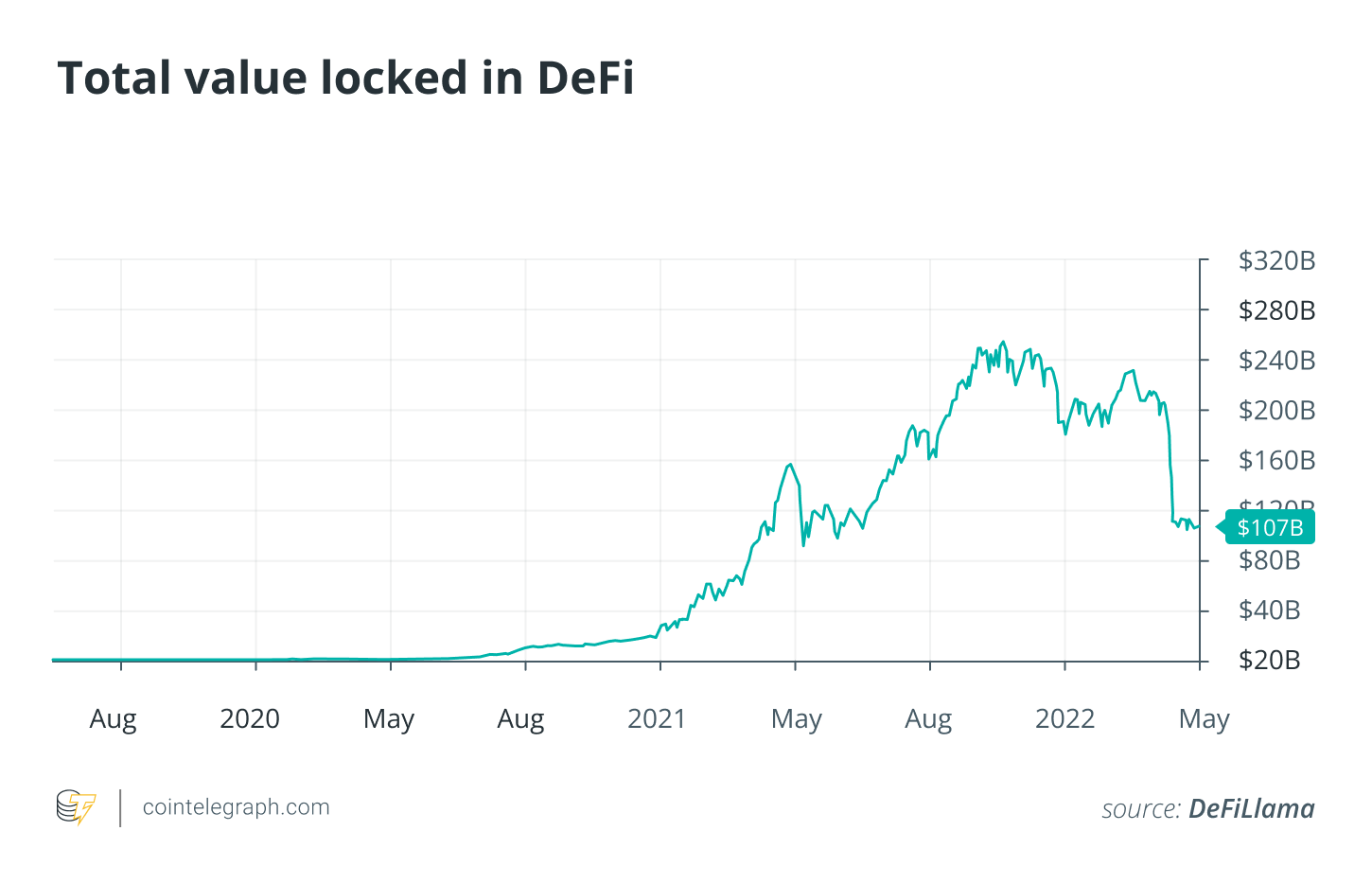

Nowadays, the blockchain market in general is within its infancy, and also the decentralized finance (DeFi) marketplace is its most promising part. Based on DefiLlama data, in 2021, the DeFi market had around $200 billion of liquidity kept in smart contracts. When we view this capital being an energy production, the forex market appears like a very promising venture. Very few global companies can feature this type of capital. But any youthful market has its own teething problems. With DeFi, the primary concern is too little qualified blockchain developers.

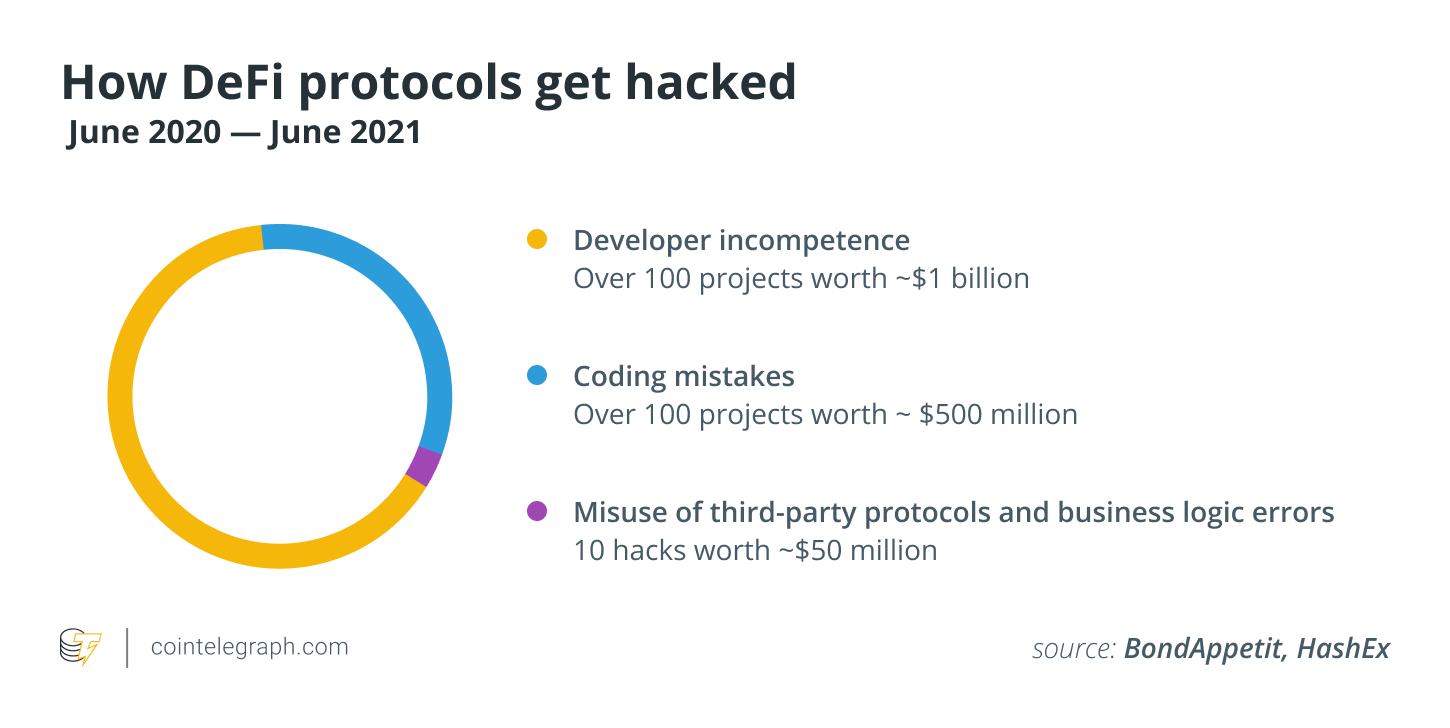

This market is very youthful and it has a comparatively small users list. Almost everyone has at the best learned about DeFi without getting any understanding of what it’s. But in fact with each and every new promising venture, it rapidly creates lots of speculative interest. Regrettably, preparing personnel takes considerably longer, especially with regards to such understanding-intense spheres as blockchain and smart contract development. Which means that some project teams will need to compromise and hire less experienced personnel.

This issue inevitably results in a growing chance of security loopholes within the code of those projects. Therefore we suffer from its effects in lost user capital. Just for a brief knowledge of how large this issue is, I’m able to state that about 10% of DeFi’s total liquidity locked continues to be stolen by online hackers. It shouldn’t surprise anybody the mainstream public would like to steer clear of an economic system that poses such dangers for their funds.

Related: How can DeFi protocols get hacked?

How have DeFi exploits altered lately?

Attacks on DeFi have lengthy been focused on reentrancy attacks. We are able to can remember the famous The DAO hack of 2016 that led to losing $150 million in investor capital and brought to Ethereum’s hard fork. Since that time, this vulnerability continues to be exploited many occasions in various smart contracts.

The callback function is positively employed by lending protocols: It enables smart contracts to check on users’ collateral balance before supplying financing. All of this process happens within one transaction, that has given online hackers a workaround to steal money from such smart contracts. Whenever you send a request to gain access to funds, the callback function first checks the collateral balance, then provides the borrowed funds when the collateral was sufficient after which changes the user’s collateral balance within the smart contract.

To fool the smart contract, online hackers return the phone call towards the callback function to initiate this method right from the start. Because the transaction is not finalized around the blockchain, the part provides another loan for the similar collateral balance. Although the fix for your problem continues to be in this area lengthy enough, many projects still become a victim of it.

Sometimes, project teams with little skill on paper smart contracts choose to borrow the codebase of some other open-source DeFi project to deploy their very own smart contract. They normally achieve this with trustworthy projects which have been audited and also have large user bases and also have demonstrated to become safely built. However they might wish to make minor modifications towards the lent code to include functionalities they would like to have within their smart contract, without altering the initial code. This can harm the logic from the smart contract, which developers frequently don’t realize.

This is exactly what permitted online hackers to steal around $19 million from Cream Finance in August 2021. The Cream Finance team lent the code from the different DeFi protocol and added a callback token within their smart contract. While you can prevent reentrancy attacks by applying the “checks, effects, interactions” pattern that prioritizes the modification of balance within the issuance of funds, some teams still neglect to safeguard their platforms from all of these exploits.

Flash loan attacks allow online hackers to steal funds differently and also have been growing more and more popular because the DeFi boom of 2020. The primary concept of flash loan attacks is that you don’t must have collateral to gain access to funds from the protocol because financial parity continues to be guaranteed because the borrowed funds is taken and came back within one transaction. And it’ll not occur if you can’t return the borrowed funds with curiosity about one transaction. But attackers have had the ability to perform effective flash loan attacks on the majority of protocols.

Related: Needed: An enormous education project to battle hacks and scams

In performing them, they will use multiple protocols to gain access to and drag liquidity through before the final act where they amplify the cost of the token through oracles or liquidity pools and employ it to swindle a pump-and-dump and become gone with liquidity in a wide array of some major different cryptocurrencies for example Ether (ETH), Wrapped Bitcoin (wBTC) yet others. Some famous flash loan attacks range from the Pancake Bunny attack, in which the protocol lost $200 million, and another Cream Finance attack, by which over $100 million was stolen.

How you can reduce the chances of DeFi exploits?

To construct a safe and secure DeFi protocol, ideally, you need to only trust experienced blockchain developers. They ought to possess a professional team lead with skill in building decentralized applications. It’s also a good idea to make sure to use safe code libraries for development. Sometimes, the less up-to-date libraries could possibly be the safest option compared to ones using the newest code bases.

Tests are another crucial factor all serious DeFi projects should do. Like a Chief executive officer of the smart contract audit company, I usually attempt to cover 100% in our clients’ code and stress the significance of decentralized protection from the private keys accustomed to call functions of smart contracts with restricted access. It is advisable to use decentralization from the public key via a multisignature that stops one entity from getting full control of anything.

Within the finish, education is among the keys that will permit blockchain-based economic climates to get safer and reliable. And education should be among the important thing concerns of individuals searching for employment in DeFi since it can provide mouthwatering rewards to any or all who can produce a viable contribution.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Dmitry Mishunin may be the founder and Chief executive officer of DeFi security and analytics company HashEx and it has lengthy-standing expertise in the area of blockchain security. He’s devoted considerable time to scientific activities, for example research in it systems, blockchain, and vulnerabilities in DeFi. Under Dmitry’s management, HashEx became one from the leaders in the area of smart contract audits.