Layer-2 (L2) solutions for that Ethereum (ETH) network have become in prominence within the this past year due to the requirement for scalable systems that provide low-fee transactions and brought to several projects that built mix-chain bridges with competing blockchain systems.

One project which has benefitted in the development of the L2 scaling solutions is Synthetix (SNX), a decentralized finance (DeFi) protocol that allows the development of synthetic assets while offering contact with derivatives and futures buying and selling around the blockchain.

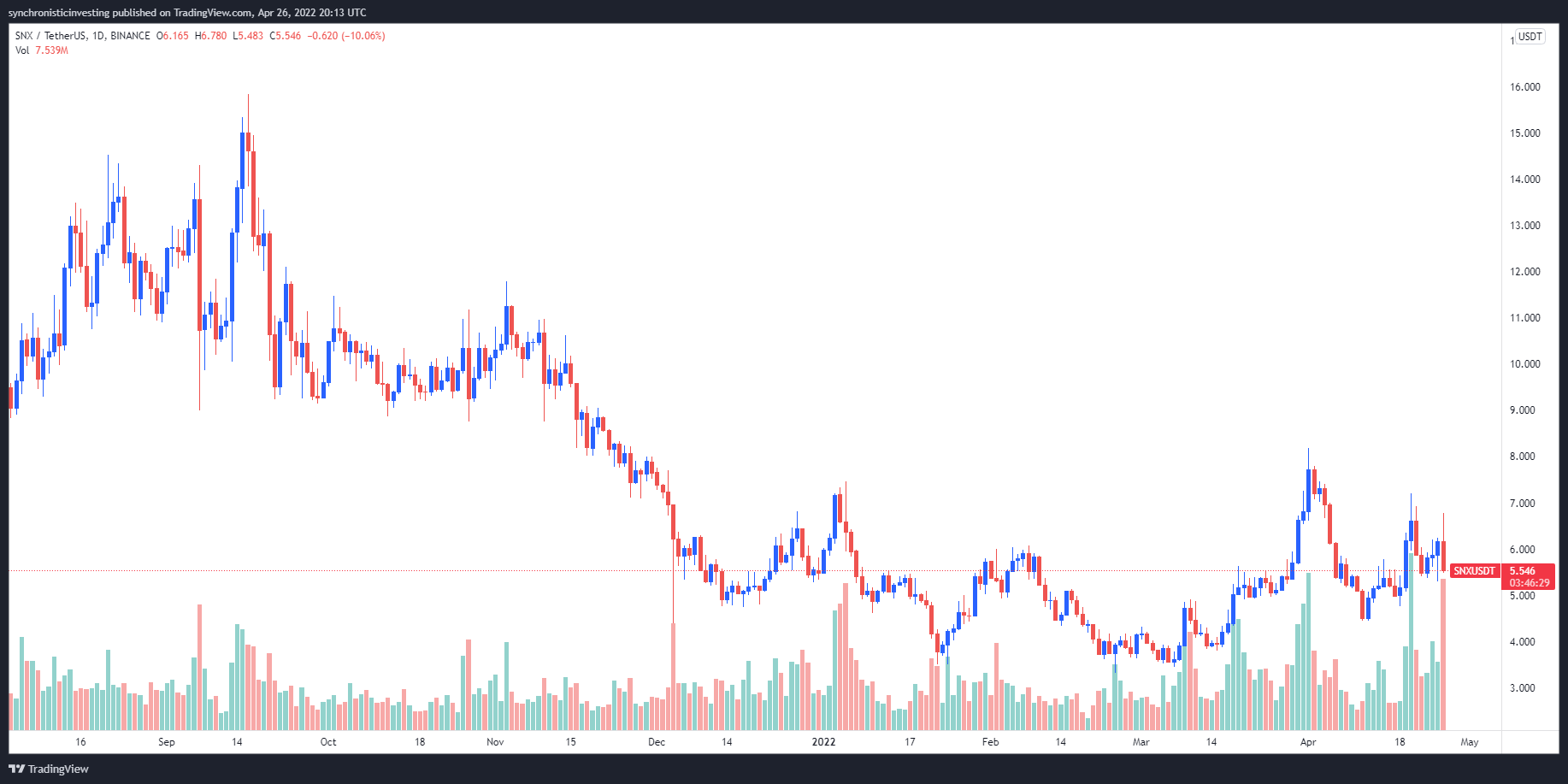

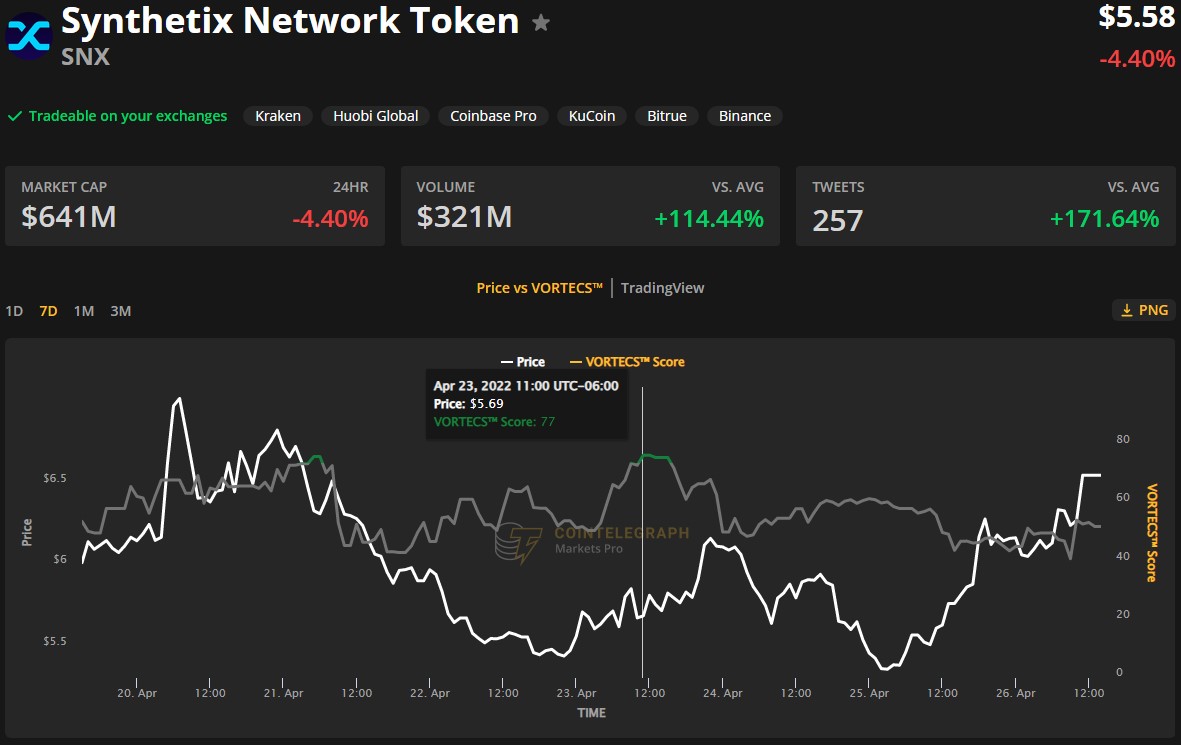

Data from Cointelegraph Markets Pro and TradingView implies that since hitting a minimal of $4.44 on April 11, the cost of SNX rallied 52.6% hitting a regular high at $6.78 on April 26 before a prevalent market downturn dropped it back lower to $5.90.

While a lot of the marketplace is lower, you will find potential catalysts for SNX cost to determine further appreciation.

Launch on Optimism

Among the greatest developments for that Synthetix protocol was its launch on Optimism, an L2 network that’s making waves now, because of an airdrop announcement. SNX staking started on Jan. 16 and because the network grows, speculators are giddy at the possibilities of future airdrops and staking incentives.

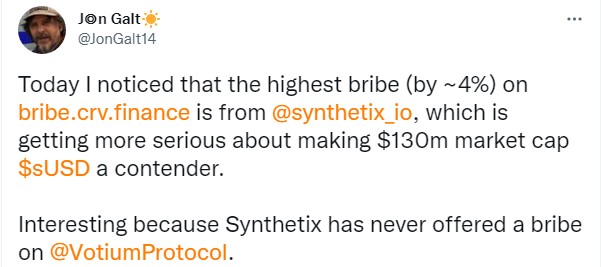

Most lately, Synthetix used its launch on Optimism to obtain more active in the “Curve Wars” and presently, it’s providing the greatest bribe to obtain veCRV voters to incentivize voting for that sUSD Curve pool.

Synthetix has additionally partnered with Lyra Finance (LYRA) to provide 12,000 SNX and 50,000 LYRA each week being an added incentive for veCRV voters.

L2 airdrop season might be a catalyst for SNX

Another reason the cost of SNX can see further appreciation is traders’ expectation that the airdrop season for L2 protocols could occur.

There’s been a lot of speculation that Optimism and Arbitrum, two of the largest L2 systems within the crypto ecosystem, would eventually airdrop their protocol tokens to early adopters from the systems.

This speculation grew to become reality after Optimism released the first information on the Optimism Collective, a “large-scale experiment in digital democratic governance” that’s “built they are driving rapid and sustainable development of a decentralized ecosystem.”

Combined with the launch from the Optimism Collective comes the launch from the OP governance token, which 5% from the initial supply is going to be airdropped to early adopters. For individuals who didn’t entitled to the first airdrop round, there’s still an opportunity to be eligible for a future airdrops when you are participating in the network using protocols like Synthetix.

With Synthetix offering futures buying and selling on Optimism, the protocol may need users seeking methods to be participating in the network which could increase interest in SNX.

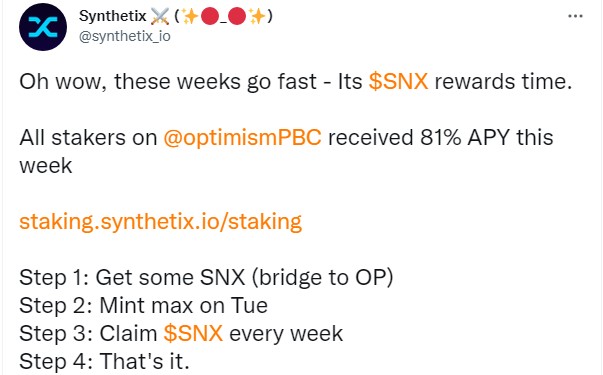

On the top from the possibility to get an OP airdrop, SNX holers are also influenced to Optimism through the 81% staking rewards presently on offer through the protocol.

Related: Optimism-based projects spike on rumors of token airdrop

Climbing users list and volume transacted

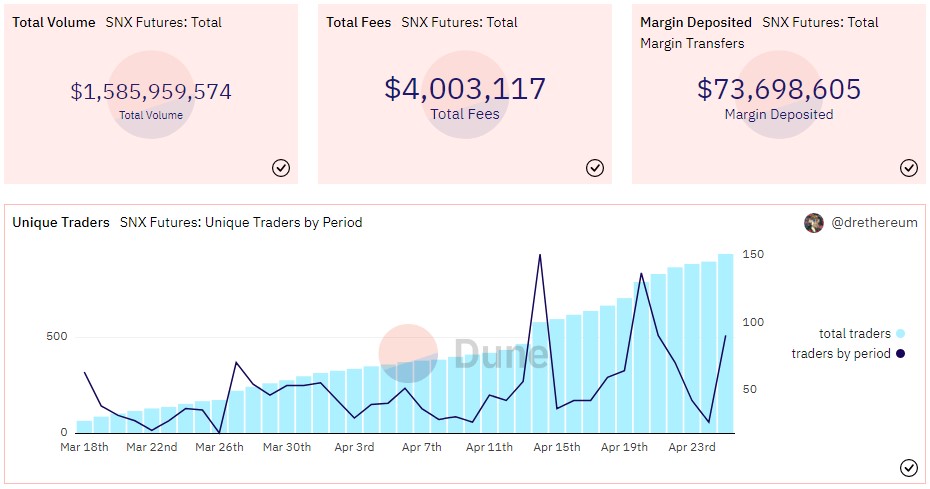

Further proof of the increasing recognition of Synthetix are available in the platform’s metrics on Optimism, that have been continuously growing within the last month, according to data from Dune Analytics.

As proven within the graphic above, the amount of unique traders around the protocol continues to be climbing since launching futures buying and selling in mid-March and also the protocol has handled nearly $1.59 billion as a whole volume.

VORTECS™ data from Cointelegraph Markets Pro started to identify a bullish outlook for SNX on April 23, before the recent cost rise.

The VORTECS™ Score, only at Cointelegraph, is definitely an algorithmic comparison of historic and market conditions produced from a mix of data points including market sentiment, buying and selling volume, recent cost movements and Twitter activity.

As observed in the chart above, the VORTECS™ Score for SNX rose in to the eco-friendly zone striking a higher of 77 on April 23, around 39 hrs prior to the cost spiked 28% over the following day.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.