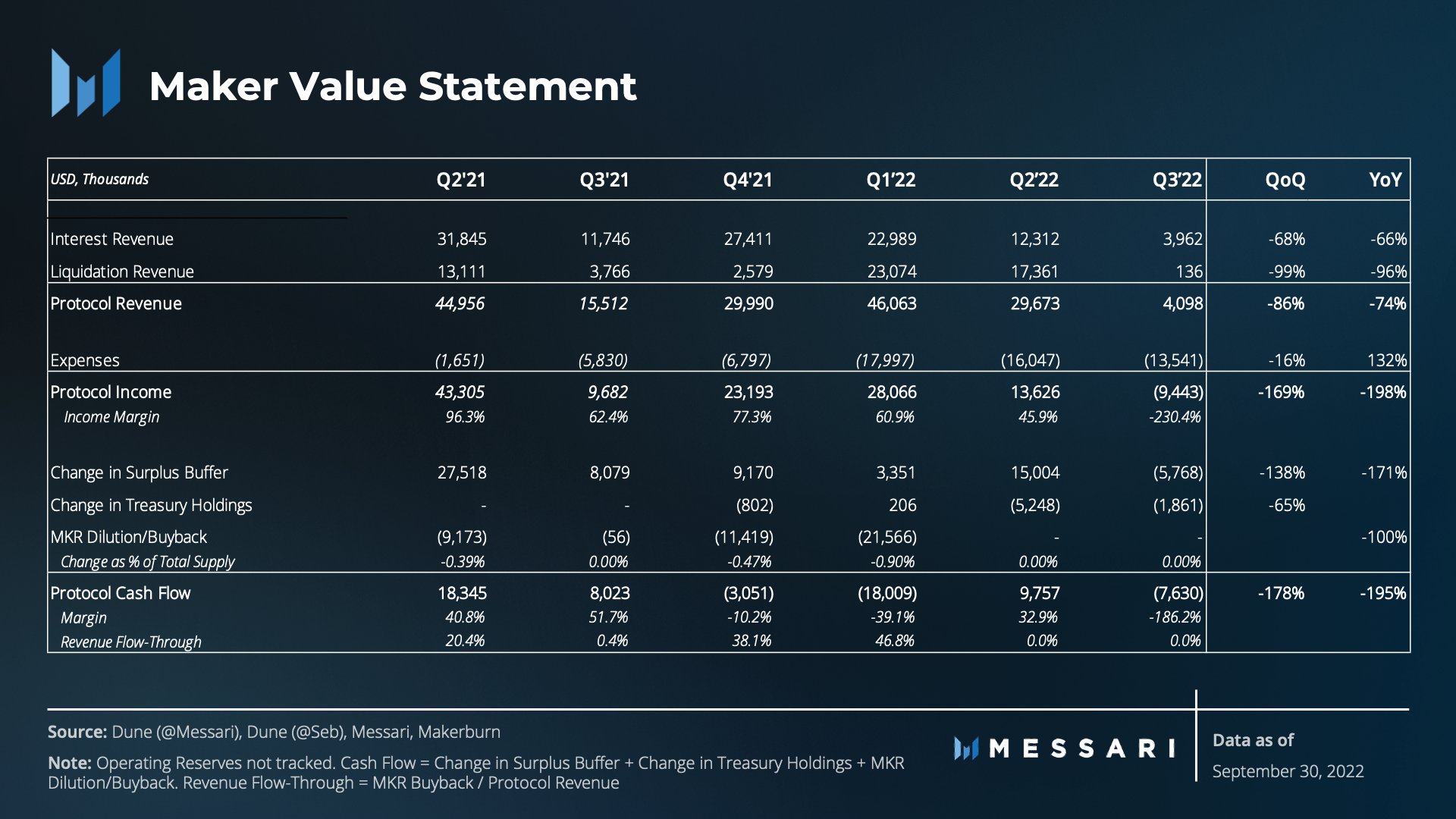

MakerDAO, the governing body from the Maker Protocol, has witnessed its revenue plummet within the third quarter of 2022, the result of a fall in loan demand and couple of liquidations, while expenses have continued to be high.

According for an March. 13 tweet by Johnny_TVL, a Messari analyst and co-author of “The Condition of Maker Q3 2022,” the decentralized autonomous organization (DAO) saw its revenue plunge to simply over $4 million in Q3, lower 86% in the previous quarter.

Among the outcomes of it has been MakerDAO’s first quarter of internet earnings loss since 2020.

The Messari senior research analyst has pointed to couple of liquidations and weak loan demand because the causes of the stop by revenue.

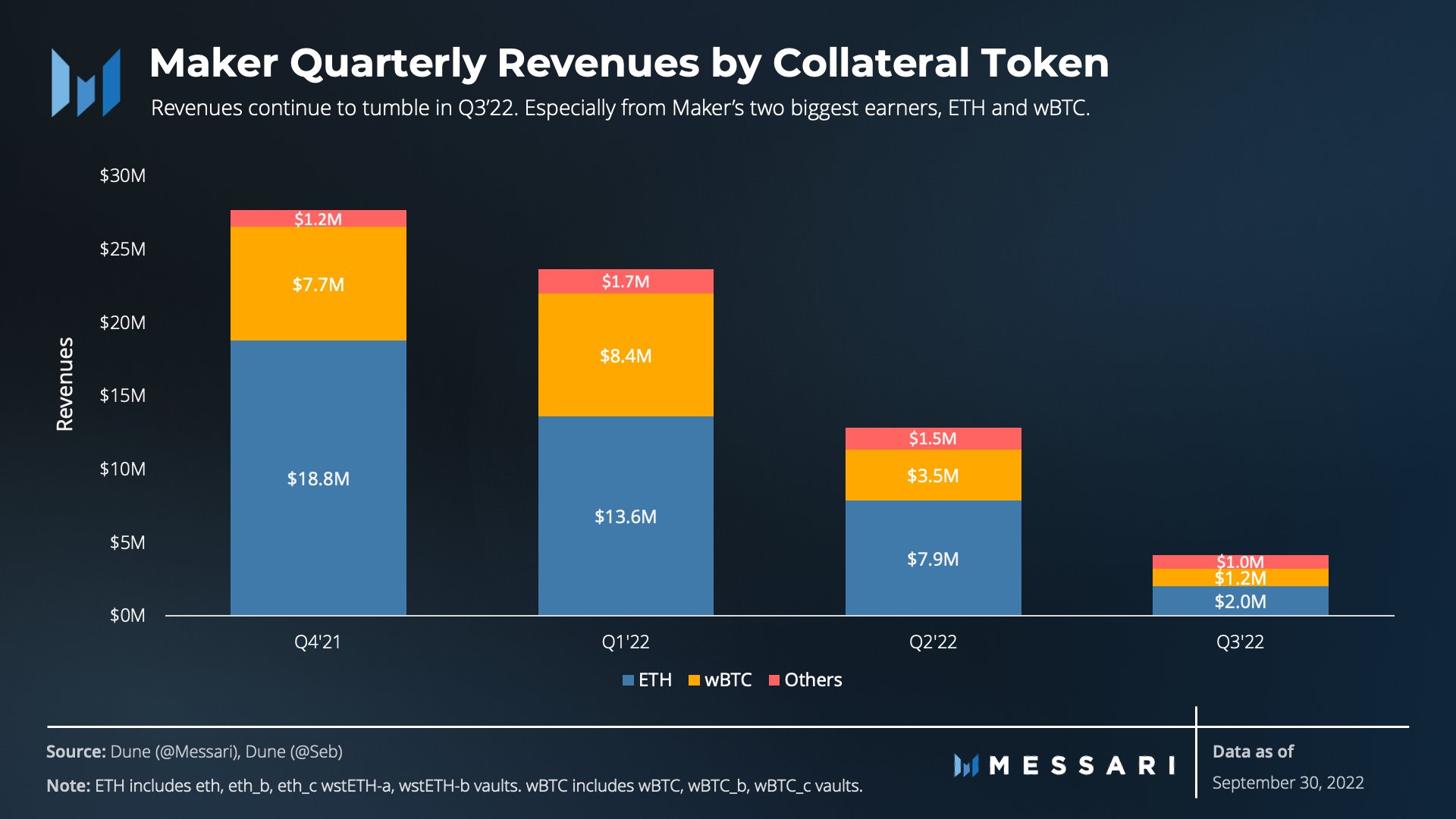

Its two greatest earners, Ether (ETH) and Wrapped Bitcoin (wBTC), have performed poorly within the last quarter, with revenue from ETH-based assets falling 74% and revenue from BTC-based assets falling 66%.

Borrowers begin using these cryptocurrencies as collateral for loans from the Dai (DAI) stablecoin, supplying some security in the volatility frequently seen within cryptocurrency markets at the expense of great interest compensated around the loans.

The analyst has additionally pointed to some fall within the collateral ratio of MakerDAO, suggesting the ratio has fallen to at least one.1 from 1.9 simultaneously this past year.

However, “expenses aren’t so elastic” stated the analyst, using the report showing that expenses have continued to be full of the quarter at $13.5 million, falling only 16% in the previous quarter.

Related: Nexo-labeled address withdraws $153M in Wrapped BTC from MakerDAO

Meanwhile, MakerDAO has lately taken steps to improve the return on assets it holds as collateral, getting commenced an offer to take a position $500 million in treasuries and bonds. MakerDAO believes this can supply the protocol with low-risk additional yield.

Another positive for MakerDAO was the development in Real Life Asset (RWA) backed loans, which now makes up about 12% of their total revenue after it effectively folded out its largest RWA-backed loan to Huntingdon Valley Bank (HVB) within the third quarter of 2022.

The borrowed funds, which involved the development of a vault with 100 million DAI, is really a new collateral enter in the Maker Protocol, which will help it generate additional revenue through vault stability charges connected with maintaining the vault and minting DAI.

HVB continues to be in a position to take advantage of this integration because it enables the financial institution to effectively increase its legal lending limit, and MakerDAO hopes when all goes easily other banks follows behind HVB.