So known as “no-loss lottery” DeFi platform PoolTogether has elevated 470.90 Ether (ETH) via NFT sales to finance its legal defense against a putative class action lawsuit suit.

Which means PoolTogether is much more than midway to the goal to raise a minimum of 769 ETH worth roughly $1.5 million to battle what it really calls a suit which has “no merit”. The woking platform has another a 3 week period to visit prior to the NFT funding campaign ends. It noted on its NFT minting page that:

“PoolTogether Corporation. is really a defendant inside a putative class action lawsuit suit. An individual deposited the same worth of $12.00 in to the protocol and it is now suing PoolTogether Corporation. yet others for substantial damages.”

The category-action suit is brought through the former technology lead for Senator Elizabeth Warren’s 2020 presidential campaign, Frederick Kent, who after depositing roughly $12 price of stablecoins in to the protocol, required action from the project, its founder Leighton Cusack and many of their affiliated partners in The month of january

Based on an amended complaint from Feb, Kent alleges that PoolTogether is working an unlawful lottery in New You are able to, and argues the platform “may never provide a positive expected value” because of keeping around 50% of every weekly prize like a reserve.

Kent needs compensation worth double the need for funds he allocated to purchasing lottery tickets in PoolTogether, and double the amount reasonable quantity of attorney’s charges and charges of law suit.

PoolTogether states offer risk-free lotteries on stablecoin deposits within the platform by utilizing ticket-buyers’ and liquidity providers’ capital to create interest using DeFi lending protocols.

The champion from the lottery receives the lion’s share from the yield, while a number of runner-ups get a smaller sized share. Other participants get a 100 % refund. Based on PoolTogether’s website, it presently offers $80,436 price of weekly prizes across its V3 and V4 pools.

PoolTogether stated the “allegations lack merit however a thorough defense continues to be needed” and pointed for an article in the Wall Street Journal in The month of january proclaiming that the suit apparently seems “to be considered a deliberate effort to place a few of the DeFi community’s core doctrines towards the test.”

To date the city has proven strong support for that campaign with 2,416 NFTs being offered for as many as 470.90 ETH worth $911,959 during the time of writing. If all NFTs are offered, the woking platform may have elevated 1,076 ETH or $2.two million.

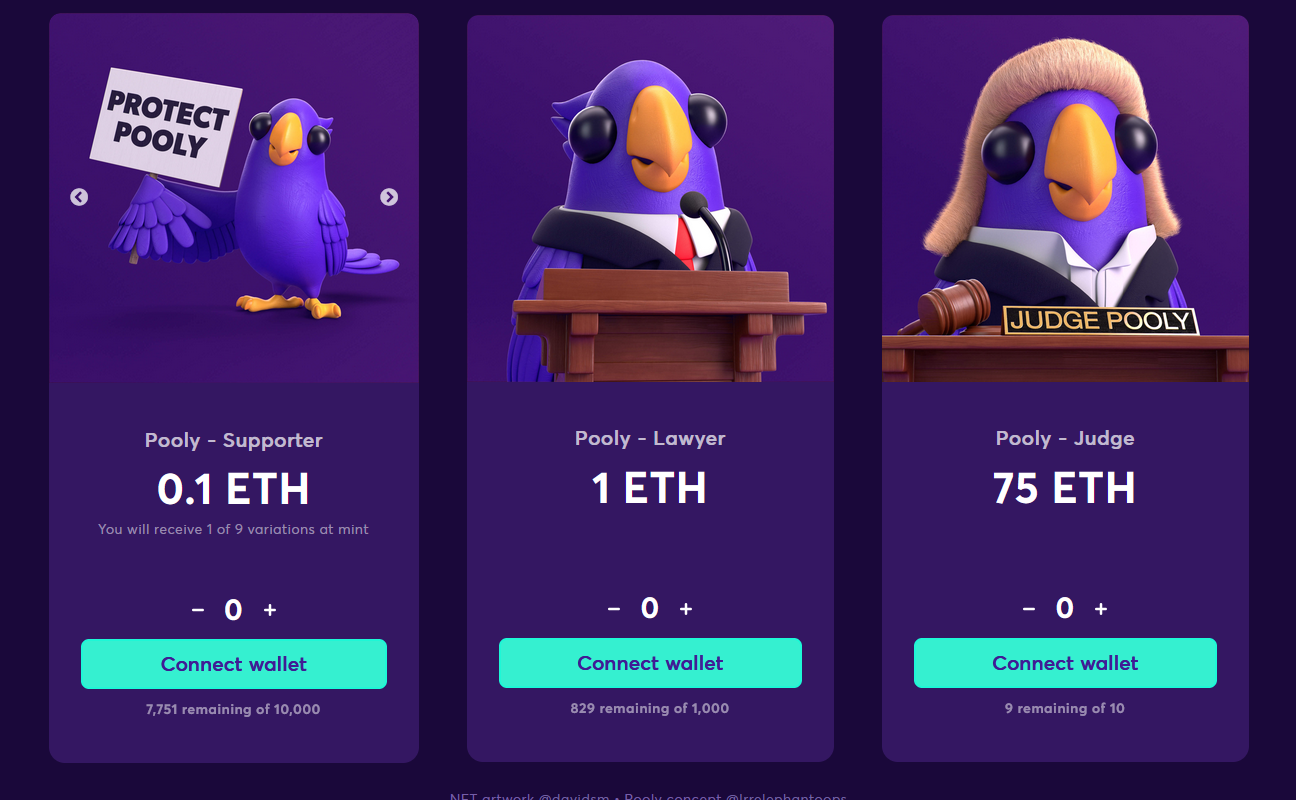

The NFTs illustrate an crimson animated avatar known as “Pooly” and are available in three kinds of rarity and prices, using the supporter tier composed of 10,000 NFTs opting for .1 ETH each, the attorney tier of 1000 NFTs for 1 ETH per token and also the judge tier of 10 NFTs as a whole opting for 75 ETH a pop.

Related: DeFi isn’t dead, it simply must fix these 3 critical problems

Prominent figures within the space for example general partner a16z Chris Dixon also have supported the reason by buying among the 75 ETH judge NFTs.

We simply purchased a 75 ETH Pooly Judge to aid. https://t.co/MCxTMIJUI7 https://t.co/IhrpOR2WXT

— cdixon.eth (@cdixon) May 27, 2022

Particularly, the complaintant also outlines a distaste for crypto in general, which might explain why the city has rallied behind PoolTogether. Kent is referred to as being “gravely concerned” the crypto sector is “accelerating global warming and allowing individuals to evade financial rules and scam consumers.”