Earlier this week, the decentralized finance (DeFi) ecosystem faced the brunt from the bears fueled by liquidation rumors of Three Arrow Capital (3AC) and Celsius liquidations. MakerDAO made the decision to chop off Aave (AAVE) from the direct deposit module like a safeguard considering the chance that Celsius folds and crashes the cost of staked Ether (stETH).

Buying and selling firm 8 Blocks Capital known as to platforms holding funds of 3AC to freeze the assets as rumors of 3AC’s insolvency stay afloat. Micheal Saylor believes Bitcoin (BTC) and also the Lightning Network can solve most of the DeFi ecosystem problems.

The very best 100 DeFi tokens were hit hard by bears, with nearly all tokens registering multi-month low together with double-digit losses in the last week.

Crypto crash wreaking damage to DeFi protocols, CEXs

Huge cryptocurrency sell-off within the markets on Monday caused significant ripples for projects and entities alike. DeFi ending protocol Aave’s utilization rates have fallen across almost all stablecoin borrowings. Most particularly, borrowings for Binance USD (BUSD) now stand in a mere 30% over a a lot of 80% in May.

The employment rates are the number of lent to deposited funds. Since borrowers are needed to publish digital asset collateral before you take out financing on Aave, users are most likely withdrawing corporation considering Monda’s sell-off and away to prevent liquidation. Data from DefiLlama signifies that Aave’s total value locked has fallen from $33.51 billion last October to $8.11 billion.

Su Zhu’s cryptic statement as rumors swirl of 3AC liquidations and insolvency

Su Zhu, the co-founding father of Singapore-based crypto investment capital firm Three Arrows Capital (3AC), has released a cryptic statement on Twitter as a result of swirling rumors that the organization is battling against insolvency.

Online chatter about 3AC being not able to satisfy a margin call started after 3AC began moving assets for this week to top-up funds on decentralized finance platforms for example Aave to prevent potential liquidations among the tanking cost of Ether (ETH) now. You will find unconfirmed reports that 3AC faced liquidations totaling vast sums from multiple positions.

Maker reduces Aave’s DAI supply as fallout from Celsius continues

MakerDAO has dicated to stop lending platform Aave’s capability to generate Dai (DAI) because of its lending pool without collateral because the perils of Celsius’s liquidity crisis loom large within the entire crypto ecosystem.

The decentralized autonomous organization (DAO) made a decision as a way of mitigating the producer protocol’s contact with the unhappy staking and lending platform in situation Celsius goes belly up and implodes the stETH peg too.

Liquidity provider asks platforms to freeze 3AC funds to recuperate assets after litigation

Danny Yuan, Chief executive officer of buying and selling firm 8 Blocks Capital, known as to platforms which are holding funds of 3AC to freeze the assets as rumors of 3AC’s insolvency stay afloat.

Inside a Twitter thread, Yuan described their company’s participation with 3AC, noting that they’re having to pay the organization to make use of the buying and selling accounts they own. The agreement incorporated the opportunity to withdraw funds at any time.

Bitcoin and Lightning Network can help to save DeFi from adversity — MicroStrategy Chief executive officer

Considering the current fragility within the DeFi sector, Bitcoin maximalist and MicroStrategy Chief executive officer Michael Saylor feels that Bitcoin and also the Lightning network may come towards the save from the DeFi market.

With two enormous protocols, Terra and Celsius, facing acute difficulties inside a month of one another, the DeFi sector goes through trouble. And, inside a recent tweet, Saylor recommended that Bitcoin and Lightning may help stabilize the.

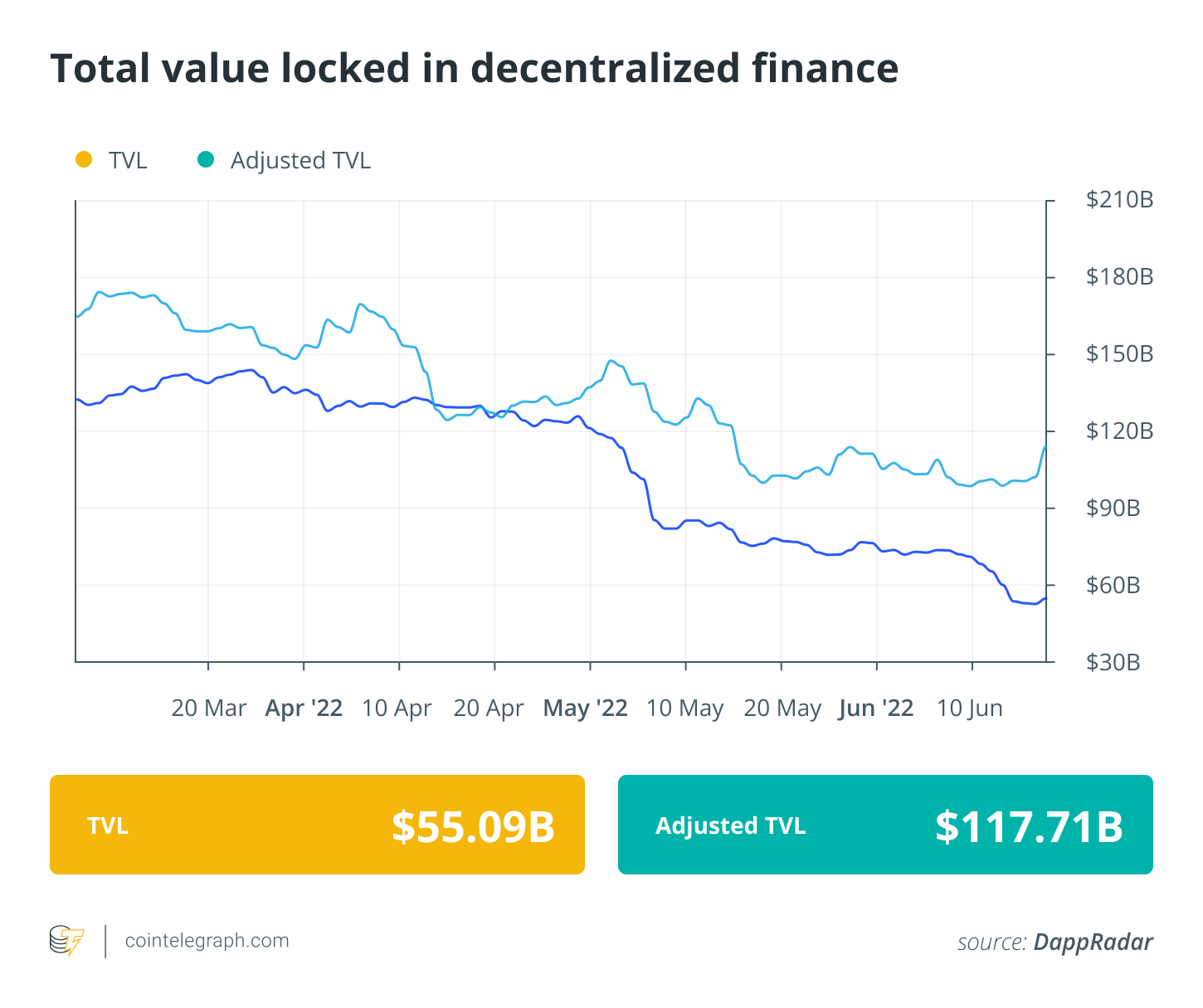

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered another week of output in the last week, using the value dipping to $55 billion. Data from Cointelegraph Markets Pro and TradingView reveals that DeFi’s top-100 tokens by market capital registered per week full of volatile cost action with bears dominating the marketplace trends.

A lot of the DeFi tokens within the best players ranking by market cap bled in double digits. Theta network demonstrated the greatest resistance falling by 12% in the last week, adopted by Fundamental Attention Token (BAT), which fell by 14%. The rest of the the very best-100 DeFi tokens fell by greater than 20%, with a few registering losses up to 40% during the last 7 days.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along again next Friday for additional tales, insights and education within this dynamically evolving space.