Finding yourself in crypto is about taking a smart view towards money. We all know that Bitcoin (BTC) may be the future, both like a store of worth as well as a method of payment, as layer 2 solutions like the Lightning Network start to flourish. It’s, therefore, vital that each cryptocurrency user makes certain that they always have the best cost for each service. While countless crypto users convert fiat to crypto utilizing a debit or charge card, this really is in no way a minimal-cost choice.

Having to pay the overhead: Converting fiat to crypto

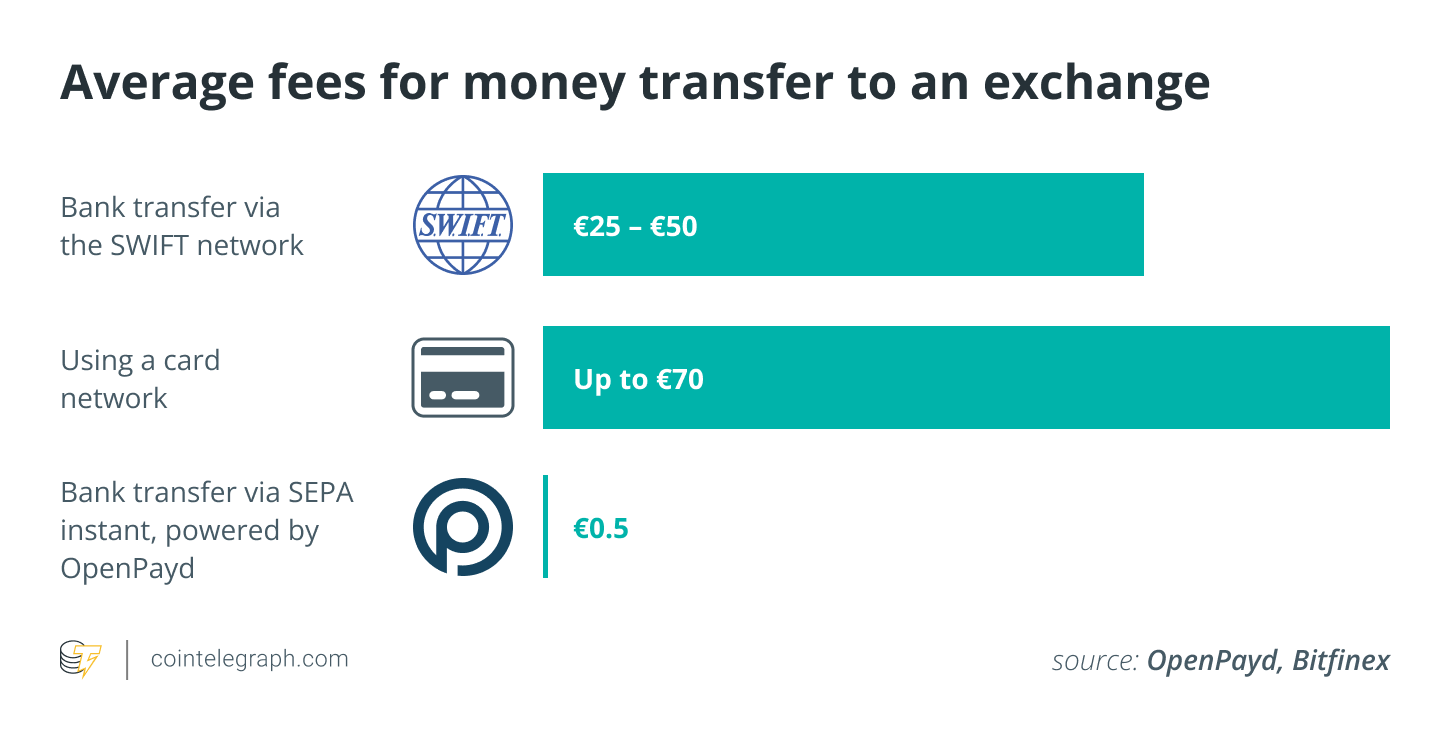

According towards the Motley Fool, those who are using charge cards to cover crypto purchases might be susceptible to a minimum of 7% in extra charges. For instance, should you purchase $1,000 in Bitcoin utilizing a charge card, you can repay to $70 in charges in case your card provider ended up being to treat the transaction as a money advance, on the top from the standard processing charges and expenses.

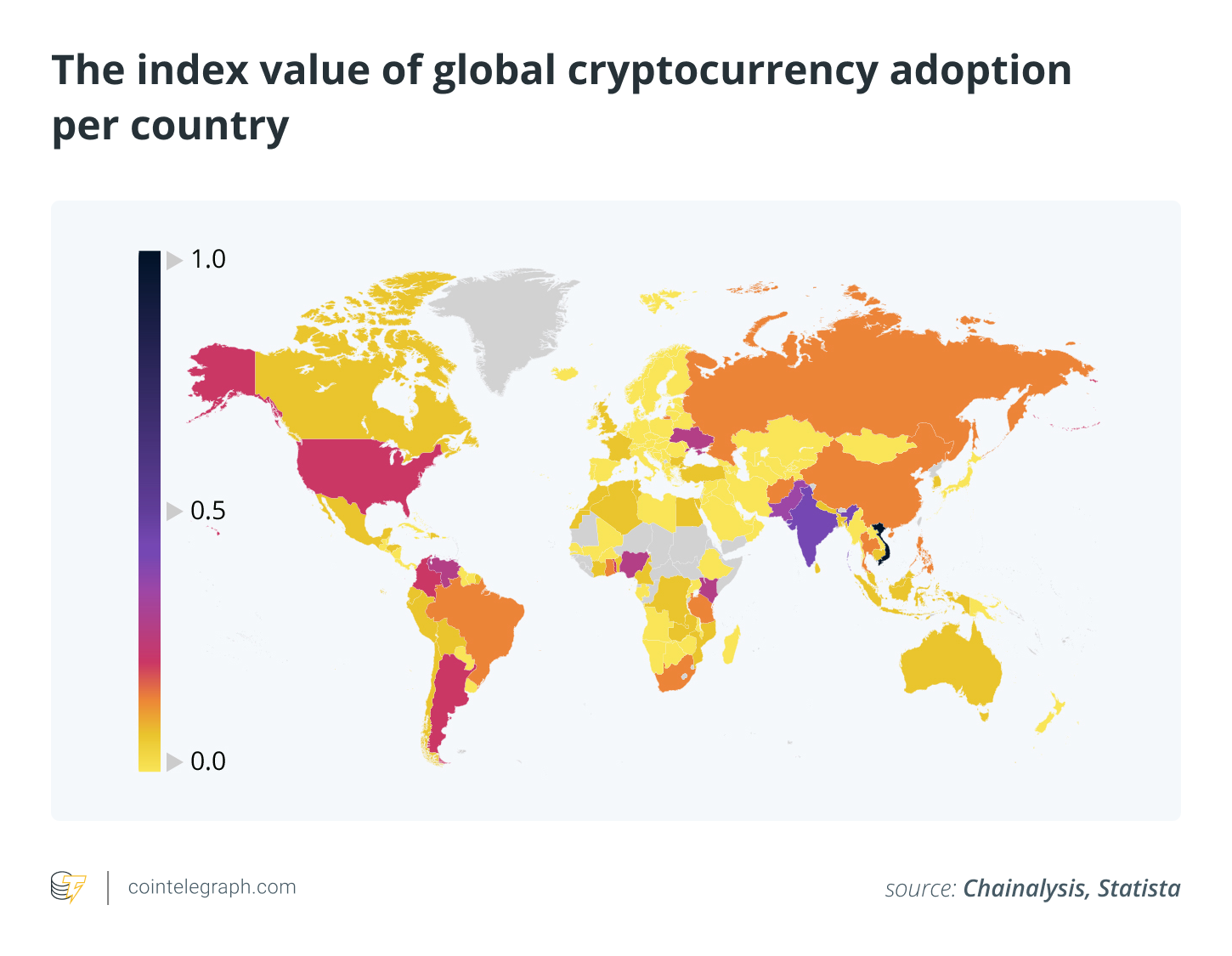

While cryptocurrencies are globally accessible, among the greatest barriers to mainstream adoption of cryptocurrencies isn’t the acceptance of digital assets but, rather, bridging the space between your crypto and fiat worlds. The failure to do this has meant that almost all people have lacked the various tools needed to interact with digital currencies and have been met with exorbitant costs in getting together with the ecosystem.

A trader or user of cryptocurrency can execute a multitude of cryptocurrency transactions, because both versions includes its very own cost structure. The price of a crypto transaction can alter regularly as well as on short notice, meaning users should be diligent on checking individuals charges — an action that’s time-consuming and under ideal when moving interior and exterior positions rapidly.

We live at a time where so-known as disruptive fintech services and applications, like the digital banking services application Revolut, are coming up with a seamless banking experience. Still, with regards to converting fiat to crypto, users are now being stung by costly clunky solutions more similar to making money chips in a casino than acquiring the future type of money.

Related: ‘I’ve never compensated with crypto before’: How digital assets really make a difference among a war

Exchanges combatting on-ramp charges

Exchanges for example Bitfinex are integrating innovative solutions to their platforms to create converting fiat into crypto cheap and efficient. Inside a collaboration with OpenPayd, an electronic provider of banking and payment solutions, Bitfinex enables its users to transfer fiat currency using their banking account to the Bitfinex platform for around just 50 euro cents per transaction. Right now, the services are only accessible for euros, however the exchange intends to roll it with other major cryptocurrencies.

Other exchanges will also be attempting to make purchasing crypto less pricey by launching an application development toolkits which will give self-custodial wallets for example MetaMask the opportunity to offer users a different way to buy or transfer crypto to some wallet. This aims to streamline the onboarding experience into Web3 for users and cuts down on the charges that users incur when moving existing crypto balances using their accounts to some self-child custody wallet/DApp with such new kinds of services.

Related: A wide open invitation for ladies to participate the Web3 movement

Reducing onboarding cost by replacing archaic rails

Using the creation of Web3 and cryptocurrencies, caused by these innovations in payments might easily read the 2017 conjecture that age charge cards might be visiting an finish. Major payment solutions and repair providers for example FIS and BCB Group will also be innovating new fiat-to-crypto solutions alongside more youthful startups like Fireblocks to be able to introduce instant settlement systems between local currencies and stablecoins. These new innovations will probably turn the archaic payments infrastructure on its mind like a new crop of solutions become readily available for all companies that are going to touch cryptocurrencies in some way within the coming decades.

As retail and institutional money still pile in to the cryptocurrency markets, nearly every major company has its own eyes focused on streamlining the onboarding experience and making crypto payments safer, accessible and immediate. By doing this, these businesses will reduce overheads for companies that may then spread savings to customers. Charging high charges simply to move fiat currency interior and exterior the crypto ecosystem is definitely an unnecessary obstacle for investors. The fiat on-ramps and off-ramps that exchanges are utilizing play an important role in onboarding new investors towards the crypto and Web3 ecosystem.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Paolo Ardoino became a member of Bitfinex at the outset of 2015 and today can serve as its chief technology officer. After graduating from Genoa’s Information Technology College in 2008, he began being employed as a investigator for any military project centered on high-availability, self-recovering systems and cryptography. Thinking about finance, Paolo started developing financial related applications this year and founded Fincluster at the end of 2013. Supported by two financing investment models, Fincluster delivered a sophisticated, modern and accessible web platform serving different clients with personalization abilities.