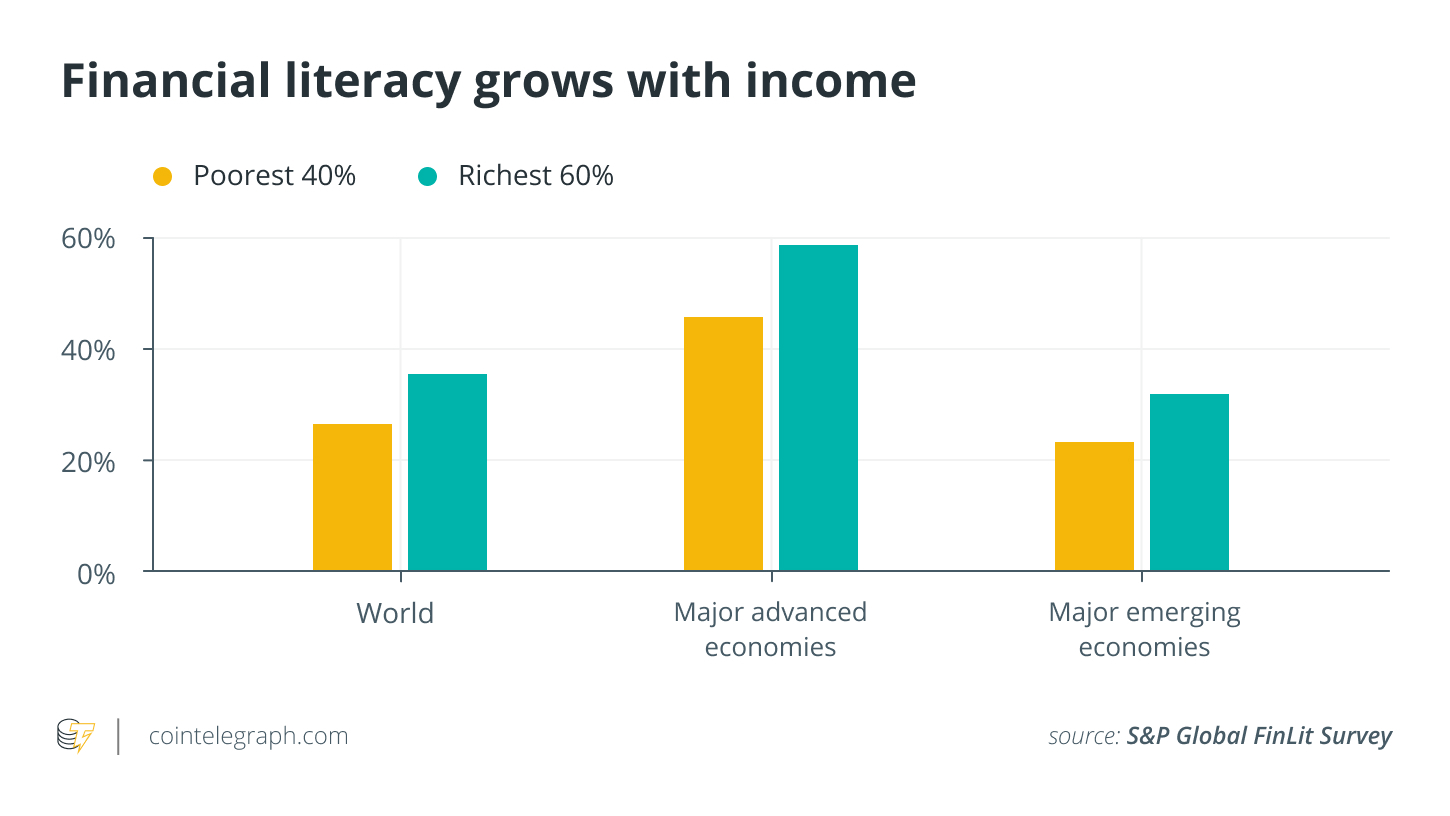

Research has proven that just 33% of adults around the world are financially literate. With lots of projects within the decentralized finance (DeFi) space concentrating on supplying individuals without use of traditional banking institutions and tools for earning, saving and transacting, this can be a key consideration.

Traditional banking institutions certainly have additional barriers that cryptocurrency projects are bypassing, for example requiring documentation, high charges along with a general insufficient local banking institutions in emerging markets. With this stated, even DeFi requires understanding and knowledge of money to easily go into the space. Comprehensive education on the inspiration of finance, from tips about savings to promote fluctuations, is vital to inspire individuals who’ve felt excluded by traditional finance to go in the DeFi world.

Related: Decentralized finance could be the future, but education continues to be missing

Cryptocurrency education and technostress

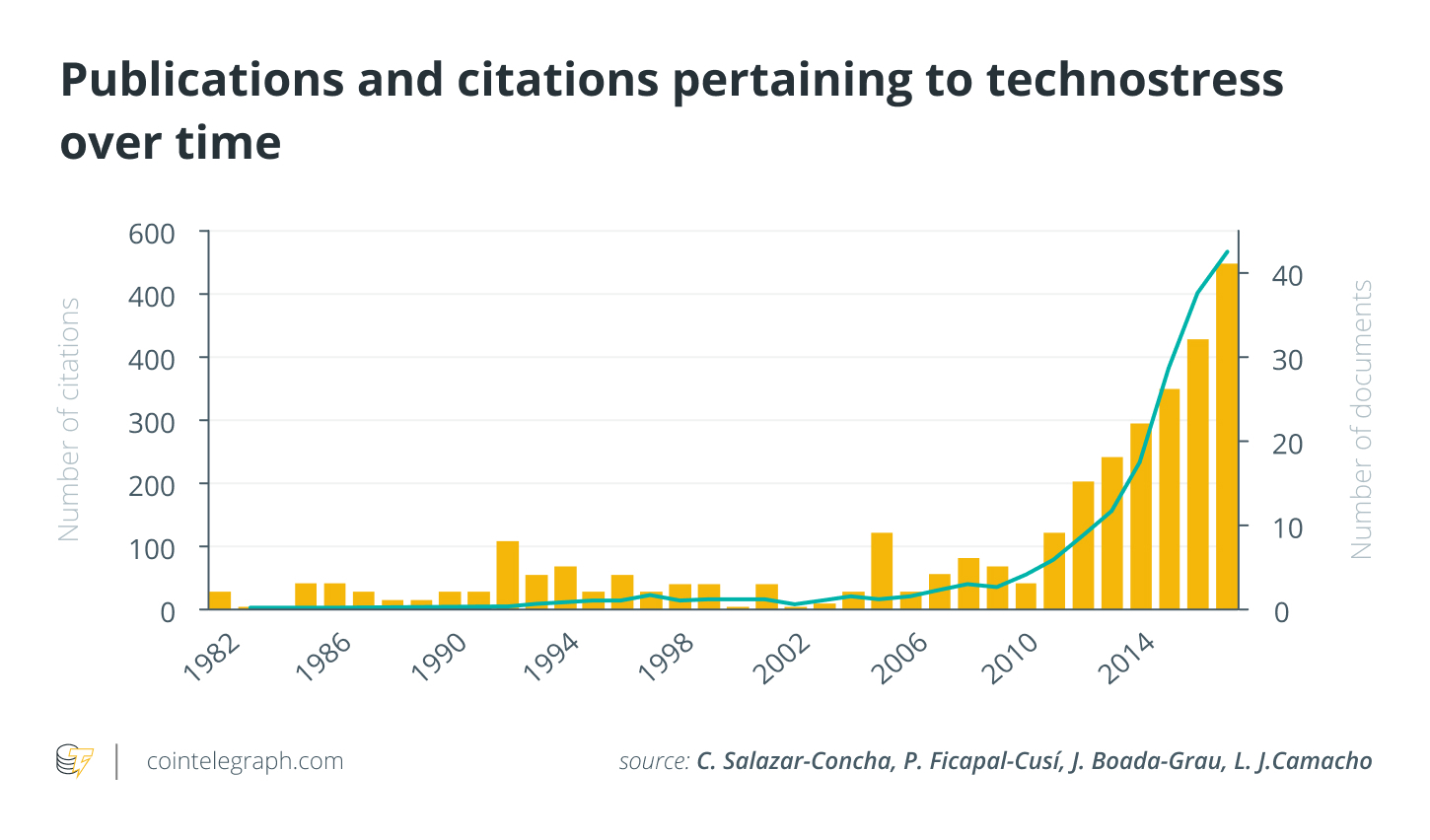

Another educational component necessary is cryptocurrency and blockchain education. New technology of all types could be overwhelming and confusing to potential new users — it’s so common the term “technostress” was created to identify this problem.

Highly technical language and frequent utilization of jargon are a couple of issues I’ve observed within the space that deter the crypto curious from diving into the field of DeFi. Supplying sources that break lower the necessities of blockchain technology, whether or not they are blogs or explanatory videos, helps you to bridge the big gap of understanding between developers and everyday individuals. Although this is an essential start, the unfortunate the fact is that education also requires one crucial and incredibly limited resource — time.

The time and effort it requires to understand the intricacies of blockchain and cryptocurrency technology could be a major barrier to creating a deep understanding essential to go into the space. While supplying easy, simple educational tools is advantageous, it serves an admittedly limited population. Consequently, financial literacy and crypto education remains important, but there are more steps developers and leaders will need to take to allow user adoption. Project leaders also needs to think about the understanding gaps because they design their platform and make out messaging. Using simple, concise language which will resonate with all of audiences is essential to welcoming new users.

Related: Women’s curiosity about crypto grows, but education gap persists

The way the wealth gap works as a barrier

As pointed out, the wealth gap presents many challenges for lower-earnings visitors to go into the space. Additionally to too little use of and here we are at education, limited liquidity is yet another massive barrier to entry.

To be able to invest, individuals must have the ability to cover their bills with a lot more money to allocate elsewhere. For individuals living payday to payday, or perhaps individuals who function not feel at ease risking their sources on investments, they’re much less inclined to purchase investment accounts.

Related: Crypto education may bring financial empowerment to Latin Americans

This is also true with digital assets because they are newer and fewer controlled than traditional investment avenues. Undercollatoralized loans will enable individuals with less liquidity to purchase the area, becoming a significant driver of mainstream crypto adoption. Projects, for example Teller Finance, that permit visitors to borrow crypto assets without posting collateral are moving the area forward. This space continuously grow and it is essential for growing ease of access.

How leaders and developers can navigate these barriers

As developers concentrate on simplicity and ease for users, their platform must reflect individuals factors. Onboarding is the initial step for just about any curious potential new user, so making certain that sign-on is intuitive is the chance to produce a lasting first impression. Should there be many complicated processes to setup a free account, individuals will understandably not need to maneuver forward. Easy Know Your Customer identification, instead of laborious protocols, is an excellent method that projects can boost their onboarding experience.

Another step for projects to consider is building out a strong network of partners. With respect to the project, this may be compatible blockchains, integration with decentralized applications, or joining initiatives like Celo’s DeFi for anyone that try to increase real-world use cases. There are plenty of projects within the space, frequently with limited interoperability, meaning users need to juggle a variety of accounts and applications. Making your platform as expansive and interoperable as you possibly can means supplying users with numerous uses of your platform through compatible programs, which encourages these to utilize your choices.

The blockchain industry’s ongoing growth requires a regular flow of recent users inside the space. To do this, we being an industry must develop projects with new users in your mind. Offering educational submissions are the initial step to creating a foundation that will permit us to transform the economy.

Considering that this doesn’t serve every user, and finding additional methods to incentivize new users to participate the area is vital. Offering uncollateralized loans helps you to bridge the wealth gap we have seen throughout crypto’s progression and elevated adoption. Keeping the audience in your mind all the way, from design to messaging, towards the choices that you simply provide, is of equal importance. The best goal is perfect for blockchain technology to become embedded within applications enough where users have no idea have to know that they’re on-chain. When our applications are as intuitive and understandable because the traditional financial tools that users have downloaded through the millions, we will have a rise in users for the first time.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Fabrice Cheng may be the co-founder, Chief executive officer and chief technology officer at Quadrata. He was formerly the mind of blockchain technology at Spring Labs. Fabrice is definitely an experienced technologist and it has been building within the Ethereum ecosystem since 2016, having a particular curiosity about how you can extract value in the mempool, and he’s also an Ethereum 2. open-source contributor at Prysmatic Labs.