Disclaimer: This information has been upgraded to mirror Nexo’s response proclaiming that the fund transfer represents an operational transfer, relating to the move of funds in one Nexo address to a different.

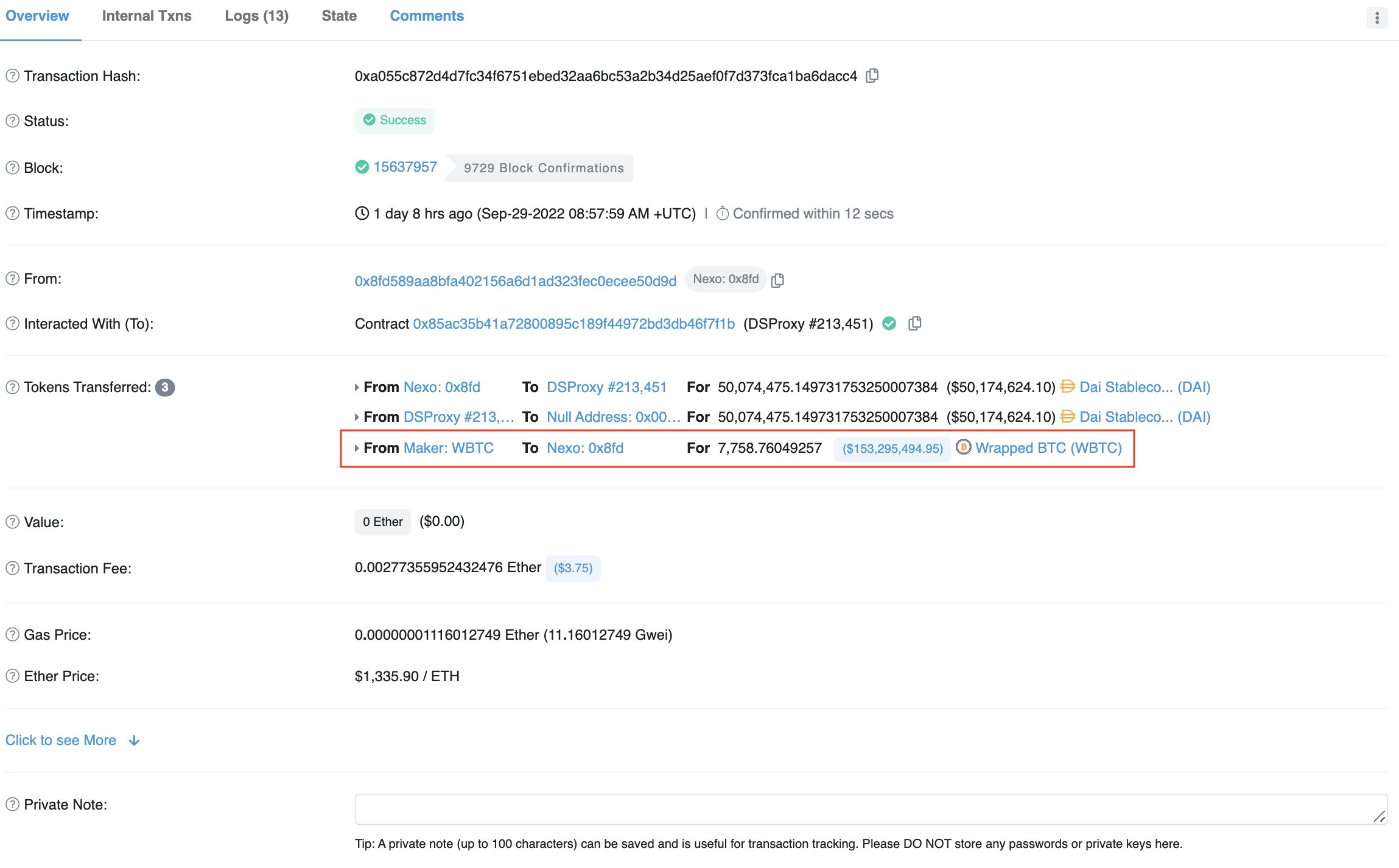

Only a couple of days after market analysts predicted a 50% stop by NEXO cost because of regulatory pressure and investor concerns, a crypto wallet address called NEXO 0x8fd withdrew 7,758.8 Wrapped Bitcoin (WBTC) — roughly worth $153M — from MakerDAO.

On Sept. 26, regulators from eight U.S. states filed a cease-and-desist order against Nexo underneath the allegations of offering unregistered securities to investors unexpectedly. Furthermore, Kentucky regulators accused Nexo of insolvency because of liabilities exceeding assets when excluding Nexo.

Following suit, on Sept. 30, blockchain investigator Peckshield alerted the change in 7,758.8 WBTC from MakerDAO. Among the primary reasons the crypto community made a decision to link the funds’ withdrawal with Nexo’s insolvency rumors is the specific wallet — Nexo: 0x8fd.

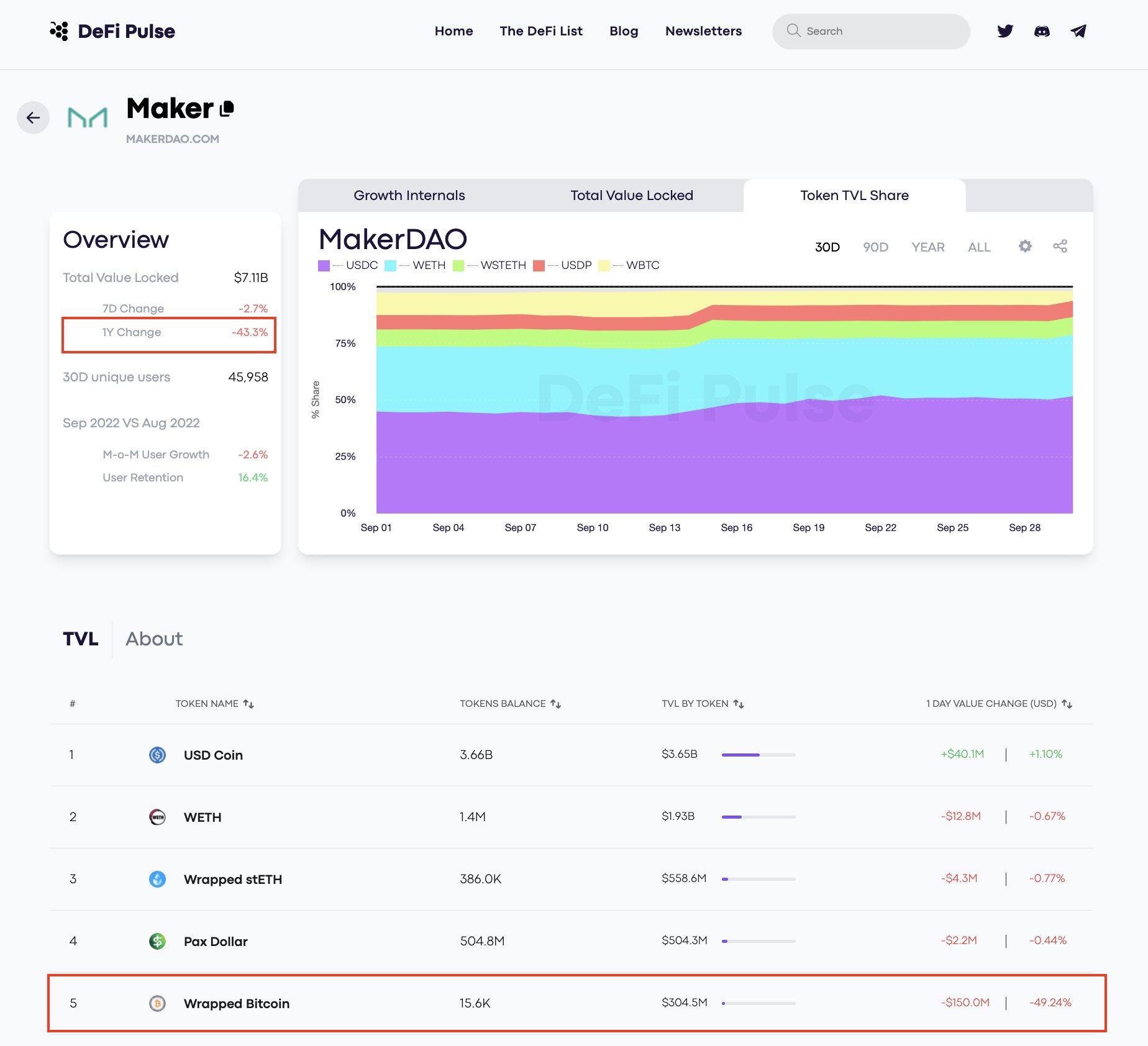

As proven above, the entire value locked (TVL) on MakerDAO has endured a decline of 43.3% in the last year, which presently is $7.11 billion.

Transaction details show the change in DAI tokens worth $50.a million from Nexo: 0x8fd to some null address (possibly a burn address) via DSProxy. As highlighted within the above screenshot, the transaction hash also confirms the change in $153.two million in WBTC.

Wish I’d seen celsius moving funds before freezing my account … help make your own mind up what this signifies https://t.co/JuQ2fXJIuS

— cryptochicca.eth (@CryptoChicca) September 30, 2022

As the crypto community suspects wrongdoing, Nexo spokesperson told Cointelegraph the funds stay in the openly tagged Nexo wallet, adding that:

This routine transaction made yesterday represents financing repayment using the latest market dynamics and as reported by the company’s standard treasury management.

Cointelegraph seemed to be informed the reported transaction was driven by Nexo’s operational needs at that time. “Consequently, and again driven through the market context, we predict the borrowed funds size at Maker to carry on to fluctuate in correlation with market volatility,” concluded the Nexo spokesperson.

Related: Nexo ‘surprised’ by condition regulators’ actions, states co-founder

Regardless of the ongoing FUD, Nexo is constantly on the broaden its business. Most lately, on Sept. 27, Nexo obtained a stake in Hulett Bancorp, a holding company that owns a federally chartered Summit National Bank.

The purchase enables Nexo and it is people to open accounts with Summit National Bank. Additionally, Nexo’s retail and institutional clients resides in the united states will obtain access to asset-back loans, card products, and escrow and custodial solutions offered through Summit.