The metaverse is really a advanced iteration from the internet, having a digital economy as well as an immersive virtual atmosphere alongside other interactive features. This relatively nascent space has acquired a lot traction recently that conservative estimates claim that by 2024, its total valuation could top $800 billion. Meta (parents body behind Facebook and Instagram), Google, Microsoft, Nvidia, Nike yet others make Fortune-100-sized metaverse splashes.

However with great valuations comes great scrutiny from more and more tech-savvy financial regulators. Unlike traditional tech products, which frequently spend years putting growth over revenue, some metaverse projects push questionable monetization schemes on their own users just before launching an active experience. Metaverse property is really a prime illustration of this practice, with platforms like In A Major Way games selling land within their metaverse before opening accessibility game.

Typically, the U . s . States Registration doesn’t part of unless of course retail investors face predatory courting of the dollars without full disclosure of what they’re purchasing. The road for which classifies like a security is frequently fuzzy — however in the situation from the metaverse, the concept of land sales should generally be described as a security under U.S. law.

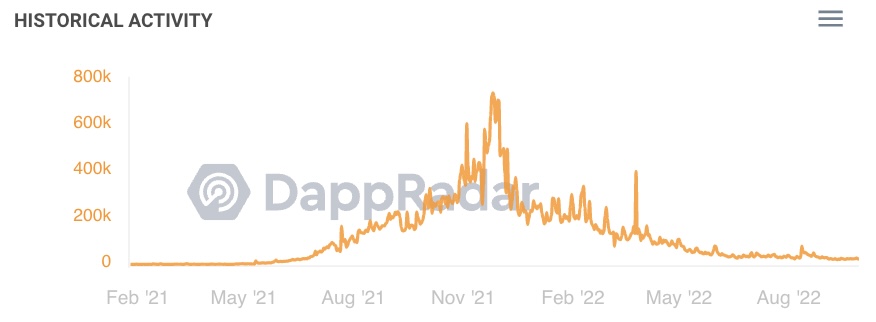

GameFi platforms like Axie Infinity demonstrate the rate where metaverse projects can birth multi-billion-dollar economies. Their sheer scale necessitates internal controls and financial policies much like multinational banks or perhaps small countries. They must be needed to staff compliance officials who coordinate with government regulators as well as conduct Know Your Customer for big transactions.

The metaverse is intrinsically associated with financialization. While no bodily harm could be inflicted within the metaverse (yet), lots of financial harm was already caused. The organization behind the Bored Apes Yacht Club nonfungible tokens (NFTs) saw a hack this season following a community manager’s Discord was compromised. Online hackers walked away with NFTs worth 200 Ether (ETH).

A swath of Wall Street banks was lately fined $1.8 billion for implementing “banned” messaging apps. Metaverse projects like Yuga Labs should face similar positive fines because of not applying secure financial and technical controls.

Related: Throw your Bored Apes within the trash

A vital initial step for just about any metaverse project is to classify which kind of asset(s) they’re issuing. For instance, could it be a burglar? A software application token? Or anything else? This may appear just like a daunting task, however the research was already laid through the initial gold coin offering era in 2017, and additional efforts ought to be carried out by regulators and protocols to supply clearness and safeguard consumers.

Following the classification process is finished, the next phase is to create a regulatory framework that may be put on the metaverse. This would include rules and rules around such things as securities choices, Anti-Money Washing and consumer protection.

It’s essential to strike the best balance. An excessive amount of regulation could stifle innovation and adoption, but not enough can lead to prevalent abuse. It will likely be as much as policymakers to utilize founders to locate that sweet place.

Despite concerns, the metaverse includes a collection of emerging technologies: virtual reality (VR), augmented reality (AR) and NFTs. All of them combined efforts to drive the area forward with growing momentum within the near-to-mid term.

Risks connected with operating within the metaverse

Cybercriminals are constantly finding new tactics to take advantage of people that use the metaverse — i.e., through hacking schemes or id theft. Because AR and VR wearables connected using these environments generate massive volumes of private data — including biometric info from eye-tracking and the body-tracking technology — the metaverse is really a tantalizing playground for bad actors.

Outdoors of monetary thievery, privacy concerns abound as three-dimensional data sets will disclose more and more sensitive private information. The Overall Data Protection Regulation in Europe and also the California Consumer Protection Act are comprehensive bits of privacy legislation which have forced tech platforms to employ data protection officials and knowledge privacy compliance officials. Metaverse platforms will have to fill similar roles and may face increased regulatory scrutiny, because of the sensitivity from the data they may collect.

Related: Biden’s anemic crypto framework offered not new

Because the interest in the metaverse is constantly on the spike, same goes with the requirement for better internet services because the former requires lots of bandwidth (believed to become several orders of magnitude from online traffic levels today). Consequently, it is extremely entirely possible that many telecom systems as well as their existing data distribution infrastructures can become overloaded.

One method to solve this problem is by purchasing 5G technology and building out a more powerful infrastructure. However this needs time to work, money and sources. Another option would be to build up more effective data compression algorithms that will help reduce the quantity of bandwidth needed to deliver data inside the metaverse.

Lastly, apart from all of the technical risks, an part of the metaverse to think about may be the negative impact it may have the prospect on one’s mental health. Because the ecosystem is unencumbered by criminal law, there might be no road to option when users have to face online abuse (for example racism).

Challenges to regulation

Because any network operator, firm or business, in writing, can exist outdoors of the suggested regulatory framework when they chose to do this — a country’s efforts at regulation may have limited impact.

This really is perfectly highlighted because most of the social networking platforms we use today, including Facebook, aren’t located in the U.S., but rather, operate from countries like Ireland and Singapore, where data protection laws and regulations tend to be more enjoyable.

Related: Crypto gaming sucks — But devs can deal with it

Exactly the same logic pertains to the metaverse. Even when a rustic would pass legislation trying to regulate this space, it’s doubtful that companies would accept stick to it.

Therefore, unless of course every participant from the metaverse aligns and concurs using the vision of establishing a uniform code of governance, there’s not a way of stopping another-party entity (just like an offshore investment firm) from creating its very own unregulated pocket inside the metaverse, which users of other digital environments may then access with no apparent limitations.

Searching ahead toward a decentralized future

The metaverse is in a position to reshape our way of life whether we love to it or otherwise. Ultimately, the “move fast and break things” ethos of technology development is alive and well, and history has proven that founders move considerably faster than regulators can maintain. But it’ll be crucial for regulators to step-up and take positive steps to match innovation to flourish without causing catastrophic financial harm to retail investors. In the end, the options we make today determines how fraxel treatments will shape our tomorrow.

Huy Nguyen may be the co-founding father of KardiaChain, Southeast Asia’s first interoperable blockchain infrastructure. Since May 2022, he’s offered because the v . p . from the Vietnam Blockchain Association, the state government body to push for mass adoption in Vietnam. He formerly offered like a senior tech lead manager at Google and holds greater than 10 experience building large-scale distributed infrastructures, such as the Google Access Wireless Platform and Google Fiber Network Infrastructure.

This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations. The views, ideas, and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.