Global markets are dealing with a difficult period — such as the cryptocurrency market. But knowing by talk in the peanut gallery, it appears like some observers haven’t received the memo.

“Feel like we are relatively safe through mid-terms,” Twitter’s “CryptoKaleo” — sometimes known simply as “Kaleo” — authored inside a Sept. 12 tweet to his 535,000 supporters, talking about the U . s . State’s November mid-term elections. The conjecture was supported with a chart indicating his thought that Bitcoin’s (BTC) cost would surge to $34,000 — a 50% profit from its roughly $20,000 level by a week ago — prior to the finish of the season.

“Of course we are able to bleed lower,” fellow pseudonymous Twitter mega-influencer Pentoshi authored inside a Sept. 9 missive to his 611,000 supporters. “But the marketplace only at that value is much more attractive than it has been in more than a year. […] I grabbed just a little $BTC yesterday / no alts and can be nibbling.”

Individuals assessments range from “respectable” observers — individuals who’ve periodically been correct previously. One gentleman within my inbox today — a Charlie Shrem searching to market his “investing calendar” — assured readers that the “major crypto ‘run-up’ could begin tomorrow.” Look further also it isn’t difficult to find much more bullish prognostications, such as the conjecture that Bitcoin is around the cusp of the 400% surge which will take it for an all-time high cost of $80,000 and market capital of $1.5 trillion — $500 billion greater than the need for all of the silver on the planet.

It’s best to begin to see the optimism running rampant, even if it’s mostly among influencers searching for engagement and having to pay customers. Regrettably, macroeconomic headwinds indicate the truth is just a little more dark — possibly a great deal more dark.

FedEx a week ago underscored the chance that economic conditions might worsen using its announcement it had fallen $500 million lacking its first-quarter revenue target. “These figures — they do not portend perfectly,” Chief executive officer Raj Subramaniam wryly noted within an interview with CNBC. His comments, which incorporated a conjecture the figures symbolized the start of a worldwide recession, motivated a 21% finish-of-week crash in the company’s stock cost that required the broader market along for that ride.

Related: What’s going to drive crypto’s likely 2024 bull run?

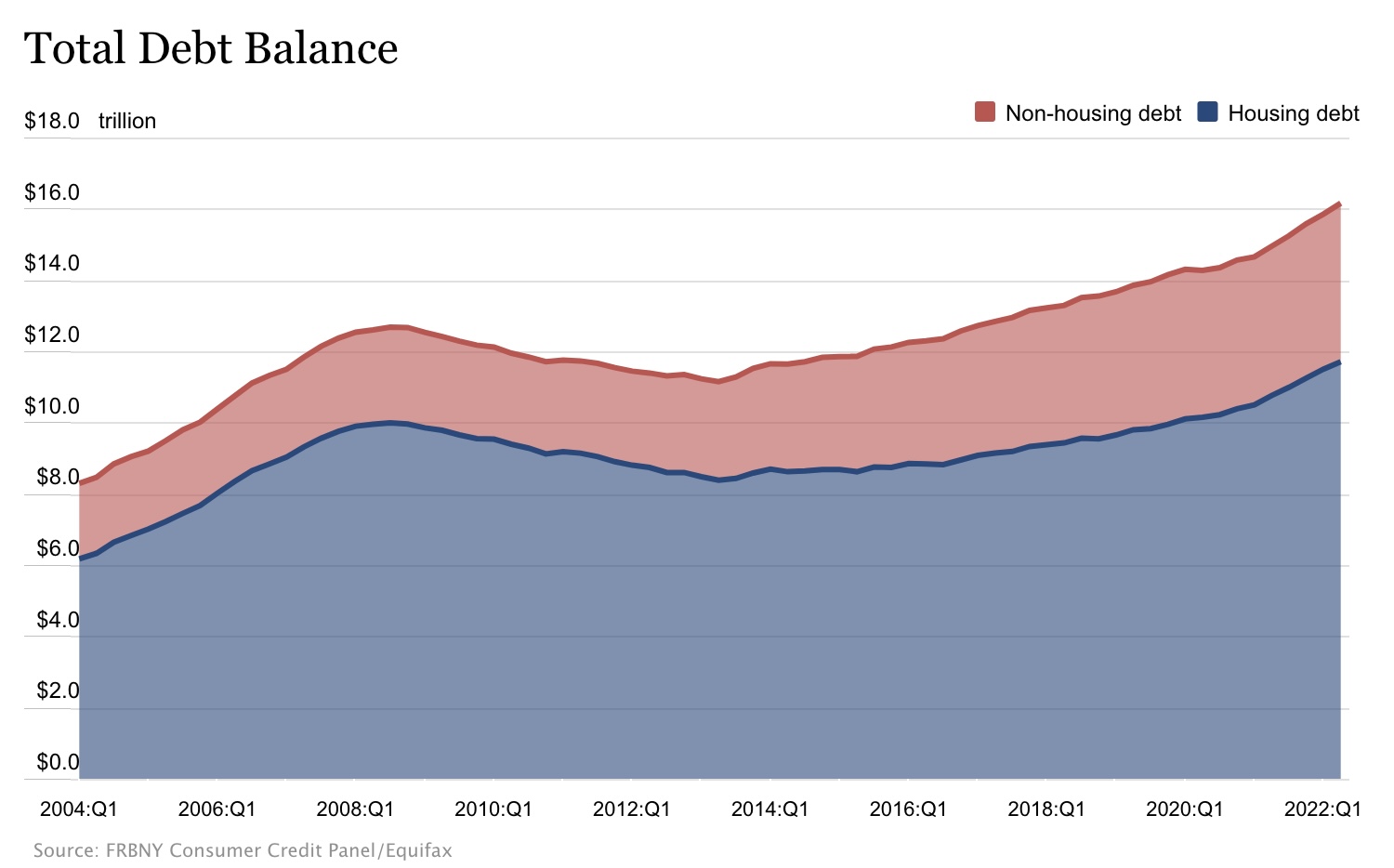

As a result of the economical doldrums, FedEx stated it had been intending to take measures such as the closure of 90 locations through the finish of the season. What’s promising: Americans are extremely saddled with debt that it is unlikely these were intending to visit any one of individuals locations anyway. Personal debt hit $16.15 trillion throughout the second quarter of 2022 — a brand new record — the Fed Bank of recent You are able to noted within an August report. The amount comes down to a bit more than $48,000 for each man, lady and child within the U . s . States — 330 million in most.

Having a national median earnings of $31,000, that means a typical debt-to-earnings ratio of 154%. If you wish to element in a bit more than $30 trillion indebted held by the us government, you can include another $93,000 per person — for as many as $141,000 along with a debt-to-earnings ratio of 454%. (The figures clearly deteriorate should you take into account the truth that just 133 million Americans enjoyed full-time employment by August.)

While policymakers may be indifferent about government debt, they’re more worried about personal debt. “I’m telling the United states citizens that we are getting charge of inflation,” President Joe Biden stated inside a CBS interview on Sunday, prompting observers to question whether he was trying to preempt this week’s Fed announcement of the potentially enormous, 100 basis point rate hike within the federal rate of interest. This type of move may likely send markets right into a tailspin that they’d not recover for a while.

Ironically, even that move may not be enough to tame inflation soon. Thinking about the rapid increase in debt, possibly it’s no shocker that inflation — up a bit more than 8% in August year-over-year — has proven couple of indications of abating. Americans might not have much cash left, but — generally — that reality hasn’t tamped lower demand. When the New You are able to Fed’s report was any indicator, the money backing that demand is originating from credit. The financial institution noted that charge card debt within the second quarter experienced the biggest year-over-year percentage rise in greater than twenty years.

Related: What’s going to cryptocurrency market seem like in 2027? Listed here are 5 predictions

Within lies the rub. Regardless of how rapidly the feds proceed to disincentivize debt, it’s not obvious when asset prices will rise. High debt levels — which already exist — mean less cash for purchasing things. Growing the price of debt service, because the Fed is trying to do, means less cash for purchasing things. Forcing Americans right into a condition of monetary ruination to be able to bring costs lower means less cash for purchasing things. Neglecting to control inflation and allowing the price of fundamental products or services to carry on rising — exacerbated, obviously, by a power crisis in Europe that financial managers haven’t much control — means less cash for purchasing other things.

Maybe this outlook is equivalent to the main one Elon Musk showed up at as he stated in June he were built with a “super bad feeling” concerning the economy. Other observers have issued even more dark takes, such as the famously debt-averse Wealthy Father, Poor Father author Robert Kiyosaki. “Biggest Bubble Bust coming,” Kiyosaki wrote on Twitter in April. “Baby Boomer’s retirements to become stolen. $10 trillion in fake money spending ending. Government, Wall Street & Given are thieves. Hyper-inflation Depression here. Buy gold, silver, Bitcoin prior to the coyote awakens.”

WIley COYOTE moment coming. Greatest Bubble Bust coming. Baby Boomer’s retirements to become stolen. $10 trillion in fake money spending ending. Government, Wall Street & Given are thieves. Hyper-inflation Depression here. Buy gold, silver, Bitcoin prior to the coyote awakens. Be mindful

— therealkiyosaki (@theRealKiyosaki) April 16, 2022

Admittedly, Kiyosaki’s assessment is partly at odds using the outcomes that pessimists might expect. Economic calamity should lead to declining asset prices overall — including prices for gold, silver and Bitcoin. A far more positive forecaster might hope that Americans will become familiar with using their mistakes, go ahead and take the coming year to pay for their financial obligations, and resume spending big in 2024 — while staying away from a hyper-inflationary depression.

Either in scenario, one factor appears relatively certain: Neither crypto nor every other asset class is around the edge of the record-breaking surge. If you wish to prosper through investing around ahead, you’d better start finding out how to buy short options from less market-savvy optimists.

Rudy Takala may be the opinion editor at Cointelegraph. He formerly labored being an editor or reporter in newsrooms which include Fox News, The Hill and also the Washington Examiner. He holds a master’s degree in political communication from American College in Washington, Electricity.

This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations. The views, ideas, and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.