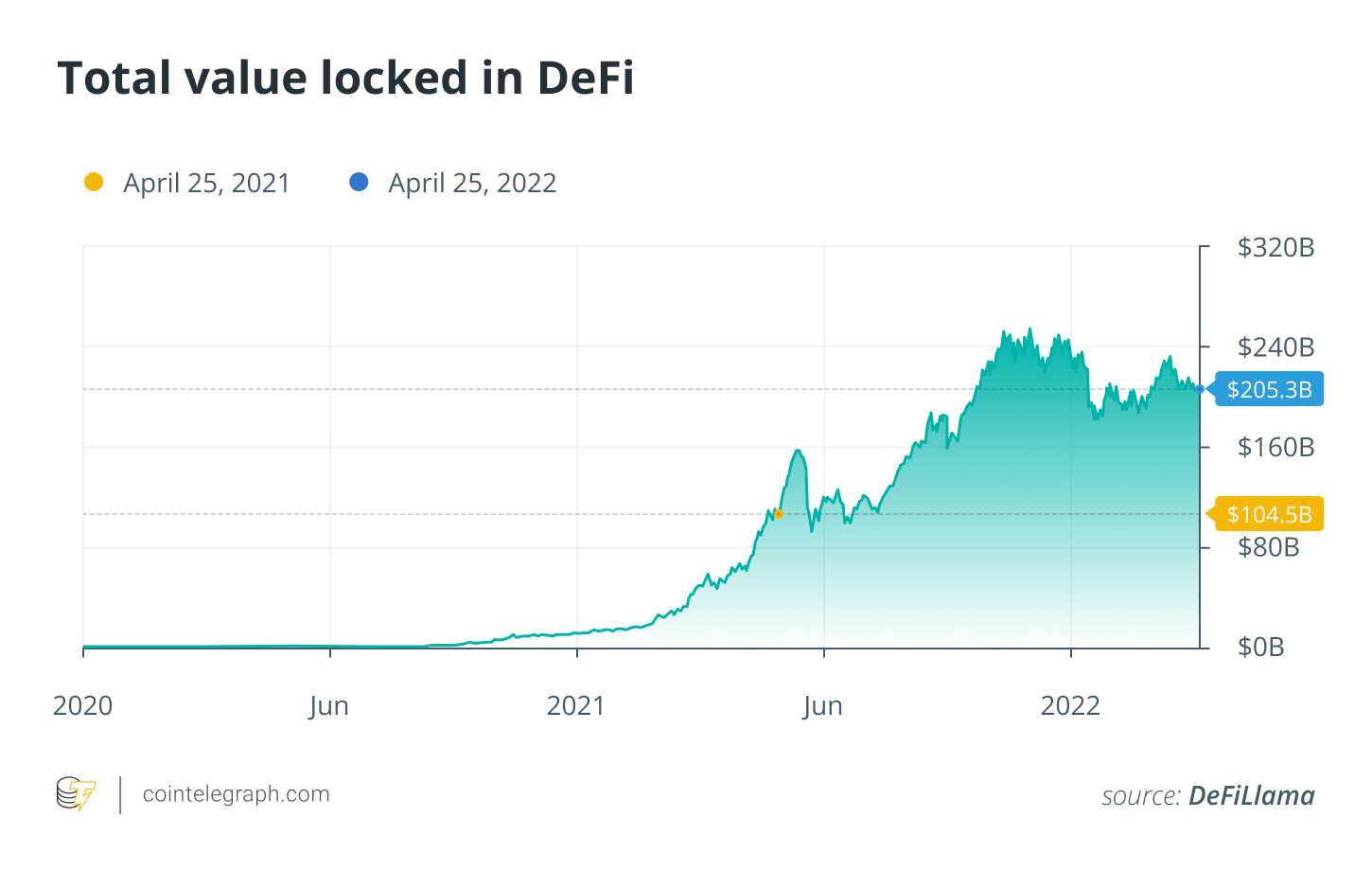

In mid-Feb 2020, the entire value locked within decentralized finance (DeFi) applications first exceeded $1 billion. Fueled through the DeFi summer time of 2020, it wouldn’t even have a year before it multiplied 20-fold to achieve $20 billion and just another ten several weeks to achieve $200 billion. Because of the pace of growth to date, it doesn’t appear outlandish to assume the DeFi markets hitting a trillion dollars within another couple of years.

We are able to attribute this monumental growth to 1 factor — liquidity. Searching back, DeFi’s expansion could be defined in three eras, each representing another critical rise in removing barriers to liquidity and making the markets more appealing and efficient to participants.

DeFi 1. — Cracking the chicken and egg problem

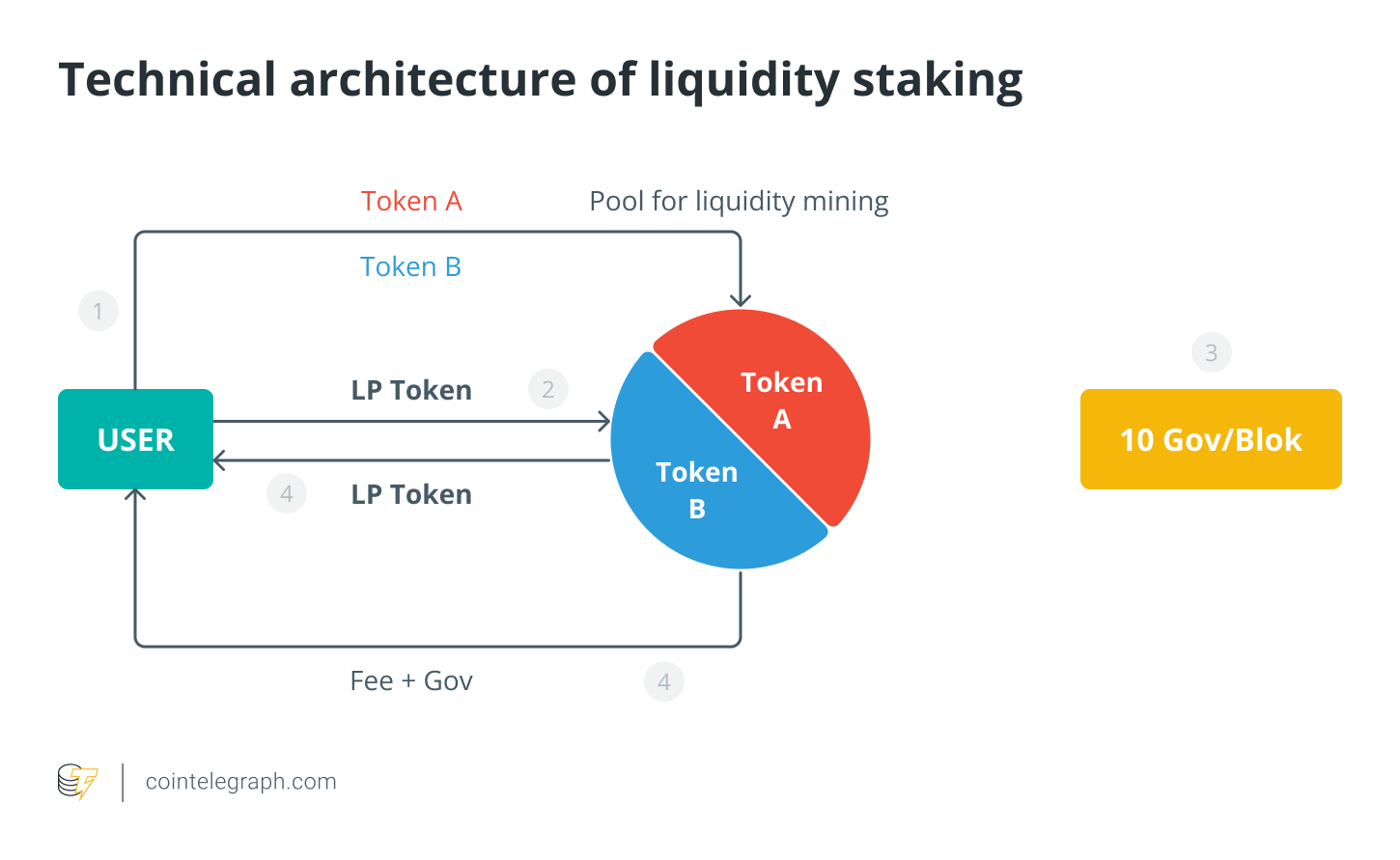

DeFi protocols existed just before 2020, however they endured somewhat from the “chicken and egg” problem if this found liquidity. Theoretically, someone could provide liquidity to some lending or swap pool. Still, there aren’t enough incentives for liquidity providers until there is a critical mass of liquidity to draw in traders or borrowers who covers the cost charges or interest.

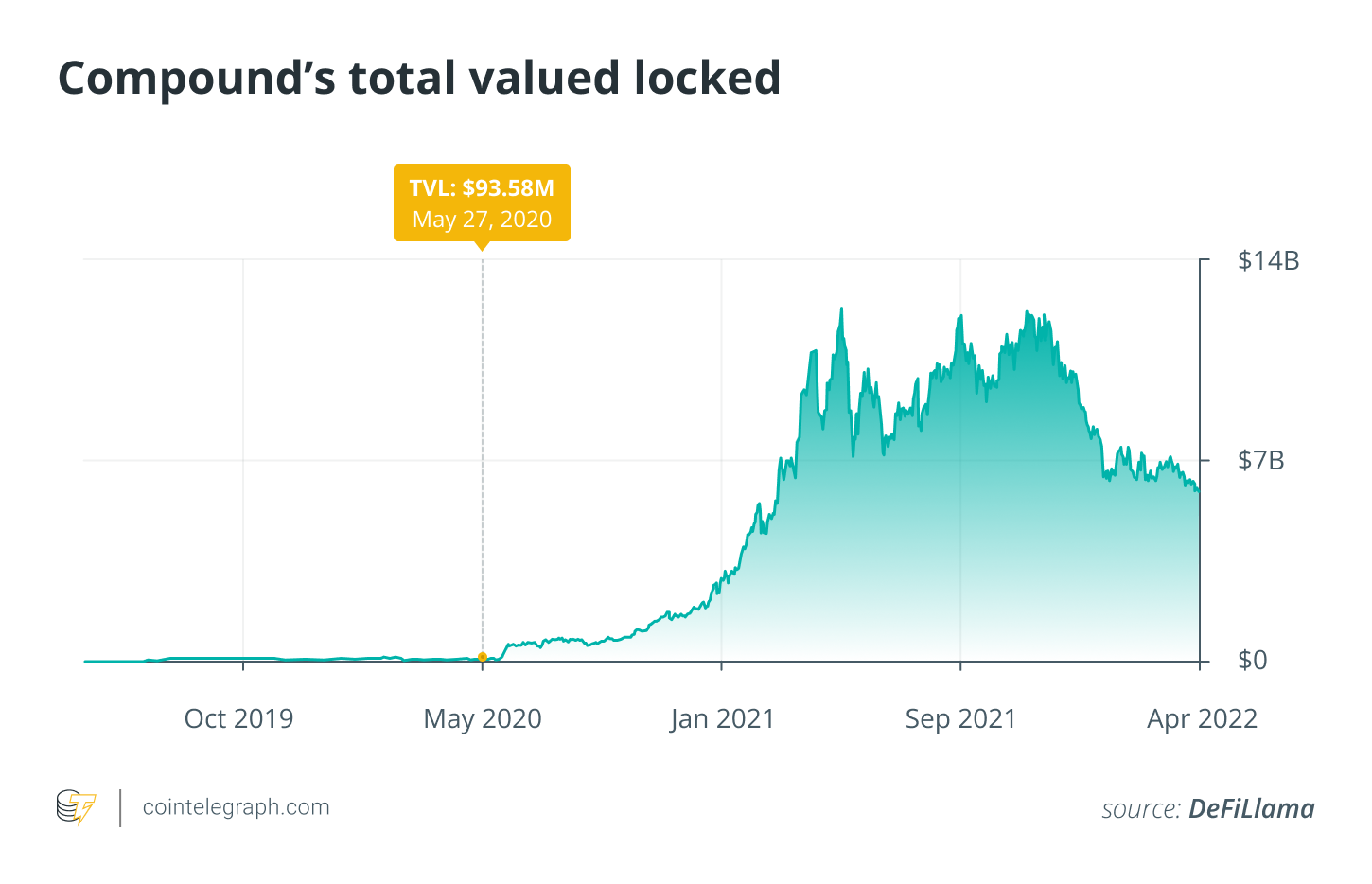

Compound was the first to hack this issue in 2020 if this introduced the idea of farming protocol tokens. Additionally to interest from borrowers, lenders on Compound may also earn COMP token rewards, supplying a motivation in the second they deposited their.

It demonstrated to become a beginning pistol for that DeFi summer time. SushiSwap’s “vampire attack” on Uniswap provided further inspiration for project founders, who started utilizing their own tokens to incentivize on-chain liquidity, starting off the yield farming craze in serious.

Related: Liquidity mining is booming — Does it last, or does it bust?

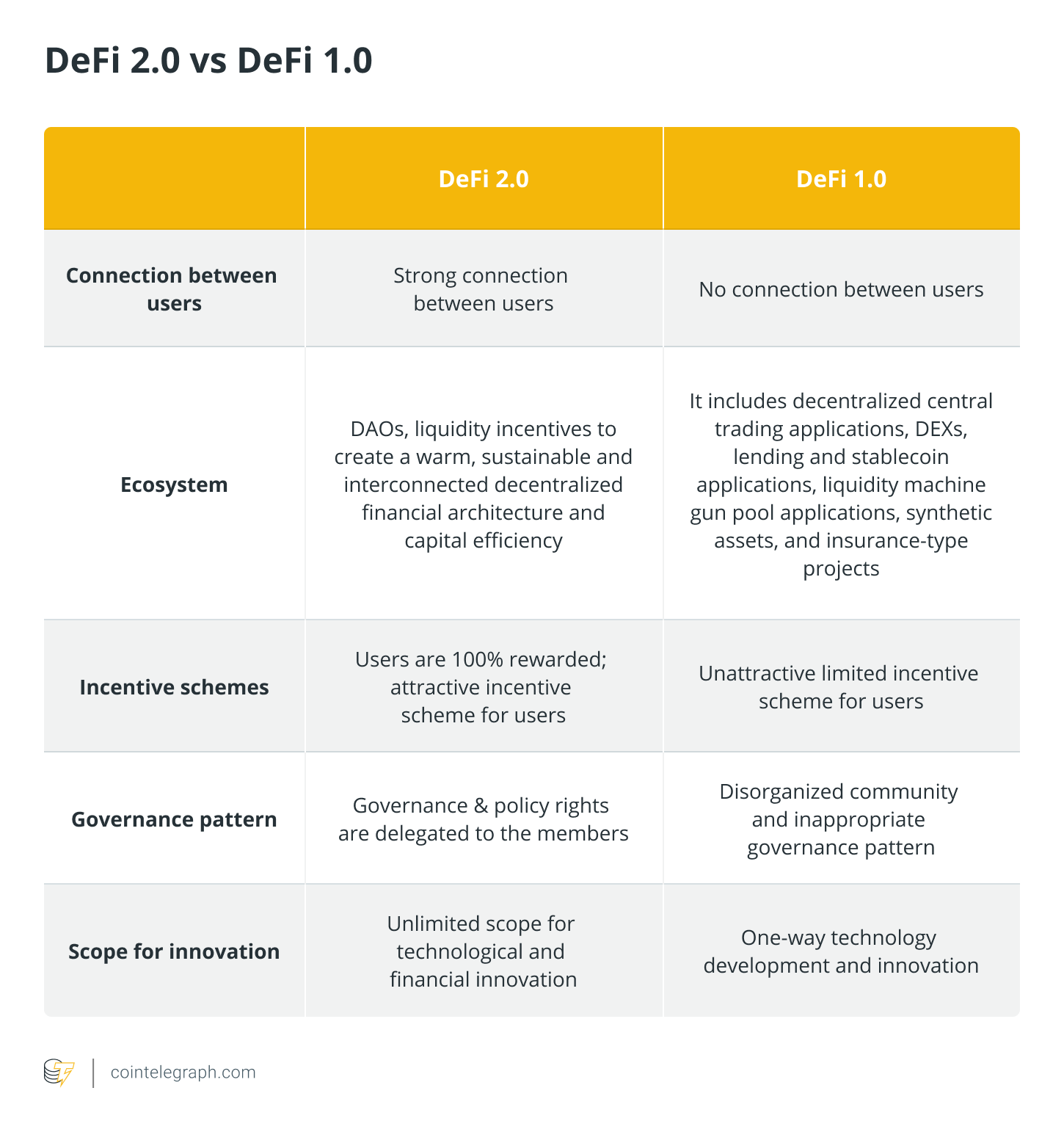

DeFi 2. — Improving capital efficiency

So, which was DeFi 1., roughly the age that required us from $1 billion to $20 billion. DeFi 2., the time that saw further growth as much as $200 billion, introduced enhancements in capital efficiency. It saw the development of Curve, which honed Uniswap’s automated market makers (AMM) model for stable assets, offering more concentrated buying and selling pairs with lower slippage.

Curve also introduced innovations like its election-escrowed tokenomic model, which incentivizes liquidity providers to secure funds for that lengthy term to help boost the longevity of liquidity and lower slippage.

Uniswap v3 also introduced further enhancements in capital efficiency using its customizable liquidity positions. Beyond Ethereum, the multichain DeFi ecosystem started to flourish on other platforms including BSC, Avalanche, Polygon yet others.

So, what’s going to propel DeFi with the next phases of growth to achieve a trillion dollars and beyond? In my opinion you will see four key developments.

DEXs go hybrid

The AMM model that’s proven so effective in DeFi evolved from necessity after it grew to become apparent that Ethereum’s slow speeds and charges wouldn’t serve an order book model good enough for this to outlive on-chain.

Related: Automated market makers are dead

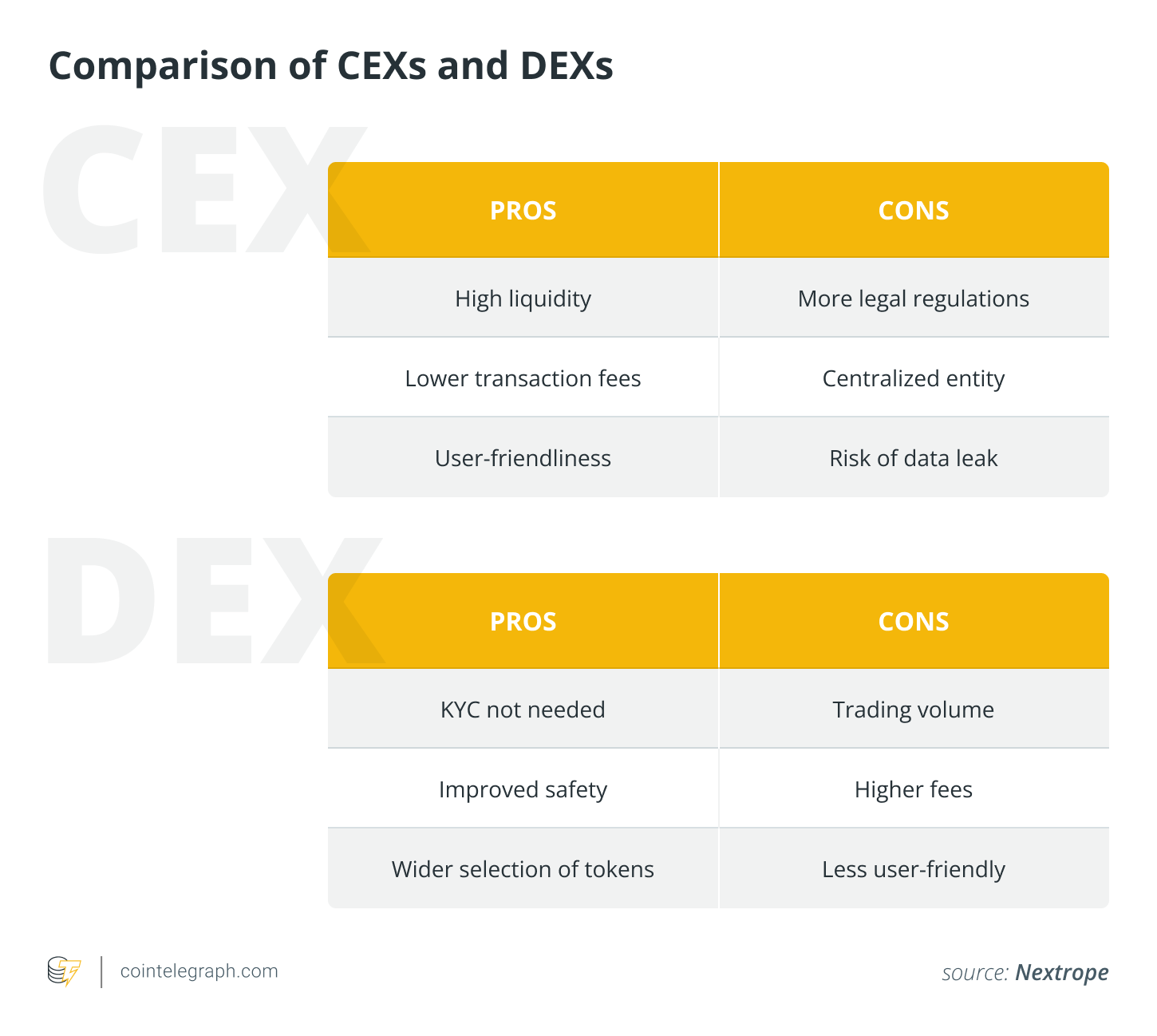

However, the presence of DeFi on high-speed low-cost blockchains implies that we’re prone to see an uptick in the amount of decentralized exchanges (DEXs) utilizing an order book model. Fast settlement occasions prevent slippage, while low to minimal charges bakes an order book exchange lucrative for market makers.

There are many types of decentralized exchanges using central limit order books emerging already — Serum, built on Solana, Dexalot on Avalanche and Polkadex on Polkadot, to provide several examples. The presence of order book exchanges could make it simpler to onboard institutional and professional investors, because they allow limit orders, creating a far more familiar buying and selling experience.

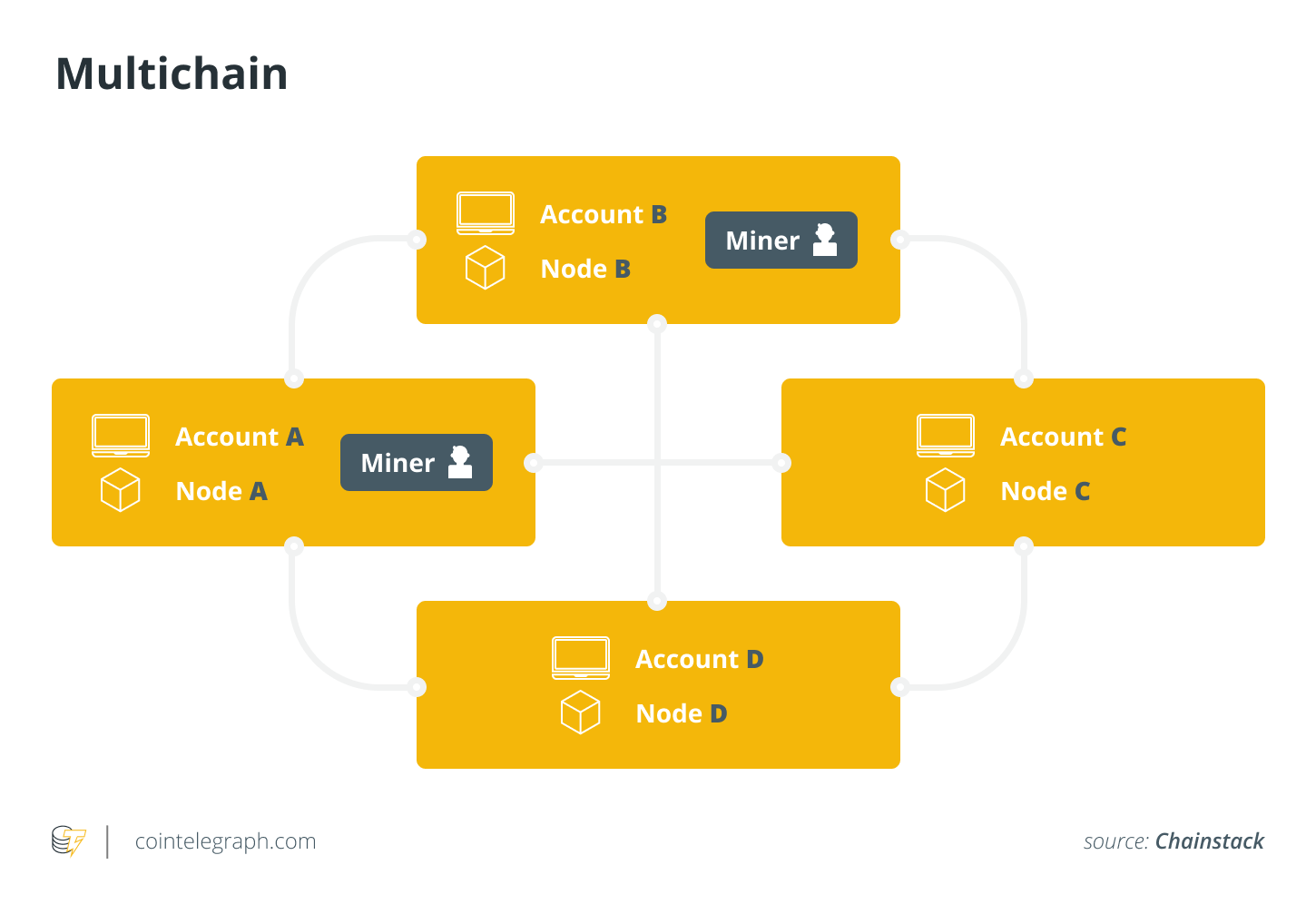

Mix-chain composability

The proliferation of DeFi protocols on blockchains apart from Ethereum has led to significant fragmentation of liquidity into different environments. To some degree, developers have attempted to beat this with bridges between blockchains, but recent hacks for example Solana’s Wormhole bridge hack have produced concerns.

Nonetheless, secure mix-chain composability has become essential to unlock the fragmented liquidity in DeFi and attract further investment. There are several positive signs — for example, Binance lately made a proper investment into Symbiosis, a mix-chain liquidity protocol. Similarly, Thorchain, a mix-chain liquidity network, launched this past year and it has lately acquired rapid ground in value locked, implying a obvious appetite for mix-chain liquidity.

Blockchain and DeFi start to merge using the markets

Since crypto has become an accepted global financial asset, it’s only dependent on time prior to the limitations start to blur with blockchain and DeFi. This will probably relocate two directions. First of all, by getting the liquidity in the established global economic climate on-chain, and next, through the adoption of crypto-related decentralized lending options by institutions.

Several crypto projects have finally launched institutional-grade products, and much more have been in the pipeline. There’s already a MetaMask Institutional wallet, while Aave and Alkemi operate Know Your Customer (KYC) pools for institutions.

On the other hand, Mike Bankman-Fried is flying the flag for getting the economic climate on-chain. In March, he spoke in the Futures Industry Association in Florida, proposing to U.S. regulators that risk management in markets might be automated using practices produced for the crypto markets. A dark tone from the Foot piece covering the storyline is telling – not even close to the dismissive, even scornful attitude the traditional financial press once had toward crypto and blockchain, it’s now packed with intrigue.

Quite when DeFi reaches the trillion-dollar milestone is anyone’s guess. But, individuals people watching the present pace of growth, investment and innovation feel reasonably certain that we’ll make it happen at some point.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Jimmy Yin is really a co-founding father of iZUMi Finance. Before entering the field of DeFi, he would be a investigator at United States Blockchain Association and community person in World Economic Forum. His PhD was supervised by Max Shen at UC Berkeley and HK College. Jimmy pursues enhancement of liquidity both in crypto and spirit.