Yesteryear week within the decentralized finance (DeFi) ecosystem saw many new developments from your adoption perspective and protocol developments. The Ecu Commission added a brand new chapter on DeFi, showing the growing impact from the nascent ecosystem, while a county within the U . s . States Condition of Virginia really wants to put its pension fund inside a DeFi yield.

DeFi exploits grew to become the middle of attention again as recent studies have shown that within the first couple of quarters of 2022, DeFi protocols have forfeit $1.6 billion to numerous exploits. Rari Fuze hacker, who got away with $80 million price of funds, was offered a $ten million bounty.

The DeFi tokens also designed a bullish comeback toward the finish of history week. However, the general weekly performance continued to be at a negative balance.

European Commission report suggests re-think from the regulatory method of DeFi

Analysts in the European Commission demonstrated an unpredicted knowledge of how DeFi functions, getting defined it as being different things in the traditional economic climate and acknowledging it will need rethinking the method of regulation.

On Monday, crypto venture advisor at Presight Capital along with a lengthy-term expert on European regulation Patrick Hansen shared some crucial details in the European Commission’s “European Financial Stability and Integration Review 2022.” The report, dated April 7, includes a 12-page chapter on DeFi, where the authors demonstrate a smart method of the subject.

Virginia county really wants to put pension funds into DeFi yield farming

The Northern Virginia county of Fairfax has invested part of its pension funds in crypto and blockchain startups. Now, it’s mulling over much deeper participation using the DeFi yield farming.

The Fairfax County Police Pension System’s chief investment officer Katherine Molnar stated on Tuesday in the Milken Institute Global Conference the system aims to finance two new crypto-focused hedge fund managers within the next three days. The following couple of days will discover a decision made, which, if approved, will be the very first time pension fund money was utilized in DeFi.

Rari Fuze hacker offered $10M bounty by Fei Protocol to come back $80M loot

DeFi platform Fei Protocol offered a $ten million bounty to online hackers so that they can negotiate and retrieve a significant slice of the stolen funds from various Rari Fuse pools worth $79,348,385.61 — nearly $80 million.

On Saturday, Fei Protocol informed its investors a good exploit across numerous Rari Capital Fuse pools while requesting the online hackers to come back the stolen funds against a $ten million bounty along with a “no questions asked” commitment.

Greater than $1.6 billion exploited from DeFi to date in 2022

DeFi space continues to be rife with hacks, exploits and scams to date this season, with more than $1.6 billion in crypto stolen from users, surpassing the quantity stolen in 2020 and 2021 combined.

Analysis from blockchain security firm CertiK revealed the data on Monday showing the month of March getting probably the most value stolen at $719.two million, over $200 million greater than that which was stolen throughout 2020. The March figure is basically because of the Ronin Bridge exploit where attackers made served by over $600 million price of crypto.

Solana and Moonbirds help NFT market achieve $6.3B monthly buying and selling volume: Report

Based on the monthly DappRadar report, the NFT market recorded a multi-month buying and selling volume a lot of $6.3 billion, surging by 23% from March, breaching the $6 billion mark just for the 3rd amount of time in its history.

Moonbirds contributed half a billion price of buying and selling volume while Solana blockchain recorded nearly $300 million in NFT trades having a 91% month-on-month increase.

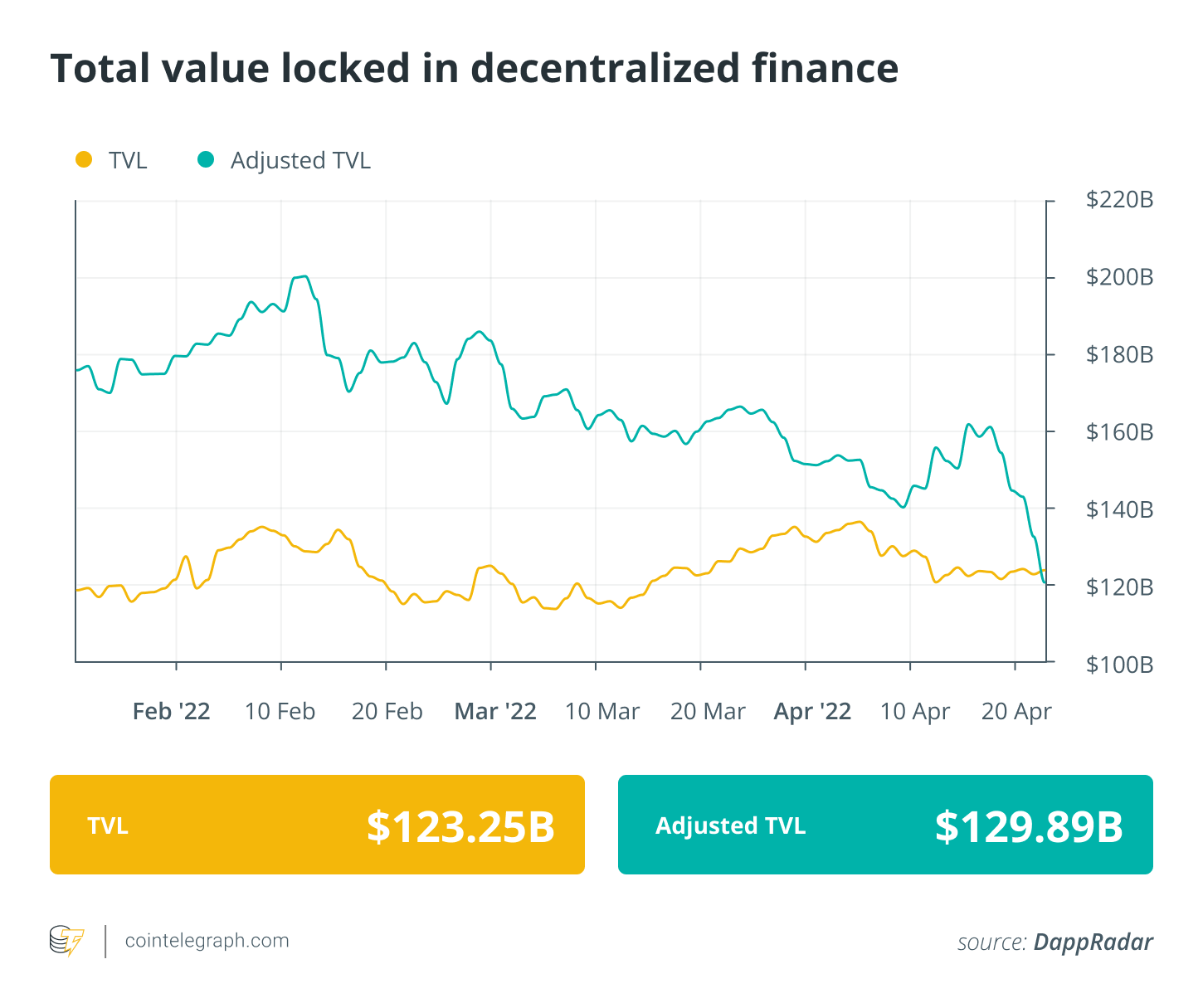

DeFi market overview

Analytical data reveals that DeFi’s total value locked continued to be inside a similar range to a week ago with $123 billion, despite a bullish surge toward the finish each week. Data from Cointelegraph Markets Pro and TradingView reveals that DeFi’s best players tokens by market capital registered per week full of volatile cost action and constant bearish pressure.

Most of the DeFi tokens within the top-100 ranking by switched eco-friendly around the daily chart, however their weekly performance continued to be bearish, barring the bend DAO Token (CRV) that surged by 4% in the last week.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along again next Friday for additional tales, insights and education within this dynamically evolving space.