Yesteryear week within the decentralized finance (DeFi) ecosystem saw many new developments, such as the rebirth from the Terra 2. blockchain. Meanwhile, Binance’s incubation platform Binance Labs launched a $500 million fund to aid and promote Web3 adoption.

Singapore’s central bank partnered with JP Morgan to understand more about DeFi applications in wholesale funding markets by creating tokenized bonds. KuCoin launched its very decentralized wallet with DeFi and nonfungible token support.

The very best-100 DeFi tokens demonstrated indications of an outbreak from the month-lengthy bearish trend, with the majority of the tokens showing overall gains previously 7 days.

Maker founder proposes MetaDAOs and artificial ETH in ‘Endgame Plan’

MakerDAO co-founder Rune Christensen has issued a brand new monumental proposal to push the work into its final form known as The Endgame Plan.

Across 3,000 words, including 35 detailed infographics, Christensen described the current type of governance at Maker results in a deadlock, which makes it hard for the protocol to effectively process “complicated real-world financial deals” and compromising its competitiveness with banking institutions.

Binance Labs’ $500M fund to catalyze crypto, Web3 and blockchain adoption

Binance Labs, an investment arm of crypto giant Binance, launched a $500 million fund together with global investors including DST Global Partners and Breyer Capital they are driving innovation over the crypto, Web3 and blockchain landscape.

Binance Labs intends to allocate the most recent $500 million fund to projects across various stages: incubation, early-stage and late-stage growth.

Discussing his undertake speeding up the adoption from the crypto ecosystem, Binance CEO Changpeng Zhao noted the significance of an association between values, people and economies.

Singapore to understand more about digital asset tokenization on public chains

The Financial Authority of Singapore (MAS) has launched Project Protector, a blockchain-based digital assets trial which will use tokenization. The work includes controlled banking institutions becoming “trust anchors,” having a pilot involving JP Morgan, DBS Bank and Marketnode, the SGX partnership for bonds.

The Work Protector initiative, that was announced throughout the Asia Tech x Singapore Summit on Tuesday, was spearheaded by Deputy Pm and Coordinating Minister for Economic Policies Heng Swee Keat. It’ll see MAS explore DeFi applications in wholesale funding markets by creating a liquidity pool of tokenized bonds and deposits to complete borrowing and lending on the public blockchain-based network.

KuCoin connects to Web3 with new decentralized wallet

Cryptocurrency buying and selling platform KuCoin has launched a brand new decentralized wallet platform as curiosity about Web3 is constantly on the gather steam.

KuCoin Wallet has become love users, using the browser-based platform paving the way in which for any mobile application, that is still in development.

The woking platform connects to the KuCoin ecosystem featuring mix-blockchain integration. Users can buy, sell, trade and send a number of cryptocurrencies, including Bitcoin (BTC), Ether (ETH) and Tether (USDT), additionally with other tokens.

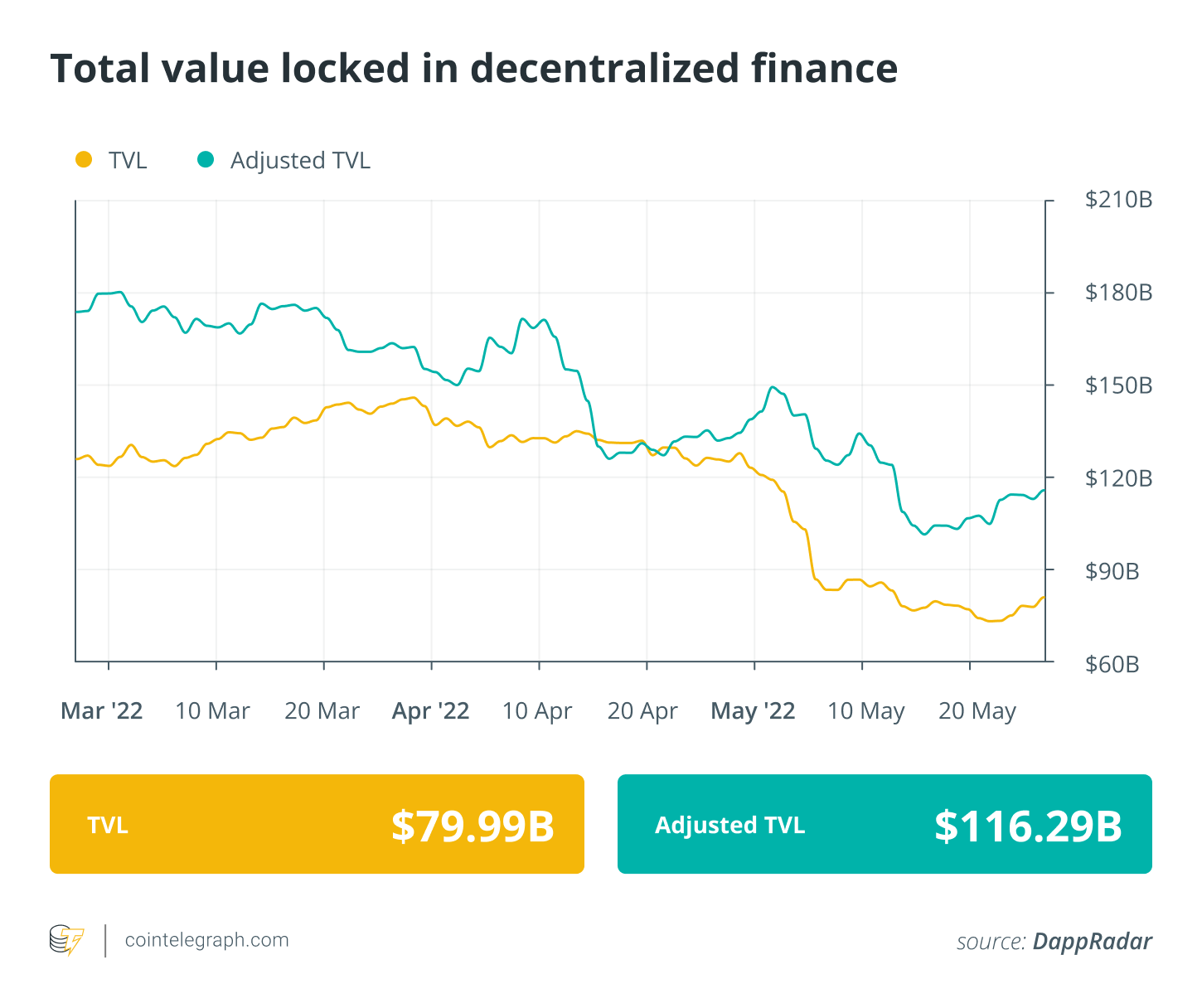

DeFi market overview

Analytical data reveals that DeFi’s total value locked saw a pattern reversal, using the value reaching above $80 billion again. Data from Cointelegraph Markets Pro and TradingView reveals that DeFi’s best players tokens by market capital registered per week full of volatile cost action but broke from the bearish trend in the last day or two.

A lot of the DeFi tokens within the top-100 ranking by market cap traded within the eco-friendly, Aave (AAVE) was the greatest gainer having a 10.42% surge, adopted by CurveDAO (CRV) with 10%. Theta Network (THETA) registered an 8% cost rise, while Chainlink (LINK) increased 7%.

The relaunched Terra 2. network, that was listed by major exchanges following its revival on May 28, has witnessed an unpredictable cost action since that time. The Terra (LUNA) cost fell by 70% on the very first day of their buying and selling and presently buying and selling at one-third of their listing cost.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along again next Friday for additional tales, insights and education within this dynamically evolving space.