MakerDAO is presently voting on the proposal targeted at helping it weather the bear market and apply untapped reserves by investing 500 million Dai (DAI) stablecoins into a mix of U . s . States treasuries and bonds.

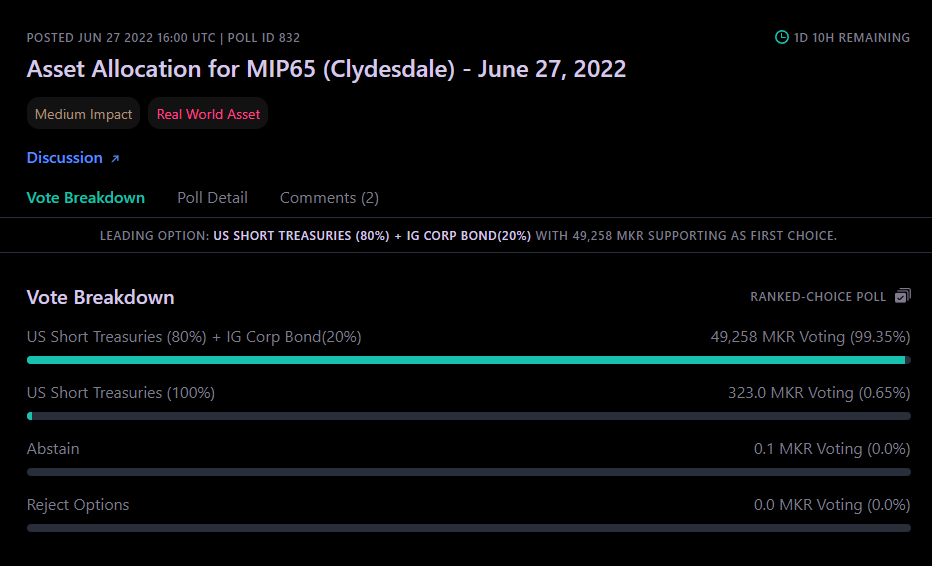

Following a straw poll inside a governance Signal Request, the decentralized autonomous organization (DAO) people now have to research if the dormant DAI is going entirely into short-term treasuries or split 80% into treasuries and 20% into corporate bonds.

The Producer Governance votes to find out how you can allocate 500 million DAI between different investment opportunities.

This allocation poll is because of the passage of MIP65: Monetalis Clydesdale: Liquid Bond Strategy & Execution.

A recap about how it might work.

— Maker (@MakerDAO) June 27, 2022

MakerDAO may be the governing body from the Maker protocol, which issues U.S. dollar-pegged DAI stablecoins in return for user deposits of Ether (ETH), Wrapped Bitcoin (wBTC) and nearly 30 other cryptocurrencies.

This proposal represents a significant step for Maker DAO, because it signals its intent to increase past the crypto realm and produce yield from traditional “safe” financialinvestments using its flagship DAI.

Among the largest delegates in MakerDAO, Doo, voted for that 80/20 split allocation. He reasoned the allocation could be advantageous for that protocol within the lengthy term for many reasons including its new contact with major traditional banking institutions and understanding how to manage finances inside a bear market.

“As TradFi is seeing rate of interest increase because of the Given,” Doo told Cointelegraph on June 29, “Maker protocol dealing with TradFi to benefit from our prime interest could strengthen its revenue model.”

MakerDAO enables participants election on proposals by staking their Maker (MKR). To date, the choice to separate the Dai between treasuries and bonds has 99.3% MKR token support, although from just 12 voters. Governance participation at Maker is presently at its cheapest level in 2022, with 169,196 MKR tokens staked.

The poll ends on June 30 at 12:00 pm EST, departing only a almost no time for other voters to choose a side, abstain or reject the choices.

Once a choice is selected, European wholesale loan provider Monetalis will give you MakerDAO accessibility financial instruments it wants. Monetalis Chief executive officer Allan Pedersen issued the Signal Request within the forum with options that his firm could supply the DAO.

The firm includes a objective of transitioning to low carbon resource efficiency, as reported by the UN’s definition.

The DAO’s decision to take a position such a lot of funds is dependant on recommendations by a number of people who think that deploying the unused funds may help raise the protocol’s main point here with minimal risk.

Related: Under 1% of holders have 90% from the voting power in DAOs: Report

Person in MakerDAO’s proper finance core unit Sebastien Derivaux posited inside a June 20 assessment from the allocation’s practicality that even though the amount under consideration appears relatively high, it ought to be a secure option for the DAO:

“An investment of 500M DAI within this context, that’s likely to remain liquid and occasional volatility, thus remains not really a significant risk for that DAI peg nor the solvency of MakerDAO.”

Derivaux recommended the two options presently being voted on were the very best of the 5 which were up for debate.

Regardless of the landmark move for Maker, MKR is lower 1.6% in the last 24 hrs and buying and selling at $964.71, according to CoinGecko.