Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

Yesteryear week within the DeFi ecosystem saw major developments focused on the Ethereum Merge.

Aave (AAVE) community suggested temporarily suspending Ether (ETH) lending prior to the Merge, citing the possibility issue of high ETH utilization that can lead to liquidations being hard or impossible and annual percentage yields (APYs) reaching negative figures. A business expert shared his opinion on possible censorship vulnerabilities the Ethereum network may ultimately face within the wake of their transition to some proof-of-stake (PoS) blockchain.

Moving in front of the Ethereum Merge developments, another major occasions that made headlines include Babylon Finance’s eventual shutdown after several weeks of attempting to recuperate in the negative momentum brought on by the Rari Fuse exploit. The U . s . States Fbi (FBI) has issued a brand new warning for investors in DeFi platforms, that have been targeted with $1.6 billion in exploits in 2022.

The very best 100 DeFi tokens recorded a bearish cost action in the last week, using the majority buying and selling at a negative balance, barring a couple of tokens which have proven even double-digit growth.

Will Ethereum 2. be susceptible to censorship? Industry professional explains

The Ethereum network can withstand censorship risks in rapid and lengthy term, based on Ethereum community member and investor Ryan Berckmans.

The ban of Ethereum-based privacy tool Tornado Cash by U . s . States government bodies earlier this year left many wondering whether Ethereum transactions may be vulnerable to censorship, especially after Ethereum’s imminent transition to some proof-of-stake system.

Aave community provides suspend ETH lending prior to the Merge temporarily

Using the Ethereum Merge in route, the danger research and analysis team Block Analitica suggested a brief pause in ETH borrowing to mitigate the potential risks that can lead to a DeFi implosion within the Aave lending protocol throughout the Merge.

They stated the possibility issue of high ETH utilization, which may lead to liquidations being hard or impossible and also the APY’s reaching negative figures. In addition, the uncertainties all around the Merge along with a potential Ethereum proof-of-work (Bang) fork could cause liquidity providers to begin a financial institution run, pushing utilization to even greater levels.

DeFi protocol shuts lower several weeks following the Rari Fuse hack

Babylon Finance has finally announced that it’ll shut lower after several weeks of attempting to recuperate in the negative momentum brought on by the Rari Fuse exploit.

Inside a statement, founder Ramon Recuero described the platform experienced an impossible negative streak despite their team’s efforts to pass through the domino effect brought on by the hack. Based on Recuero, the protocol lost $3.4 million. After this, the entire value locked inside the platform went from $$ 30 million to $4 million. In addition, the Fuse pool was abandoned, getting a lending market worth $ten million, Recuero noted.

FBI issues alert over cybercriminal exploits targeting DeFi

The U.S. FBI issued a brand new warning for investors in DeFi platforms, that have been targeted with $1.6 billion in exploits in 2022.

Inside a public service announcement on Tuesday, the FBI’s Internet Crime Complaint Center stated the exploits have caused investors to get rid of money — counseling investors to conduct diligent research about DeFi platforms before with them whilst advocating platforms to enhance monitoring and conduct rigorous code testing.

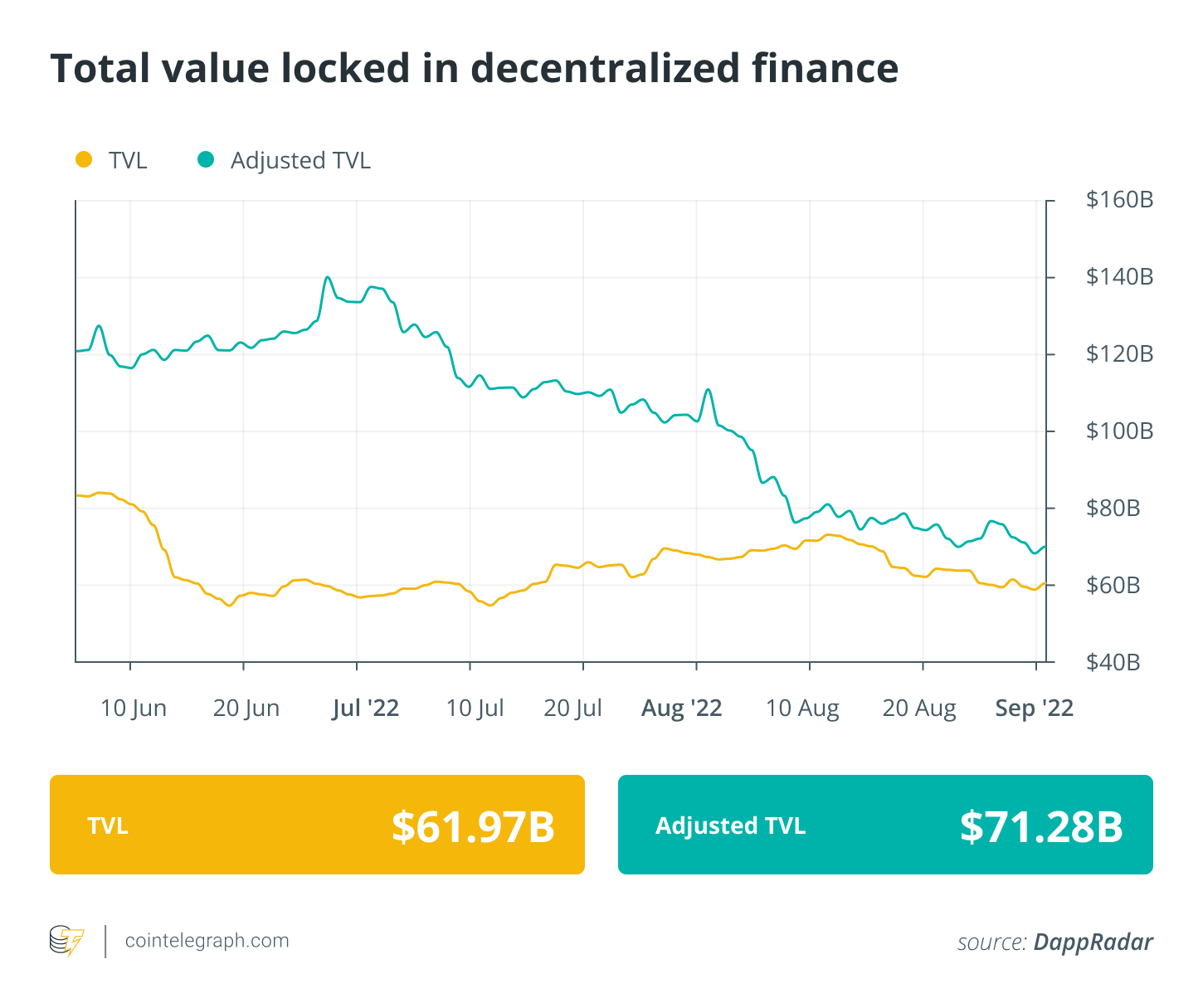

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered a small vary from yesteryear week. The TVL value involved $61.97 billion during the time of writing. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s best players tokens by market capital were built with a mixed week. Despite the fact that a lot of the tokens are buying and selling in red around the weekly charts, the cost change continues to be minimal when compared to a week ago.

Lido DAO (LDO) was the greatest gainer one of the best players tokens, registering an every week gain of 5.31%, adopted by PancakeSwap (CAKE), having a rise of just onePercent. All of those other other top100 tokens registered just one-digit decline in the last week.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.