The decentralized finance (DeFi) ecosystem is constantly on the have a problem with the continuing market volatility after-results of the Terra ecosystem collapse. In the last week, major DeFi protocols demonstrated indications of elevated buying and selling activity, with Uniswap breaching the $1 trillion buying and selling volume mark.

Terra continued to be the main focus of the majority of the discussions around blockchain and crypto in the World Economic Forum (WEF), with analysts suggesting Terra was offering unsustainable yields. DeFi insurance protocol to spend millions after Terra collapse, while curiosity about Ethereum Name Services (ENS) shattered new records.

Top DeFi tokens by market cap were built with a mixed week of cost action, with several tokens within the best players registering double-digit gains in the last week, even though many others still trade at a negative balance.

WEF 2022: Terra was offering unsustainable yields and DeFi supports financial inclusion

Reporting in the inaugural day’s the Blockchain Hub Davos 2022 conference, Cointelegraph’s editor-in-chief, Kristina Lucrezia Cornèr, located a panel discussion focused on DeFi entitled “Programmable Cash is Here — and it is Altering the planet as you may know It.”

Barrier Capital’s Horsman shared the Terra crisis partially happened because “they were basically offering yields which were unsustainable, and [that] there have been investment capital businesses that were bootstrapping individuals yields to be able to bootstrap an ecosystem.” He noted that his firm made the decision to withdraw funds in the project in November–December 2021 after their reserve modeling data predicted worrying calculations for future years.

InsurAce states it’ll pay millions to claimants after Terra’s collapse

DeFi insurance protocol InsurAce states it had been within its legal rights to lessen the claims period for individuals impacted by the TerraUSD (UST) depegging event from 15 days to seven — but added it’s already processed almost all 173 posted claims and can shell out $11 million.

InsurAce (INSUR) may be the third-largest insurance carrier for decentralized finance (DeFi) protocols, having a market cap of $15 million. On May 13, InsurAce caused a stir if this announced it’d shortened the claims window for individuals with cover associated with Anchor (ANC), Mirror (MIR), and stablecoin UST following a collapse from the Terra layer-1 blockchain.

Uniswap breaks $1T in volume — but only has been utilized by 3.9M addresses

Decentralized exchange (DEX) Uniswap has capped $1 trillion as a whole buying and selling volume since launching on Ethereum at the end of 2018.

That develops from a relatively small users list, however, indicating that there’s lots of potential growth in the future. Based on data from Uniswap Labs, that are major contributors to the introduction of the protocol and ecosystem, the DEX’s quantity of cumulative addresses hit around 3.9 million this month after approximately 3 years.

Curiosity about Ethereum Name Service reaching ‘critical mass’

The Ethereum Name Services are getting its best month on record for brand new registrations, account renewals and revenue, because of community awareness and occasional gas charges.

Lead developer at ENS Nick Manley tweeted on Monday the metrics for that Web3 domain service through May to date. He noted that figures were poised to shatter existing records simply because they were already whatsoever-time highs, “and there’s still per week of May left.”

DeFi market overview

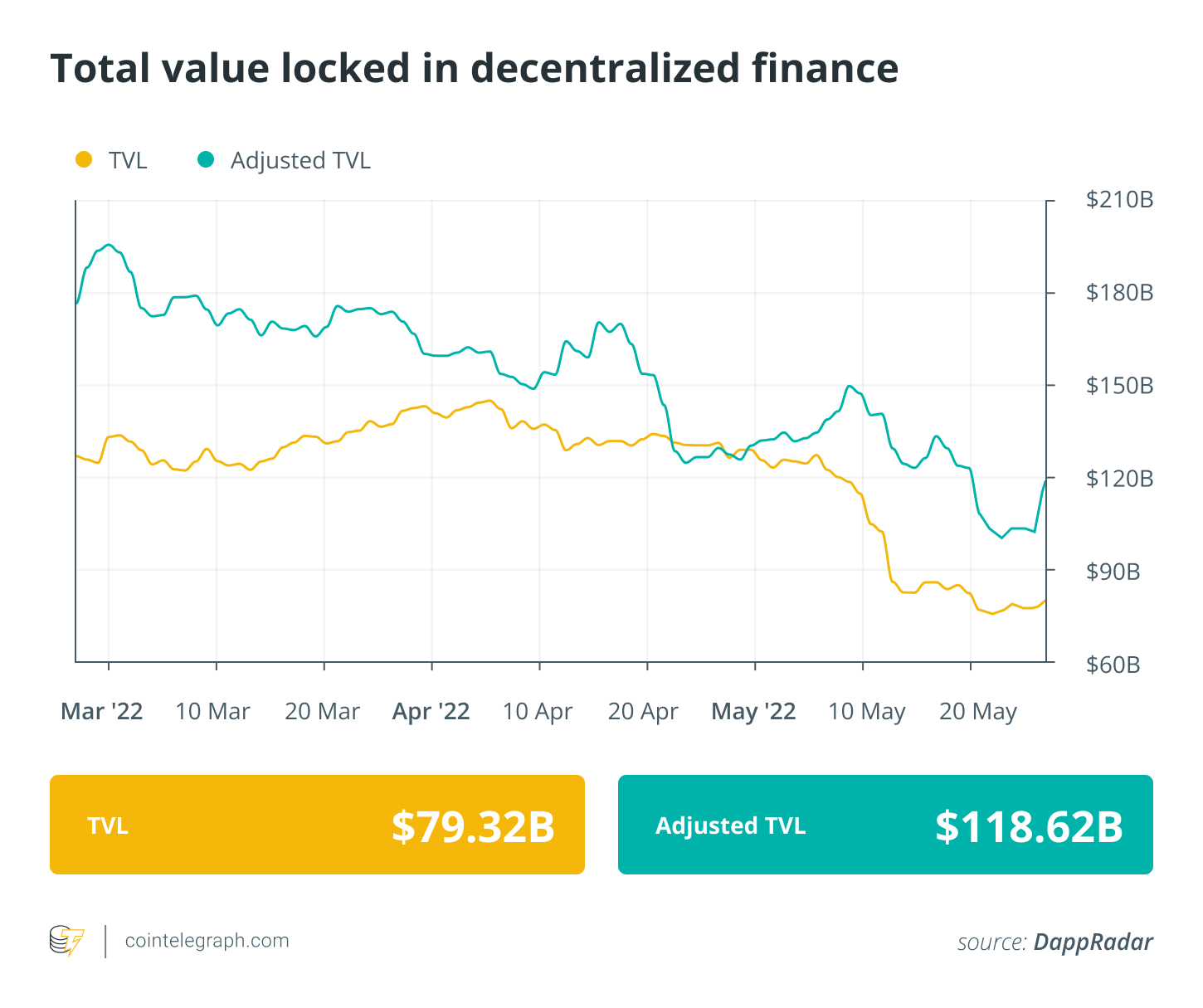

Analytical data reveals that DeFi’s total value locked ongoing to exhibit output previously week too, falling to $79 billion, a $5 billion decline in the last week. Data from Cointelegraph Markets Pro and TradingView reveals that DeFi’s best players tokens by market capital registered per week full of volatile cost action and constant bearish pressure.

Most of the DeFi tokens within the top-100 ranking by market cap traded in red, barring a couple of. Aave (AAVE) was the greatest gainer having a 15% surge, adopted by Loopring (LRC) with 14%. Tezos (XTZ) saw an11% cost rise while Kava (KAVA) increased by 10%.

Prior to going!

Do Kown’s Terra revival proposal finally got approved. Kwon’s “Terra Ecosystem Restoration Plan” would be to create new coins and provide them out to investors who lost money. “Let’s call the present Terra blockchain network ‘Terra Classic,’ and also the present Luna blockchain, ‘Luna Classic,’ and make up a new Terra blockchain,” Chief executive officer Kwon tweeted on May 18.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along again next Friday for additional tales, insights and education within this dynamically evolving space.