Ether (ETH) cost is lower 37.5% within the last 7 days and up to date news reported that developers made the decision to postpone the network’s migration to some proof-of-stake (PoS) consensus. This upgrade is anticipated to finish the reliance upon proof-of-work (Bang) mining and also the Merge scalability solution that’s been went after within the last six years.

Competing smart contracts like BNB, Cardano (ADA) and Solana (SOL) outperformed Ether by 13% to 17% since June 21 despite the fact that there is an industry-wide correction within the cryptocurrency sector. This means the Ethereum network’s issues also considered around the ETH cost.

The “difficulty explosive device,” feature was put into the code in 2016 as plans for the brand new consensus mechanism (formerly Eth2) appeared to be created. In the peak from the so-known as “DeFi summer time,” Ethereum’s average transaction costs surpassed $65, that was frustrating for probably the most fervent users. This really is the key reason why the Merge plays such a significant part in investors’ eyes and, consequently, Ether cost.

Options traders remain very risk-averse

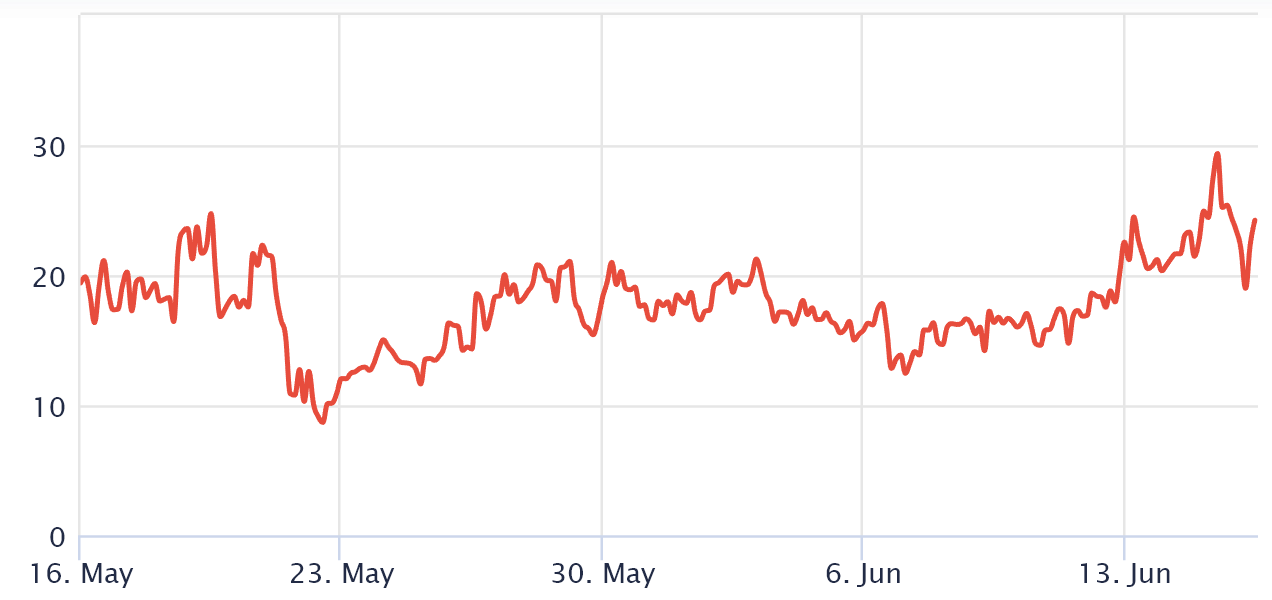

Traders need to look at Ether’s derivatives markets data to know how whales and market makers are situated. The 25% delta skew is really a telling sign whenever professional traders overcharge for upside or downside protection.

If traders expected an Ether cost crash, the skew indicator would move above 10%. However, generalized excitement reflects an adverse 10% skew. This really is the key reason why the metric is called the professional traders’ fear and avarice metric.

The skew indicator improved on June 16, a minimum of for any brief moment, because it touched 19%. However, when it grew to become apparent that climbing over the $1,200 resistance would take more time than expected, the skew metric rose to 24%. The greater the index, the less inclined traders will be to cost downside risk.

Lengthy-to-short data show traders aren’t thinking about shorts

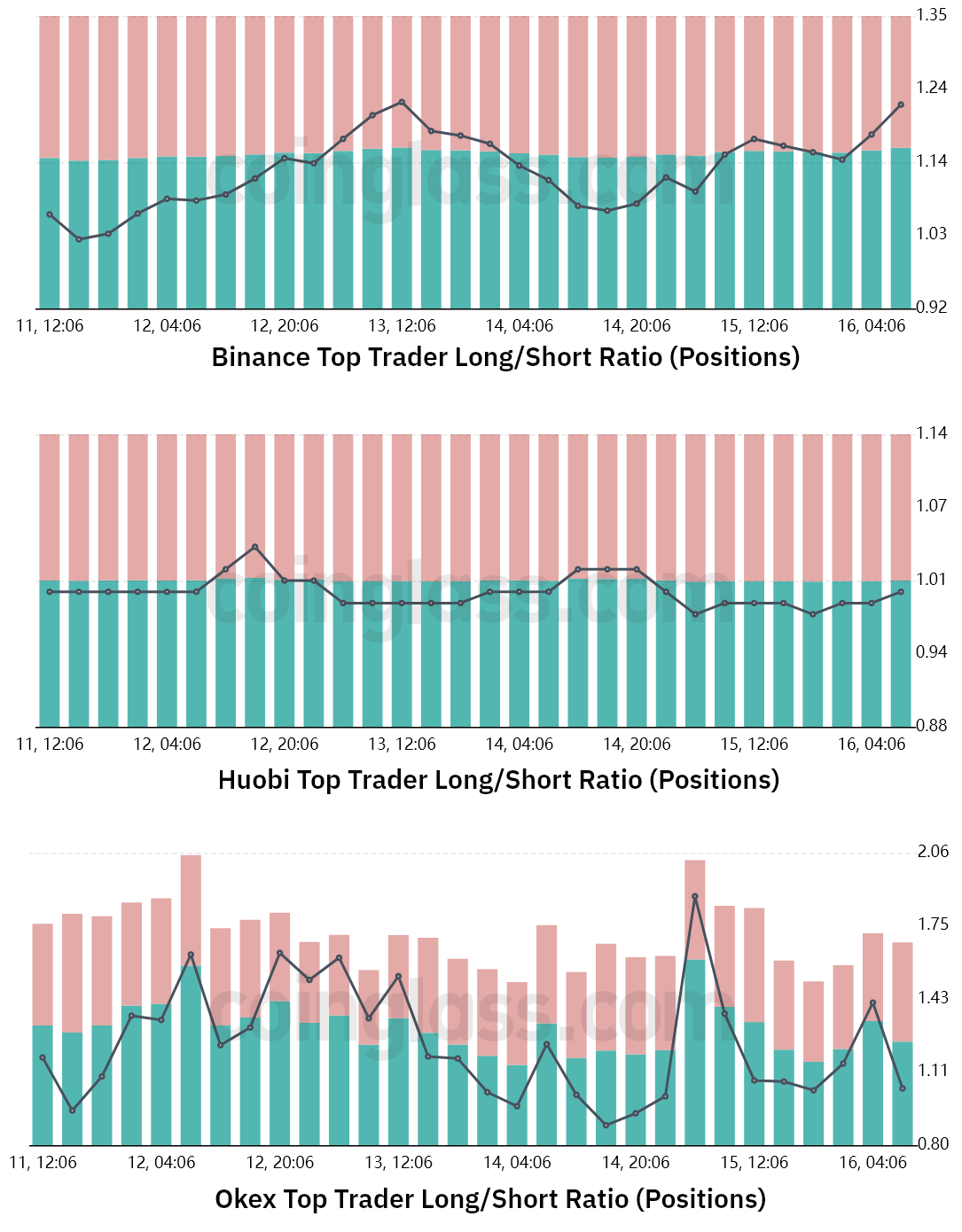

The very best traders’ lengthy-to-short internet ratio excludes externalities that may have exclusively impacted the choices markets. By analyzing these positions around the place, perpetual and quarterly futures contracts, it’s possible to better understand whether professional traders are leaning bullish or bearish.

You will find periodic methodological discrepancies between different exchanges, so viewers should monitor changes rather of absolute figures.

Despite the fact that Ether has unsuccessful to sustain the $1,200 support, professional traders didn’t change their positions between June 14 and 16, based on the lengthy-to-short indicator.

Binance displayed a modest rise in its lengthy-to-short ratio, because the indicator moved from 1.11 to at least one.22 in 2 days. Thus, individuals traders slightly elevated their bullish bets.

Huobi data shows a reliable pattern because the lengthy-to-short indicator remained near 1.00 whole time. Lastly, at OKX exchange, the metric oscillated drastically inside the period but finished nearly unchanged at 1.04.

Hope all went well, but get ready for the worst

Overall, there has not been a substantial alternation in whales’ and market makers’ futures positions despite Ether’s plunge lower to $1,012 on June 15. However, options traders fear that the crash below $1,000 remains achievable, however the negative newsflow heavily influences cost.

If individuals whales and market makers had evidence that there might be a much deeper cost correction, this could have been reflected within the exchanges top traders’ lengthy-to-short ratio.

As they say, “follow their actions, not their words,” meaning traders should be ready for sub-$1,000 Ether, although not because the base scenario.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.