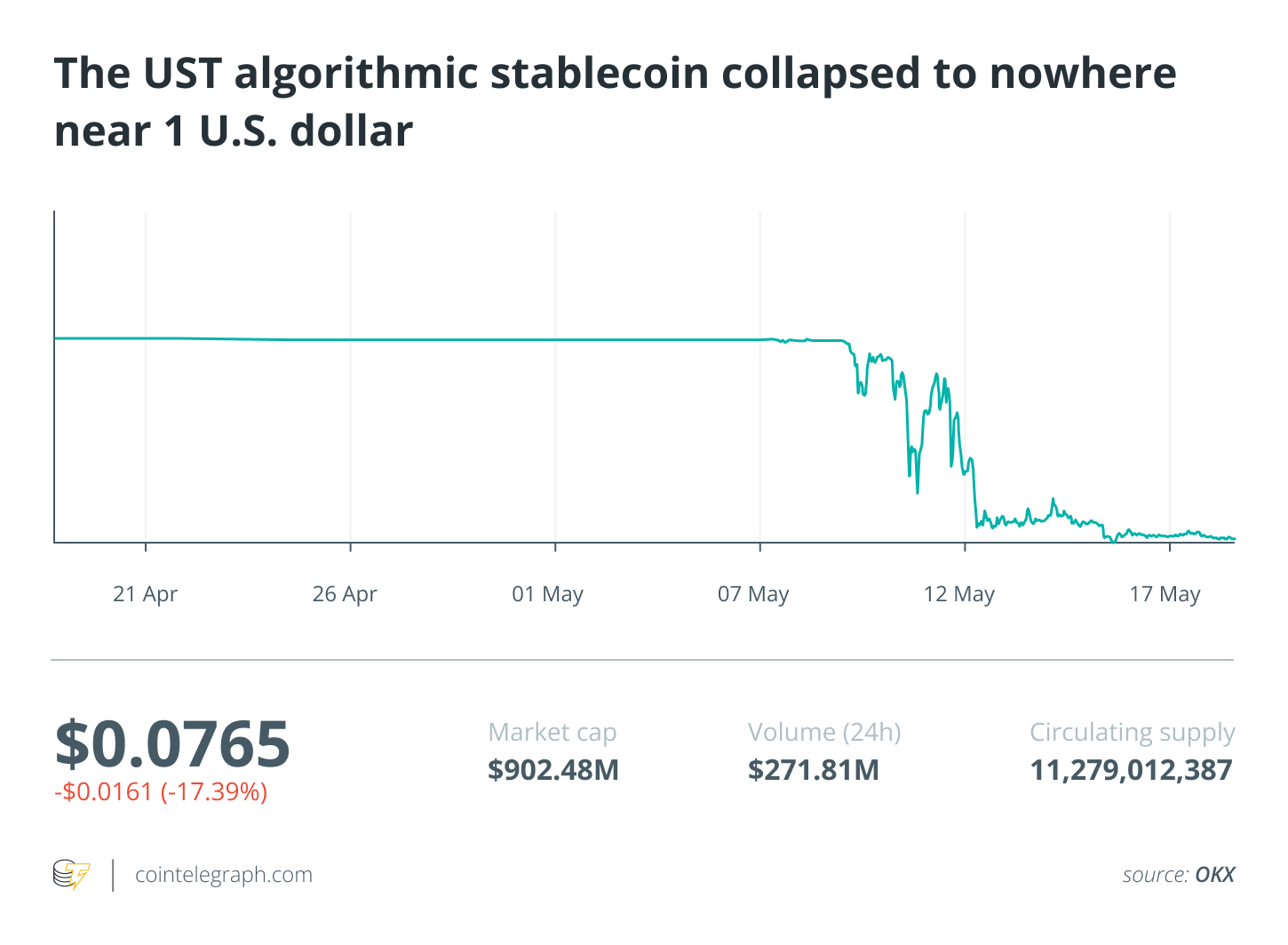

The collapse of Terra’s ecosystem — namely, native gold coin LUNA and algorithmic stablecoin TerraUSD (UST) — rocked the broader blockchain and cryptocurrency ecosystem. Not just did Terra-ecosystem tokens (for example Anchor’s ANC) collapse in value, however the prevalent fear, uncertainty and doubt sent market-leading cryptocurrencies Bitcoin (BTC) and Ether (ETH) below $27,000 and $1,800, correspondingly, on some exchanges.

As of times that I’m penning this article, the cryptocurrency market still hasn’t retrieved — even when Terra’s contagion continues to be mostly contained.

Related: What went down? Terra debacle exposes flaws plaguing the crypto industry

An enormous blow to industry confidence

Crypto market participants — and particularly individuals associated with LUNA and UST — were easily wiped in the collapse of these two assets. For those who were staking the supposedly safe “stablecoin” tenuously pegged towards the dollar to earn interest, the UST dying spiral was absolutely brutal. Not only hedge funds, but regular individuals lost lots of money. In some instances, they lost their existence savings.

Regrettably, most regular users (as well as a few of the hedge funds) were not aware from the risks associated with staking algorithmic stablecoins, despite past experimental failures around the algo-stable front with no effective implementations.

Regulators required the bait

Regulators were quick — almost too quick — to make use of Terra’s dramatic unwinding to illustrate why stablecoin (and decentralized finance) regulation is needed. U . s . States Treasury Secretary Jesse Yellen was quick to say the big event inside a Congressional hearing of the home Financial Services Committee around the Financial Stability Oversight Council’s Annual Are accountable to Congress, where she requested lawmakers develop a “consistent federal framework” on stablecoins in order to address risks.

Related: DeFi: Who, how and what to manage inside a borderless, code-governed world?

Yellen’s surveys are relatively tame in comparison with Senator Elizabeth Warren’s, that has frequently lambasted decentralized finance (and, generally, crypto) being an industry operated by “shadowy super coders” and crooks. The lawmaker also lately authored with Senator Tina Cruz that “investing in cryptocurrencies is really a dangerous and speculative gamble,” amongst other things. Studying between your lines, Terra’s collapse is tossing fuel on Congressional crypto critics’ fires.

The image being colored by a few lawmakers — and definitely not merely by individuals within the U.S. — would be that the crypto market is a harmful place that people invest their cash. They frequently cite too little rules, user protections and risk-minimization systems (if not busy falsely stating its mainly utilized by crooks).

However, this painting isn’t exactly a practical one.

The function of CEXs within the risk management and user protection

That old “Wild West” times of the cryptocurrency industry are lengthy-gone — a minimum of, within the centralized exchange (CEX) space. Many advanced buying and selling platforms with centralized order books do, actually, provide safety nets and risk-minimization measures using the sole reason for protecting their users from severe market volatility.

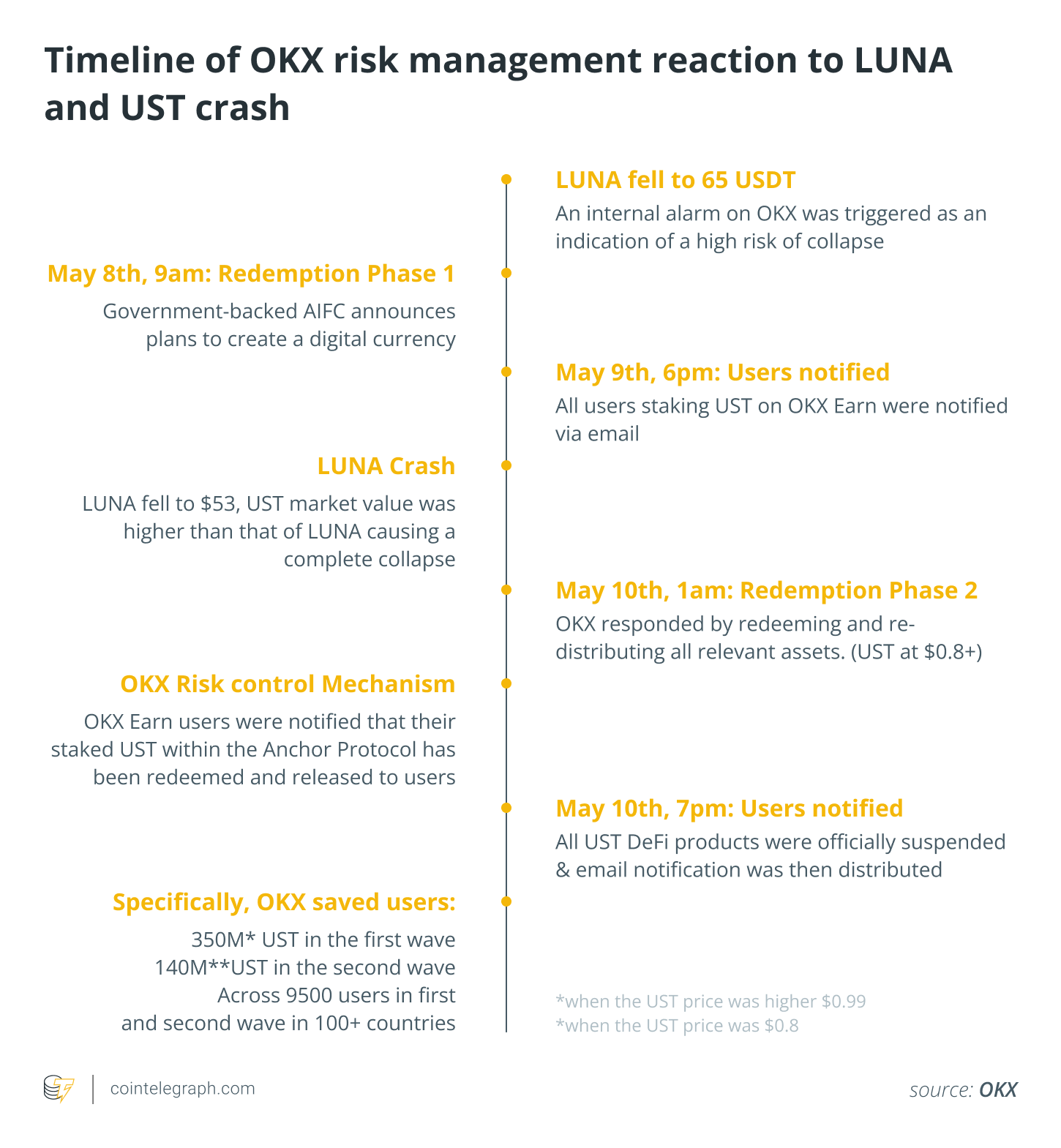

For example, within the wake from the crypto market collapse around LUNA and UST a week ago — that was devastating for thus many crypto investors and traders — OKX was out as cryptocurrency exchange that could safeguard its customers in the brutal results of the meltdown.

I’ll let you know that that labored — OKX’s risk-management system accomplished this beginning with realizing the cost volatility of LUNA and delivering an e-mail aware of all investors who have been staking UST on OKX Earn, the exchange’s crypto-earning aggregator platform which includes DeFi earning choices. Over two phases, OKX released over 500 million UST owned by over 9,000 investors. The cost of UST over these two phases was $.99 and $.8. OKX also notified Earn users their UST have been released from staking.

Related: Risk management in crypto: Also known as ‘the art of not losing all of your money’

Releasing/unlocking investors’ UST from being staked via OKX Earn gave investors an opportunity to avoid further loss on their own UST, which unsuccessful to keep its peg towards the dollar.

Why risk management matters in crypto

The Terra collapse and wider effects around the cryptocurrency market demonstrate why crypto exchanges need advanced risk management systems — particularly when supplying use of decentralized finance (DeFi) protocols offering favorable yields. The response of OKX’s risk management system, which gave traders an opportunity to be paid by the results triggered through the severe volatility within the markets, highlights the advantages of utilizing a centralized exchange platform for “doing DeFi.” Rather of “going it alone,” as they say, and staking on Anchor or any other protocols, employing a CEX’s choices offer user protection and risk minimization assuming things fail for that protocol under consideration.

Obviously, there has to be an account balance between your founding values of crypto — independence, decentralization, freedom, “trustless” security — and risk minimization for individuals and firms who wish to purchase, earn or trade crypto. In the finish during the day, everybody wants everybody to possess safe and independent accessibility ever-growing realm of crypto. However, not everybody is prepared (or perhaps wants) to defend myself against all of the risks themselves.

Centralized exchanges have a significant role to experience in facilitating safer use of decentralized finance through advanced risk-minimization systems. As more new people go into the exciting world provided by blockchain technology, we are able to provide guidance, expertise and risk-mitigations to assist make sure that — in the finish during the day — they hang in there.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Lennix Lai may be the md of OKX. He leads the company strategy and processes for OKX, worldwide. Before joining OKX, Lennix offered at JP Morgan, AIG and funds Financial Services Group. With 15 experience within the worlds of monetary services and fintech, Lennix plays a vital role in OKX’s transformation from the standard centralized exchange in to the largest hub for DeFi services, nonfungible tokens and blockchain gaming — in addition to crypto buying and selling.