Earlier this week, the decentralized finance (DeFi) ecosystem attempted gaining some momentum among the bear market crash. Uniswap saw a pattern reversal and overtook Ethereum regarding network charges compensated. However, not every DeFi protocols were as lucky, as Bancor needed to pause its “impermanent loss protection” within the wake of the hostile market.

DappRadar’s report implies that the GameFi ecosystem is constantly on the thrive regardless of the current downturn on the market. Solend invalidates Solana whale wallet takeover plan with second governance election.

The very best 100 DeFi tokens demonstrated indications of recovery after last week’s mayhem, and some of the tokens registered double-digit gains.

DeFi Summer time 3.? Uniswap overtakes Ethereum on charges, DeFi outperforms

Decentralized exchange (DEX) Uniswap has surpassed its host blockchain Ethereum when it comes to charges compensated more than a seven-day moving average.

The surge seems a part of a current spate of popular for DeFi among the present bear market. Decentralized finance (DeFi) platforms for example Aave and Synthetix have experienced surges in charges compensated in the last 7 days, while their native tokens yet others for example Compound (COMP) also have boomed in cost.

GameFi keeps growing despite crypto winter: DappRadar report

Blockchain games were the topic of the most recent DappRadar x BGA Games Report #5, printed Tuesday. The report checked out healthy environments and investments in GameFi and metaverse markets.

The report covered several projects at length, outlining their ongoing success and growth. Splinterlands, Illuvium, Galaverse and STEPN have ongoing getting beginners for their platforms, gaining financial interest and expanding their companies.

Bancor pauses impermanent loss protection citing ‘hostile’ market conditions

Bancor, a DeFi protocol frequently credited because the pioneer from the DeFi space, stopped its impermanent loss protection (ILP) function on Sunday, citing “hostile” market conditions.

Inside a blog publish on Monday, the DeFi protocol noted the ILP pause is really a temporary measure to safeguard the protocol and also the users. Whenever a user gives liquidity to some liquidity pool, the number of their deposited assets changes in a later moment, potentially departing investors with a lot of lower value token, this is whats called impermanent loss.

Solend invalidates Solana whale wallet takeover plan with second governance election

Solana-based DeFi lending protocol Solend has produced another governance election to invalidate the lately-approved proposal that gave Solend Labs “emergency powers” to gain access to a whale’s wallet to prevent liquidation.

On Sunday, the crypto lending platform launched a governance election entitled “SLND1: Mitigate Risk From Whale.” It permitted Solend to lessen the danger the whale’s liquidation poses towards the market allowing the lending platform connect to the whale’s wallet and letting the liquidations happen over-the-counter.

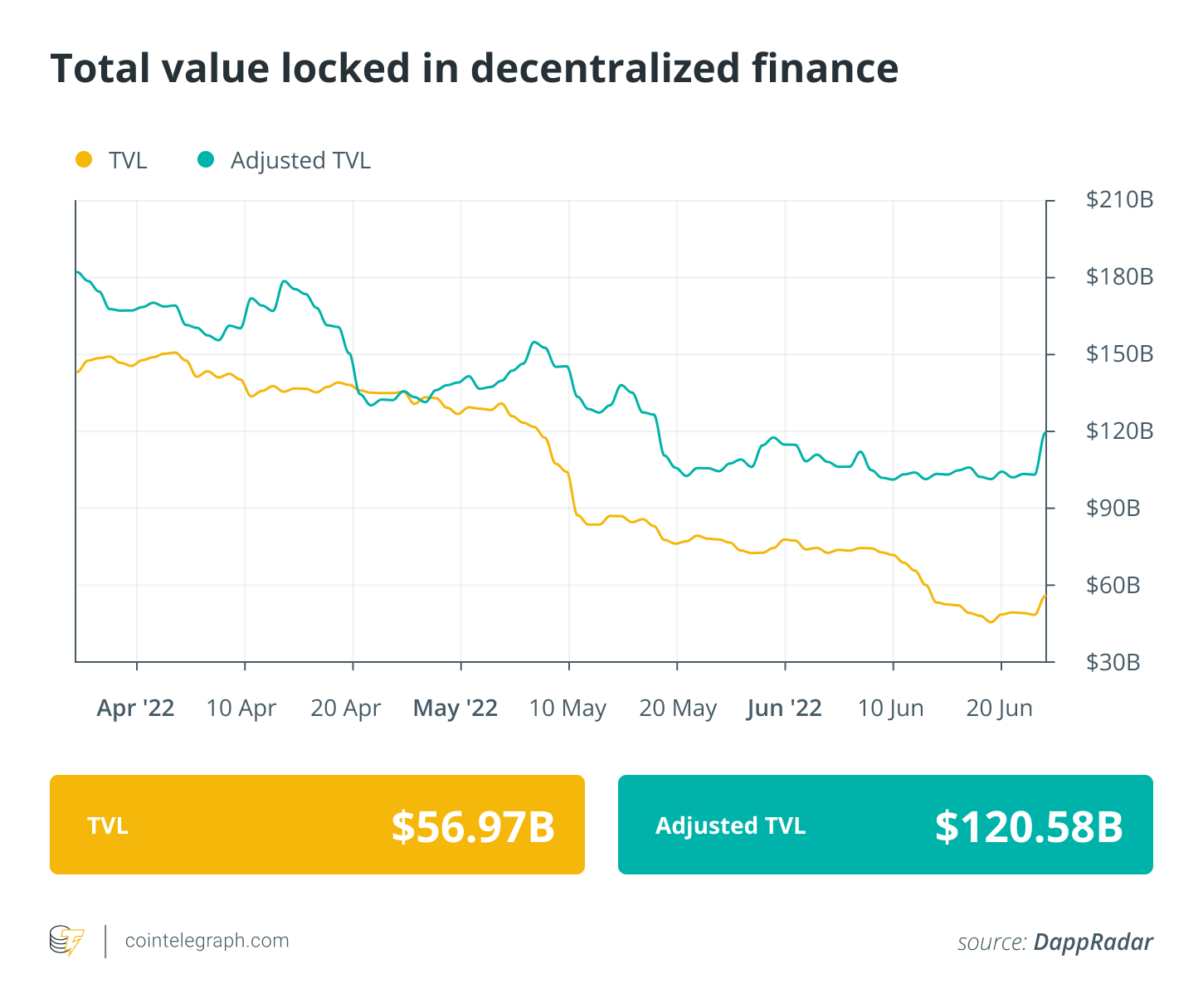

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered a small recovery rising above $56 billion. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s top-100 tokens by market capital were on the go, and most of the tokens registered double-digit gains in the last week.

A lot of the DeFi tokens within the best players ranking by market cap were buying and selling in eco-friendly. Synthetix (SYX) registered the greatest gain having a 90% surge in the last week, adopted by Uniswap (UNI), which saw a 37% appreciation in cost previously 7 days. COMP acquired 31%, while Thorchain (THOR) saw a 22% rise.

Prior to going!

Celsius network, the lending platform that’s been in danger over liquidations and insufficient Capital, saw a residential area-brought short squeeze of their native token, CEL. It registered a 300% jump in the last week among market uncertainty over its future.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along again next Friday for additional tales, insights and education within this dynamically evolving space.