A week ago, 55,000 parcels of “virtual land” were offered around the Ethereum blockchain in excess of $300 million, the biggest nonfungible token (NFT) mint ever. It was not without debate.

To acquire spending near to $6,000, a purchaser received an Otherdeed NFT, which authenticates that buyer’s possession of the patch of digital property in developer Yuga Labs’ new Otherside game atmosphere.

What else could you use a plot of virtual ground? Well, you are able to build up your own games onto it or develop a digital gallery, amongst other things. Furthermore, you may expect lots of website traffic driving the right path since the Otherside “world” is definitely an extension of Yuga’s popular Bored Ape Yacht Club (BAYC) NFT project.

The purchase started at 9:00 pm EDT on April 30, and also the NFTs were offered in around three hrs. In that time, gas charges around the Ethereum blockchain soared — with eager customers sometimes requiring 1000s of dollars to accomplish just one transaction. That’s far above the price of the land parcel. Countless investors not just unsuccessful to secure an Otherdeed token, they also lost their Ether (ETH) gas charges too. The Ethereum blockchain even went dark for some time.

Some billed Yuga Labs with favoritism along the way, saying, for example, it’d saved all of the good “land” by itself or existing proprietors of Bored Ape Yacht Club NFTs.

Others wondered what all of this had to say of gaming and NFTs. Whether it cost $6,000 for any parcel, and around $6,000 in gas charges simply to play, could it have been all being a playground for that loaded alone?

The purchase also elevated questions regarding Ethereum’s scalability — again — and also the susceptibility of blockchain-based projects to manipulation and self dealing.

The Metaverse shines brightly

Still, whether or not the Yuga Labs purchase didn’t go entirely easily, shouldn’t still it be celebrated like a milestone of sorts within the crypto/blockchain world, especially at any given time once the cost of Bitcoin (BTC), Ether along with other cryptocurrencies happen to be flat or ebbing?

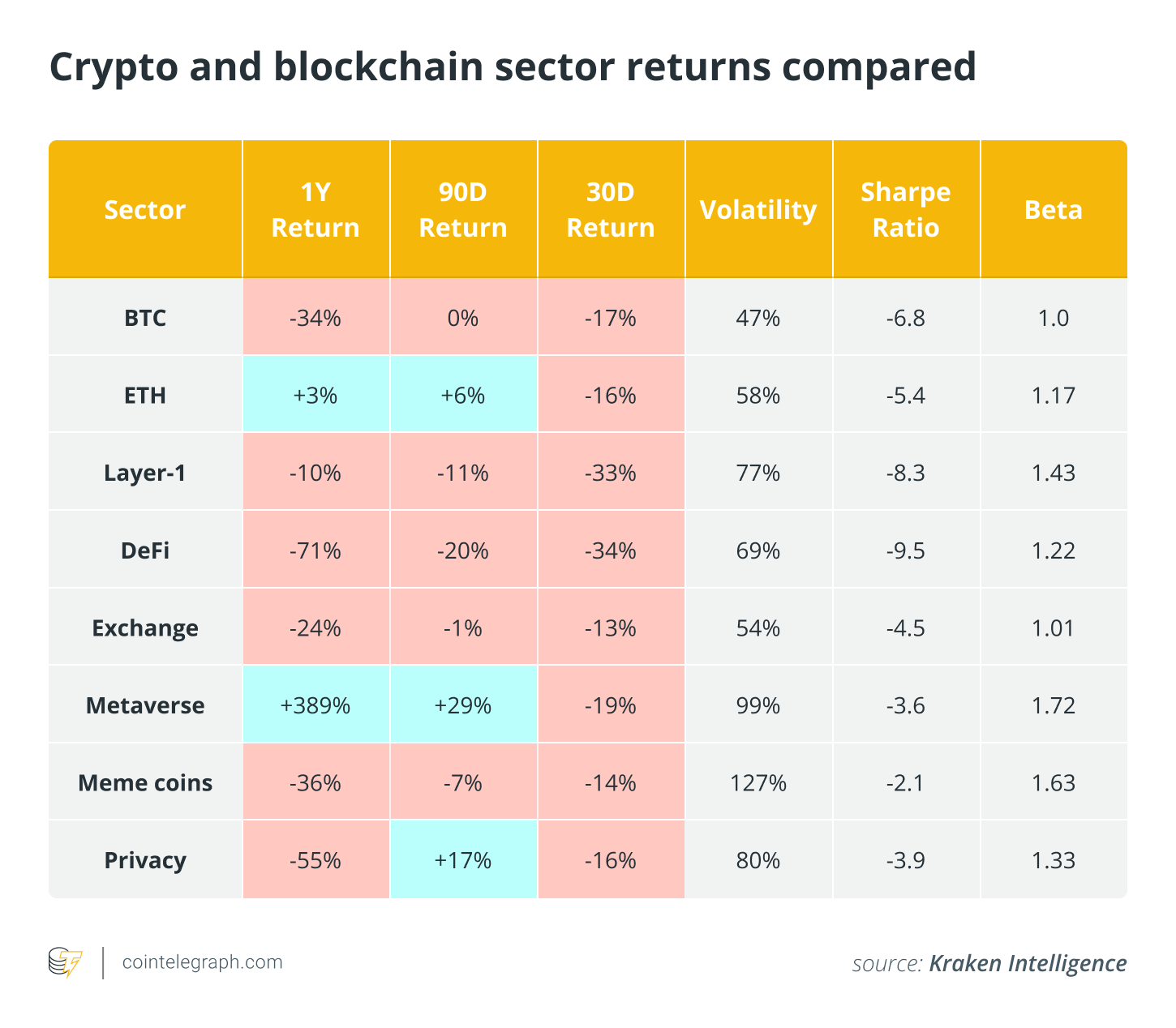

Think about a report printed a week ago by Kraken Intelligence which reinforced the concept the Metaverse — a residential area of internet “worlds” with lots of dedicated to role-doing offers — is among the brightest stars within the crypto-based universe nowadays. Over the newest 12-month period, the metaverse sector notched a yearly return of +389%, noted Kraken, in contrast to Bitcoin’s at -34%, Ether’s at +3%, layer-1 systems at -10% and decentralized finance (DeFi) projects at -71%.

The Metaverse sector includes assets like Decentraland (MANA), The Sandbox (SAND), Axie Infinity (AXS), too projects like Yuga Lab’s Apecoin (APE). In online “communities” like Sandbox, an Ethereum-based play-to-earn (P2E) game, players can take shape an online world, including purchasing digital land whose possession is guaranteed by an ERC-721 standard nonfungible token. The fungible SAND, an ETH-20 standard token, can be used not just to buy land, purchase equipment and personalize avatar figures but additionally enable holders to have fun playing the Sandbox’s governance decisions.

“The Metaverse continues to be a comparatively fresh theme within the crypto industry,” Thomas Perfumo, mind of strategy at Kraken, told Cointelegraph to assist explain why the Metaverse appeared to become thriving when other sectors were moving sideways. “When Facebook rebranded as Meta within the other half of 2021, we had a corresponding increase in the cost of metaverse-connected fungible assets for example SAND and MANA. Before that, it was not surface of mind for many market participants.”

Additionally, it represents a part of a continuing evolution from the crypto industry. Perfumo stated earlier in an announcement that “it expands from financial utility into creative expression and community building.”

Still, $320 million for 55,000 parcels of “virtual land” appears a little pricey. Mark Stapp, the Fred E. Taylor chaired professor of property at Arizona Condition University’s W. P. Carey School of economic, was requested if “virtual land” has any special characteristics or uses which may be generally overlooked — and may explain the considerable outlays for Otherdeeds as well as their ilk. He told Cointelegraph:

“I see the ‘virtual land’ as getting value for marketing purposes therefore the platform/world it is operational within adjacencies to other people. Relative place for recording visitors and awareness could be desirable attributes.”

Quite simply, it might enhance your very own or commercial brand or game, if that’s what you’re creating, getting Snoop Dogg, for instance, like a neighbor inside your online eco-system. This happened lately if somebody apparently compensated $450,000 for any virtual parcel bordering Dogg’s The Sandbox estate.

Recent: Mixing reality using the Metaverse: Fashion icon Phillip Plein goes crypto

Everything appears a brand new use of the standard real-estate adage: “location, location, location.” As Sandbox notes on its website:

“LANDs that are nearer to major partners or social hubs will probably get greater traffic from gamers, which could potentially mean more earnings through monetisation.”

Along wrinkles, some grumbling attended last week’s Otherdeed launch about the caliber of “land” which was provided to the general public. The truly good patches appeared to be stored by insiders like existing BAYC holders, while some were billed. Based on Crypto Twitter celebrity CryptoFinally:

i needed to sign up in yuga, but one of the most fked up areas of otherdeed: non BAYCs who wish to become involved compensated for a lot shttier land, BAYCS got the only real land useful. yuga does not appear to exhibit curiosity about decentralization outdoors the present core group. priced out.

— CryptoFinally (@CryptoFinally) May 2, 2022

Is really a bubble developing?

How about the concept the astronomical prices being compensated for metaverse property is suggestive of a developing bubble — one which could burst at any time?

Lex Sokolin, mind economist at ConsenSys, told Cointelegraph he wouldn’t call anything a bubble. Rather, he prefers to speak about cases of “over-valuing future appreciation.” But, within this situation, just like crypto generally, another dynamic might be playing. Sokolin stated:

“In traditional markets, you’d discount future expectations according to some possibility of hitting individuals expectations, and a few price of capital. In crypto, enterprise value is instantly capitalized through tokens and becomes very volatile as sentiment changes.”

That does not imply that the entrepreneurial ideas listed here are wrong or misleading, he added, exactly that there might be “long-term disconnects between how people project the long run and how it’s really built.”

Exactly why is Ethereum gas so costly?

Then, there’s the problem of Ethereum’s gas charges, which by one estimation might have arrived at up to $14,000 throughout the Otherdeed purchase. Should one be worried about the world’s second-largest blockchain network?

“There’s no believe that gas charges up to $6,000 per transaction is suggestive of the continuing scaling challenges Ethereum faces,” Perfumo told Cointelegraph. “But, it’s worth noting that ordinary transfer transactions and minting NFTs aren’t fully comparable activities around the Ethereum blockchain,” he stated, adding:

“In this unique example, so many people have the symptoms of minted simultaneously. As a result, smart contract optimization alone may likely not have access to altered much.”

Sokolin added that Ethereum supplies a scarce computational resource and it is an all natural place to go for high-value transactions “since capacity is restricted per block.” And, there have been also scaling solutions available which might have prevented the transaction crunch, but Yuga Labs chose not for their services. “That stated, getting NFTs which are on Ethereum provides them greater perceived status and also the largest secondary market, that is likely why Yuga Labs went this route.”

Presight Capital crypto venture advisor Patrick Hansen went even more, asserting the launch in this way showcased Ethereum’s current status. “Ethereum has massive challenges ahead, all over again visible in yesterday’s crazy gas charges spike,” he tweeted on May 2. “But the truth that many people will be ready to spend mind-boggling +4k$ for #Ethereum transactions also shows how valuable its blockspace is. Not one other blockchain comes close in that way.”

Sokolin agreed. “Exactly. If people were not prepared to pay transaction charges, they wouldn’t pay.” It is among the peculiarities of crypto financial aspects the arbitrage activity such occasions is really high that the lengthy-term players “have to pay for a really high cost to scalpers,” he observed.

Departing a poor taste

Still, the record launch created a sour aftertaste for many. “I think the Otherdeeds purchase was botched, resulting in user backlash,” Aaron Brown, a crypto investor, told Bloomberg.

But, maybe some manipulation just appears in the future using the virtual turf? “I think that what a lot of companies are calling ‘ownership’ within the metaverse is totally different from possession within the physical world, and individuals are vulnerable to being swindled,” authored legal scholar João Marinotti lately.

Land swindles exist in the physical property world, obviously, so perhaps one shouldn’t over-react here, but there are several variations. “Normally a prudent and informed buyer of real estate would conduct research, and also the offeror could be susceptible to regulatory controls including needed disclosures,” Stapp told Cointelegraph. Within the situation of virtual property, “I’m not aware associated with a needed disclosures or regulatory oversight,” he stated, adding:

“Regulation is supposed to prevent fraud, misrepresentation and the naive from trouble. The present atmosphere for selling these ‘opportunities’ is ripe for fraud or at best disappointment.”

A unfaithfulness of crypto’s roots?

Finally, how about inclusivity and also the crypto world’s valued democratic ethos. Exactly what does it say whether it takes $10,000 or even more simply to take part in a blockchain-based community?

“There’s been a freedom in the concept that anybody could participate with anywhere they wanted,” Mark Beylin, co-founding father of Myco, told Cointelegraph. Bitcoin is divisible to eight decimal places, in the end, so even though you owned only a small fraction of the Bitcoin, you’ll still got exactly the same benefits as somebody who owned a great deal, for example control of your funds or freedom to transact, for example, stated Beylin, adding:

“That isn’t true for NFTs, though, since owning a small fraction of an NFT doesn’t usually confer any legal rights to holders, past the speculative upside potential.”

There have been some other type of disappointments too. Some would-be investors, for example, lost all of their Ethereum transaction charges but still didn’t develop any land tokens. These “gas” losses encountered 1000s of dollars in some instances. When Yuga Labs announced on May 1 it had become focusing on refunding gas charges to any or all Otherdeed minters whose transactions unsuccessful, some were skeptical.

Recent: Wanting to work: Bitcoin change to proof-of-stake remains unlikely

Nonetheless, on May 4, the developer published this message:

“We have refunded gas charges to everybody who designed a transaction that unsuccessful because of network conditions brought on by the mint. The charges happen to be delivered back towards the wallets employed for the first transaction.”

The developer refunded some 500 transactions worth with each other 90.566 ETH, or about $244,000 during the time of the refund. The biggest single refund was for just two.679 ETH, worth about $7,877 on May 4 when refunds were sent, according to Etherscan.

Meanwhile, Beylin, who’d some bitter things to say of Yuga Labs early a week ago, struck a far more positive and philosophical note through the week’s finish. “In the lengthy run, the very best projects will discover a method to spread out up access for that many rather of only the couple of,” he told Cointelegraph.