With regards to cryptocurrencies, you have to think about a couple of important aspects prior to deciding whether or not to invest. Whether you are just starting to get on the floor floor of recent crypto projects or are searching to grow your portfolio, it’s useful with an evaluation framework handy for crypto projects.

This information will explain one step-by-step framework to help you in evaluating various crypto projects.

How can you evaluate a crypto project?

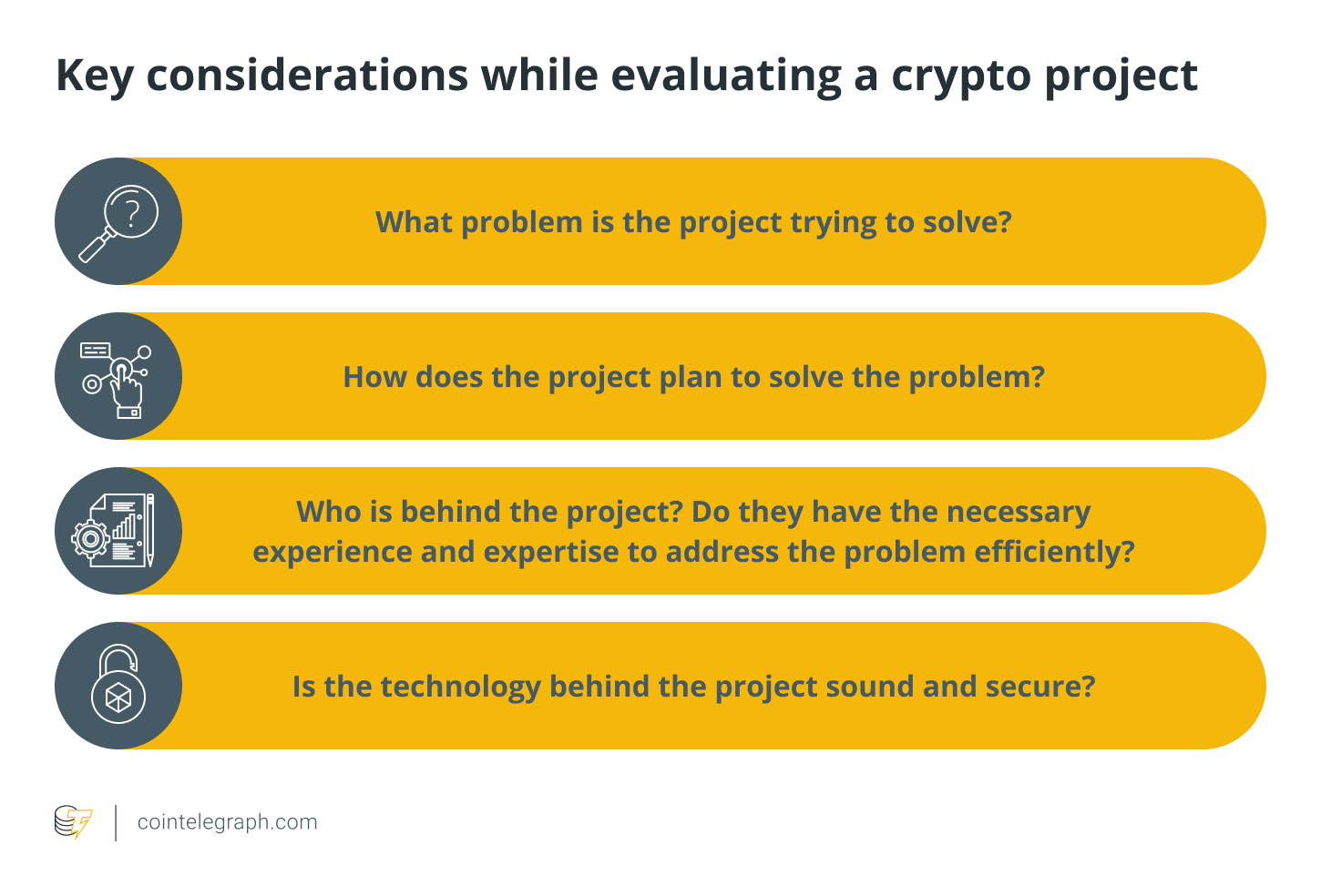

On your analysis of the crypto project, you need to check out the different factors from the project to create an educated financial commitment. You need to generally veer from making impulsive decisions according to feelings, because this can lead to financial loss.

Mull next aspects rather:

These a few of the questions you have to ask on your cryptocurrency evaluation. We’ll go through them in depth throughout this informative guide, which provides you with a framework for evaluating crypto projects.

Through the finish, you ought to have an excellent feeling of things to look for — and the way to make an educated financial commitment. Keep in mind that there’s lots of speculation within the crypto world. So, seek information before beginning investing.

How do you research a brand new crypto project?

There are a handful of platforms to help you find high-quality crypto projects to purchase, for example Binance Launchpad, OK Jumpstart and Gate.io Startup. All of these are initial exchange offering (IEO) platforms, which offer their users with possibilities to purchase startup blockchain projects.

There’s also initial gold coin choices (ICOs), that are fundraiser mechanisms for crypto projects. However, it’s worth noting that ICOs are usually considered riskier than IEOs. It is because ICOs are located on the cryptocurrency project’s website, which makes them a far more fertile ground for fraudsters and scammers.

IEOs, however, are launched on exchange platforms such as the ones we pointed out formerly. They can be safer since most startups that submit their projects to those platforms undergo a vetting process prior to being permitted to produce their token sales.

However, even if dealing with an IEO platform, you need to still conduct independent research. Doing this will help you see whether a task may be the right investment chance for you personally and when it is something you are able to purchase lengthy-term.

How you can evaluate a blockchain project?

Generally, here’s what you need to consider when searching in the primary facets of a crypto project:

The vision from the project

When looking for a crypto project, it’s important to make sure that it features a strong and achievable vision. In crypto, there’s this type of factor as “vaporware,” which frequently describes projects with the features — but they are unlikely to obtain off the floor. When looking for a crypto project, be skeptical of individuals that appear too awesome and promise an excessive amount of without getting a good plan or foundation to support it.

Visionaries in the market develop many groundbreaking project ideas, only a couple of are ever achievable or practical enough to become implemented.

Background team

Another key factor to think about may be the team behind the work. This will be significant because, in the finish during the day, it is the people focusing on a task that can make it effective (or otherwise). When searching in the team, consider such things as:

- They members’ experience

- Their background and degree of knowledge of the crypto space and

- How cohesive they is.

The above mentioned factors provides you with some understanding of whether a group is powerful and sure to create their project effective.

Excellence of the white-colored paper

The white-colored paper is really a document that typically outlines all you need to know of the project, such as the vision, the issue it promises to solve, the answer, the tokenomics and much more.

Related: What’s Tokenomics? A beginner’s guide on demand and supply of cryptocurrencies

A great white-colored paper is going to be well-written and clear to see without having to be too technical. It ought to be obvious concerning the problem the work aims to resolve and just how the answer works.

If your white-colored paper is vague or uses a lot of obscure terms you do not understand, it might not be worth your time and effort (and cash) to purchase that project. Should you not have time or persistence to undergo multiple white-colored papers, you may also browse the projects’ litepapers. They are abridged versions of white-colored papers but they are just like informative.

Potential market and employ cases

When thinking about a task, you’ll want to think about the potential market and whether there’s an excuse for the answer the work is providing. For instance, if your project is attempting to resolve an issue that does not exist or was already solved by another project, then it is unlikely the work creates a dent within the crypto space.

You’ll want to consider the possibility use cases for any project. For instance, if your project is attempting to resolve an issue that concerns merely a small group, then the marketplace for that project can be really limited.

Tokenomics

Tokenomics refers back to the economic type of the work and just how the token is going to be used inside the ecosystem. For instance, if your token is just getting used as a way of payment, then it’s value will probably fluctuate combined with the market.

However, when the token has been accustomed to power a decentralized application (DApp), then your tokenomics could be more complex, and it is value could be more stable. You need to comprehend the tokenomics of the project before investing, as it can certainly provide you with some understanding of the possibility worth of the token.

Possibility of growth

Growth potential refers back to the probability of the work growing in value with time. For instance, if your project includes a strong team, a great roadmap along with a solid tokenomics model, then the chances are the work will grow in value with time. Researching a task completely before investing is essential, as numerous factors can impact its growth potential.

The merchandise

The merchandise refers back to the actual solution the work is providing. Again, you need to make sure the method is really needed which solves a genuine problem. Take Ethereum (ETH), for instance, that was built in line with the requirement for a platform that could support smart contracts and expand the abilities of blockchain technology.

Solana (SOL), however, is really a blockchain that utilizes proof-of-history, a distinctive consensus mechanism. Built around the premise that the “internal clock” can greatly benefit transaction speed, Solana been successful in succeeding as among the best blockchains with regards to transactions per second.

Community traction

Community traction refers back to the degree of interest and engagement the work has produced in the community. A great way to gauge community traction is as simple as searching at the amount of social networking supporters, blog subscribers and forum posts. The greater active the city, the much more likely the work is going to be effective.

You’ll want to consider the caliber of the city, instead of only the quantity. For instance, a task with a lot of social networking supporters but very couple of active users is probably less strong like a project having a smaller sized quantity of social networking supporters but an energetic users list.

Market capital

Market capital may be the total value of all of the tokens which have been found. It’s a great way to gauge the general size a task. Within the situation of crypto that is not found, the marketplace cap may also make reference to the entire worth of a company’s shares. It’s a great indicator of asset stability, considering that crypto could be volatile. Generally, cryptos with bigger market caps tend to be stable than individuals with smaller sized market caps.

The woking platform

A project’s platform refers back to the underlying technology the work is made on. For instance, Ethereum is made around the Ethereum blockchain, while BNB is made around the BNB Smart Chain (BSC). Each platform features its own pros and cons, and you need to research a task completely before investing. For instance, Ethereum is easily the most popular platform for building DApps, while BSC is made to offer high end and occasional charges.

Transparency

Transparency refers back to the degree of information which they provides to the community. A transparent team will regularly talk to its community and supply updates around the project’s progress.

A non-transparent team, however, is going to be secretive and withhold information from the community. You need to purchase projects which are transparent, as it is a good sign the team is positive about the work and prepared to most probably about its progress. Furthermore, it’ll help you stay protected from various scams like rug pulls.

Related: Crypto rug pulls: Exactly what is a rug get crypto and 6 methods to place it

The roadmap

The roadmap should outline a project’s strategic business plan and provide you with some understanding of the way the team intends to execute its vision. A great roadmap is going to be well-thought-out and realistic, with obvious milestones the team intends to achieve. It ought to be updated regularly to mirror its current status. If your roadmap is outdated or impractical, then the chances are the work will not be effective.