Without fail, crypto has a means of humbling the most self-assured which marketplace is certainly not for that average person. Nonfungible token (NFT) investors have joined what seems to become a bear market and also the recent chaos can also be impacting community morale.

The loss of NFT prices happened because the U . s . States Fed elevated rates of interest, Terra’s LUNA and UST-based platforms collapsed and traders found terms with the matter that the whole sector might be inside a bear market.

Things aren’t badly because they were in 2018, however the NFT market isn’t as seasoned. Regardless of this, investors happen to be strapping up for potential future profits and the ways to survive the present market downturn.

Will blue-nick tier NFTs contain the line?

Every week, most blue-nick tier NFTs maintained their position within the top ten as a whole product sales despite some floor prices shedding nearly 25% within the last 7 days.

Particularly, Yuga Labs’ Otherdeed NFTs, Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) have seen home loan business their floor cost. BAYC has since retrieved from the dip in floor cost following the Otherdeed launch and it has seen a small 3% decrease within the last 7 days. MAYC has witnessed nearly a 13% reduction in floor cost within the last 7 days.

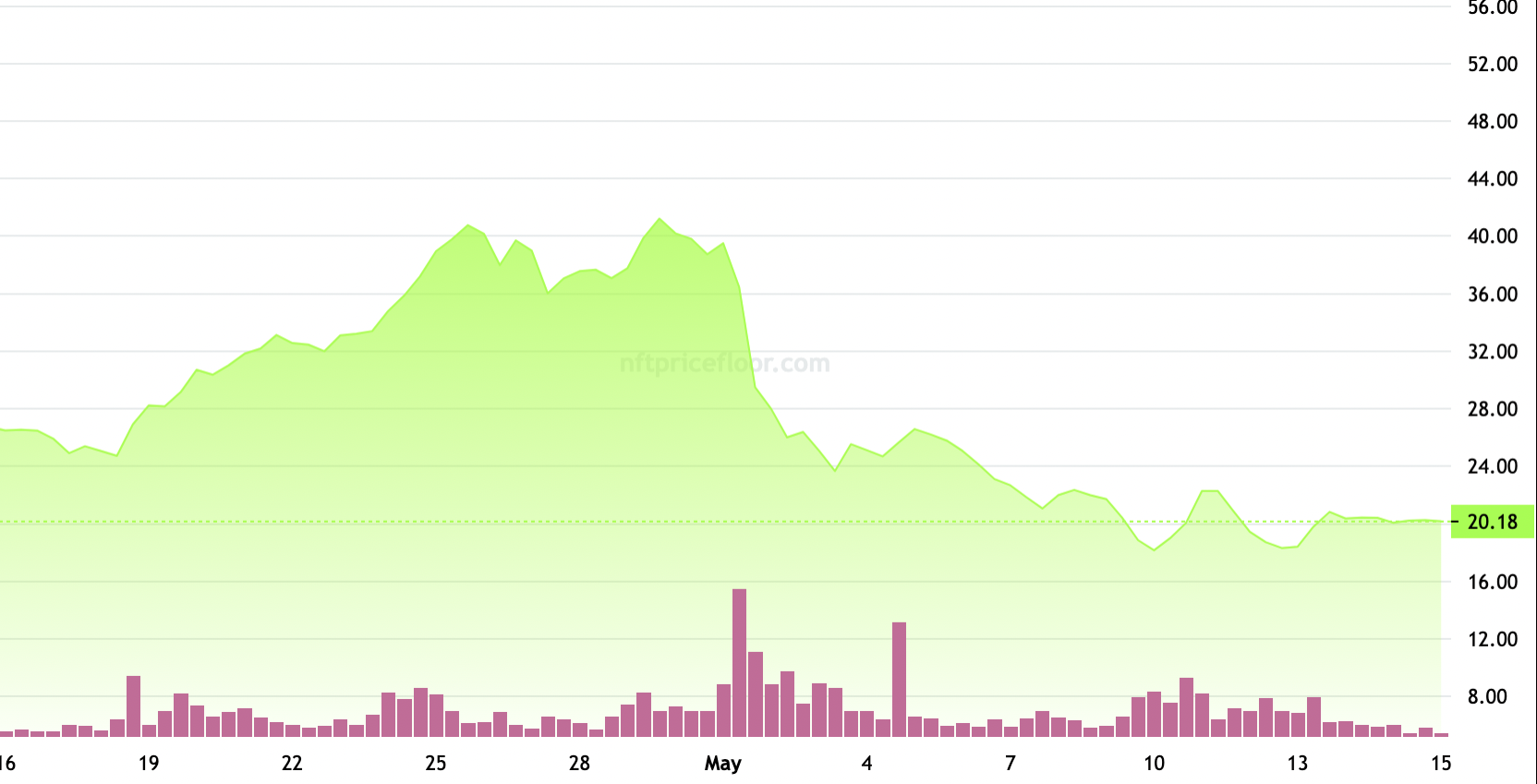

MAYC continues to be on a significant ride, falling drastically from the peak at 41.2 Ether (ETH) to $120,386 at that time. Presently, MAYC is worth 19.6 Ether, approximately 53% discount since MAYC’s pump was largely because of their eligibility to assert Yuga Labs’ Otherside’s Otherdeed NFT.

Despite all the uproar and debate all around the Otherdeed NFT drop, the work remains towards the top of the charts as a whole volume despite a 75% drop during the last 7 days.

The functionality of those digital lands continues to be unclear and Otherdeed has witnessed its floor cost inside a consistent downward trend. Within the last 7 days, the ground cost decreased by 1.2%, and also, since minting, the cost has dropped 55% from the all-time high at 7.4 Ether.

RTFKT studio’s CloneX floor cost has dropped nearly 13% within the last 7 days with volume decreasing slightly over 12%. However, these figures don’t phase the city.

Regardless of the recent dip, the RTFKT ecosystem is buzzing after celebrating the outlet of Japanese contemporary artist Takashi Murakami’s An Arrow through History in New You are able to City. The exhibit is presently within the Gagosian Gallery, featuring CloneX-inspired pieces together with pieces from Murakami’s first NFT collection, Murakami Flowers.

Despite the NFT market cooling, the prices appears just like a blowout purchase with a investors searching to take advantage of news. Because it would come out, announced blue-nick Azuki NFT required the greatest plunge considering certainly one of its founders, Zagabond, freely acknowledging for their tumultuous past plagued with rugging the CryptoPhunks and Tendies community.

I fucked up.

Following the spaces today, I recognized my shortcomings in the way i handled the last projects that we began. Towards the communities I walked from, to Azuki holders, and also to individuals who supported me — I’m truly sorry.

1/x

— ZAGABOND.ETH (@ZAGABOND) May 11, 2022

NFT investors purchase the rumors and also the news

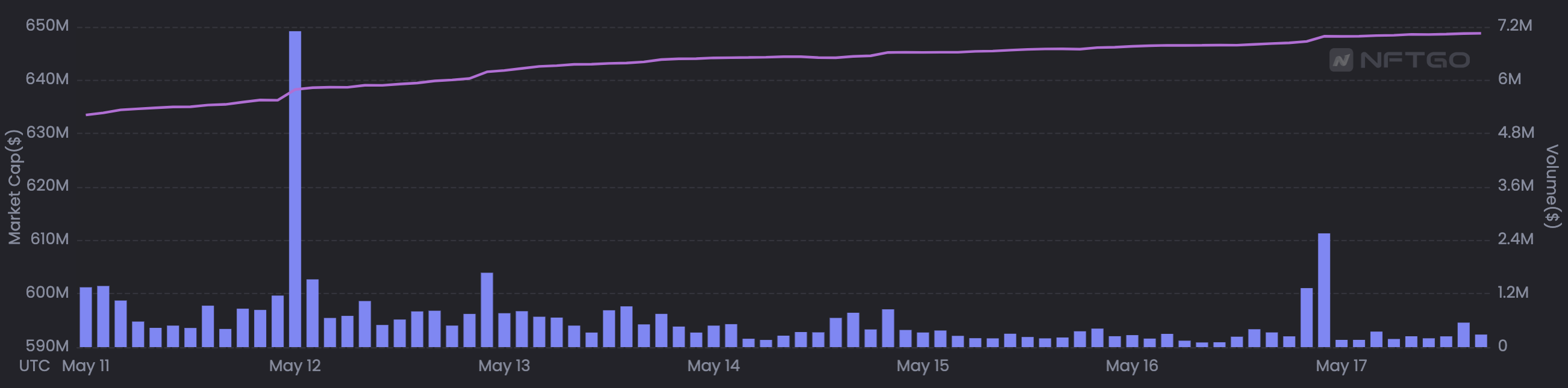

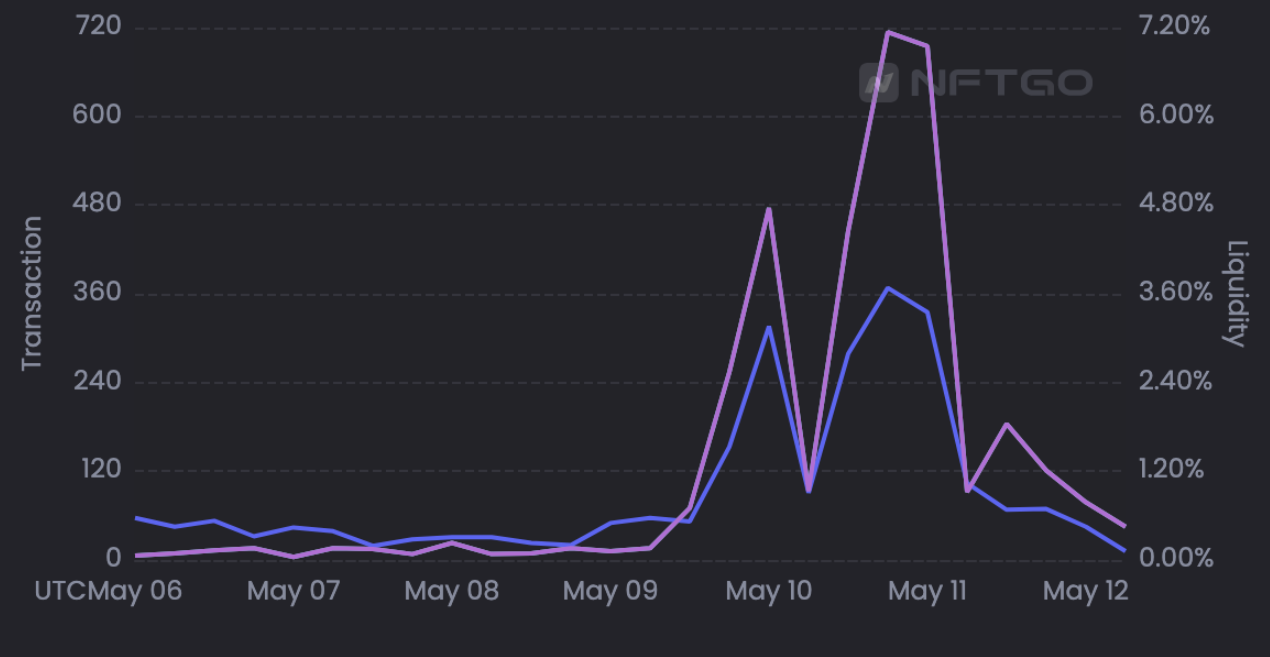

Because the famous adage goes, traders “buy the rumor, sell this news,” so that they can increase sales. Considering Zagabond’s admission, holders made the decision to election using their assets and Azuki’s floor cost dipped by 74%.

Despite this volatility, Azuki presently ranks towards the top of the charts for total product sales on OpenSea.

NFTs continue to be considered nature West, however, many investors are learning that everyone’s barometer for morals and ethics is slightly different. Following the news sank in, Azuki’s floor cost dropped precipitously but certain NFT influencers were quick to jump in and sweep the floors for potential future possibilities.

Since May 10, the Azuki floor cost has continuously seen a rise above 10 Ether, a remarkable 200% rise in total product sales that happened after fresh news circulated.

Azuki’s partner collection, BEANZ, had also taken an 83% decrease in its floor cost. Despite the 248% boost in volume, BEANZ’ total product sales has decreased by 64% within the last week.

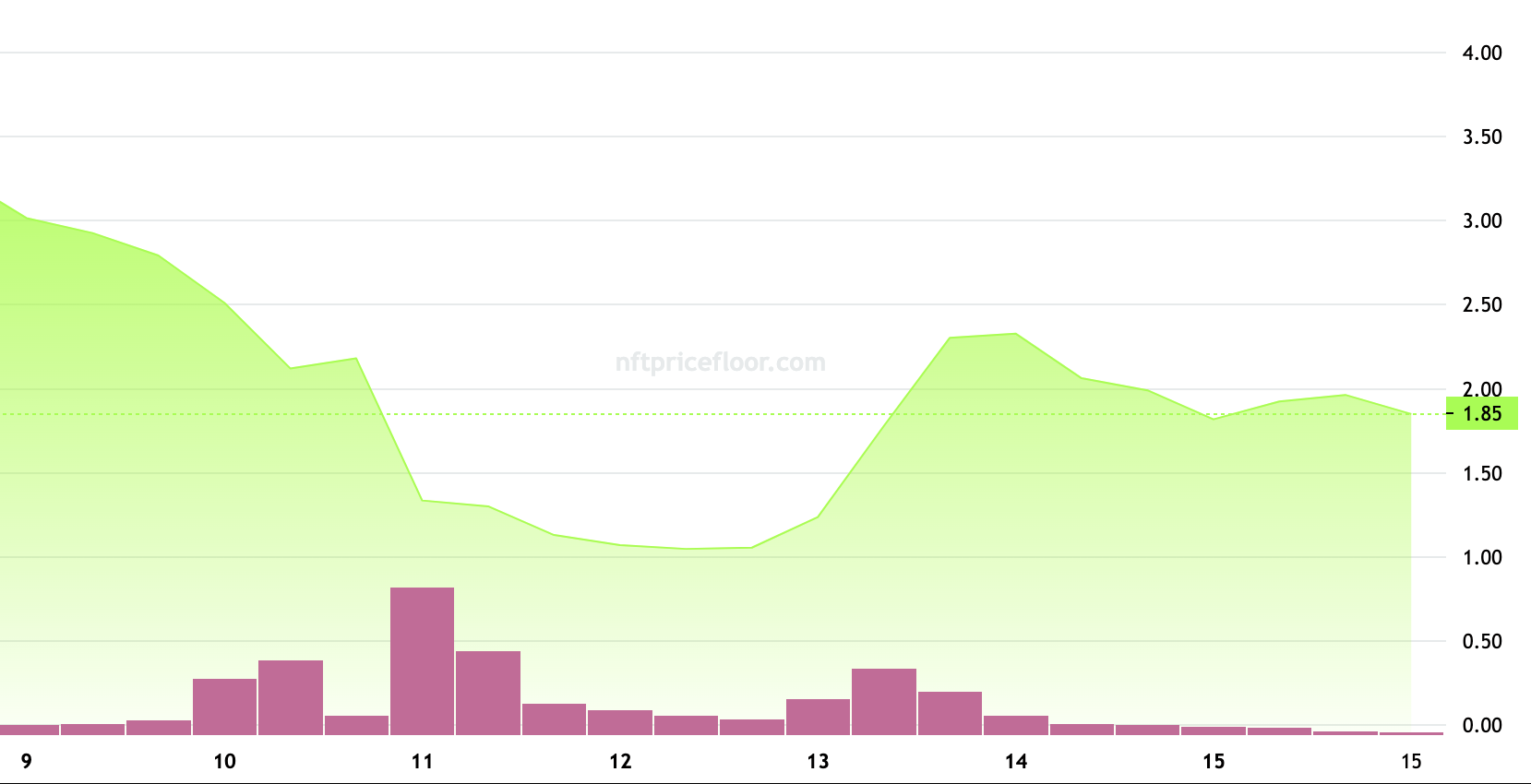

Pre-reveal, BEANZ traded at 6.8 Ether which cost continuously descended publish show their current prices at 1.65 Ether.

Other anticipated anime-inspired drops have surfaced for example PXN: Ghost division NFT, which slid into the top charts on OpenSea for volume. Ragnarok Meta also surged for any brief moment in the pre-reveal stage, but rumors that Zagabond was behind the work seem to be weighing on cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.