Thanks for visiting Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights, a e-newsletter crafted to create you a few of the major developments during the last week.

Earlier this week, the DeFi ecosystem saw several new developments despite a bearish phase introduced on through the lending crisis within the crypto market. Another crypto loan provider, Celsius, rich in stakes in DeFi protocols, declared personal bankruptcy. The general DeFi market fell to new lows within the second quarter. However, a brand new report signifies users haven’t quit hope.

BNB Chain launched a brand new decentralized application (DApp) platform by having an alarm feature. Vermont condition regulator opened up an analysis into troubled crypto loan provider Celsius, deeming it deeply insolvent. A DeFi investigator has predicted that Ethereum proof-of-stake (PoS) might help Ether (ETH) overtake Bitcoin (BTC).

The DeFi tokens saw a brand new flow of bullish momentum in the last day or two because of an industry-wide eco-friendly momentum following the inflation data release.

DeFi market fell off high cliff in Q2, but users haven’t quit hope: Report

Regardless of the DeFi market suffering a 74.6% market cap loss of Q2, user activity has continued to be relatively resilient, states CoinGecko.

Inside a report printed through the crypto data aggregator on Wednesday, CoinGecko reported the overall DeFi market cap fell from $142 million to $36 million within the second quarter, due mainly towards the collapse of Terra and it is stablecoin TerraUSD Classic (USTC) in May.

BNB Chain launches DApp platform with ‘Red Alarm’ to warn users about scams

BNB Chain has launched a brand new platform, DappBay, to uncover new Web3 projects. DappBay is outfitted having a novel feature known as Red Alarm, which assesses project risk levels in tangible-some time and alerts users of potentially dangerous DApps, based on a Thursday announcement.

Red Alarm is really a contract risk checking tool provided by DappBay that can help users identify high-risk projects to safeguard their investments from rug pulls and scams. Users can see if an agreement address has logical flaws or fraud risks simply by entering it in to the Red Alarm feature.

Vermont becomes the sixth US condition to produce analysis against Celsius

Vermont’s Department of monetary Regulation (DFR) issued an alert against troubled crypto finance company Celsius on Tuesday, reminding users the crypto finance company isn’t licensed to provide its services within the condition.

The DFR alleged that Celsius is “deeply insolvent” and doesn’t possess “assets and liquidity” to satisfy its obligations toward the shoppers. The condition regulator accused the crypto loan provider of mismanaging customers’ funds by allocating them toward dangerous and illiquid investments.

PoS gives Ethereum the economical structure to overtake Bitcoin, states DeFi investigator

As Ethereum shifts into PoS, a DeFi investigator has contended the platform can overtake Bitcoin’s throne because the top dog in crypto.

Inside a Twitter thread, investigator Vivek Raman highlighted the approaching Ethereum Merge could produce a better economic structure for that smart contract platform. Based on Raman, the shift into PoS lowers Ether inflation, gives better security and positions the crypto like a digital bond.

DeFi market overview

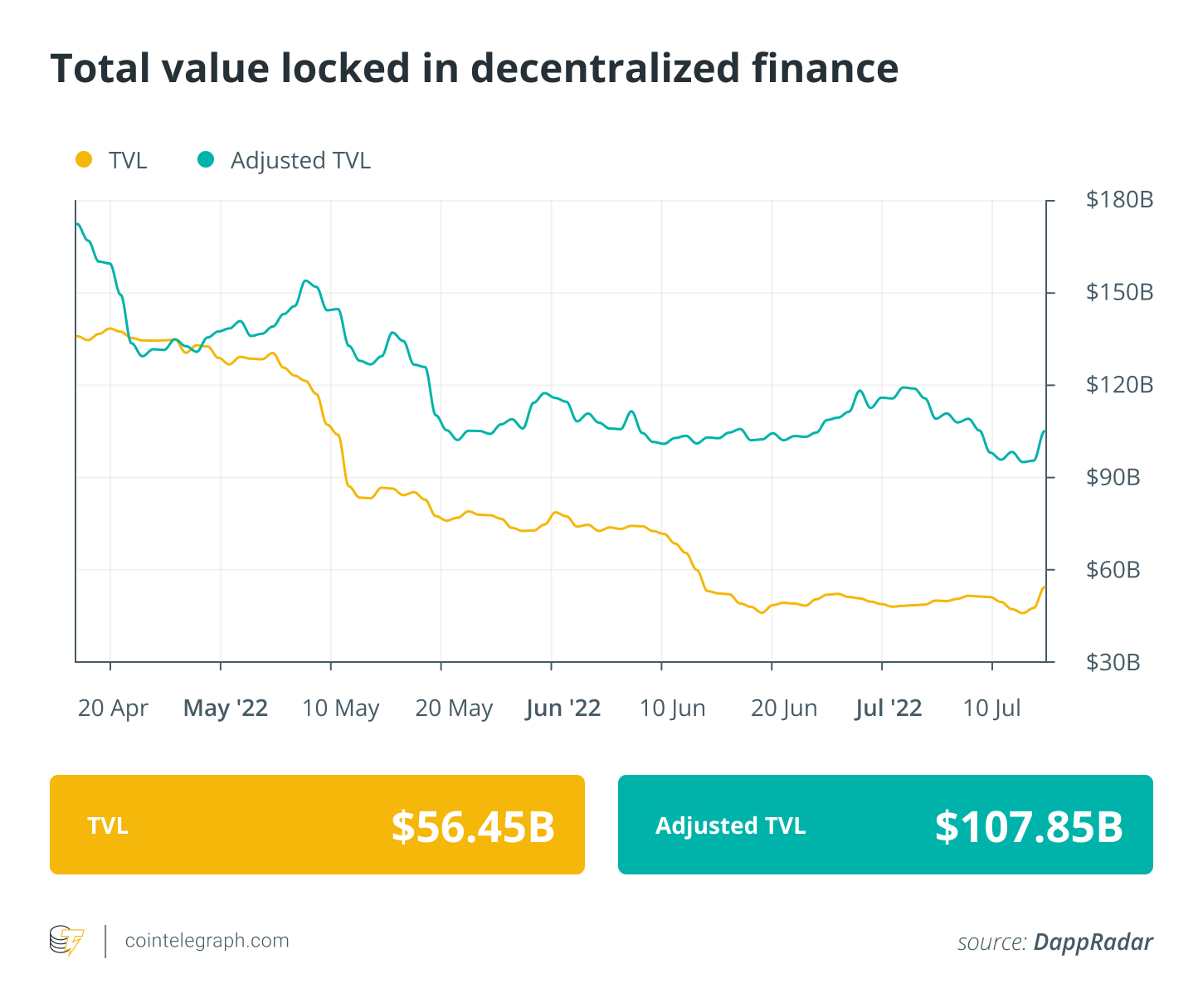

Analytical data reveals that DeFi’s total value locked registered a small dip in the past week, falling to some worth of $56.45 billion. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s top-100 tokens by market capital were built with a mixed week, with several tokens buying and selling in red while a couple of others registered even double-digit gains.

Aave (AAVE) was the greatest gainer one of the best players having a 30% rise in the last week, adopted by Uniswap (UNI) having a 23% surge. Compound (COMP) registered a 19% surge in the last week, while Curve DAO Token (CRV) also saw a 15% increase in cost in the last 7 days.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.