Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

Earlier this week, there have been some major developments within the run-to the approaching Ethereum Merge slated for Sept. 15. Bitfinex grew to become the most recent crypto exchange to throw its support behind the chain split token.

While DeFi bridge hacks have grown to be a typic this season, developers behind Rainbow Bridge were able to foil an exploit attempt within a few moments, resulting in the hacker losing their safety deposit.

The Tornado Cash developer who had been arrested a week ago was delivered to 90-day judicial child custody waiting for charges. It didn’t go lower well using the crypto community, who’ve positively rallied behind the developer and also have accused the government bodies of throttling freedom.

Cardano’s testnet and Vasil hard fork encountered trouble again now as founder Charles Hoskinson required to Twitter to assert the issues all around the hard fork as “incredibly corrosive and damaging.”

The very best-100 DeFi tokens were built with a mixed week when it comes to cost action, with most of them buying and selling at a negative balance around the weekly charts, barring a couple of tokens which have proven even double-digit growth.

Hacker attempts to exploit bridge protocol, fails miserably

Mix-chain bridges have more and more become targeted by malicious entities. However, not every online hackers can try to escape with millions within their exploit attempts. Some finish up taking a loss using their own wallets.

Inside a Twitter thread, Alex Shevchenko, the Chief executive officer of Aurora Labs, told the storyline of the hacker who tried to exploit the Rainbow Bridge but wound up losing 5 Ether (ETH), worth around $8,000 during the time of writing.

Bitfinex offers new chain split tokens in front of Ethereum Merge

iFinex, the organization accountable for Bitfinex Derivatives, announced on Tuesday the launch of the cool product offering open to users prior to the highly-anticipated Ethereum Merge. The exchange offers Ethereum Chain Split Tokens (CSTs).

Tokens open to users represent the 2 systems active in the Merge: ETHW, that is proof-of-work (Bang) and ETHS, that is proof-of-stake (PoS). Bitfinex released the brand new buying and selling tokens so users could trade around the potential forking event. The coins is going to be available with the Bitfinex derivatives platform.

Ruling to help keep Tornado Cash developer in prison for 3 months sparks backlash

The court within the Netherlands ruled that Tornado Cash developer Alexey Pertsev has in which to stay jail for 90 more days while awaiting charges. Undecided about the choice, the crypto community rallied to demand the discharge from the developer.

Inside a Tweet, crypto investor Ryan Adams contended the developer did something great for the general public together with his code contributions, proclaiming that “a couple of bad guys” made the decision to make use of Pertsev’s code and today the developer needs to suffer the effects.

What’s happening with Cardano’s testnet and Vasil hard fork?

Cardano founder Charles Hoskinson has ongoing to refute claims the Cardano’s testnet is “catastrophically damaged,” implying the necessity to finally proceed with the lengthy-delayed Vasil hard fork.

Inside a Twitter thread on Sunday, Hoskinson shared his frustration concerning a few of the videos claiming Cardano’s testnet includes a “catastrophic” issue, which comes from a Friday thread from Cardano ecosystem developer Adam Dean.

DeFi market overview

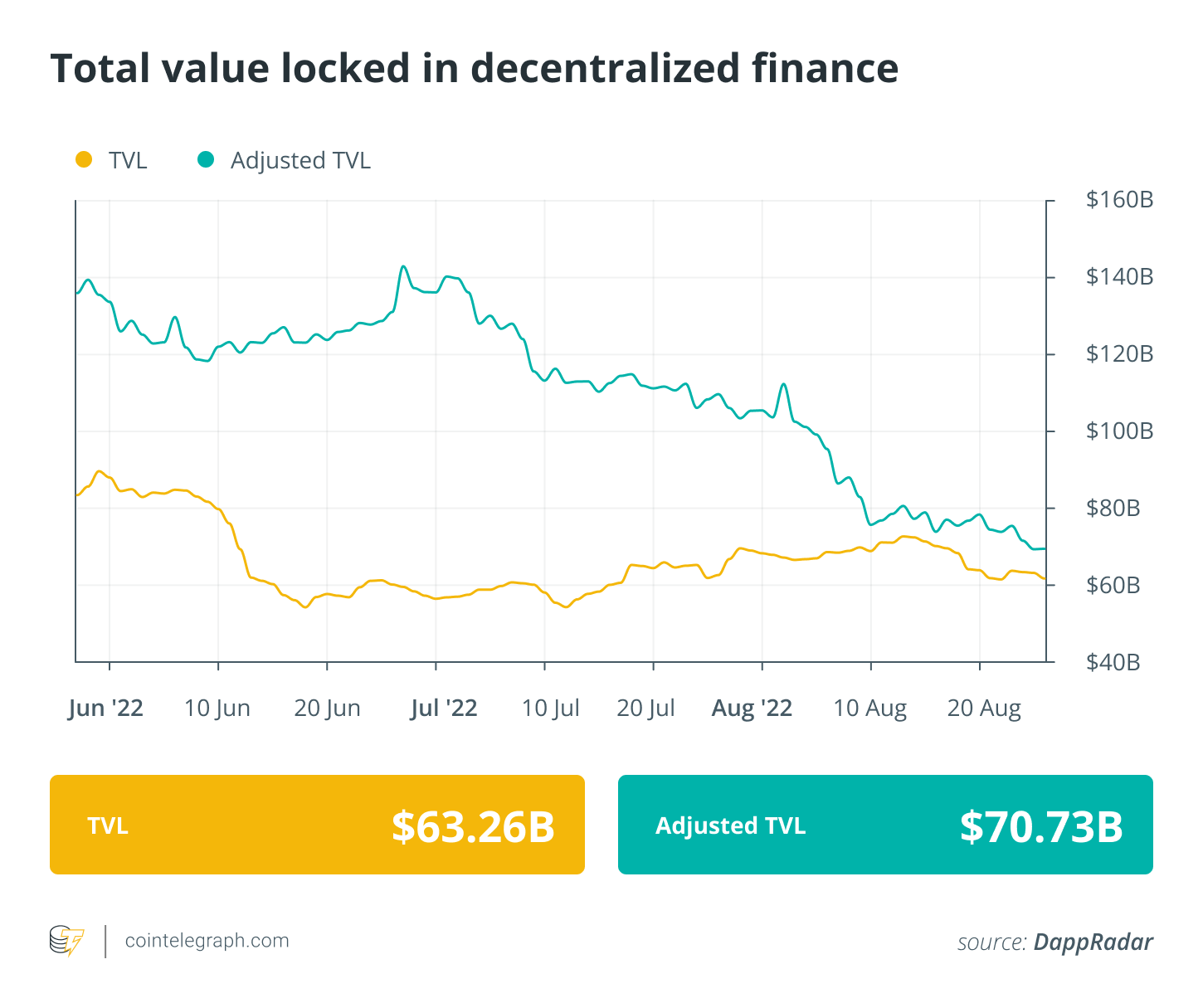

Analytical data reveals that DeFi’s total value locked registered a $3 billion decline in the past week because of the market dip toward the finish each week. The TVL value involved $63.26 billion during the time of writing. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s best players tokens by market capital were built with a mixed week, with several tokens buying and selling in red while a couple of others even demonstrated double-digit gains.

Theta Fuel (TFUEL) was the greatest gainer having a weekly rise of 19.94% adopted by Curve DAO token (CRV) by having an 11.76% surge. Convex Finance (CVX) rose by 9.48% around the weekly charts and Pancake Swap (CAKE) saw an every week gain of seven.56%.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.