Axie Infinity would be a pioneer from the play-to-earn movement and also the project inspired new Web3 applications that desire to use the earning model for their particular environments.

The most recent project to participate the move-to-earn movement is STEPN, a Solana-based Web3 application where proprietors from the nonfungible token (NFT) athletic shoes earn because they walk.

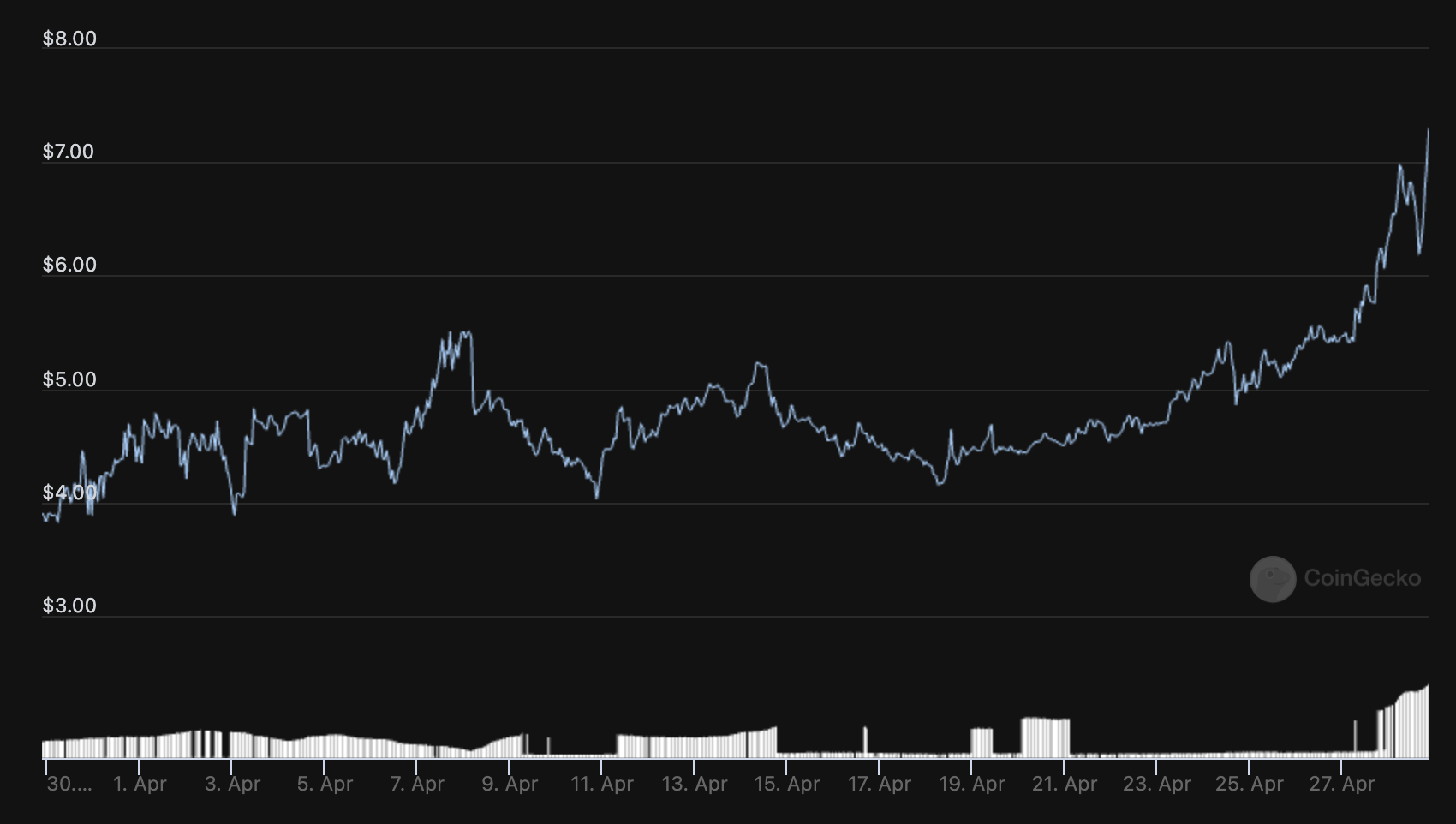

STEPN has programmed a couple of factors that determine simply how much an individual can make using its athletic shoes and also the Eco-friendly Satoshi Token (GST) is STEPN’s in-game token that presently trades for $7.30. During the last thirty days, the token has surged over 77%, but could it be sustainable?

What’s interesting concerning the move-to-earn phenomenon is the fact that it’s basically a kind of P2E because it gamified fitness via a digital asset, the sneaker. It doesn’t matter how one slices it, NFT holders must participate in the applying mechanics to get the reward.

While STEPN may be accumulating some serious profits for investors now, we already have an increasing number of competitors emerging, and new earning models could soon allow it to be simply a passing fad. Play-to-earn was extremely popular in 2021, however that movement is really a mere shadow of their former self. This will lead investors to question the sustainability from the move-to-earn trend.

Move-to-earn DApps go parabolic

Incentivizing behavior isn’t a novel concept, mainly in the physical fitness space. Actually, SweatCoin, a task founded in 2018, was among the first applications that will pay its users digital currency to workout.

There are more crypto fitness applications for example Dotmoovs, Calo and Step, each using their particular in-application reward tokens. Which means that STEPN isn’t pioneering the movement, but it may be revitalizing it.

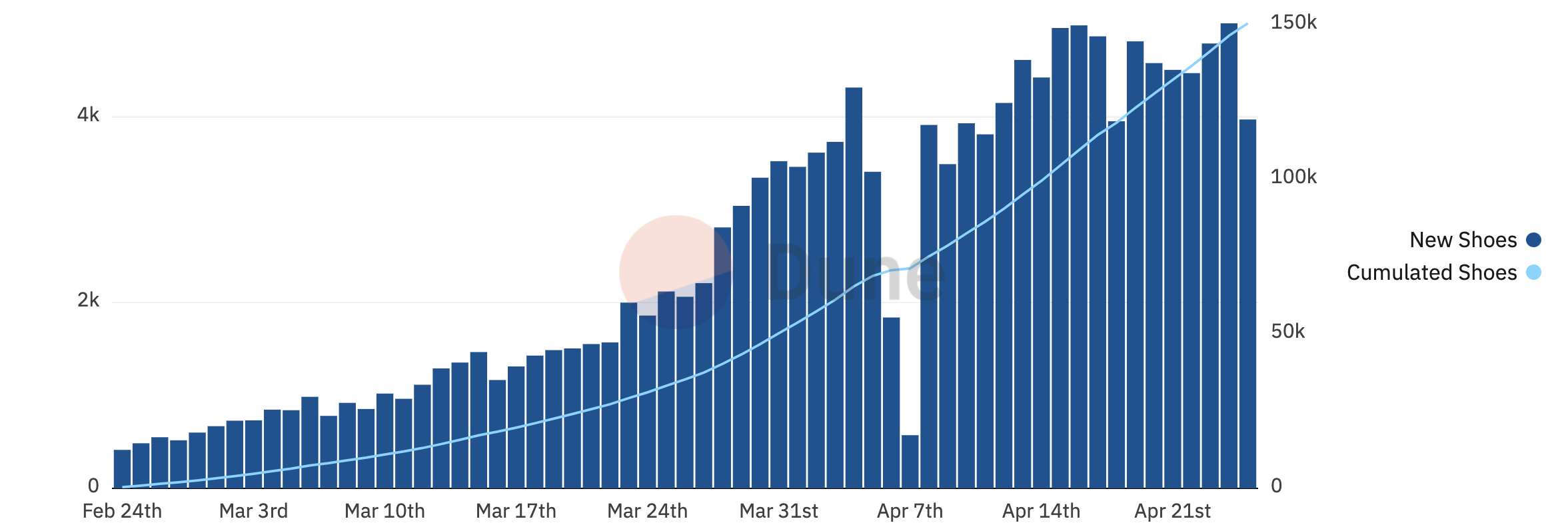

The work is presently in beta, with new users requiring a code to sign up. In branding and packaging move-to-earn, STEPN acquired recognition among crypto and NFT pundits coupled with a parabolic spike in upward growth. Cumulatively, STEPN has accumulated over 200,000 users over its lifetime with consistent volume. Within the last 7 days, over 32,800 new athletic shoes happen to be minted.

Typically, a STEPN sneaker can earn a person as much as $20 each day, while reasonably limited tier sneaker could make users 100’s of dollars in the current cost of GST.

Much like Axie Infinity, users must first place in initial capital investment to start earning rewards. There have been 99,999 NFT athletic shoes readily available for mint, but simply like Axie Infinity, users can breed their athletic shoes during sneaker minting occasions (SME).

Presently on Magic Eden, another marketplace, the least expensive STEPN sneaker is on purchase for 16.56 Solana (SOL), or $1,628 during the time of writing, and also the most costly is 300 SOL, or $29,493 during the time of writing.

There’s a variety of sneaker types, together with tiers of attributes and levels a sneaker acquires that impact just how much it may yield.

The sturdiness of cellular signals and the effectiveness of a user’s gps (Gps navigation) play an important role in earning. If either Gps navigation or signal is choppy, there’s no be certain that information is being recorded, and STEPN depends on understanding the distance an individual has covered to earn rewards.

2/n Presently to earn tokens (GST) in #STEPN, the walking / running requirement is very low. I earned ~USD40 with ten mins of walk daily so it’s pretty chill. The only real factor is, you have to go outside where the Gps navigation signal is powerful. That’s the way the steps are calculated for GST

— Smallveggie TMA (@small_veggie) April 17, 2022

STEPN is presently in beta with new users requiring a code to sign up. By branding and packaging move-to-earn, it’s acquired recognition among crypto and NFT pundits coupled with an increase in upward growth.

Cumulatively, STEPN has accumulated over 223,500 users, also it presently dominates the move-to-earn landscape as a whole market capital. Its governance token, Eco-friendly Metaverse Token (GMT), has ended 20x those of other movement economy tokens combined, which makes it an appealing bet.

Web3 applications lace up for that race

STEPN isn’t alone within the move-to-earn race. Lately Step Application, a decentralized application (DApp) on Avalanche blockchain, become a rival planning to take advantage of the $100 billion fitness industry.

Step Application has multiple token emissions with FITFI, a governance token, and KCAL, the in-game token being earned. However, the danger in token emission of any sort is it turns into a vacuum for value extraction. To mitigate the potential of inflation, Step Application will integrate token sinks into its tokenomics, and burning mechanisms will indefinitely remove tokens from circulation.

Unlike STEPN and Sweat Gold coin, Step Application will develop a software development package that gives others with tools to construct within its metaverse. In this manner, it’s more Web3 native and may potentially mitigate bottlenecks that hamper the product’s overall scalability.

✨Step Application Memorandum is Live

The Step Protocol SDK may be the first step toward the #FitFi economy.FitFi is in the centre from the $100B fitness and also the $200B gaming markets. Developers, projects, and Fortune 500 corporations will join FitFi, because they did with #GameFi.

pic.twitter.com/afSqNz2HRI— Step.Application (@StepApp_) April 23, 2022

It’s still uncertain how these move-to-earn applications will combat saturation and just how well their token mechanics can sustain a proper cost point once these applications are servicing countless users. In addition, there’s the chance of a possible drop-off in active users since maintaining exercise regimes is more powerful from habit-building and intrinsic motivations instead of exterior rewards.

Since many of these move-to-earn applications require capital upfront, users should stay conscious of the cost action, volatility, growth and saturation from the movement economy and also the amounts of activity needed to interrupt even or profit.

Turning exercise into profit turn into more and more difficult when the move-to-earn ecosystem develops and gains more recognition. Since more users are searching to show their exercise to cash, this impacts the token cost and may boost the cost of entry. As a result, these applications will work to tackle the manipulation of fraudulent inputs of exercise being an exploit for maximal earnings.

Theoretically, move-to-earn applications are very well intended in centering overall health. However, the prosperity of these models comes from incentivizing and, essentially, trying to influence behavior to create habits.

Research has shown that routine is sustained more readily through intrinsic personal motivations (that are difficult to evaluate) instead of exterior rewards. Therefore, you will find fundamental things to consider when purchasing the move-to-earn movement for that lengthy term.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.