Institutional investors have shifted their attention from Ethereum (ETH) to competing Layer 1 blockchains recently, with capital inflows for altcoin investment products growing a week ago although Ether products published outflows for that third week consecutively.

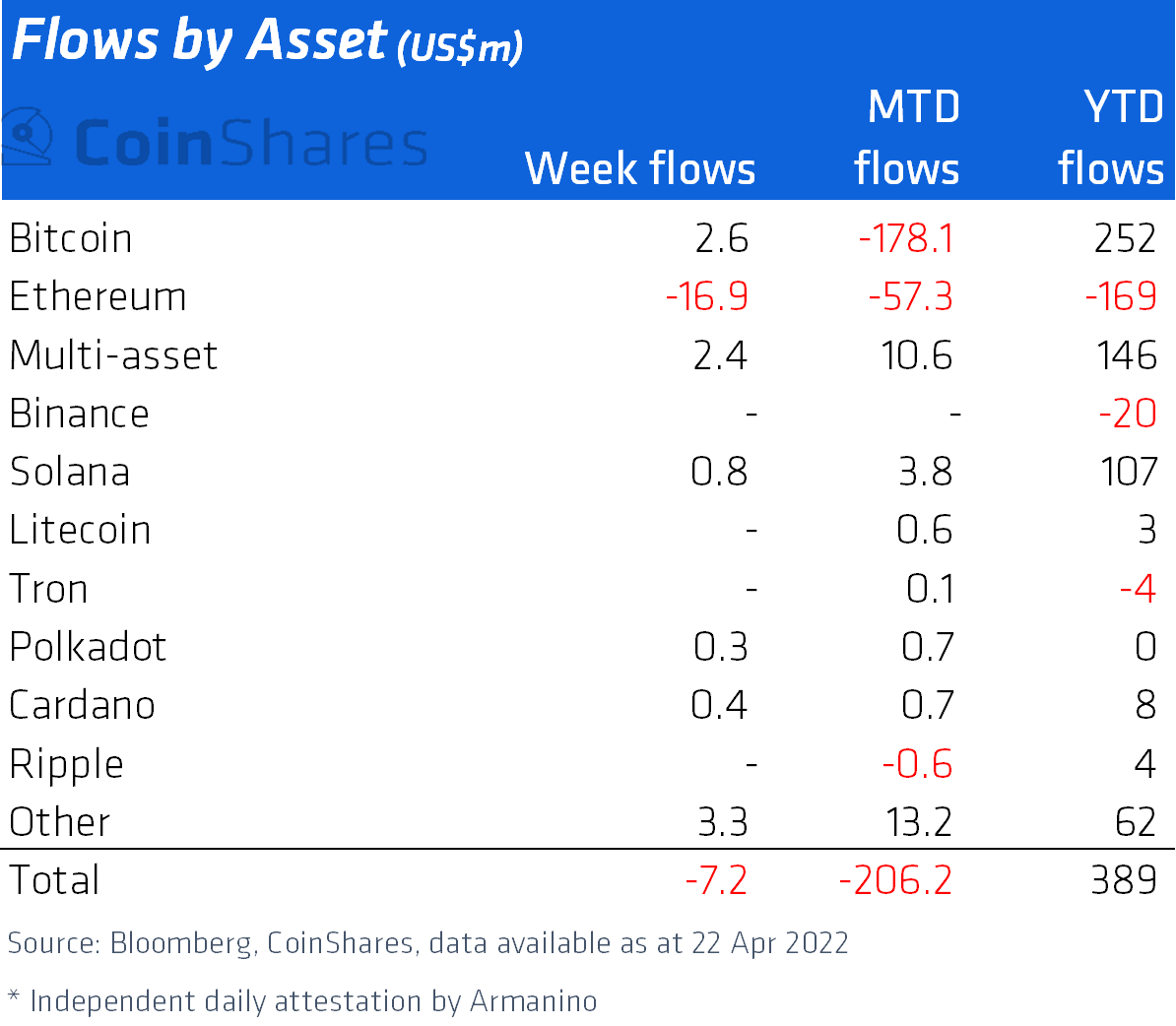

Data from CoinShares’ latest Digital Asset Fund Flows report implies that investors a week ago (ending April 22) loaded on $3.5 million price of Avalanche (AVAX), Solana (SOL), Terra (LUNA) and Algorand (ALGO) funds although capital outflows from Ether products totaled $16.9 million.

It marks the 3rd straight week that Ethereum products have experienced outflows, getting the entire over that point to $59.3 million, comparable to around 35% of the season-to-date outflows of $169 million in the second-largest blockchain.

Particularly, investors also favored digital gold a week ago despite some recent hesitancy, with Bitcoin (BTC) products fetching $2.six million price of inflows.

In the last 10 days, inflows to Ethereum products have arrived at only $68.5 million with what could signal a bearish trend by institutions for the major blockchain.

Alternate layer 1 blockchains happen to be growing in recognition lately, decentralized application (dApp) usage on Solana within the last seven days has elevated based on metrics from DappRadar. Usage for that decentralized exchange Orca is continuing to grow nearly 43% within the week, and automatic market maker Raydium has witnessed a 15.5% increase, with volume in the application reaching over $1.5 billion.

Although the metrics for Avalanche’s dApp usage haven’t elevated within the week, the blockchains’ investments in incentive programs and millions spent luring developers towards the platform have traders bullish on the way forward for AVAX.

Related: Does the way forward for DeFi still fit in with the Ethereum blockchain?

The Avalanche, Solana, Terra and Algorand inflows were $1.8 million, $800,000, $700,000 and $200,000 correspondingly, although Bitcoin saw inflows equating $2.six million the very first time in 2 days using the analysts noting that month-to-date outflows for that largest crypto stay at $178 million.

Total outflows in the last three days have experienced $219 million leave the marketplace, with this number cooling a week ago winding lower to simply 7.two million, a stark contrast towards the $134 million which left the marketplace within the first week of April.

Regardless of the recent run of outflows, the analysts observe that year-to-date flows remain positive with $389 million entering crypto assets since the beginning of the entire year.