Thanks for visiting Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights, a e-newsletter crafted to create you a few of the major developments during the last week.

Earlier this week, the DeFi ecosystem saw Axie Infinity’s Ronin bridge relaunch having a fully backed 1:1 Ether (ETH) nearly three several weeks following the infamous $600 million hacks.

MakerDAO intends to invest $500 million into U . s . States Treasurys and bonds to weather the continuing bear market. Polkadot (Us dot) announced they would transform their governance model to maneuver towards complete decentralization. While decentralized autonomous organizations (DAOs) are the way forward for governance, research conducted recently shows under 1% of holders have 90% from the voting power in DAOs.

The very best 100 DeFi tokens again stepped right into a ocean of red after showing some fightback a week ago. A lot of the top-100 tokens registered double-digit losses in the last week.

Fight-hardened Ronin bridge to Axie reopens following $600M hack

Sky Mavis, developers from the popular play-to-earn (P2E) nonfungible token (NFT) game Axie Infinity (AXS) announced the relaunch of Ronin bridge on Thursday, three several weeks after it had been hacked in excess of $600 million.

On March 29, 173,600 ETH and 25.5 million USD Gold coin (USDC) were drained in the bridge after online hackers managed to get into private validator keys. The hack was more vital than $620 million at that time.

Based on the Tuesday announcement in the Sky Mavis team, the Ronin bridge has returned online after three audits (one internal, two exterior), a brand new design and full compensation from the users’ stolen assets.

MakerDAO looks to take a position $500M into ‘minimal risk’ Treasurys and bonds

MakerDAO is presently voting on the proposal targeted at helping it weather the bear market and apply untapped reserves by investing 500 million Dai (DAI) stablecoins into a mix of U . s . States Treasurs and bonds.

Carrying out a straw poll inside a governance Signal Request, the DAO people now have to research if the dormant DAI is going entirely into short-term Treasurys or split 80% into Treasurys and 20% into corporate bonds.

Polkadot’s founder announces steps toward full decentralization with new governance model

Polkadot and Kusama founder Gavin Wood announced the blockchain’s governance model would undergo a brand new transformation. Dubbed Gov2, anybody could begin a referendum anytime as many occasions what ever they want within the new setup, much like initiating new transactions around the blockchain.

After that, the pending referendums need 50% from the election from stakeholders within 28 days’ here we are at approval or face rejection automatically. Participants may also intervene and launch timely cancellation proposals, which require similar voting procedures when technical glitches are discovered inside the referendums themselves.

Under 1% of holders have 90% from the voting power in DAOs: Report

A current report from Chainalysis examined the workings of ten major DAO projects and located that, typically, under 1% of holders have 90% from the voting power. The finding highlights a higher power of decision-making power at the disposal of a particular couple of — a problem DAOs were produced to solve.

This power of decision-making power was apparent using the Solana (SOL)-based lending DAO Solend. The Solend team attempted to consider more than a whale’s account and execute the liquidation themselves via over-the-counter (OTC) desks to avoid cascading liquidations over the decentralized exchange (DEX) books.

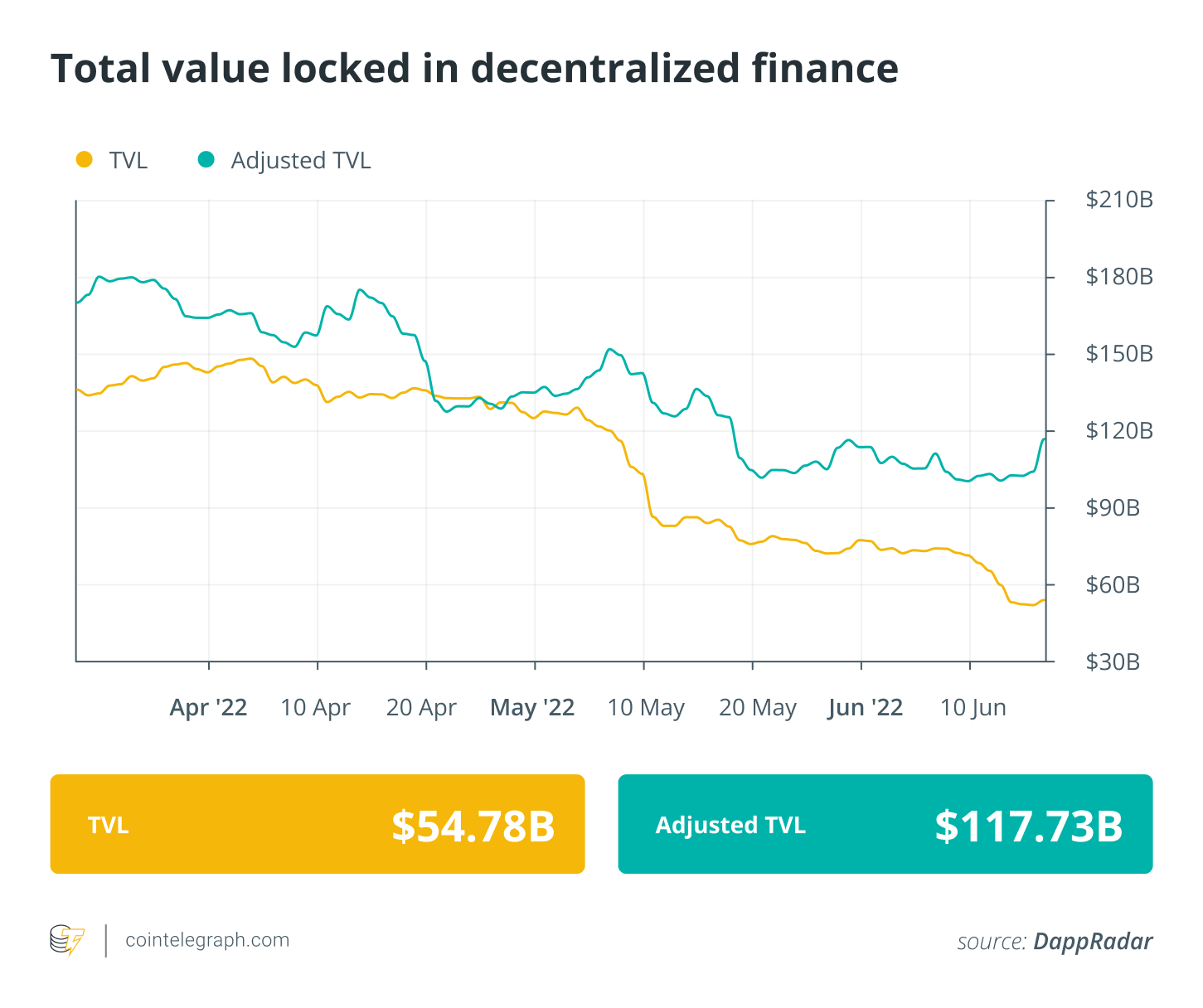

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered a small dip in the past week, falling to some worth of $54 billion. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s top-100 tokens by market capital demonstrated high cost volatility many them traded in red in the last week.

Compound (COMP) was the only real DeFi token within the best players to join up an every week eco-friendly having a 2% surge in the last week. The remainder of other DeFi tokens within the best players demonstrated a general bearish momentum dipping in double digits.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.