Decentralized exchanges (DEXs) puppy nip within the bud several issues concerning their centralized counterparts for example power of liquidity at the disposal of a couple of players, compromise of funds in situation of the security breach, closed control structure and much more. One issue, however, which has declined to subside is front-running. Unscrupulous players continue to be finding methods to swindle unsuspecting traders.

For those who have received under expected when putting a trade on the DEX, there’s an excellent possibility of you getting hit by front runners. These bad actors exploit the automated market maker (AMM) model to create profits at the fee for unsuspecting traders.

This information will explain the attack vector which help you comprehend the fundamental concept of front-running in crypto buying and selling, the possibility effects and the way to prevent crypto front-running.

What’s front-running in crypto?

The word “front-running” refers back to the process if somebody uses technology or market benefit to get prior understanding of approaching transactions. This enables unhealthy actors to benefit from the forthcoming cost movement making economic gains at the expense of individuals who’d introduced these transactions. Front-running happens via manipulations of gas prices or timestamps, also referred to as slow matching.

On centralized in addition to decentralized exchanges, front-running is really a frequent activity. The goal of a front runner is to find a piece of tokens in a low cost and then sell them in a greater cost while concurrently exiting the positioning. When performed precisely, it earns risk-free profits for that traders committing it.

Related: DeFi versus. CeFi: Evaluating decentralized to centralized finance

Buying and selling of stocks and assets according to insider understanding to benefit from the cost movement is a well-known tactic. Though illegal and dishonest, brokers happen to be participating in it. The tactic carefully resembles insider buying and selling with only a small difference the executioner works best for the client’s brokerage and never the client’s business.

Exactly what is a front-running bot?

Frontrunning is performed using crypto front-running bots performing on a nanosecond-scale time-frame. Before an individual blinks, they are able to read a string of transactions, calculate the optimum transaction size and gas cost, configure the transactions and run them.

The main of the front-running bot operates by listening for that pending transaction around the blockchain. Getting together with the blockchain utilizing an interactive script, the bot buys prior to the buyer and sells immediately after it. The bot analyzes the trends from the crypto and executes transactions to create a profit.

Front-running tactics on decentralized exchanges

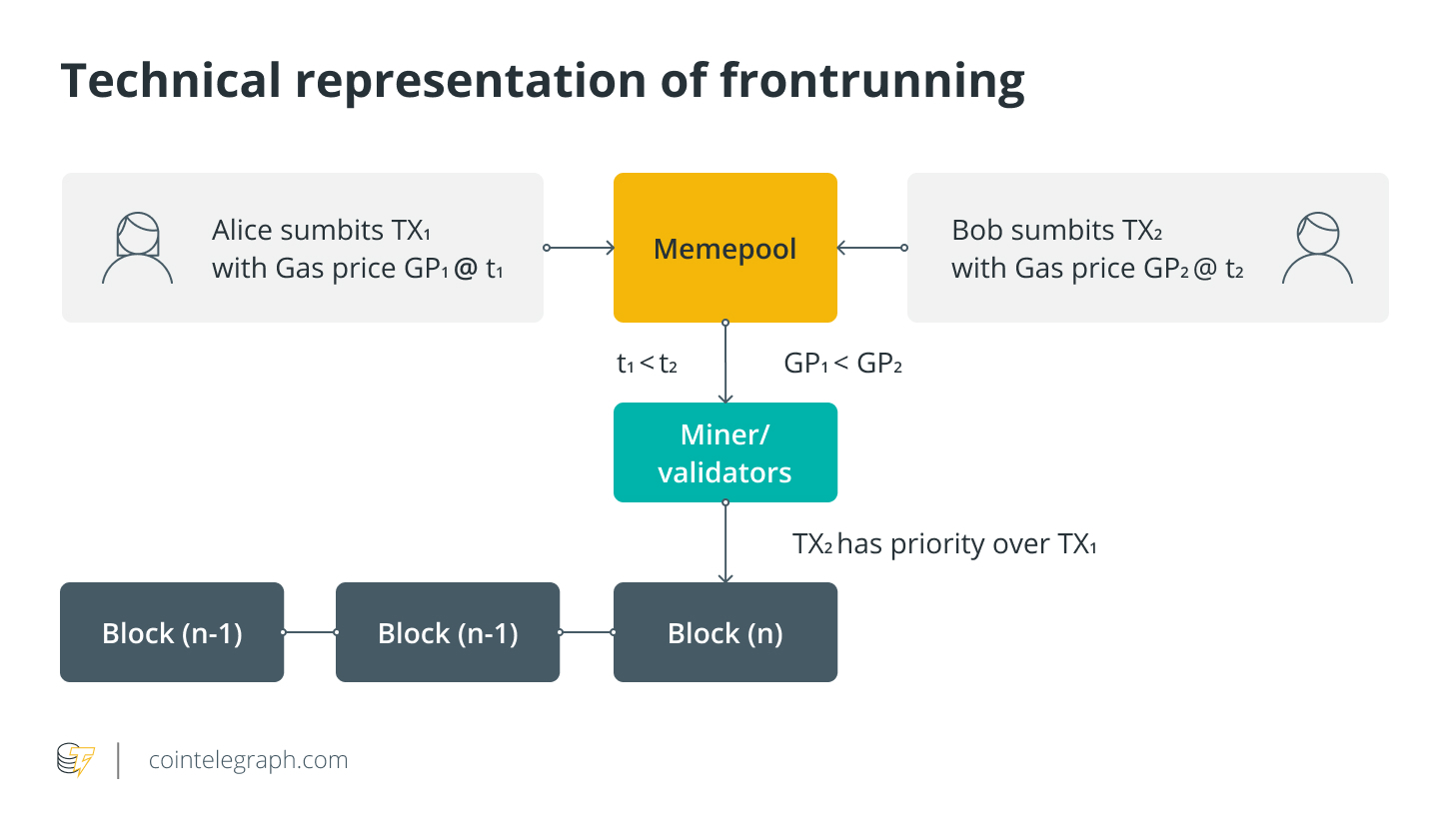

Whenever a trade occurs, the machine broadcasts it towards the blockchain, requiring miners to ensure the transaction. However, in almost any blockchain of significance, the stream of incoming transactions is much more compared to capacity from the subsequent block. Unmined transactions remain inside a pending transaction pool known as a mempool.

Blockchain mempools are transparent, an element the front runners exploit. Getting understanding of the atmosphere from the traders, they could predict the approaching cost movements and put their very own orders accordingly. They set a greater gas cost on their own transactions to inspire picking their transactions prior to the pending ones, thus front-running the unsuspecting traders.

Methods to prevent front-running around the trader side

There’s not one means to fix solve issues regarding front running on all platforms. Rather, various anti-front-running approaches have to be adopted on several projects, with respect to the scenarios.

Use large liquidity pools

Front runners love low liquidity pools, as there’s less possibility of competition in addition to disruption of the transaction with a large order that suddenly alters the swimming pool weighting. Executing your trades in large liquidity pools causes it to be less inclined to get hit by frontrunning.

Keep maximum slippage low

Will the question “How will i avoid slippage” perennially pricks you? You skill is placed an optimum slippage tolerance in many decentralized exchanges. Quite simply, you are able to fix the utmost deviation in the expected return. A good example can help you comprehend the scenario better.

Suppose you make an order on the DEX and expect coming back of 500 Tether (USDT) for this. Should you set your slippage to at least onePercent of the order, then you definitely will not be receiving under 495 USDT. However, if greater slippage tolerance is larger, you will see more deviation.

So, the formula is straightforward: Keep maximum slippage low, around .5%-2%, to battle front runners. If you are planning to put a large order, keep the slippage in the lower keel. Front runners would like you to help keep slippage high, so easier to do quite contrary from it.

Pay too much on gas

Front runners are happy to see slow transactions since it provides them additional time to plot a purchase for riding your trade and making money. Underpaying on gas makes your transactions queue up for extended, supplying front runners additional time to formulate their strategy and damage your interests.

Overpaying on gas motivates miners to validate your transaction faster, minimizing the chances of you becoming the prospective of the bad actor. For this function, you may set the gas cost to greater than average or just make use of the fast gas option in your wallet. If you’re putting a large value order, it might be much more important to complete the transactions with alacrity.

Convey a low-value order

To create a profit, front runners need to meet some minimum thresholds. They need to spend the money for gas charges two times, on entering and exiting the marketplace, as well as recover the quantity compensated because the buying and selling fee. Their profits begin once they return their expenses.

Presently, prominent Ethereum-based automated market makers for example Uniswap, Balancer and SushiSwap pay a gas fee of $25 per transaction. Because they need two transactions to complete frontrunning, they will probably spend $50 to complete the trade. Additionally, it means in case your trade is raking in under $50 profit, you will find minimal likelihood of you becoming the prospective from the frontrunners.

Whenever you enter a minimal-value trade, you practically allow it to be an unprofitable venture for frontrunners. More often than not, buying and selling with amounts under $1,000 is protected.

Look for a taker

A openly-located order book may be the first factor to attract front runners. Just try to locate a taker, you’ll be able to fill confirmed order and can stay away from public markets and, subsequently, front-running. When you get a taker and negotiate a cost effectively, a trustless on-chain exchange will get performed.

Methods to prevent front-running on DEX side

DEXs may take proper care of several design suggests make front-running hard to execute:

Quick matching

Front runners search for slow matching speed to place their orders prior to the execution. A DEX can ensure fast matching to depart little room for front runners to place their tactic to motion. Super quick block time will effectively result in the front runners not able to react. For many frontrunners, who aren’t so technically inclined, this ought to be enough.

Decentralized match engine

Within the situation of the centralized matching engine, it’s difficult to establish the exchange is not involved with front running. Decentralized matching engines, however, allow anybody managing a full node to see the matching instantly. They are able to match the transaction within the latest block by hand using the current order book.

Periodic auction matching

Periodic auction matching adds an additional layer of security in the front running. It adds a non-deterministic layer which makes it improbable for anybody to understand the following execution cost unless of course they understand the matching logic, the incoming orders for the following block and also the trade cost and also the current order book in the last match.

How to prevent front-running in Ethereum 2.

Some traders question concerning the impact from the full discharge of Ethereum 2. later in 2023, merging the mainnet with Beacon Chain and presenting an evidence-of-stake (PoS) consensus mechanism. Validators who are meant to process transactions within an epoch is going to be intimated of the positions in advance.

An epoch is really a defined length of amount of time in a blockchain network. This time period can be used to explain when certain occasions inside a blockchain network will occur, for example when incentives is going to be distributed or whenever a new number of validators is going to be allotted to validate transactions.

Related: Ethereum upgrades: A Beginner’s Help guide to Eth2

Within this scenario, it will likely be tougher for front runners to locate lucrative trades inside a blockchain teeming with transactions, although not impossible. Many frontrunners available are technically proficient, which means you can’t just eliminate the chance. DEXs can cover design points like quick matching, decentralized match engine and periodic auction matching to reduce the chances of front-running.