Thanks for visiting Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights — a e-newsletter crafted to create you a few of the major developments during the last week.

Earlier this week, the DeFi ecosystem saw several new developments associated with the DeFi lending crisis as Celsius declared personal bankruptcy. At any given time when bears tend to be more dominant in the present market, DeFi protocols having a revenue system can thrive.

Lido Finance has announced intends to offer its Ether (ETH) staking services over the entire L2 system. Aave intends to leverage Pocket’s distributed network of 44,000 nodes to gain access to on-chain data from various blockchains, and gamers are plugging in DeFi with the Razer reward partnership.

A lot of the best players DeFi tokens traded in eco-friendly, with lots of registering double-digit gains in the last week.

DeFi downturn deepens, but protocols with revenue and fee discussing could thrive

Because the crypto winter drags on, savvy crypto investors have recognized that among the reliable causes of passive earnings that also exists are available in protocols that generate revenue and share a lot of it using their particular communities.

Data from Token Terminal shows revenue positive platforms are mainly the nonfungible token (NFT) marketplaces like LooksRare and OpenSea.

Ethereum staking service Lido announces layer-2 expansion

Inside a Monday blog publish, the Lido team noted it would initially start by supporting Ether staking via bridges to L2s using wrapped stETH (wstETH). Continuing to move forward, it is going to enable users to stake on the L2s “without the necessity to bridge their assets back” towards the Ethereum mainnet.

When it comes to partnered L2s, they mentioned that prior to the announcement, it’d already integrated its bridged staking services with Argent and Aztec. It added the next assortment of partnerships and integrations could be unveiled within the next couple of days.

Aave taps Pocket Network to strengthen decentralized application development

Aave, a wide open source DeFi protocol, is teaming track of decentralized Web3 infrastructure provider Pocket Network to provide developers elevated scalability and simplicity of use when building decentralized applications (DApps) around the Aave Protocol.

Based on the statement on Tuesday, Aave uses Pocket’s distributed network in excess of 44,000 nodes to gain access to on-chain data from various blockchains to power decentralized applications. Developers building Aave-powered DApps may now access blockchain data from Pocket Network when needed following a new integration.

Gamers plug into DeFi with the new Razer rewards partnership

Gamers and customers from it and gaming hardware firm Razer are going to plug into the field of DeFi via a new rewards swap program together with Cake DeFi.

Razer remains a family group favorite brand for gamers all over the world, using its Razer Gold rewards program allowing gamers to earn and redeem Razer Silver points for various hardware and digital rewards, including Steam games and voucher codes.

DeFi market overview

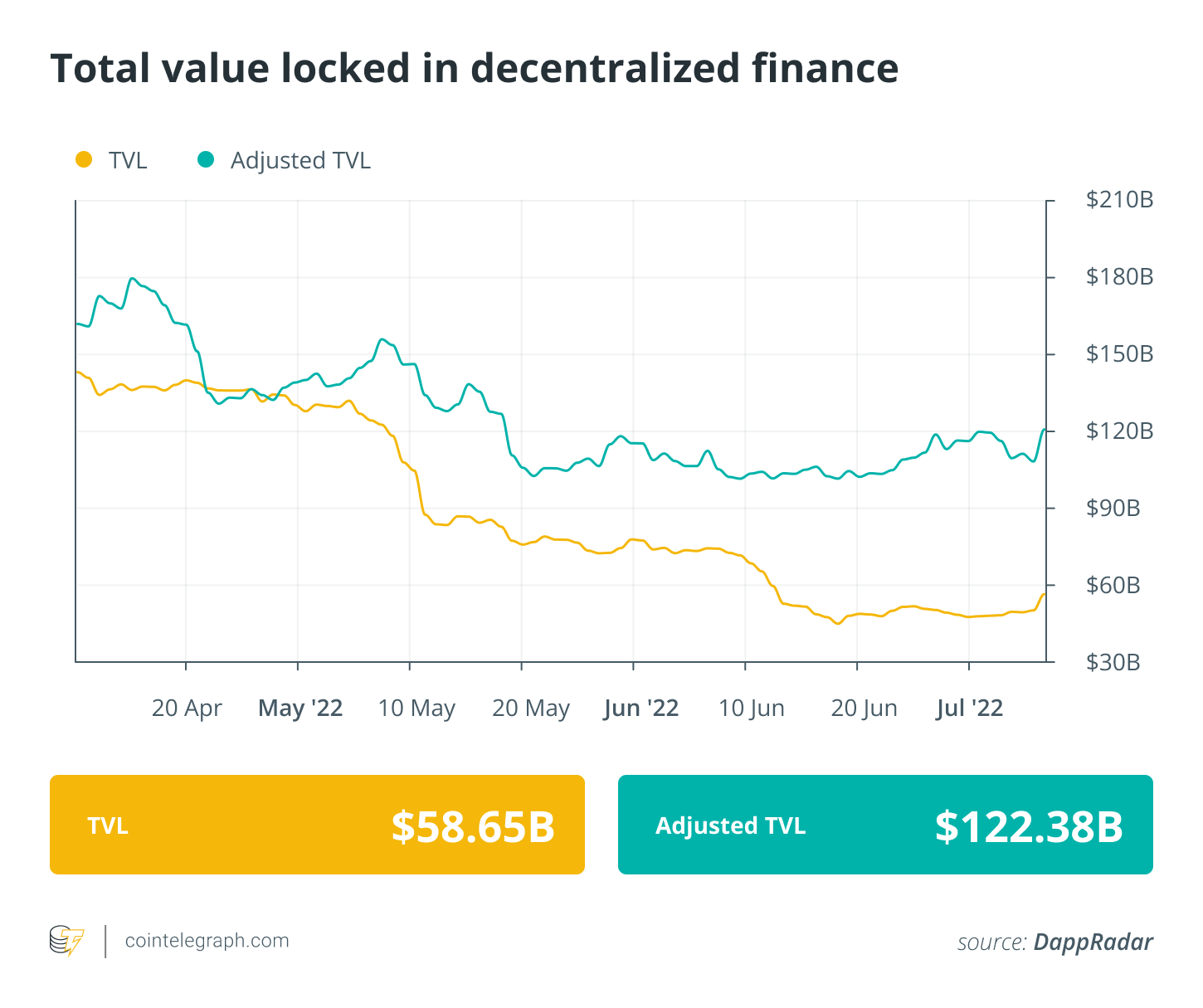

Analytical data reveals that DeFi’s total value locked registered an almost $5 billion rise in the past week, posting something of $58.65 billion. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s top-100 tokens by market capital were built with a mixed week, with several tokens buying and selling in red while a couple of others registered even double-digit gains.

Lido DAO (LDO) was the greatest gainer one of the best players DeFi tokens by having an 80% rise in the last week, adopted by Fantom (FTM) having a 28% surge. Avalanche (AVAX) registered a 26% surge in the last week, while ThorChain (RUNE) saw a 21% increase in cost in the last 7 days.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.