The spectacular implosion from the Terra ecosystem in mid-May left the crypto industry damaged. Even though there were some brave critics who understood precisely how thin the razor’s edge was for TerraUSD (UST) — now TerraUSD Classic (USTC) — I believe it’s reliable advice that many people didn’t expect Terra to fail so quick, so dramatically and thus completely irrevocably.

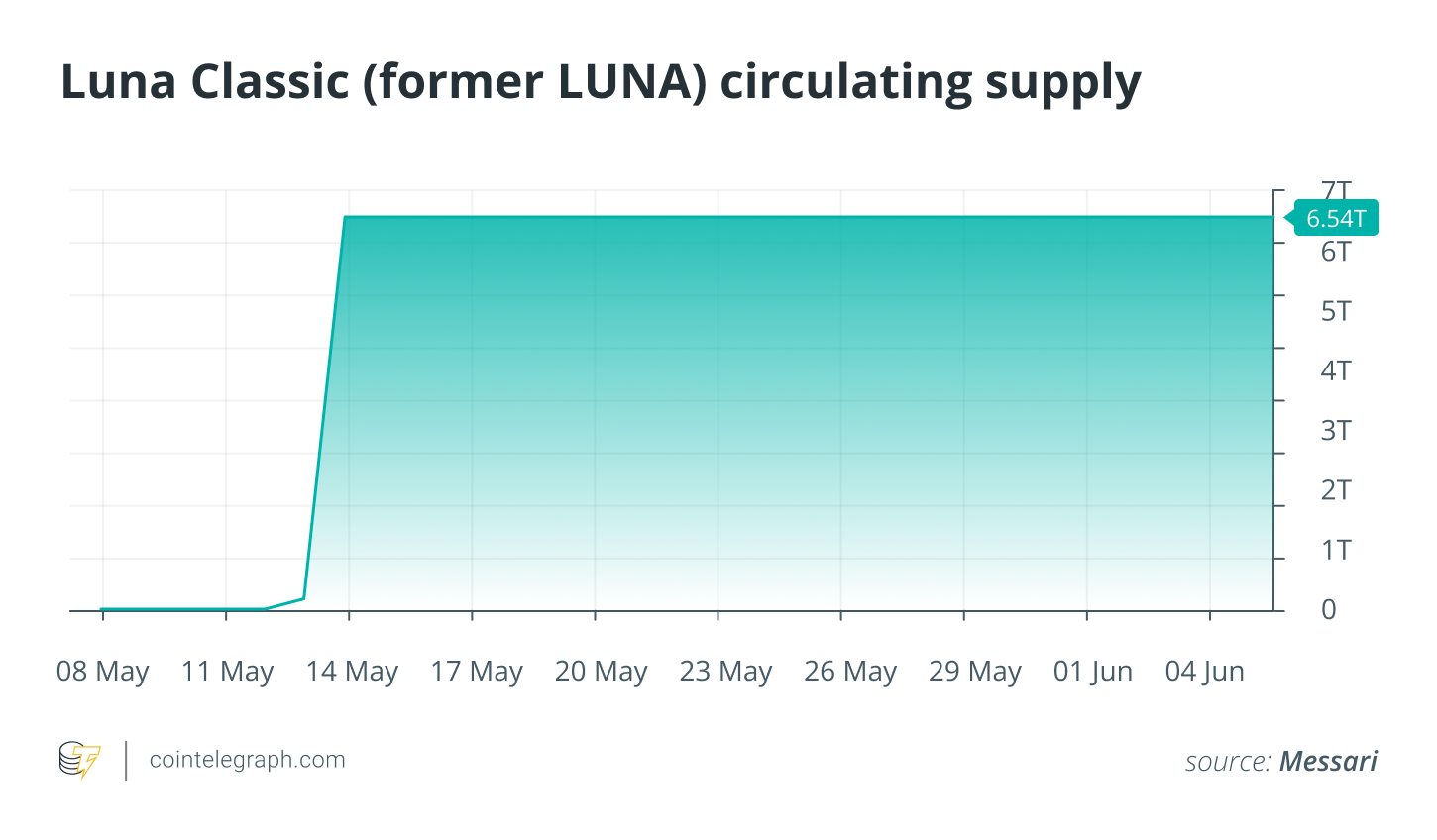

I’m penning this because the Terra community is voting on the intend to restart some type of Terra 2. — an agenda to salvage the layer-1 ecosystem with no UST stablecoin. That old Terra, how to be referred to as Terra Classic, is totally dead. An ill-fated make an effort to backstop UST holders printed trillions of LUNA tokens, destroying their value and eventually jeopardizing the security from the network itself.

The entire wipeout of $50 billion in value appears to possess made people decide for good that algorithmic stablecoins cannot work. However I think it’s important to possess a more nuanced knowledge of why the initial LUNA unsuccessful and just how others can study from its training.

Related: Terra 2.: A crypto project built around the ruins of $40 billion in investors’ money

Stablecoins: New reputation for a time-old concept

The word stablecoin mostly evokes U . s . States dollar-pegged currencies that try to conserve a $1 value. But it’s remember this that chiefly dependent on convenience. Exactly the same mechanisms underpinning today’s USD stablecoins may be used to create coins which are pegged towards the euro, gold, even Bitcoin (BTC), Nasdaq futures, or some specific stock, for example Tesla (TSLA).

It is also interesting to notice that stablecoins aren’t actually a brand new crypto idea. Today’s stablecoin designs are carefully associated with either how money works within defacto standard — e.g., Maker’s Dai is really a claim that they can a tough collateral much like early banknotes were states a gold vault — or they’re a replica of pegged currencies like the Hong Kong dollar.

The HKD is an extremely interesting example throughout this because it’s virtually your run-of-the-mill “algorithmic stablecoin.” It’s pegged towards the U.S. dollar, even when away from single:1 ratio, and also the HK central bank uses its vast reserves to help keep HKD’s cost inside a well-defined ratio by buying and selling it available on the market. The most recent audits put the Hong Kong reserves at $463 billion, that is six occasions the HKD in immediate circulation and nearly half of their M3, the largest meaning of “money” which includes not immediately liquid assets (like locked bank deposits).

The only real reason HKD is technically no algorithmic stablecoin is the fact that there’s a main bank performing market operations. In decentralized finance (DeFi), the central bank is substituted with an formula.

Related: UST aftermath: Can there be any future for algorithmic stablecoins?

Terra ain’t no HKD, though

Conflating Terra using the algorithmic stablecoin space, generally, does not understand why Terra collapsed as hard because it did. It’s vital that you realize precisely how fragile the Terra protocol design was. The bottom line is, UST was “collateralized” by LUNA, the gas token from the Terra blockchain. Concerning would be a fairly solid DeFi and nonfungible token ecosystem developed on Terra, the LUNA token had some natural value that helped raise the initial way to obtain UST.

How a mechanism labored was, in principle, much like HKD. If UST traded above $1, users could get some good LUNA and burn it because of its dollar value in UST. Crucially, the machine assumed that UST was worth $1, therefore the LUNA burner can simply sell the UST available on the market for, say, $1.01 making a profit. They are able to then recycle the earnings into LUNA, burn it again, and continue the cycle. Eventually, the peg could be restored.

If UST traded below $1, overturn mechanism helped backstop it. Arbitrageurs would purchase the cheap UST, redeem it for LUNA for a price of just one UST equaling $1, then sell individuals tokens available on the market in a profit.

This technique is excellent at maintaining your peg in normal conditions. One problem with Dai, for instance, is it can’t be directly arbitraged because of its underlying collateral. Arbitrageurs have to “hope” the peg stabilizes to create a profit, the primary reason Dai is really dependent on USD Gold coin (USDC) now.

But we should also mention the ultimate reflexivity in Terra’s design. Interest in UST which makes it exceed peg leads to interest in LUNA, and therefore, a rise in cost. The keystone of the mechanism was Anchor, the lending protocol on Terra that guaranteed a 20% APY to UST stakers.

Where did the 20% APY originate from? From extra UST minted through Terraform Labs’ LUNA reserves. A greater cost of LUNA resulted in they might mint more UST for Anchor yield, thus growing UST demand and growing LUNA’s cost — thus they could mint much more UST…

UST and LUNA were inside a cycle of reflexive demand that, you probably know this, had all of the aspects of a Ponzi. The worst factor was that there wasn’t any cap about how much UST might be minted as, say, a portion of LUNA market capital. It had been purely driven by reflexivity, which resulted in just before the disaster happened, $30 billion in LUNA’s market cap backed $20 billion in UST’s market cap.

As Kevin Zhou, founding father of Galois Capital along with a famous critic of LUNA and UST before it collapsed, described within an interview, each dollar put in an unpredictable asset raises its market cap by eight or even more occasions. Used, this resulted in UST was extremely undercollateralized.

According to his calculations, @Galois_Capital‘s Kevin Zhou believes that $4-$5B in liquidity leaves UST when the yields on Anchor are cut lower to 7-12%, that they estimates can lead to an 8x decompression from the LUNA cost. Exactly what do you consider his math? https://t.co/pnlLHHXtkM pic.twitter.com/oAhNCvTgim

— Laura Shin (@laurashin) April 8, 2022

Pricking the bubble

It’s hard to target the specific reason the collapse started if this did, because there were certainly multiple factors ongoing. For just one, Anchor reserves were visibly depleting, with only a few several weeks price of yield remaining, there was talk of lowering the yield. The marketplace seemed to be not doing too well, since many large funds started to anticipate some type of large crash and/or protracted bear market.

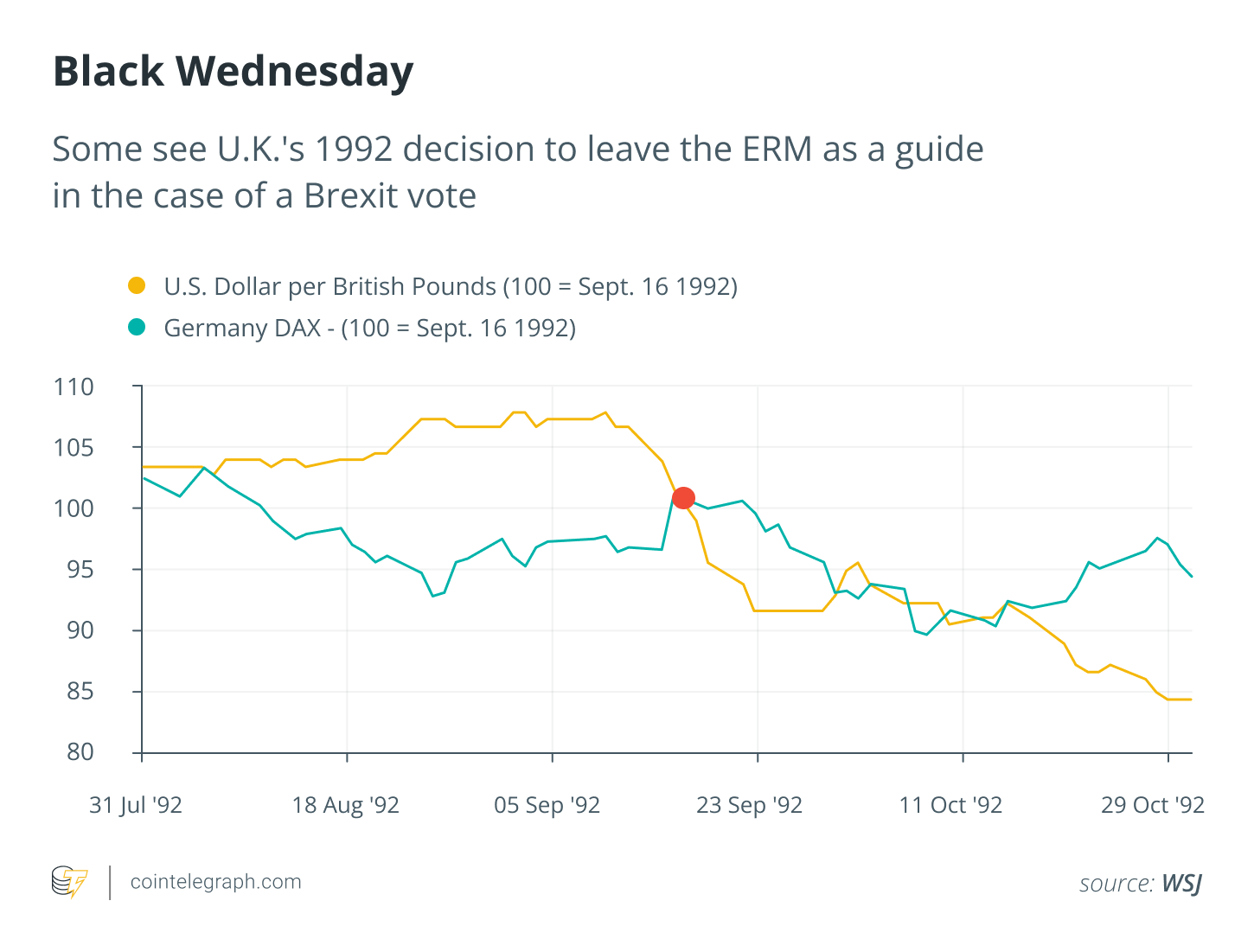

Some conspiracy theorists blame TradFi giants like Citadel, or perhaps the U.S. government, for “shorting” UST with billions and triggering the financial institution run. Be that as it might, this really is crypto: If it is and not the U.S. government, it’s likely to be some wealthy whale who would like to be referred to as second introduction of Soros (who famously shorted the British pound if this were built with a similar peg setup, referred to as Black Wednesday. Whilst not as dramatic as Terra, the pound did lose 20% in almost two several weeks).

Quite simply, in case your system can’t handle coordinated and well-funded attacks, it most likely wasn’t a great system, to start with.

Terraform Labs searched for to organize itself for that inevitable, collecting as many as nearly 80,000 BTC which were designed to backstop the peg. It had been worth about $2.4 billion at that time, not nearly enough to redeem all UST holders who desired to exit.

The very first depegging event between May 9 and 10 required UST to around $.64 before recovering. It had been bad, although not deadly at this time.

There’s an underappreciated reason UST never retrieved. The LUNA redemption mechanism I described earlier was limited to about $300 million each day, that was ironically completed to prevent a financial institution run for UST from destroying LUNA’s value. The issue was that LUNA collapsed anyway, rapidly going from $64 to simply about $30, which already shed $15 billion in market capital. The depeg event barely shed any UST supply, as increasing numbers of than 17 billion continued to be from a preliminary 18.5 billion.

With Do Kwon and TFL being silent for the following couple of hrs, the cost of LUNA ongoing its collapse with no significant redemption activity, likely to single-digit lows. It had been only here the management made the decision to in the redemption cap to $1.2 billion when LUNA’s market cap had already fallen to $2 billion. The remainder, as the saying goes, is history. This rushed decision sealed the fate from the Terra ecosystem, leading to hyperinflation along with a later halt from the Terra blockchain.

Related: Terra’s meltdown highlights advantages of CEX risk-management systems

It’s by pointing out collateral

Effective examples from TradFi like HKD ought to be an idea as to the happened here. Terra made an appearance to become overcollateralized, however it wasn’t. The actual collateralization before the disaster happened amounted to maybe $3.6 billion (the Bitcoin reserves plus Curve liquidity and a few days price of LUNA redemptions).

But 100% isn’t enough whenever your collateral is really as volatile like a cryptocurrency. A great collateral ratio might be between 400% and 800% — enough to take into account that valuation compression Zhou pointed out. And smart contracts should rigorously enforce this, prohibiting new coins from being minted when the collateralization isn’t ideal.

The reserve mechanism ought to be maximally algorithmic. So, within the situation of Terra, the Bitcoin should’ve been put into a computerized stabilization module rather of opaque market makers (though here, there just wasn’t lots of time to construct it).

With safe collateralization parameters, a little bit of diversification along with a real use situation for that asset, algorithmic stablecoins can survive.

It’s here we are at a brand new the perception of algorithmic stablecoins. A lot of things i suggested here’s within the Djed white-colored paper which was released last year to have an overcollateralized algorithmic stablecoin. Nothing has truly altered since that time — the Terra collapse was unfortunate but foreseeable, given precisely how undercollateralized it had been.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Shahaf Bar-Geffen continues to be the Chief executive officer of Coti in excess of 4 years. He seemed to be area of the Coti founding team. He is called the founding father of WEB3, a web-based marketing group, in addition to Positive Mobile, each of which were acquired. Shahaf studied information technology, biotechnology and financial aspects at Tel-Aviv College.