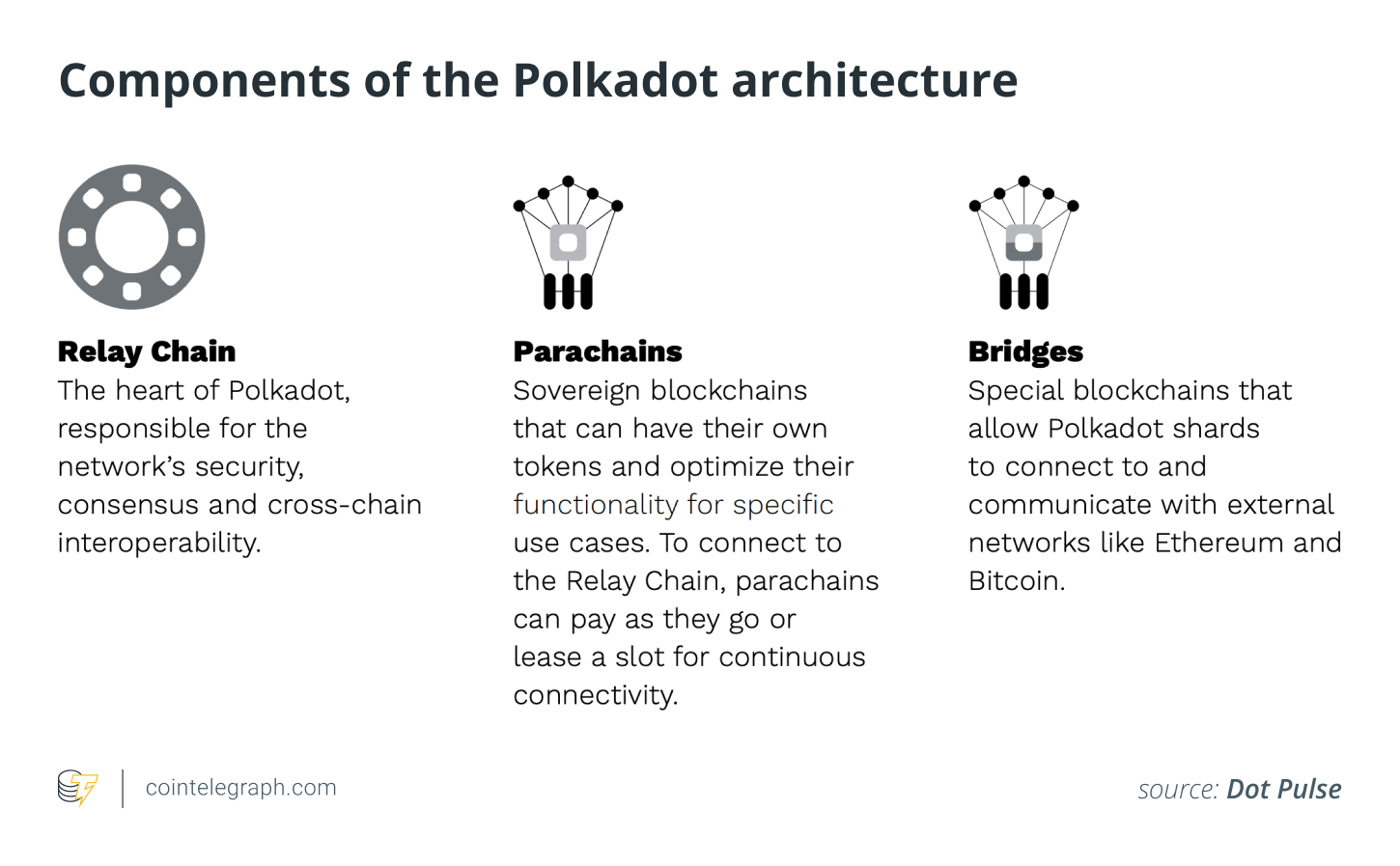

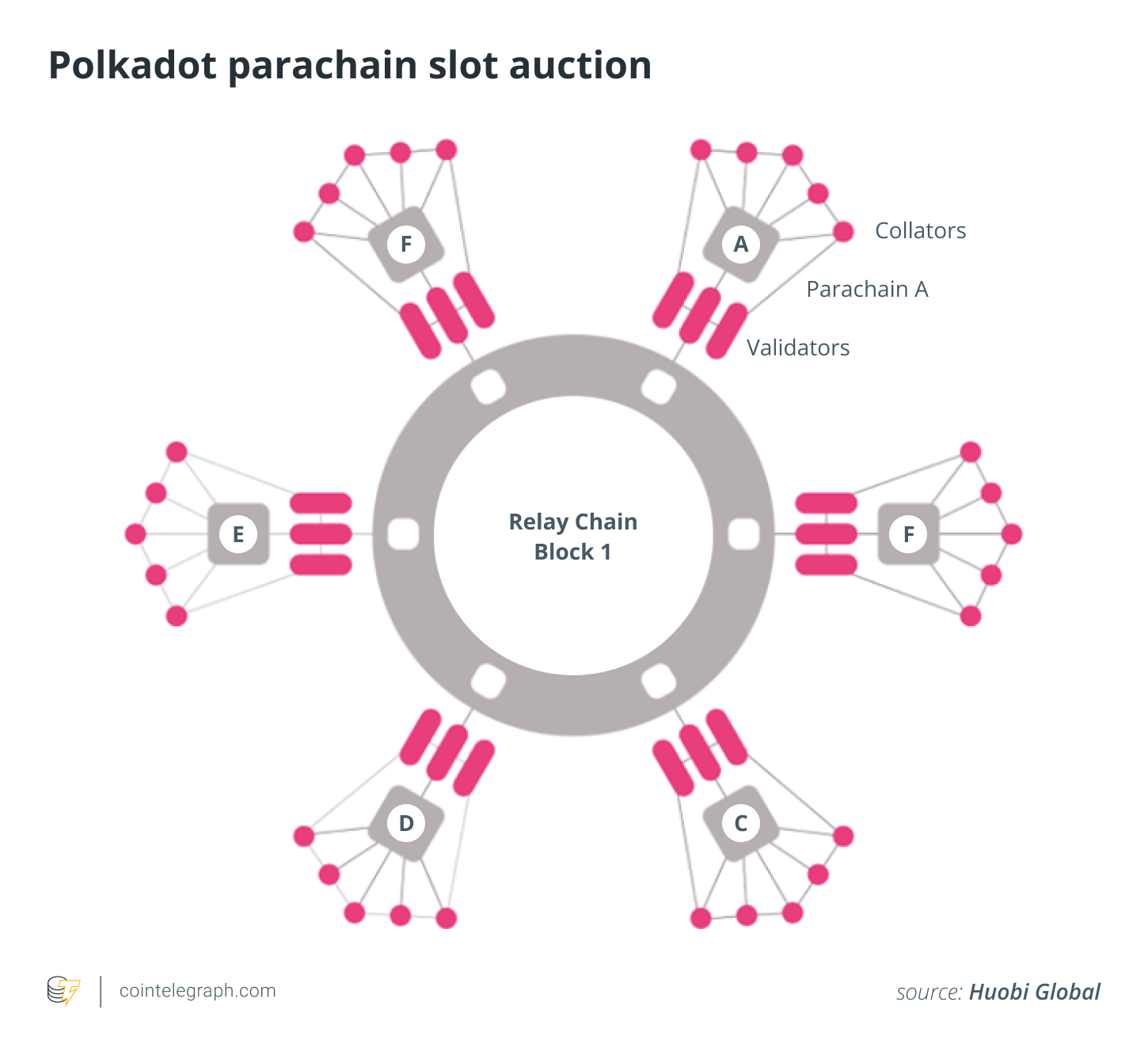

Last summer time, Polkadot made its very own bit of history after confirming the very first five projects to occupy parachain slots on its canary network Kusama. Disparate blockchains that secure onto Polkadot’s primary Relay Chain for security, yet are otherwise independent, parachains represent a different way to do business in blockchain, a maximalist vision targeted at enhancing scalability and governance while permitting the potential of forkless upgrades. The 5 projects were Karura, Moonriver, Shiden, Khala and Bifrost.

Fast-toward today, and also the first batch of parachains are going to expire, releasing over a million locked Kusama (KSM) tokens in to the market. Considering that KSM’s current supply is 9 million, fundamental financial aspects dictates the cost are affected, as tokens which were formerly inaccessible will all of a sudden reenter circulation. Cost fluctuations, obviously, affect staking and liquid staking — although the latter innovation enables users to make use of their tokens even if they’re locked.

Related: Just how much intrigue is behind Kusama’s parachain auctions?

Getting your cake and eating it

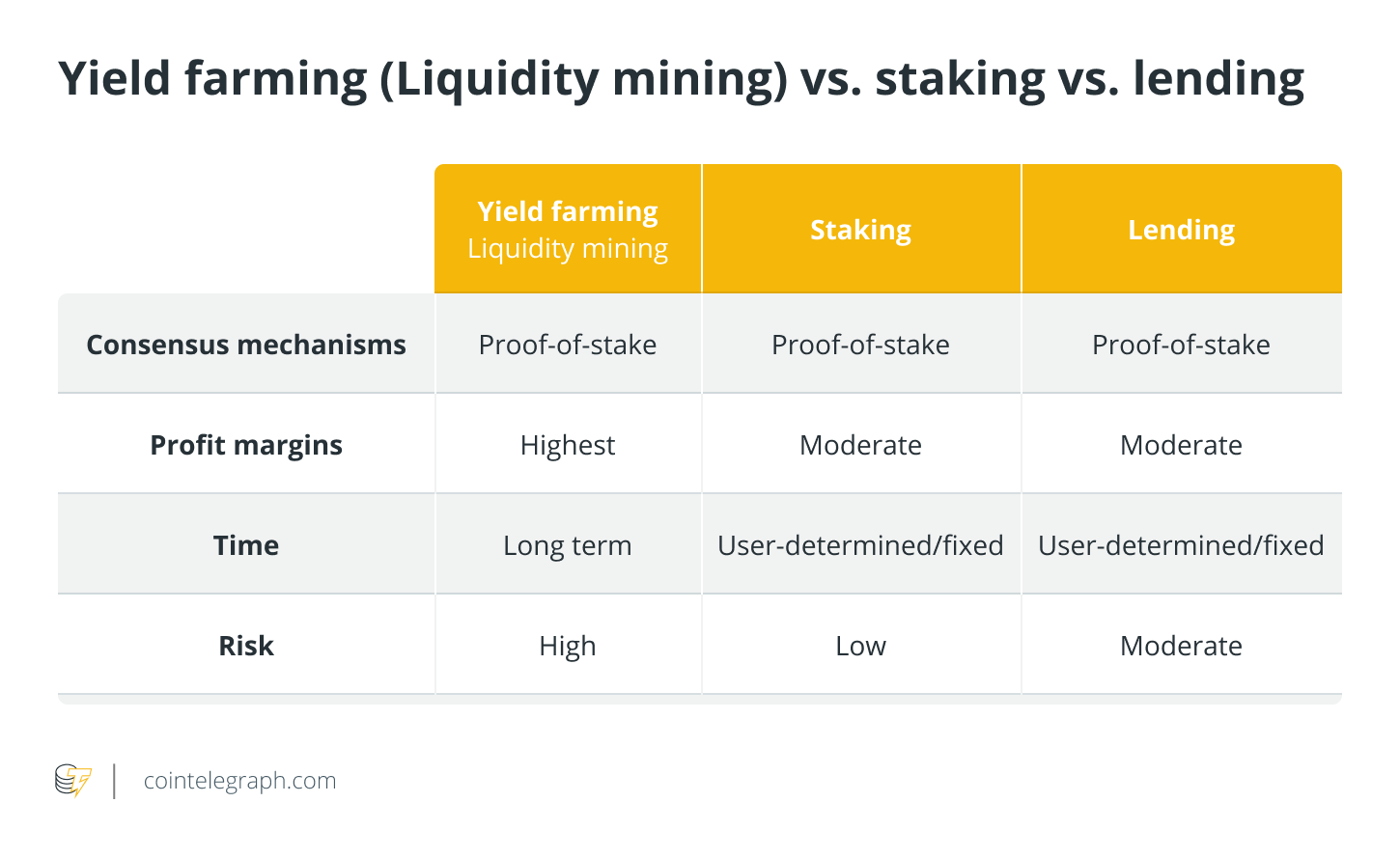

We’re all acquainted with staking: It’s the entire process of “locking” tokens right into a system as collateral with regards to securing a network. In return for one’s participation such an attempt, rewards are accrued.

Within Polkadot’s complex nominated proof-of-stake (NPoS) ecosystem, stakers may either be nominators (whose role it’s to appoint validators they trust) or validators, but in the two cases, exactly the same economic incentive applies. The issue, as described above, is exactly what happens in the finish of the staking period. It’s great receiving generous rewards for securing the Relay Chain (as well as several parallel chains), however, if the cost from the native token nosedives, it might create a mockery from the entire venture.

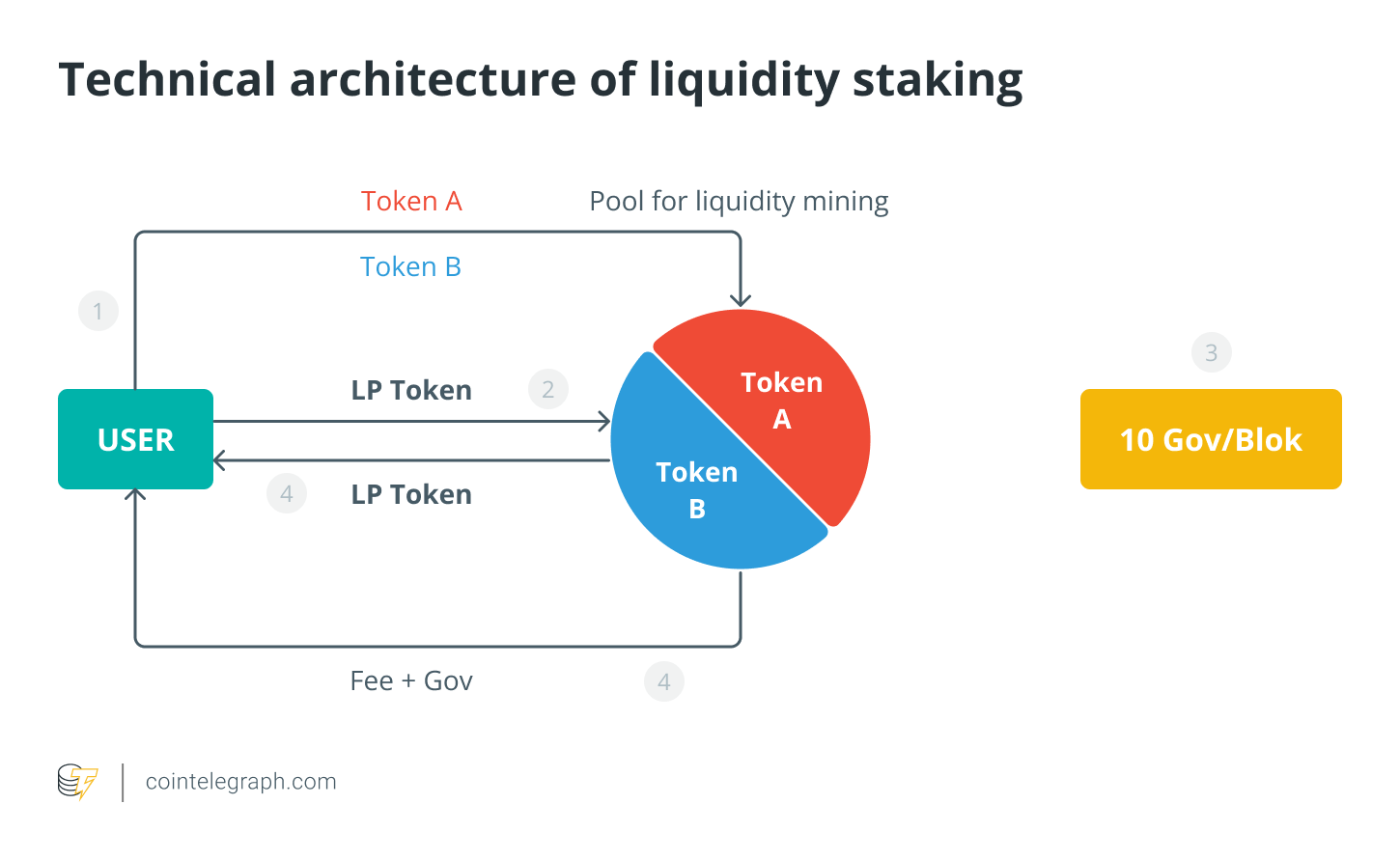

While liquid staking doesn’t safeguard the actual cost from the staked assets, it evidently enables users to securely unlock on-chain liquidity and make the most of yield-bearing possibilities provided by numerous decentralized applications. This really is permitted with the issuance of the separate token that represents the worth of one’s stake. With this particular liquid derivative basically serving as the native token available on the market, the chance of sudden cost instability following a finish of the unbonding period is addressed.

This model enables users to keep their liquidity and apply the actual token, whether through transferring, spending or buying and selling because they think fit. Indeed, stakers may even use their derivatives as collateral to gain access to or lend across different environments to sign up in other decentralized finance (DeFi) possibilities. The best of this is the fact that staking rewards still accrue around the original assets kept in the staking contract.

Related: How liquid staking disrupts parachain auctions on Polkadot

What occurs when the staking period concludes, You may ask. Well, the derivatives are merely exchanged back for that native coins in order to conserve a steady circulating supply.

The bottom line is, it’s a situation of getting your cake and eating it.

The way forward for proof-of-stake?

The proof-of-stake consensus mechanism continues to be under an more and more vibrant spotlight, particularly once we catch up with towards the roll-from PoS for Ethereum 2.. The blockchain’s lengthy-mooted transition to proof-of-stake is anticipated to lessen its energy consumption by over 99%, departing ecological critics to direct their censure to Bitcoin and it is questionable proof-of-work model.

There’s without doubt that PoS may be the eco seem option, even when some Bang critique is overblown because of an improving energy matrix popular with miners. Regardless of the many enhancements the consensus mechanism makes to the predecessor, however, there’s still try to be achieved. Not even close to being settled science, proof-of-stake is definitely an innovation that may and really should be refined. So we can begin by growing the amount and abilities of PoS validators.

It was the concept behind Polkadot’s NPoS model, which searched for to mix the safety of PoS using the advantages of stakeholder voting. In my opinion, liquid staking builds upon individuals advantages by solving a lengthy-standing quandary faced by users: whether or not to lock their tokens or rely on them in DeFi decentralized applications (DApp).

Related: The numerous layers of crypto staking within the DeFi ecosystem

This dilemma doesn’t only plague users, obviously it hurts the general DeFi landscape. For many cryptocurrencies, the proportion of circulating supply kept in staking can exceed 70%. During the time of writing, for instance, almost three-quarters of Solana’s SOL tokens are staked —- and also over 80% of BNB, according to Statista. It doesn’t have a genius to understand that getting just 30% of the token supply readily available for use within DApps is really a internet negative for that industry in general.

While proof-of-stake systems require an active staking community to make sure security, DApp developers wish to facilitate transactions — and transactions need tokens. The emergence of liquid staking has thus been welcomed by parties especially by DApp creators, who’ve been made to offer greater and greater APYs to convince users their assets would be best deployed in lucrative DApps than staking contracts.

By preserve a stable circulating supply, addressing worrisome cost fluctuations and helping users generate greater rewards (staking payouts plus DApp yield), liquid staking is among the brightest innovations in DeFi’s short history. Let’s hope more stakers arrived at that realization.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Lurpis Wang is really a co-founding father of Bifrost as well as an entrepreneur involved in the area of Web3. He was an earlier full-stack developer of Sina Weibo. After Lurpis co-founded Bifrost in 2019, the woking platform grew to become the very first batch of teams to make use of Substrate, it received a grant in the Web3 Foundation, also it won the very first Substrate hackathon award.