Yesteryear week within the decentralized finance (DeFi) ecosystem was covered with Terra’s collapse and it is aftermath on various environments it had been connected. Now BNB chain originates towards the save of countless stranded projects on Terra by providing financial and technical assistance.

After its spiral collapse, Terra co-founder Do Kown suggested a revival plan along with a hard fork to bring back the blockchain. Chainalysis introduced new tools to watch and track stolen funds across multiple blockchains. Swiss asset manager Julias Baer is eyeing crypto and DeFi potential.

Top DeFi tokens saw another week of bleeding, with nearly all these tokens buying and selling in red in the last week.

Do Kwon proposes Terra hard fork in order to save the ecosystem

Do Kwon, co-founding father of the troubled Terra Luna blockchain, announced a revised intend to restore the ecosystem after significant market volatility and natural protocol design flaws easily wiped out a majority of the blockchain’s market cap. As relayed through Kwon, Terraform Labs suggested a brand new governance model on May 18 to fork the Terra Luna blockchain known as Terra (token name: LUNA).

However, the brand new chain won’t be from the TerraUSD (UST) stablecoin. Meanwhile, that old Terra blockchain continuously exist with UST and become known as Terra Classic (LUNC). Under Kwon’s plan, if passed, the brand new LUNA blockchain goes survive May 27.

BNB Chain offers another lifeline to Terra ecosystem projects

Binance will welcome migration and supply support to projects in the Terra ecosystem after this month’s unraveling from the DeFi platform and it is algorithmic stablecoin.

BNB Chain (BNB) has dedicated to supplying investment and support to projects thinking about moving in the Terra ecosystem within the wake from the greatest black swan event hitting the cryptocurrency space recently.

DeFi-ing exploits: New Chainalysis tool tracks stolen crypto across multiple chains

Chainalysis launched a beta form of its Storyline software on Wednesday. Touted like a “Web3-native blockchain analysis tool,” Storyline aims to trace and visualize smart contract transactions having a concentrate on nonfungible tokens (NFTs) and DeFi platforms. This really is using the growing recognition and prevalence of NFTs and DeFi within the cryptocurrency space in the last year.

Chainalysis provides blockchain analysis and annual reports on cryptocurrency crime trends along with other analytics. The ever-altering landscape has witnessed DeFi and NFTs become important cogs within the ecosystem, with Chainalysis estimating the 2 sectors account in excess of 1 / 2 of global cryptocurrency transactions.

Swiss asset manager Julius Baer eyes crypto and DeFi potential

The 132-year-old Swiss asset management firm, Julius Baer, promises to offer contact with cryptocurrencies and decentralized finance because of its high internet-worth clients. The firm’s Chief executive officer Philipp Rickenbacher confirmed the transfer to the cryptocurrency space throughout his receiving the company’s strategy update for the following 3 years.

Rickenbacher noted the recent slump within the cryptocurrency markets presented a watershed moment because of its clients to achieve contact with the nascent asset class.

DeFi market overview

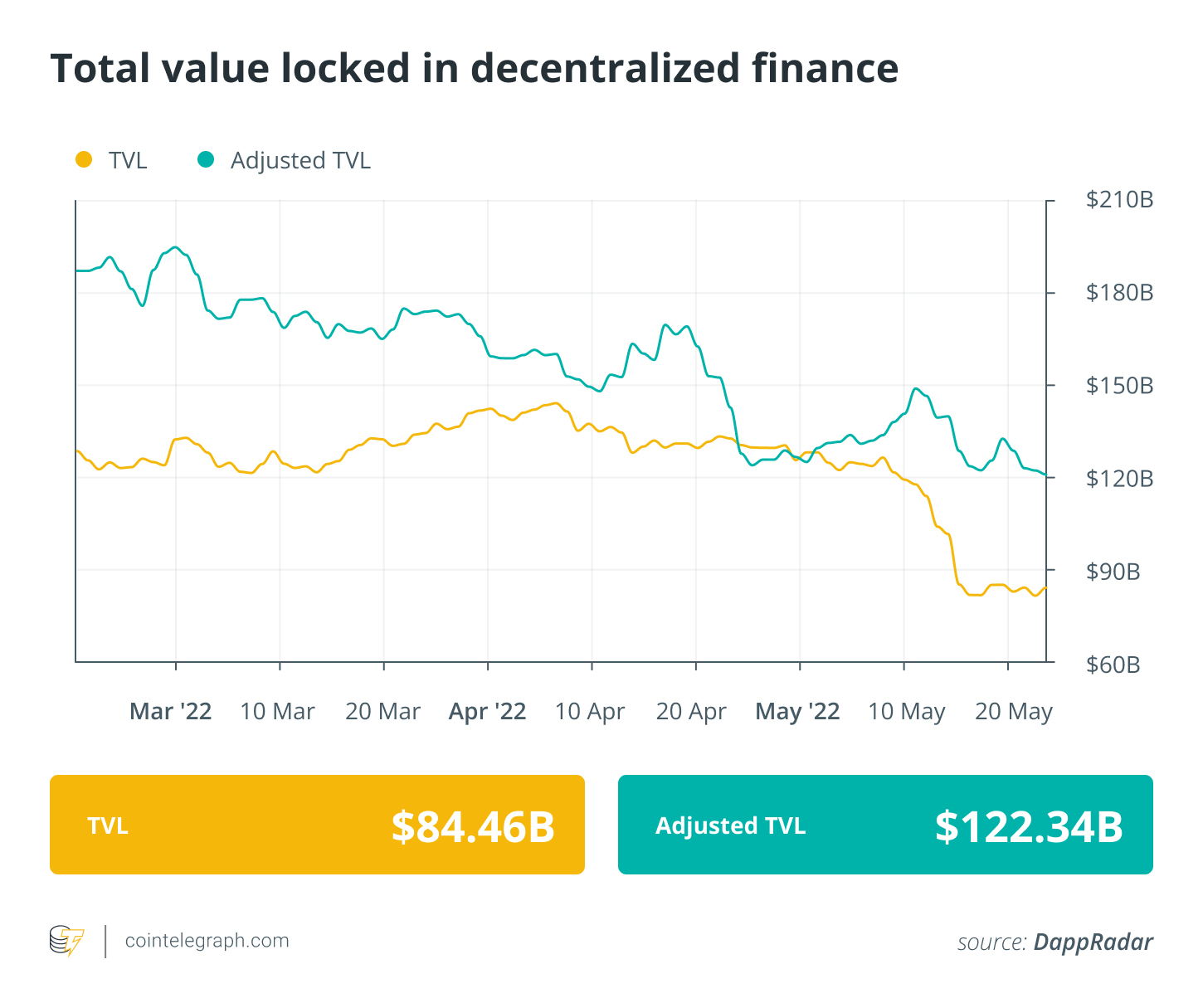

Analytical data reveals that DeFi’s total value locked continued to be underneath the $100 billion mark, falling to $84.2 billion. Data from Cointelegraph Markets Pro and TradingView reveals that DeFi’s best players tokens by market capital registered per week full of volatile cost action and constant bearish pressure.

Most of the DeFi tokens within the top-100 ranking by market cap traded in red, barring a couple of. Kyber Network Very v2 (KNC) was the greatest gainer having a 74% rise in the last week, adopted by Kava (KAVA) at 25% and PancakeSwap (CAKE) at 5%.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along again next Friday for additional tales, insights and education within this dynamically evolving space.