The approaching Ethereum (ETH) Merge is among the most spoken-about developments within the cryptocurrency ecosystem because the world’s second-largest cryptocurrency by market cap undergoes the tough transition from proof-of-work (Bang) to proof-of-stake (PoS).

One protocol whose fate is basically associated with the effective completing the Merge is Lido DAO (LDO), a liquid staking platform that enables users to take advantage of the worth of their assets to be used in decentralized finance and produce yield from staking.

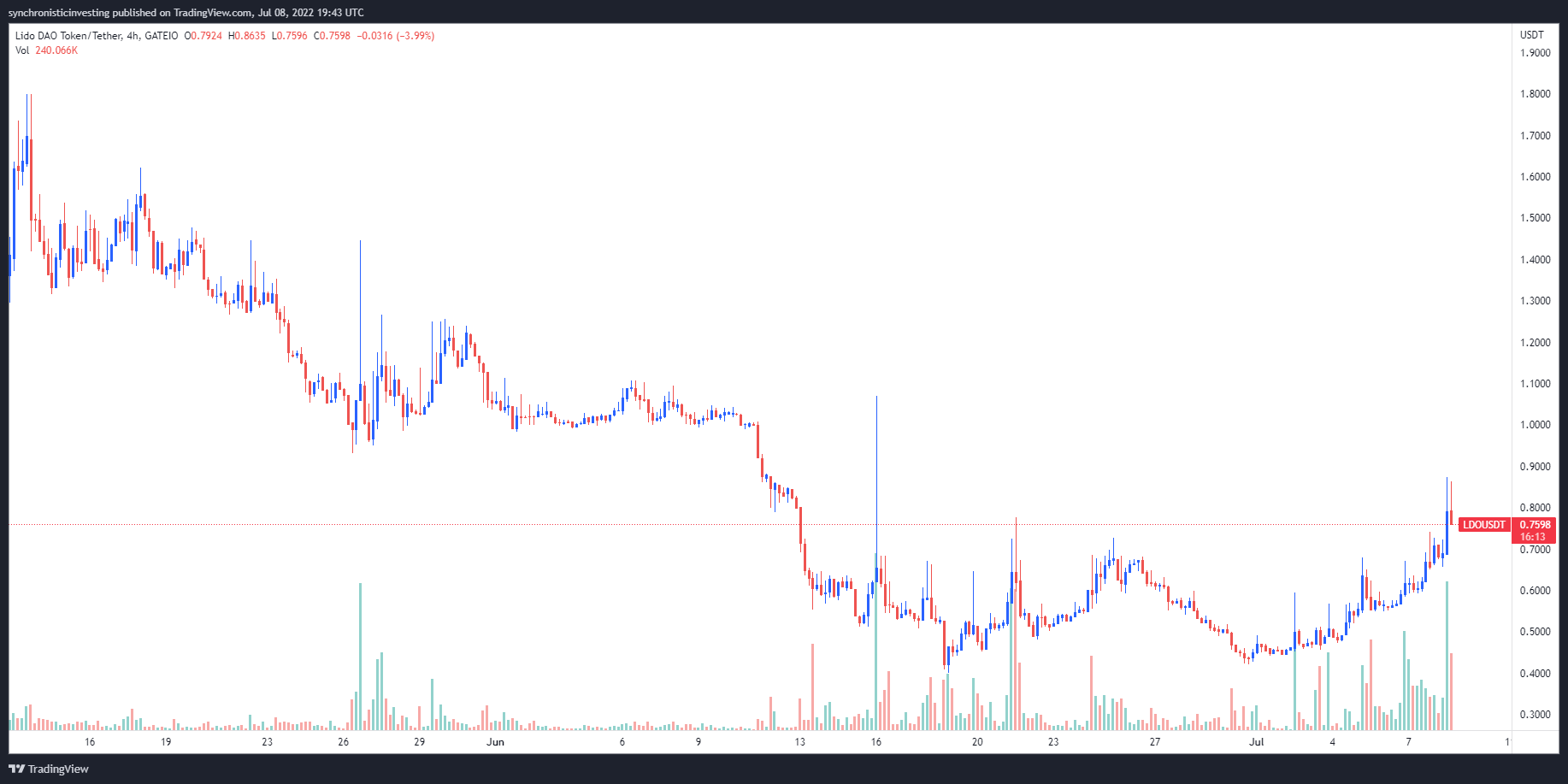

Data from Cointelegraph Markets Pro and TradingView implies that since LDO hit a minimal of $.42 on June 30, its cost has rose 107.6% hitting a regular a lot of $.874 on This summer 9, but during the time of writing the altcoin has retracted to $.65.

Three good reasons for that sharp turnaround for LDO range from the effective Merge around the Sepolia testnet, the ongoing rise in Ether deposits around the platform and also the slow recovery of staked Ether (stETH) cost compared to Ether’s place cost.

Sepolia testnet merge

Moving to proof-of-stake is a challenging process, however it came a measure nearer to completion on This summer 6 using the effective Merge from the Bang and PoS chains on Ethereum’s Sepolia testnet.

BREAKING – Ethereum completes another effective test from the Merge on Sepolia

Goerli next.

Mainnet after.

Don’t sleep. pic.twitter.com/YeQfghmm5O

— bankless.eth (@BanklessHQ) This summer 6, 2022

After this development, there’s just one more Merge trial to conduct around the Goerli testnet, and when which goes lower with no major issues the Ethereum mainnet is going to be next.

Since Lido focuses on supplying liquid staking services for Ethereum, each step closer fully transition to PoS benefits the liquid staking platform because Ether holders who would like an easier method to stake their tokens can utilize Lido’s services without having to be worried about token lock-ups.

Ether deposits still rise

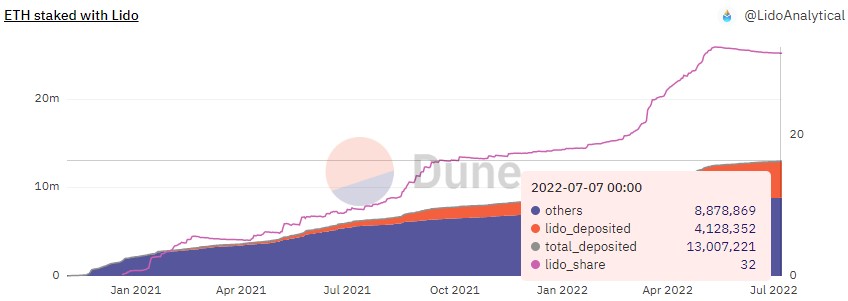

Proof that curiosity about staking on Lido has ongoing to climb are available in data provided by Dune Analytics, which shows an growing quantity of Ether deposited around the protocol.

As proven around the chart above, by This summer 7 there have been 4.128 million Ether staked through Lido.

Related: Ethereum testnet Merge mostly effective — ‘Hiccups won’t delay the Merge.’

stETH starts to recover

Take into consideration assisting to boost the need for LDO continues to be the recovery of stETH cost, which lost its peg to Ether in the last couple of several weeks as distressed funds offered their stETH so that they can stave of insolvency.

Based on data from Dune Analytics, the cost of stETH has become buying and selling at approximately 97.2% from the cost of Ether, up from the low of 93.6%, which happened on June 18.

While stETH hasn’t fully retrieved its cost parity with Ether, its relocate the best direction coupled with less selling pressure from forced liquidations seems to possess helped restore some investor belief within the token.

This, consequently, has benefited LDO because the protocol may be the largest liquid Ether staking provider and issuer of stETH.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.