Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

Earlier this week, the DeFi ecosystem saw two exploits, one to another, inducing the lack of huge amount of money. First, mix-bridge token platform Nomad grew to become a target of the items many considered a decentralized robbery, which saw almost $190 million drained from their wallets.

Solana ecosystem grew to become the victim of the prevalent unknown attack that saw a large number of wallets getting drained of all the funds. Aside from a number of exploits, Nansen accepted their negligence toward the DeFi market throughout the NFT boom.

The very best-100 DeFi tokens were built with a mixed cost action in the last week, with lots of visiting a downturn after a little bullish action a week ago.

Nomad token bridge drained of $190M in funds in security exploit

The Nomad token bridge seems to possess possessed a security exploit which has permitted online hackers to systematically drain a substantial area of the bridge’s funds more than a lengthy number of transactions.

Nearly the whole $190.seven million in crypto continues to be taken off the bridge, with simply $651.54 left residing in the wallet, based on the DeFi tracking platform DefiLlama. However, Nomad later recommended to Cointelegraph that a few of the funds were withdrawn by “white hat friends” who required the funds by helping cover their the aim of safeguarding them.

Slope wallets blamed for Solana-based wallet attack

Because the dust settles from yesterday’s Solana (SOL) ecosystem mayhem, information is surfacing that wallet provider Slope is basically accountable for the safety exploit that stole crypto from a large number of Solana users.

Slope is really a Web3 wallet provider for that Solana layer-1 blockchain. With the Solana Status Twitter account on Wednesday, the Solana Foundation pointed the finger at Slope, proclaiming that “it seems affected addresses were at some point produced, imported, or utilized in Slope mobile wallet applications.”

Nansen admits neglecting DeFi plans throughout the NFT craze

Chief executive officer and co-founder Alex Svanevik lately spoke about Nansen’s growth, highlighting that the organization has registered over 130 million addresses and it has grown 30% regardless of the crypto downturn. Svanevik credited a lot of his success to the need for blockchain platforms, particularly individuals according to Ethereum.

Cointelegraph arrived at to Nansen’s Andrew Thurman for additional understanding of their success. Thurman, a Simian psychometric enhancement specialist, described that whenever the nonfungible token (NFT) craze, they neglected their DeFi plans a little.

Uniswap Foundation proposal will get mixed reaction over $74M cost tag

The Uniswap Labs community has begun mulling more than a new proposal that will form a Uniswap Foundation located in the U . s . States, however, it’s likely to cost $74 million.

The proposal has received mixed feedback in the community to date, with lots of praising the foundation’s intends to support and expand the Uniswap ecosystem, while some have balked at its hefty cost tag.

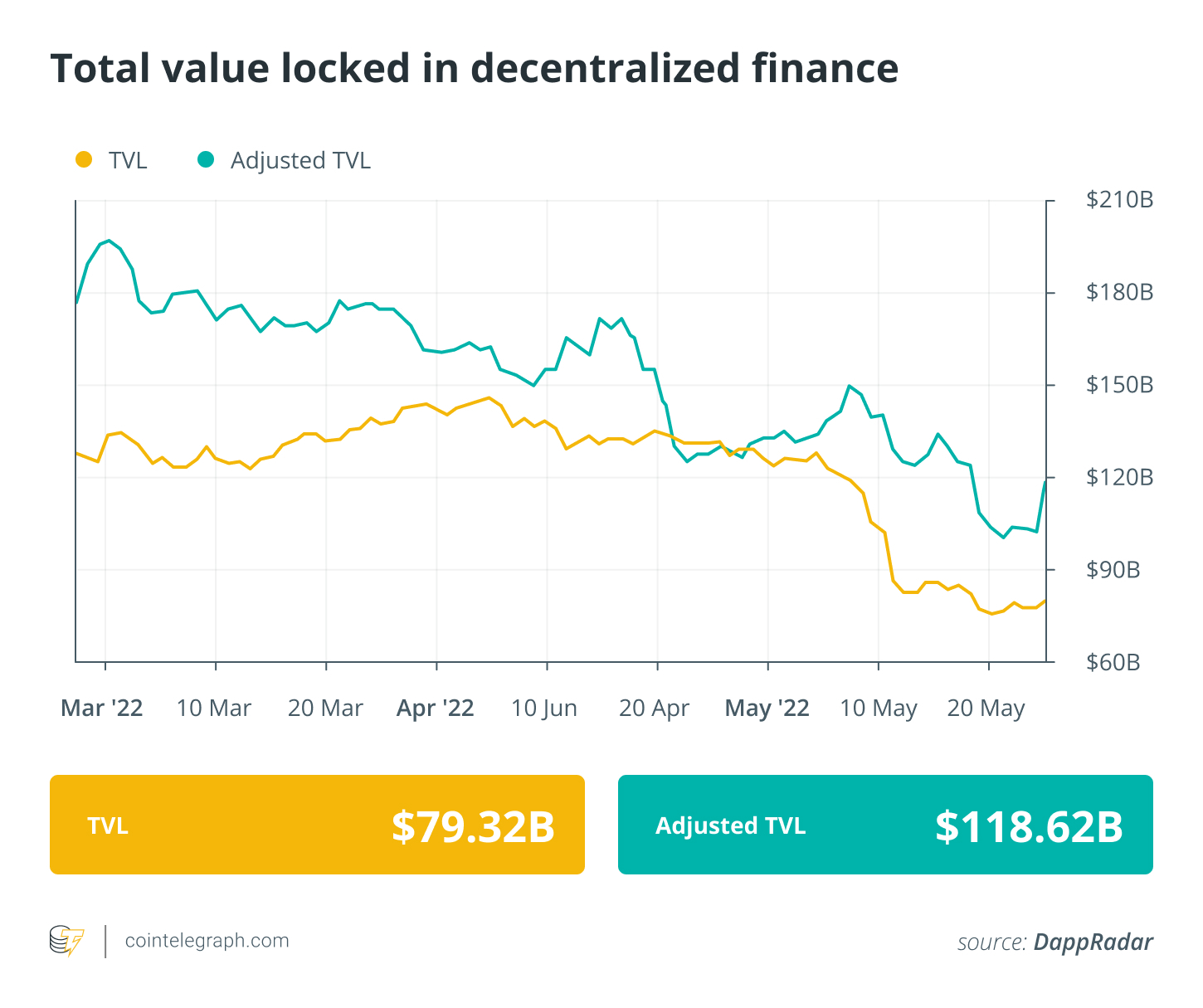

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered an increase of nearly 9 billion dollars in the past week, posting something of $79.4 billion. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s top-100 tokens by market capital were built with a mixed week, with several tokens buying and selling in red while a couple of others registered even double-digit gains.

Yearn.finance (YFI) was the greatest gainer one of the best players, registering a 20% surge in the last week, adopted by Lido DAO (LDO) having a 16% surge. Fantom (FTM) saw a tenPercent cost rise and PancakeSwap (CAKE) registered an 8% rise around the weekly chart.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.