Given Ethereum’s dominance along with the current crypto bear market, it remains questionable if L1s will flourish. It was lately highlighted inside a Chainalsys blog publish titled “New layer 1 blockchains are expanding the DeFi ecosystem, but no ETH killers yet.” Ethan McMahon, an economist at Chainalysis, told Cointelegraph that Chainalysis printed this are accountable to raise awareness for that current L1 ecosystem:

While Ethereum permitted decentralized finance (DeFi) to achieve 2020, numerous layer-1 blockchains (L1s) have since been designed to address the difficulties connected using the network. For example, as Ethereum’s proof-of-work (Bang) consensus mechanism and gas charges still impact transaction speed and scalability within its ecosystem, L1s like Algorand, BNB Chain, Avalanche yet others try to solve these complaints.

“Chain comparison is essential since it appears as though most crypto services are just offered on Ethereum, however this isn’t true. There’s a couple of different blockchains with competitive choices which have advantages Ethereum doesn’t provide.”

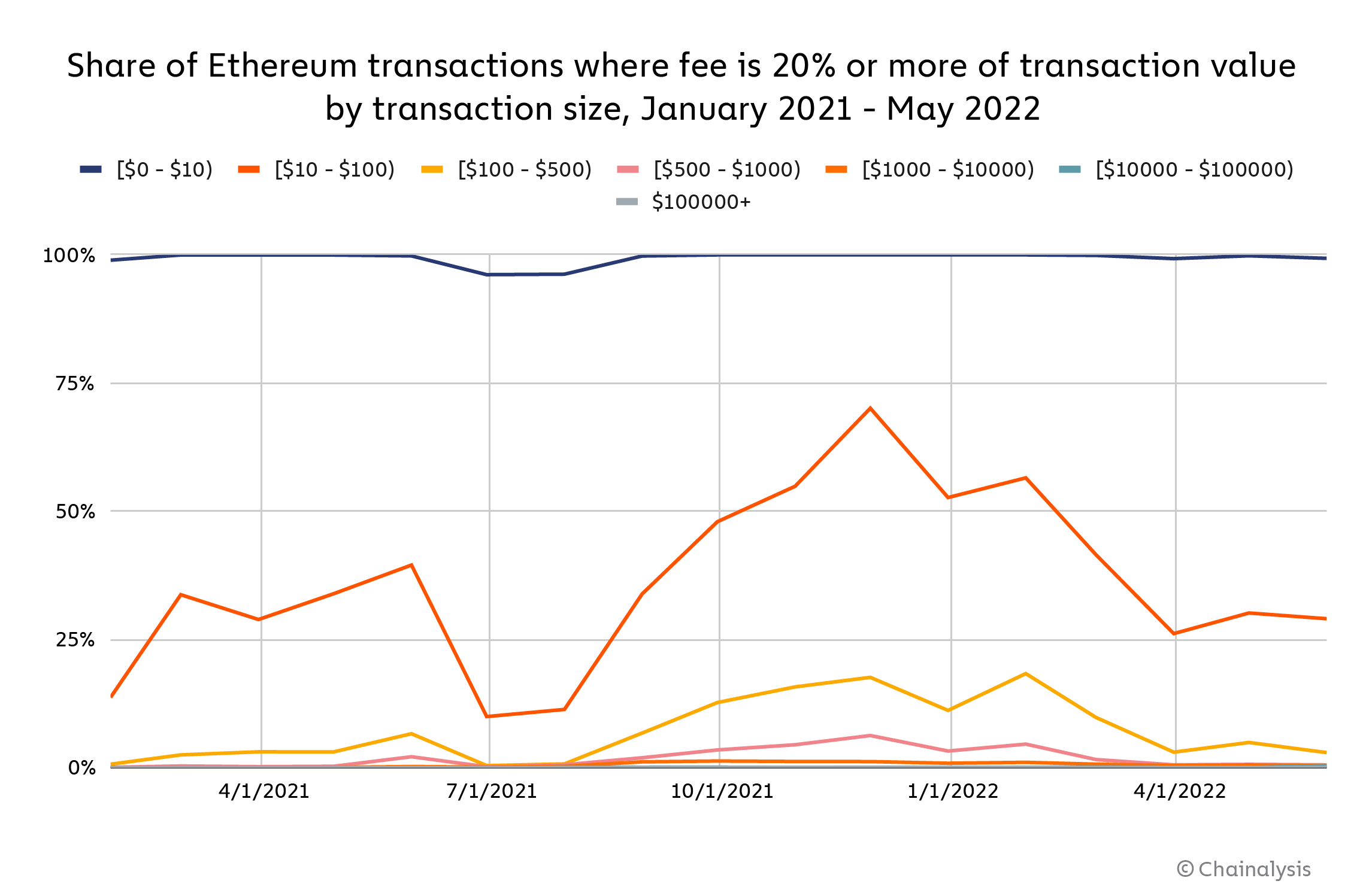

To be able to demonstrate this, McMahon described that Chainalysis collected data from various blockchains to look for the weaknesses and strengths from the systems. For instance, the publish highlights by using gas charges running at the top of Ethereum, many developers have selected to construct decentralized applications (DApps) on Algorand. Binance Smart Chain, or BNB Chain, can also be famous for its capacity to aid new tokens and DApps with no high gas charges of Ethereum. “It’s interesting to determine that individuals are having to pay exuberant gas charges on Ethereum’s network. Our findings reveal that transactions under $1,000 lead to a lot of investment property on gas charges,” McMahon stated.

According to Chainalysis’s overall findings, however, the publish concludes that no L1-blockchains examined happen to be effective in solving all challenges connected using the Ethereum network. This enhances the question if L1s can survive lengthy-term. For example, the present crypto winter may slow lower investments during these environments. Additionally, the merge of Ethereum 2. — that is set to occur this season but might be pressed to 2023 — can lead to enhancements within the Ethereum ecosystem that could impact alternative L1 uses.

L1 developments they are driving adoption

To be able to figure out how L1s will advance, it’s vital that you take particular notice at recent developments inside the various environments pointed out by Chainalysis. For instance, the report categorizes Algorand like a top-10 L1 blockchain by market capital, stating:

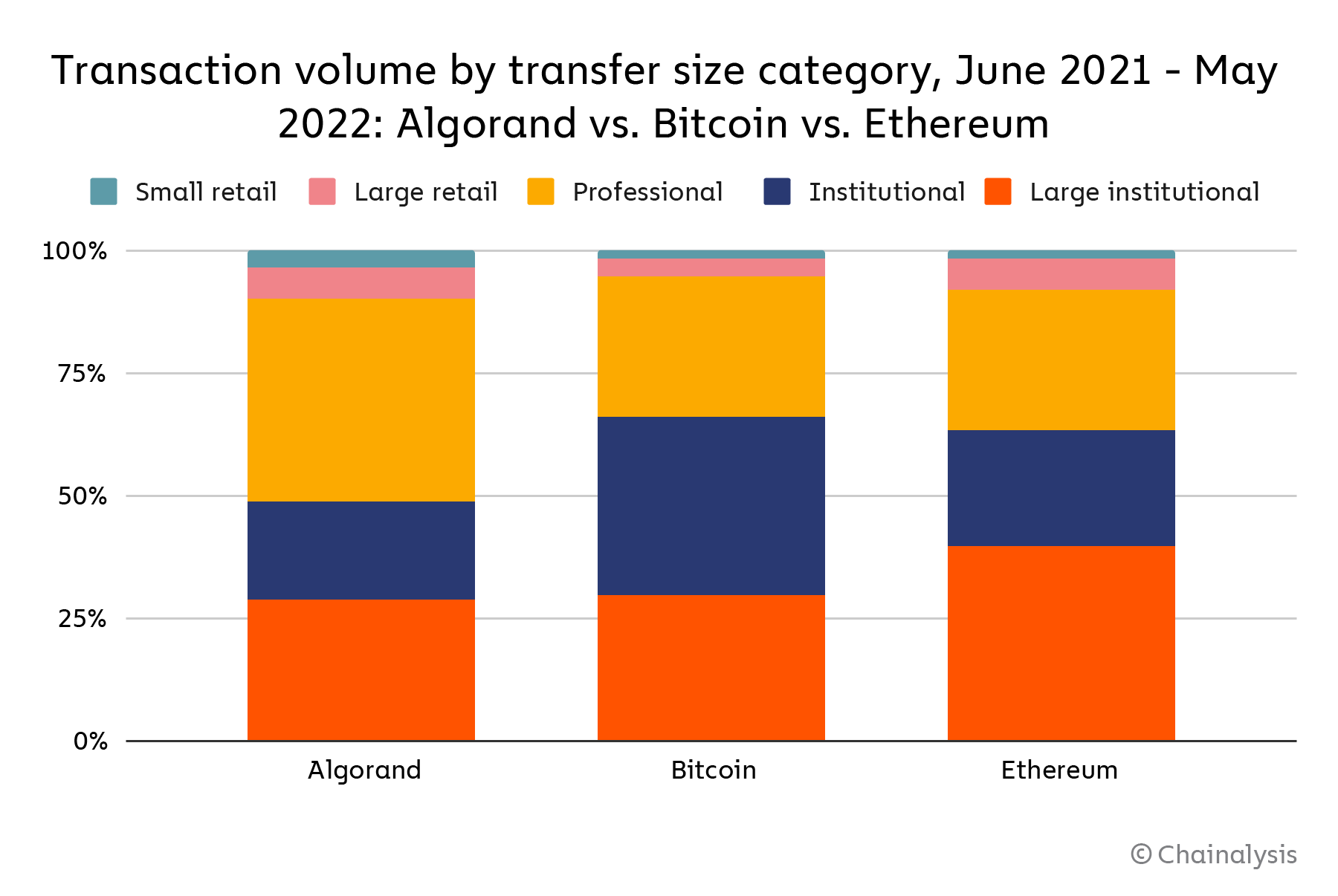

“During Q3 2021, Algorand saw its transaction volume grow 65%, while Bitcoin and Ethereum saw volumes drop 37% and 45% correspondingly. This might have reflected Algorand’s growing hype — getting launched in April 2019, Algorand would be a relatively recent blockchain, and arrived at an exciting-time cost full of September 2021.”

Findings also reveal that 10% of Algorand’s transaction volume originates from retail investors, in contrast to 5% for Bitcoin (BTC) and eightPercent for Ether (ETH). With all this, the report notes this could signify Algorand’s success in enabling a higher amount of smaller sized transactions.

Staci Warden, Chief executive officer from the Algorand Foundation — the business behind Algorand’s financial supply financial aspects, governance and ecosystem — told Cointelegraph that Algorand utilizes a Pure proof-of-stake (PPoS) consensus mechanism, allowing the network to particularly solve issues that require scale. “The most fundamental distinction between Algorand along with other L1s may be the network’s capability to deliver financial inclusion towards the two billion people on the planet that do not get access to modern economic climates,” she stated.

Warden elaborated that Algorand’s PPoS consensus mechanism enables this because of its low staking needs. Based on the Chainalysis publish, only one Algorand (ALGO) token is required to stake around the network. Warden also noticed that Algorand is extremely centered on decentralized finance (DeFi) development, noting the network is capable of doing settling about 1,200 transactions per second, with gas charges equating to .001 ALGO.

Recent: Integrating blockchain-based digital IDs into daily existence

“These needs are essential for systems to scale,” stated Warden. Compared, the Chainalysis report mentions that Ethereum are only able to handle roughly 15 transactions per second. Yet, it’s been noted that Eth2 aims to improve this significantly to around 150,000 once upgrades are completed.

To be able to stay competitive, Warden shared that Algorand is while moving out a brand new feature that will permit the network to stay transactions by 50 percent.5 seconds, in contrast to some.5 seconds it presently takes. Furthermore, as multichain systems be important, Algorand intends to deliver “state proofs” that will permit users to maneuver tokens in one chain to a different.

“Algorand could finish up as being a router for those transactions across chains, because it are designed for fast transactions, with little carbon footprint for sub-cent charges,” described Warden. While condition proofs along with other developments will not be folded out immediately, it’s notable that FIFA lately announced that it’ll use Algorand to build up its digital asset strategy. “FIFA is building their very own wallet on Algorand and creating an NFT marketplace that may accomodate secondary ticket sales,” added Warden.

BNB Chain can also be pointed out within the Chainalysis report and it is recognized because of its capacity to aid new tokens and DApps without high gas charges. Actually, DappRadar found there to become more L2 projects built on BNB Chain than every other blockchain. Gwendolyn Regina, investment director of BNB Chain, told Cointelegraph the goal behind the network would be to help builders create DApps that scale for large crypto adoption. She stated:

“This year, BNB Smart Chain may have 30 occasions the computing power Ethereum as well as focus on decentralized storage solutions. Consequently, blockchain technology is going to be more and more built-into real-world applications.”

Based on Regina, the important thing focus areas for BNB Chain’s 2022 roadmap include decentralization, faster transaction speed, multichain integration as well as an elevated concentrate on supporting developers and sustainability. Particularly speaking, Regina shared the BNB Chain community lately released plans for more decentralization through the BEP-131 proposal, that will introduce candidate validators to BNB Smart Chain.

“This proposal would increase the amount of BNB Smart Chain Mainnet validators from 21 to 41, supplying more decentralization and incentives for validators to constantly innovate their hardware and infrastructure,” she stated. Although this may create more decentralization, there’s been critique regarding whether DeFi is decentralized following Solend’s spontaneous governance proposal associated with among the whale wallets vulnerable to liquidation.

Decentralization aside, it’s notable that BNB Beacon Chain — a blockchain produced by Binance and it is community that implements a decentralized exchange for digital assets — lately grew to become open-sourced. “BNB Beacon Chain has become available for developers to construct on,” stated Regina. She further described that the advantages of the BNB Beacon Chain are broad, noting its high-speed order book based decentralized exchange to make sure quick transactions. “Harnessing native secure mix-chain support will open doorways for blockchain interoperability, meaning users can seamlessly navigate the chains they will use,” she remarked.

Additionally to Algorand and BNB Chain, Avalanche was pointed out in Chainalysis’s findings. Based on the report, Avalanche focuses on customizability, scalability and interoperability. John Wu, president of Ava Labs — charge developer from the Avalanche blockchain — told Cointelegraph the network particularly aims to resolve numerous problems within Web3 environments. He stated:

“Avalanche has got the fastest time for you to finality in the market at approximately 500 milliseconds to two seconds. Which means that all mix-chain and subnet transactions are immortalized inside a blink. Banking institutions building DeFi products and Web3 gaming studios developing AAA shooters and RPGs need near-instant finality. It’s a precondition to success. Without them, their apps cannot work.”

To Wu’s point, finality is very essential as more institutions go into the DeFi sector. Actually, Avalanche’s quick finality time might be much greater in comparison to Eth2 finality time, which some believe may never achieve under fifteen minutes. Ethereum presently processes 15–30 transactions per second with more than one-minute finality.

Wu added that no matter market conditions, the Avalanche community continuously build. For instance, Wu shared that subnets — some validators cooperating to attain consensus around the condition of some blockchains — will open new doorways for DeFi. For instance, he pointed out that the subnet’s capability to incorporate Know Your Customer (KYC) needs and circumvent the bottlenecking that may occur on the chain distributed to third-party applications attracts institutions. “The first Subnet engineered particularly for institutional DeFi is within production at this time,” he stated.

Survival from the fittest?

Although L1 blockchains are evolving, the Chainalysis report still notes the potential of Ethereum becoming the “dominant player” because of market conditions and expected upgrades towards the network. For example, Raul Jordan, among the core devs focusing on the Eth2 merge, told Cointelegraph that soon anybody on the planet can run an ETH node, which demonstrates the real power decentralization.

It’s crucial that we give capacity to people around the globe, particularly in developing countries, to operate full nodes on consumer software. Full nodes preserve the safety from the protocol by enforcing its rules #ethereum https://t.co/UVucpOQnzM

— rauljordan.eth (@rauljordaneth) April 21, 2022

Alex Tapscott, author and co-founding father of the Toronto-based Blockchain Research Institute, further told Cointelegraph there are two good reasons to question the durability of L1s:

“First, bear markets generally visit a stop by interest for crypto-native applications, therefore if gas charges drop by themselves on Ethereum, why would you use a more recent or fewer proven chain when you are able use Ethereum? Second, the merge to proof-of-stake will improve Ethereum’s performance, so even when demand returns, it might be able to handle new growth.”

However, Tapscott added he believes any decreasing curiosity about L1s is going to be short-resided. “Long term, you will see surging interest in block space, with a few developers and users prepared to downside between security (Ethereum) for speed and convenience. Also, I believe several L1s for those their potential continue to be pretty initial phase tech, so that as they mature they’ll be reliable, helpful and broadly adopted.”

Recent: How to begin a job in crypto? A beginner’s guide for 2022

Tapscott further noticed that “L1s were initially effective not simply because they attracted investor capital, speculate they drove user adoption and interest.” And, if history has trained the crypto space anything, it might be that bear financial markets are an ideal here we are at projects to construct. “A bear market could be an excellent way to assess and support projects that really really make a difference within the blockchain ecosystem as lengthy as innovative teams keep emerging to resolve real-world problems using blockchain technology,” Regina stated.

However, numerous projects also have a tendency to fail in bear markets. Warden commented there will indeed be fallout for many L1 blockchains: “Crypto winter is a period when every element of the crypto ecosystem will probably be asked and tire-kicked, and not simply DApps, but every aspect of crypto infrastructure, including L1s.”

However, Warden added that projects that may scale and take care of transactions continuously accelerate, posing challenging to Ethereum: “Businesses or projects which are building for lengthy-term utility and real-world adoption will accelerate and garner attention during this time period.”