Crypto contagion claims another casualty. In a statement, Singapore-based crypto exchange Vauld makes the “difficult decision to suspend all withdrawals, buying and selling and deposits around the Vauld platform with immediate effect.”

With what seems to become a operate on the crypto bank, the audience promises to “apply towards the Singapore courts for any moratorium,” as Vauld customers have attempted to withdraw an “excess of the $197.seven million since 12 June 2022.”

The decision to suspend withdrawals is really a screeching U-turn. Apparently, Vauld boasted $1 billion assets under management in May this season, during June 16, a business email mentioned that business would “continue to function as always.” Just 18 days later, the organization is exploring “potential restructuring options.”

On June 21, Chief executive officer Darshan Bathija tweeted that Vauld had cut its team by 30% — the very first sign that the organization was under stress. Individually, Bathija also stressed that Three Arrows Capital (3AC) was an earlier investor in the organization, but had exited at the end of 2021.

We’ve sent an e-mail relating to this. We don’t have subjection to 3AC or Celsius.

Full disclosure: 3AC would be a seed investor in us since 2020, who we facilitated an entire exit in 12 , 2021.

— Darshan Bathija (@darshanbathija) June 23, 2022

The statement from Vauld shows that “volatile market conditions, the financial hardships in our key partners inevitably affecting us, and also the market climate” were reasons for their decision to freeze customers’ money.

Nevertheless, 3AC’s demise is reported and regarded a significant cause of capitulation among centralized finance (CeFi) companies. 3AC had substantial contact with Luna Classic (LUNC), which blew in spectacular fashion, reducing 3AC’s holdings from $560 million to $670.

Indeed, Vauld follows within the actions of huge CeFi platforms for example Celsius, Voyager and BlockFi. Voyager clearly blamed 3AC for his or her recent decision to freeze customers’ funds and BlockFi is near to a $240 million cope with FTX following financial hardships, while intends to salvage Celsius from personal bankruptcy were lately shared by lead investor BnkToTheFuture.

For crypto investigative journalist Otterooo, Vauld’s trouble is much more motivation for investors to carry their very own keys. Possessing one’s private keys is really a guiding principle of crypto investing: If you don’t hold your personal keys, you don’t own your coins.

VAULD closes withdrawals, undergoing debt restructuring

another cefi loan provider bites the dust

its a damaged business design

either withdraw today or spend years battling lawyers for the money

You Shouldn’t Be STUPID ANON, withdraw to cold wallet NOWhttps://t.co/X3H8iLCuYi pic.twitter.com/hS2vv2IBJo

— otteroooo (@otteroooo) This summer 4, 2022

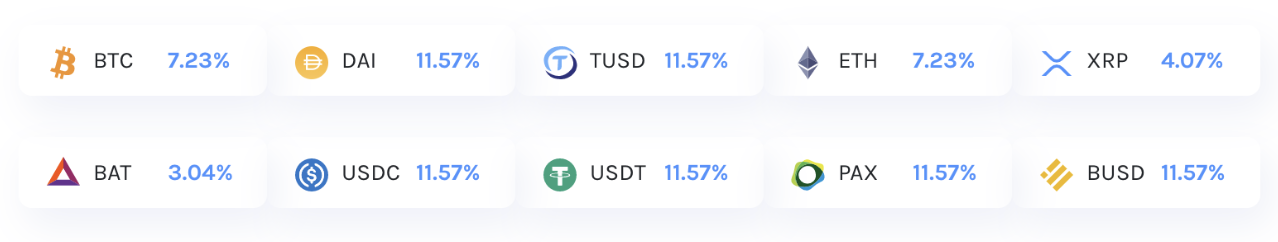

As Cointelegraph reported inside a March 2021 pr release, Vauld boasted double-digit rates of interest on popular stablecoins for example Tether (USDT) and Dai (DAI), while Bitcoin (BTC) interest could achieve 7.23%. Essentially, in “lending” your cryptocurrency tokens to Vauld, you’d produce a yield. However, the organization effectively owns your assets.

The rates were as good as lenders and interest bearers for example Celsius, BlockFi and Nexo — one of these is constantly on the function. Nexo tweeted that there might be delays to customer transactions because of Independence Day within the U . s . States.