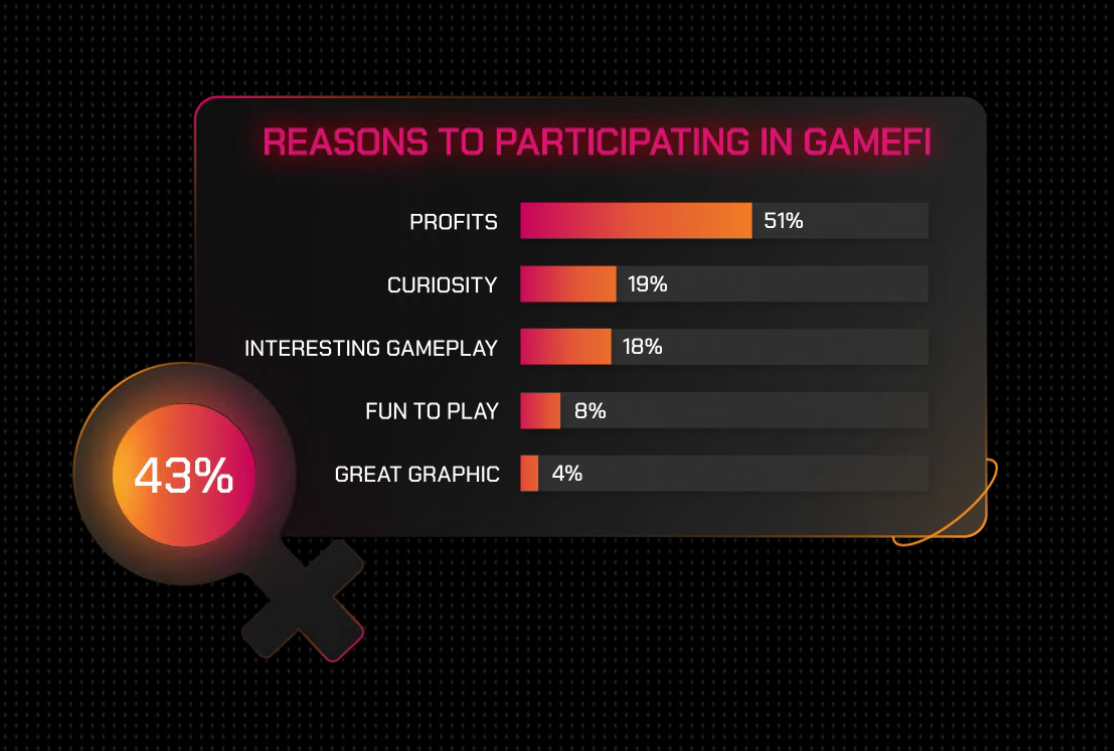

GameFi, the fusion of gaming and decentralized finance (DeFi) attracts some investors that have a tendency to choose projects according to their use situation instead of money-generating potential.

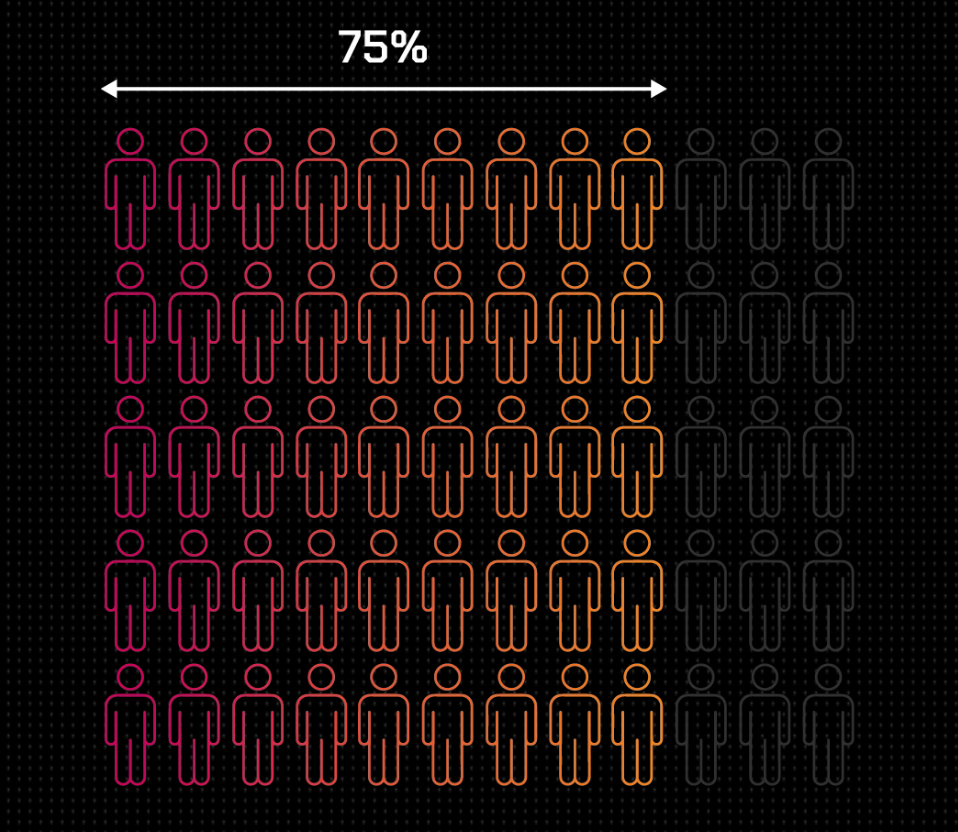

The GameFi ecosystem attracts GenZ investors and gaming enthusiasts. Consequently, it stands being an access point for various first-time investors. A ChainPlay survey participated by 2428 GameFi investors says 75% from the respondents became a member of the crypto space exclusively due to GameFi.

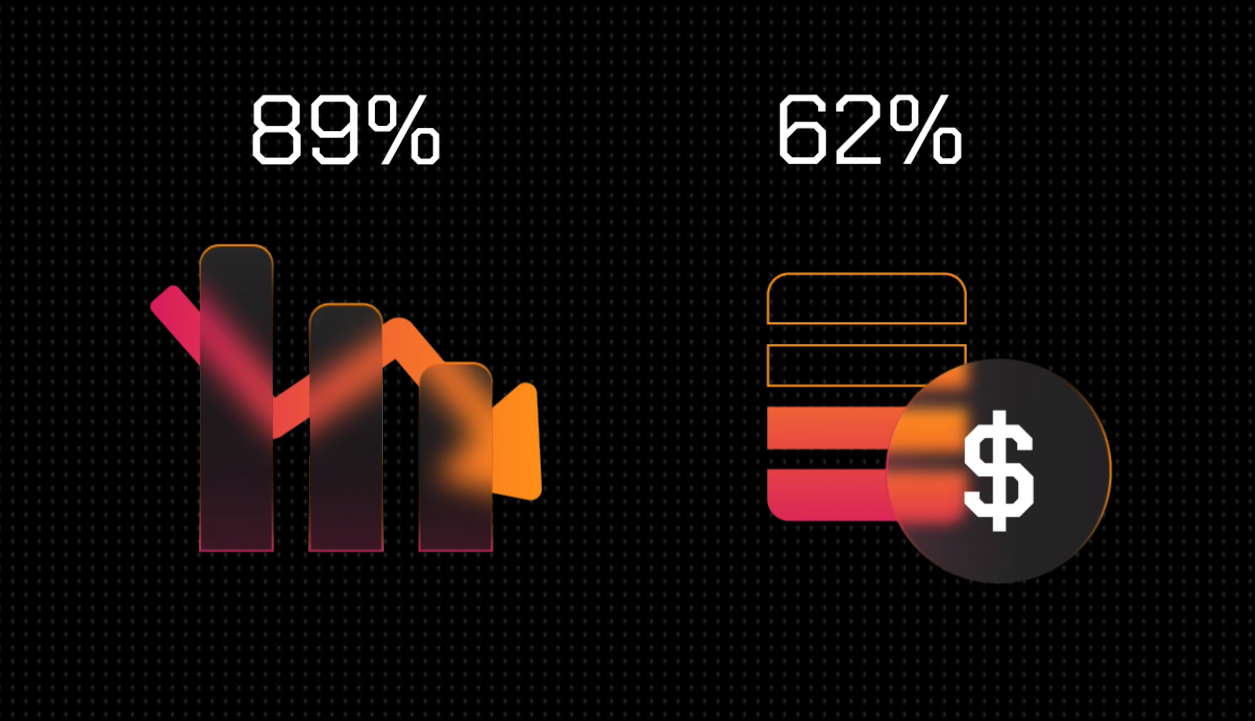

While roughly 1 / 2 of the investors became a member of the GameFi space initially for profits, 89% of GameFi investors was a victim of the crypto winter of 2022 — with 62% of these losing greater than 50% of the profits.

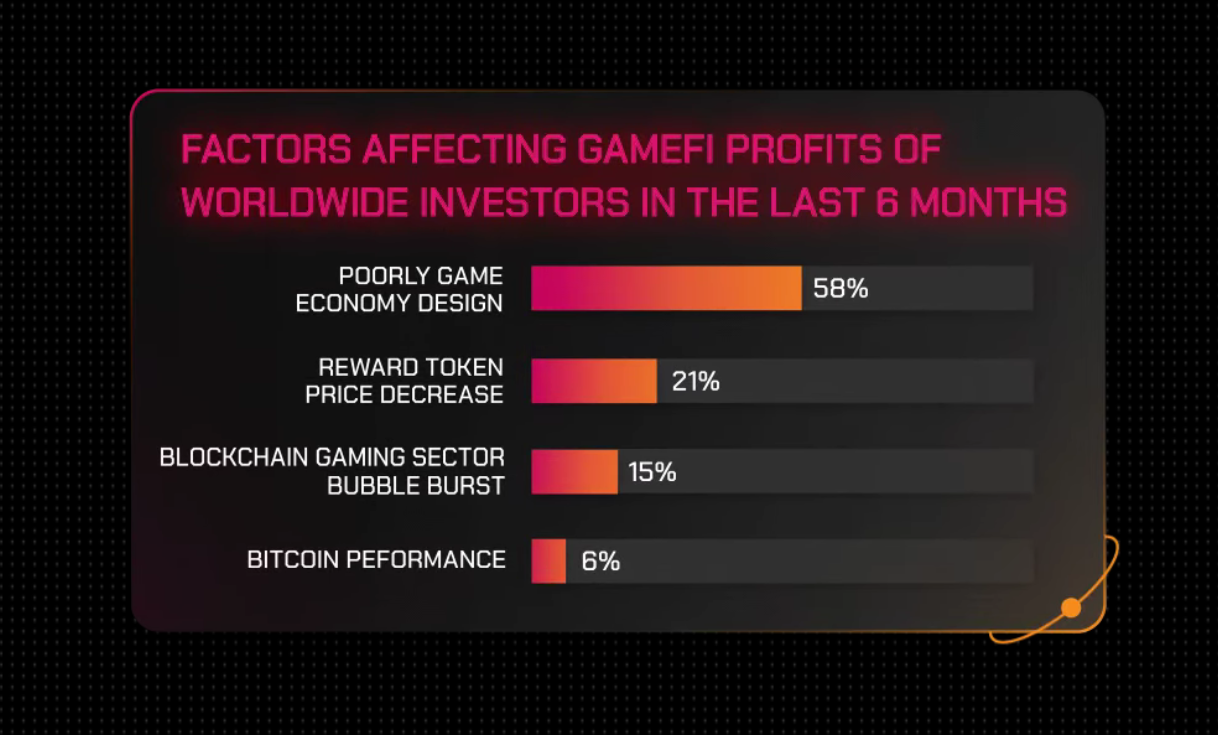

However, investors think that poor in-game economy design was the primary reason behind their losses. In compliance with this particular sentiment, laptop computer says in 2022, investors worldwide spent typically 2.5 hrs each day taking part in GameFi, that is lower 43% to 4.4 hrs from this past year.

The worry of rug pulls and Ponzi schemes along with sub-componen graphics are the greatest motorists stopping investments in new GameFi projects. Consequently, 44% of investors think that the participation of traditional gaming companies could be answer to GameFi’s growth.

Furthermore, with regards to future GameFi projects, 81% of GameFi investors are leaving the standard mindset and prioritizing the enjoyment factor over profit-making because they seek positive in-game encounters.

Related: GameFi and crypto ‘natural fit’ for game publishers: KBW 2022

Blockchain gaming and also the Metaverse were minimal affected environments through the Terra debacle, confirmed a DappRadar report.

Additionally, a sustained institutional investment was observed in both blockchain gaming and also the Metaverse, highlighting that lots of top companies see the opportunity of strong economic development in both sectors continuing to move forward.