The knock-on aftereffect of the collapse of Terra (LUNA) and it is TerraUSD (UST) stablecoin spread wide over the cryptocurrency market on May 11 as projects with any type of connection to the decentralized finance (DeFi) ecosystem have experienced the prices hammered.

The forced selling from the Bitcoin (BTC) holdings backing some of UST also influenced BTC’s current drop to $29,000. Analysts fear that DeFi platforms which have liquidity pools mainly made up of UST and LUNA will collapse.

Terra-based protocols suffer

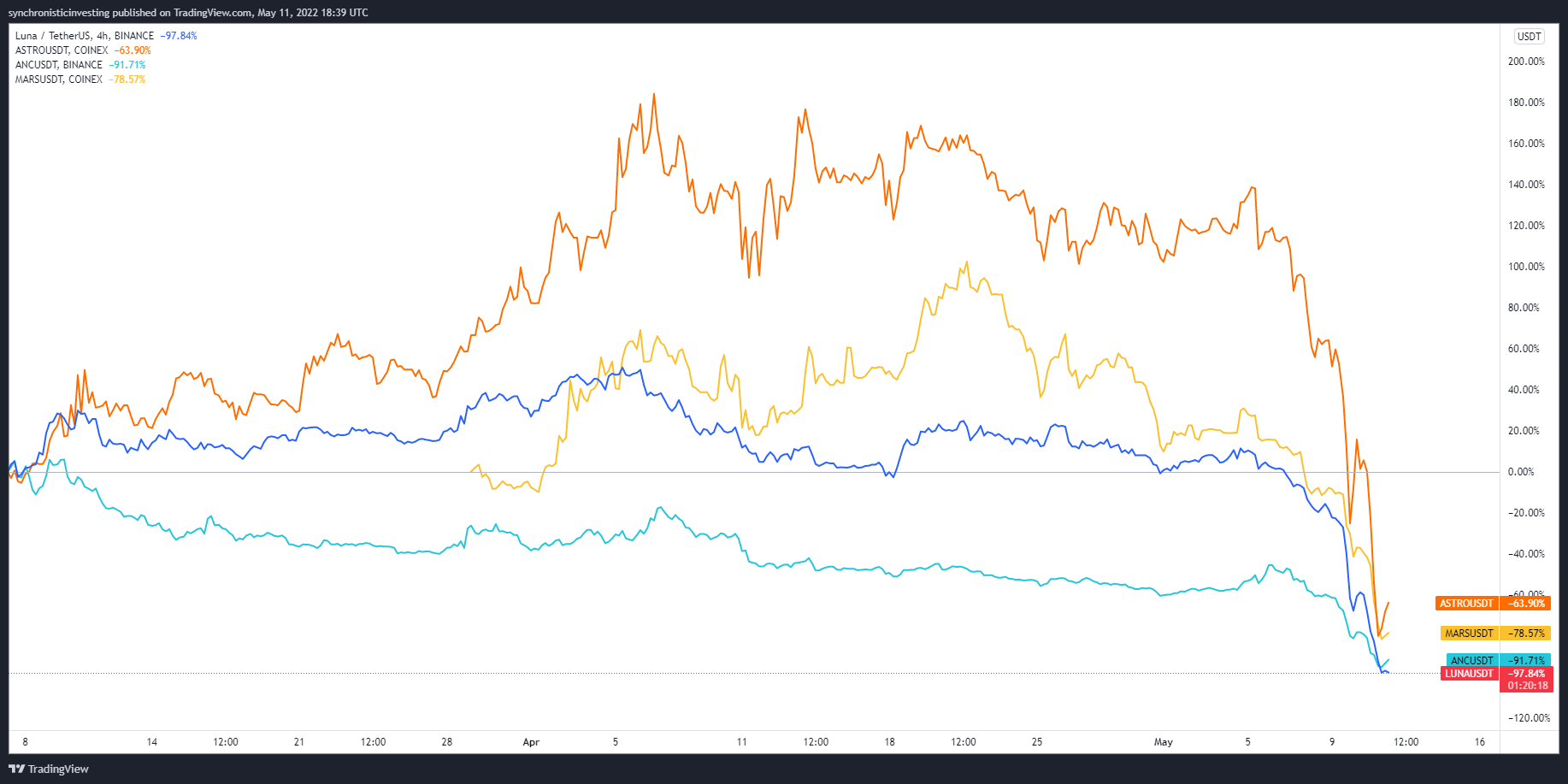

Projects using the direst of outlooks are individuals which are located around the Terra protocol including Anchor Protocol, Astroport and Mars Protocol.

As proven within the chart above, Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS) saw prices plummet greater than 80% since May 4, when LUNA cost first began to fix.

The protocols under consideration are DeFi-focused, meaning that they heavy integration with UST because the primary stablecoin for his or her liquidity pairs, in addition to LUNA like a major supply of value locked on their own smart contracts.

As lengthy as UST remains off its $1.00 peg and LUNA trades lower 98% where it had been just 7 days ago, it’s unlikely these protocols can recover and get over today’s fallout.

The Interblockchain Communication Protocol also required a success

Assets within the Cosmos ecosystem were also hard hit by UST’s collapse. Cosmos (ATOM) and other tokens like Mirror Protocol (MIR), Osmosis (OSMO) and Kava (KAVA) that make use of the Interblockchain Communication Protocol (IBC) remedied dramatically because of their integration with Terra.

The cost declines of these assets were less extreme than individuals located around the Terra protocol, however their proxy to Terra hasn’t protected them from contagion.

Related: LUNA meltdown sparks theories and told-you-sos from crypto community

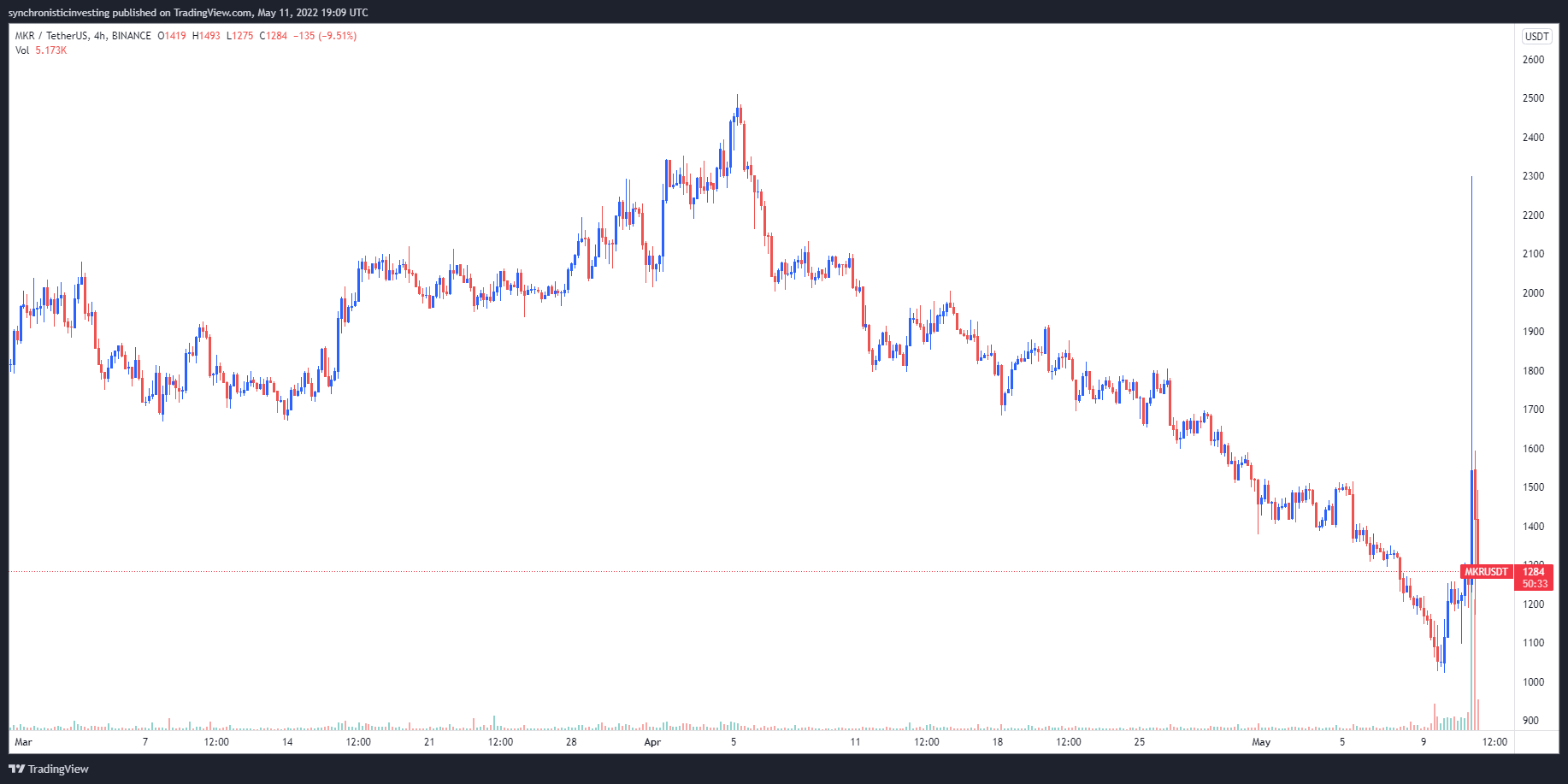

Maker advantages of the volatility

Maker (MKR) may be the one vibrant place to emerge in buying and selling on May 11 as crypto traders now end up embracing Dai (DAI) because the “best” decentralized stablecoin option on the market.

MKR cost spiked 124% in buying and selling on May 11, going from the low of $1,025 for an intraday a lot of $2,299 before settling back lower to $1,278.

Because the market digests the present correction and news of fund and protocol collapses emerge, it will likely be interesting to determine how other stablecoin protocols like Frax Share, USDD and mStable perform and whether crypto traders will be put off by these projects for additional centralized options.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.