Other family members . of June, the Eu arrived at a contract regarding how to regulate the crypto-asset industry, giving the eco-friendly light to Markets in Crypto-Assets (MiCA), the EU’s primary legislative proposal to supervise the in the 27 states. Each day earlier, on June 29, lawmakers within the member states from the European Parliament had already passed the Change in Funds Regulation (ToFR), which imposes compliance standards on crypto assets to hack lower on money washing risks within the sector.

With all this scenario, today we’ll further explore both of these legislations that, because of their broad scope, may serve as a parameter for that other Financial Action Task Pressure (FATF) people outdoors from the 27 countries from the EU. As it’s usually best to understand not just the outcomes but the occasions that brought us to the present moment, let us return a couple of years.

The relation between your FATF and also the recently enacted EU legislation

The Financial Action Task Pressure is really a global intergovernmental organization. Its people include most major nation-states and also the EU. The FATF isn’t a democratically elected body it consists of country-hired representatives. These representatives try to develop recommendations (guidelines) about how countries should formulate Anti-Money Washing along with other financial watchdog policies. Although these so-known as recommendations are non-binding, if your member country will not put them into action, there might be serious diplomatic and financial effects.

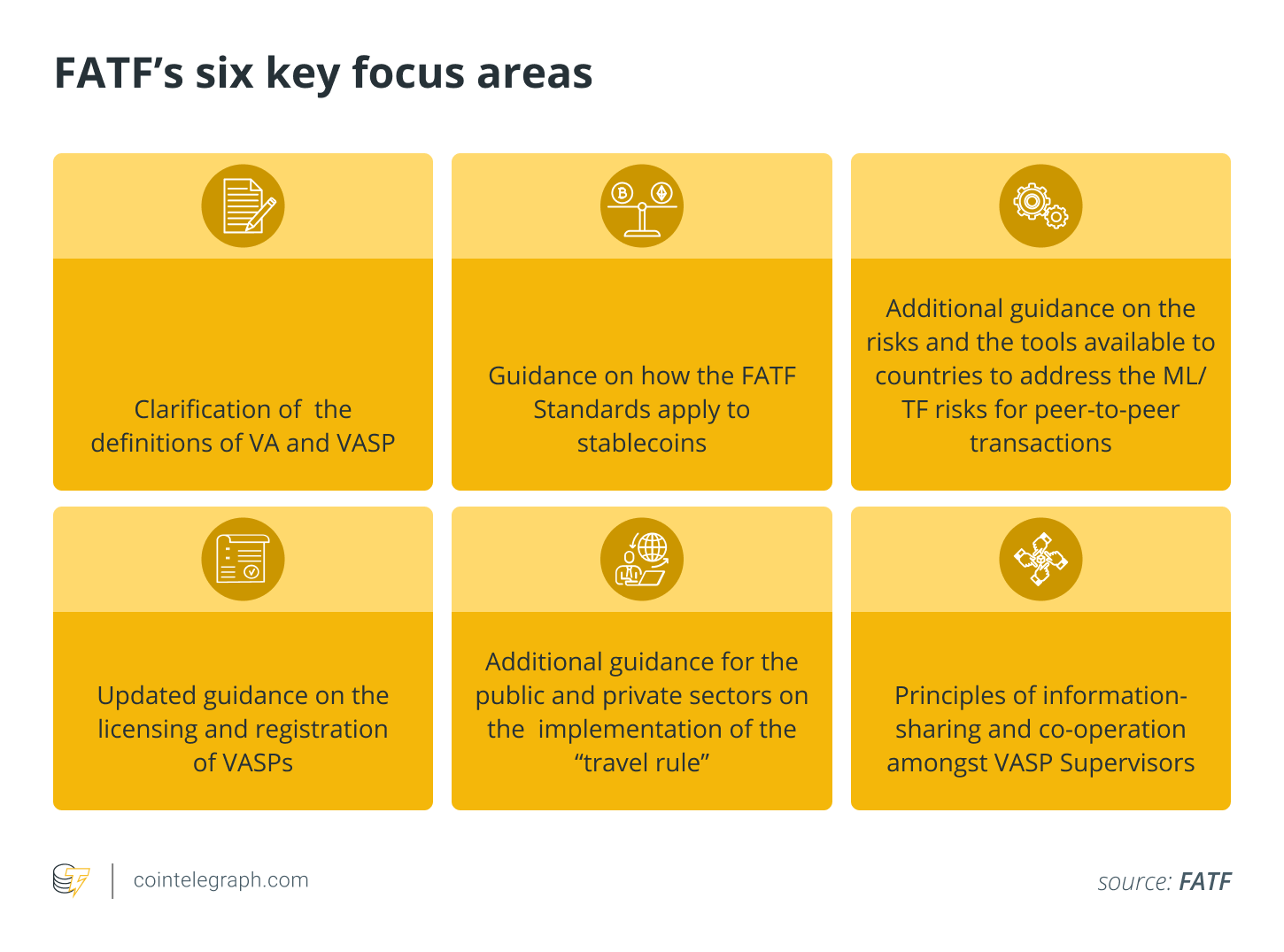

Along wrinkles, the FATF released its first guidelines on crypto assets inside a document printed in 2015, exactly the same year when countries like South america began debating the very first bills on cryptocurrencies. This primary document from 2015, which mirrored the present policies from the U . s . States regulator the Financial Crimes Enforcement Network, was reassessed in 2019, as well as on October 28, 2021, a brand new document entitled “Updated Guidance for any risk-based method of virtual assets and VASPs” arrived on the scene that contains the present FATF guidelines on virtual assets.

Related: FATF includes DeFi in guidance for crypto providers

This is among the explanations why the EU, the U.S. along with other FATF people will work difficult to regulate the crypto market, additionally towards the already known reasons for example consumer protection, etc.

When we look, for instance, in the 29 of 98 jurisdictions whose parliaments have previously legislated around the “travel rule,” have the ability to adopted the FATF’s recommendations to make sure that providers involving crypto assets verify and report who their clients will be to the financial government bodies.

The Ecu digital financial package

MiCA is among the legislative proposals developed inside the framework from the digital finance package launched through the European Commission in 2020. This digital finance package has since it’s primary objective to facilitate the competitiveness and innovation from the financial sector within the Eu, to determine Europe like a global standard setter and also to provide consumer protection for digital finance and modern payments.

Within this context, two legislative proposals — the DLT Pilot Regime and also the Markets in Crypto- Assets proposal — were the very first tangible actions carried out inside the framework from the European digital finance package. In September 2020, the proposals were adopted through the European Commission, as was the Change in Funds Regulation.

Related: European ‘MiCA’ regulation on digital assets

Such legislative initiatives were produced using the Capital Markets Union, a 2014 initiative that aims to determine just one capital market over the EU in order to reduce barriers to macroeconomic benefits. It ought to be noted that every proposal is just a draft bill that, in the future into pressure, must be considered through the 27 states from the European Parliament and also the Council from the EU.

Because of this, on June 29 and June 30, two “interim” contracts on ToFR and MiCA, correspondingly, were signed through the political settlement groups of the ecu Parliament and also the Council from the Eu. Such contracts continue to be provisional, as they have to go through the EU’s Economic and Financial Matters Committee, adopted with a plenary election, before they are able to enter pressure.

So, let us check out the primary provisions decided to through the political settlement groups of the ecu Parliament and also the European Council for that crypto market (cryptocurrencies and asset-backed tokens for example stablecoins).

Primary “approved” topics from the Change in Funds Regulation

On June 29, the political settlement groups of the ecu Parliament and also the Council from the Eu agreed on provisions from the ToFR around the European continent, also referred to as the “travel rules.” Such rules detailed specific needs for crypto asset gets in be viewed between providers for example exchanges, unhosted wallets (for example Ledger and Trezor) and self-located wallets (for example MetaMask), filling a significant gap within the existing European legislative framework on money washing.

Related: Government bodies are searching to narrow the gap on unhosted wallets

Among what’s been approved, following a FATF recommendation line, the primary topics are listed below: 1) All crypto asset transfers must be associated with a genuine identity, no matter value (zero-threshold traceability) 2) providers involving crypto assets — that the European legislation call Virtual Asset Providers, or VASPs — will need to collect details about the issuer and also the beneficiary from the transfers they execute 3) all companies supplying crypto-related services in almost any EU member condition will end up obliged entities underneath the existing AML directive 4) unhosted wallets (i.e., wallets not locked in child custody by a 3rd party) is going to be influenced by the guidelines because VASPs is going to be needed to gather and store details about their customers’ transfers 5) enhanced compliance measures also will apply when EU crypto asset providers communicate with non-EU entities 6) regarding data protection, travel rules data is going to be susceptible to the robust needs from the European data protection law, General Data Protection Regulation (GDPR) 7) the ecu Data Protection Board (EDPB) will manage defining the technical specifications of methods GDPR needs should be relevant to the transmission of travel rules data for cryptographic transfers 8) intermediary VASPs that execute a transfer with respect to another VASP is going to be incorporated within the scope and will also be needed to gather and transmit the data concerning the initial inventor and also the beneficiary across the chain.

Here, you should observe that European ToFR appears to possess fully adopted the recommendations enshrined in FATF Recommendation 16. That’s, it’s not enough for Virtual Asset Providers to talk about customer data with one another. Research should be performed alternatively VASPs that their clients transact, for example checking whether other VASPs perform Know Your Customer checks and also have an Anti-Money Washing/Combating the financial lending of Terrorism (AML/CFT) policy, or facilitate transactions rich in-risk counterparties.

Related: European ‘MiCA’ regulation on digital assets: Where will we stand?

Additionally, this agreement around the ToFR should be approved in parallel through the European Parliament and Council just before publication within the Official Journal from the EU, and can commence no after 18 several weeks after it goes into pressure — without getting to wait for a ongoing reform from the AML and counter terrorism directives.

Primary “approved” points from the Markets in Crypto-Assets

MiCA is paramount legislative proposal controlling the crypto sector in Europe, although not the only person inside the European digital finance package. It’s the first regulatory framework for that crypto-active industry on the global scale, since it’s approval imposes rules to become adopted by all 27 states from the bloc.

Ich bin mir sicher, MiCA ist ein europäischer Erfolg und globaler Standardsetzer. Danke an das Verhandlungsteam @McGuinnessEU /3 pic.twitter.com/bSJh10OY61

— Stefan Berger (@DrStefanBerger) June 30, 2022

As already pointed out, negotiators in the EU Council, the Commission and also the European Parliament, underneath the French presidency, arrived at a contract around the supervision from the Markets in Crypto-Assets (MiCA) proposal throughout the June 30 political trialogue.

The important thing points approved within this agreement are listed below:

- Both European Securities and Market Authority (ESMA) and also the European Bank Authority (EBA) may have intervention forces to stop or restrict the supply of Virtual Asset Providers, along with the marketing, distribution or purchase of crypto assets, in situation of a menace to investor protection, market integrity or financial stability.

- ESMA can also get a substantial coordination role to make sure a regular method of the supervision from the largest VASPs with some customer above 15 million.

- ESMA is going to be given the job of creating a methodology and sustainability indicators to determine the outcome of crypto assets around the climate, in addition to classifying the consensus mechanisms accustomed to issue crypto assets, analyzing their energy use and incentive structures. Here, you should observe that lately, the ecu Parliament’s Committee on Economic and Financial Matters made the decision to exclude in the MiCA (by 32 votes to 24) suggested legal provision that searched for to stop, within the 27 EU states, using cryptocurrencies operated by the “proof-of-work” formula.

- Registration of entities located in third countries, operating within the EU without authorization, is going to be established by ESMA according to information posted by competent government bodies, third country supervisors or recognized by ESMA. Competent government bodies may have far-reaching forces against listed entities.

- Virtual Asset Providers is going to be susceptible to robust Anti-Money Washing safeguards.

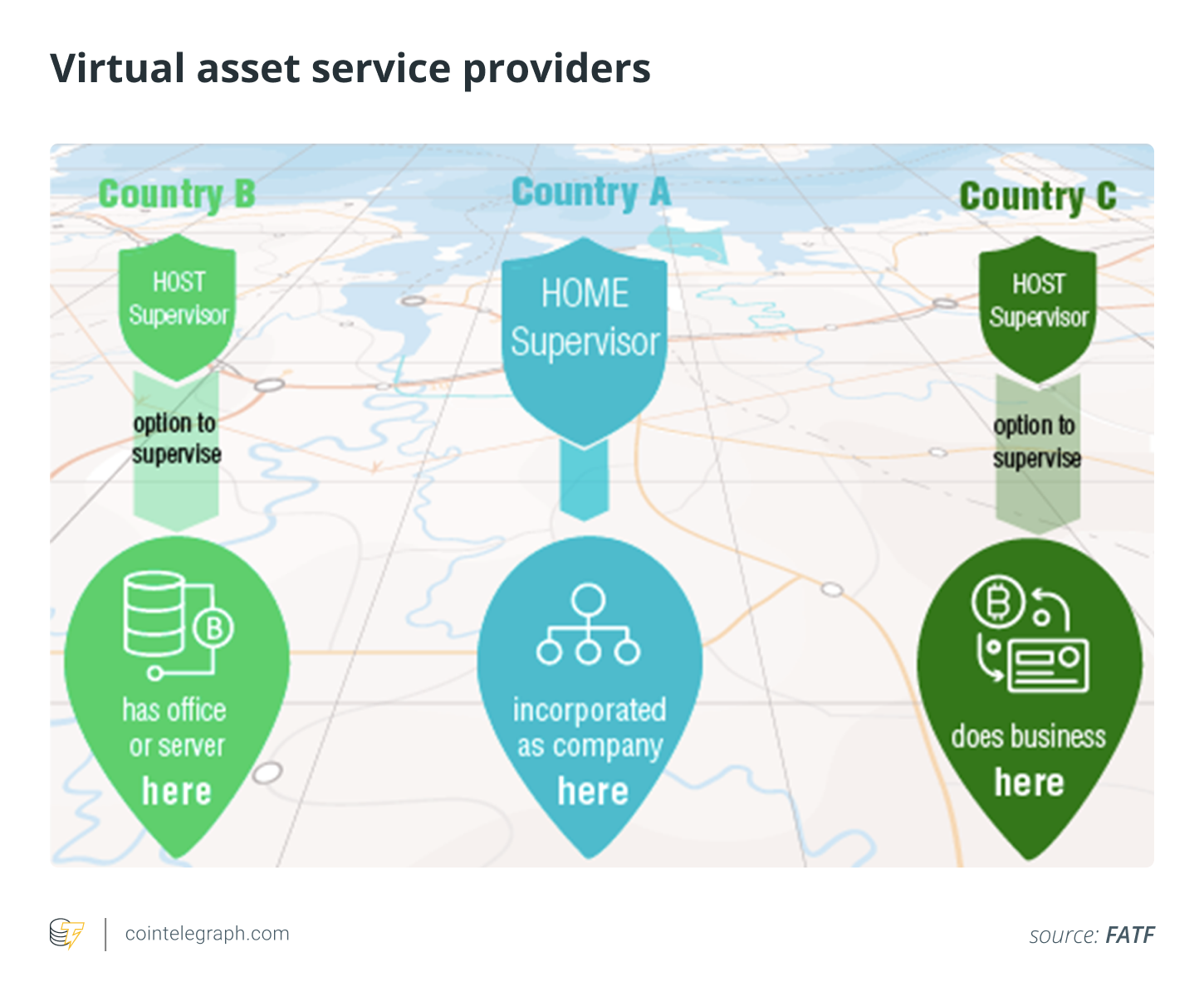

- EU VASPs must be established and also have substantive management within the EU, together with a resident director and registered office within the member condition where they make an application for authorization. You will see robust checks on management, persons with qualifying holdings within the VASP or persons with partners. Authorization ought to be declined if AML safeguards aren’t met.

- Exchanges may have liability for damages or losses caused for their customers because of hacks or operational failures they must have prevented. For cryptocurrencies for example Bitcoin, the brokerage will need to give a white-colored paper and become responsible for any misleading information provided. Here, you should be aware of distinction between the kinds of crypto assets. Both cryptocurrencies and tokens are kinds of crypto assets, and both of them are used in an effort to store and transact value. The primary distinction between them is logical: cryptocurrencies represent “embedded” or “native” transfers of worth tokens represent “customizable” or “programmable” transfers of worth. A cryptocurrency is really a “native” digital asset on the given blockchain that is representative of a financial value. You can’t program a cryptocurrency that’s, you can’t alter the characteristics of the cryptocurrency, that are determined in the native blockchain. Tokens, however, really are a customizable/programmable digital asset that operates on another or third generation blockchain that supports more complex smart contracts for example Ethereum, Tezos, Rostock (RSK) and Solana, amongst others.

- VASPs will need to segregate clients’ assets and isolate them. Which means that crypto assets won’t be affected in case of a brokerage firm’s insolvency.

- VASPs will need to give obvious warnings to investors about the chance of volatility and losses, entirely or perhaps in part, connected with crypto-actives, in addition to adhere to insider buying and selling disclosure rules. Insider buying and selling and market manipulation are strictly prohibited.

- Stablecoins have grown to be susceptible to a much more restrictive algorithm: 1) Issuers of stablecoins is going to be needed to keep reserves to pay for all claims and supply a lasting right of redemption for holders 2) the reserves is going to be fully protected in case of insolvency, which may make a positive change in the event like Terra.

First introduced in 2020, the MiCA proposal experienced several iterations before reaching this time, with a few suggested legislative provisions showing more questionable than the others, for example NFTs remaining outdoors the scope but having the ability to be reclassified by supervisors on the situation-by-situation basis. That’s, nonfungible tokens happen to be excluded from the brand new rules — although, within the MiCA settlement discussions, it had been noticed that NFTs might be introduced in to the scope from the MiCA proposal later on.

Related: Are NFTs a pet to become controlled? A Eu method of decentralization, Part 1

Different color leaves, DeFi and crypto lending were overlooked within this MiCA agreement, however a report with possible new legislative proposals must be posted within 18 several weeks of their entry into pressure.

For stablecoins, a ban in it was considered. But, within the finish, the understanding continued to be that banning or fully restricting using stablecoins inside the EU wouldn’t be in conjuction with the goals set in the EU level to advertise innovation within the financial sector.

Final factors

Soon after the ToFR and MiCA contracts were reported, some belittled the ToFR, mentioning, for instance, that although legislators tried operator, the approved origin and recipient identification measures is only going to achieve central bank digital currencies, although not privacy-focused blockchain systems like Monero and Dash.

Others have contended for the requirement for a harmonized and comprehensive framework such as the MiCA proposal, that can bring regulatory clearness and limitations for industry players so that you can operate their companies securely over the various EU states.

Do you consider European policymakers have had the ability to make use of this chance to construct a good regulatory framework for digital assets that promotes responsible innovation and keeps bad actors away? Or do you consider that new way of transactions will emerge to hamper the traceability of crypto assets with zero threshold? Would you see an excuse for regulation to avoid losing greater than $1 trillion in worth of digital asset industry in recent days brought on by the announced chance of algorithmic stablecoins? Or would you think that market self-regulation is enough?

It is a fact that market adjustment is trembling up many scammers and fraudsters. But regrettably, it’s also hurting countless small investors as well as their families. No matter positioning, being an industry, the crypto sector must be conscious of accountability to users, who are able to vary from sophisticated investors and technologists to individuals who know little about complex financial instruments.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Tatiana Revoredo is really a founding person in the Oxford Blockchain Foundation and it is a strategist in blockchain at Saïd Business School in the College of Oxford. Furthermore, she is experienced in blockchain business applications in the Massachusetts Institute of Technology and it is the main strategy officer from the Global Strategy. Tatiana continues to be asked through the European Parliament towards the Intercontinental Blockchain Conference and it was asked through the Brazilian parliament towards the public hearing on Bill 2303/2015. She’s the writer of two books: Blockchain: Tudo O Que Você Precisa Saber and Cryptocurrencies within the Worldwide Scenario: What’s the Position of Central Banks, Governments and Government bodies About Cryptocurrencies?