The insurance coverage industry includes a lengthy good reputation for supplying vital support for major leaps in innovation. It’s no coincidence the modern insurance industry and also the industrial revolution came about in parallel. Indeed, it’s been convincingly contended the invention of fireside and property insurance — as a result of the truly amazing Fire based in london — lubricated the gears of capital investment that powered the commercial revolution and it is likely exactly why it began working in london. Using that first and every subsequent technological revolution, insurance has offered innovators and investors a security internet and offered being an outdoors, objective validator of risk — therefore serving as an origin of both encouragement and also the security required to with confidence make sure break barriers.

Today, we’re in the middle of a brand new digital financial revolution, and also the situation with this new technologies are obvious and compelling. The current White-colored House executive order on “Ensuring Responsible Growth and development of Digital Assets” further underscored this and it was a watershed moment for that industry, elevating the discussion around the significance of we’ve got the technology towards the national stage and acknowledging its importance towards the U . s . States strategy, interests and global competitiveness.

The possible lack of crypto insurance

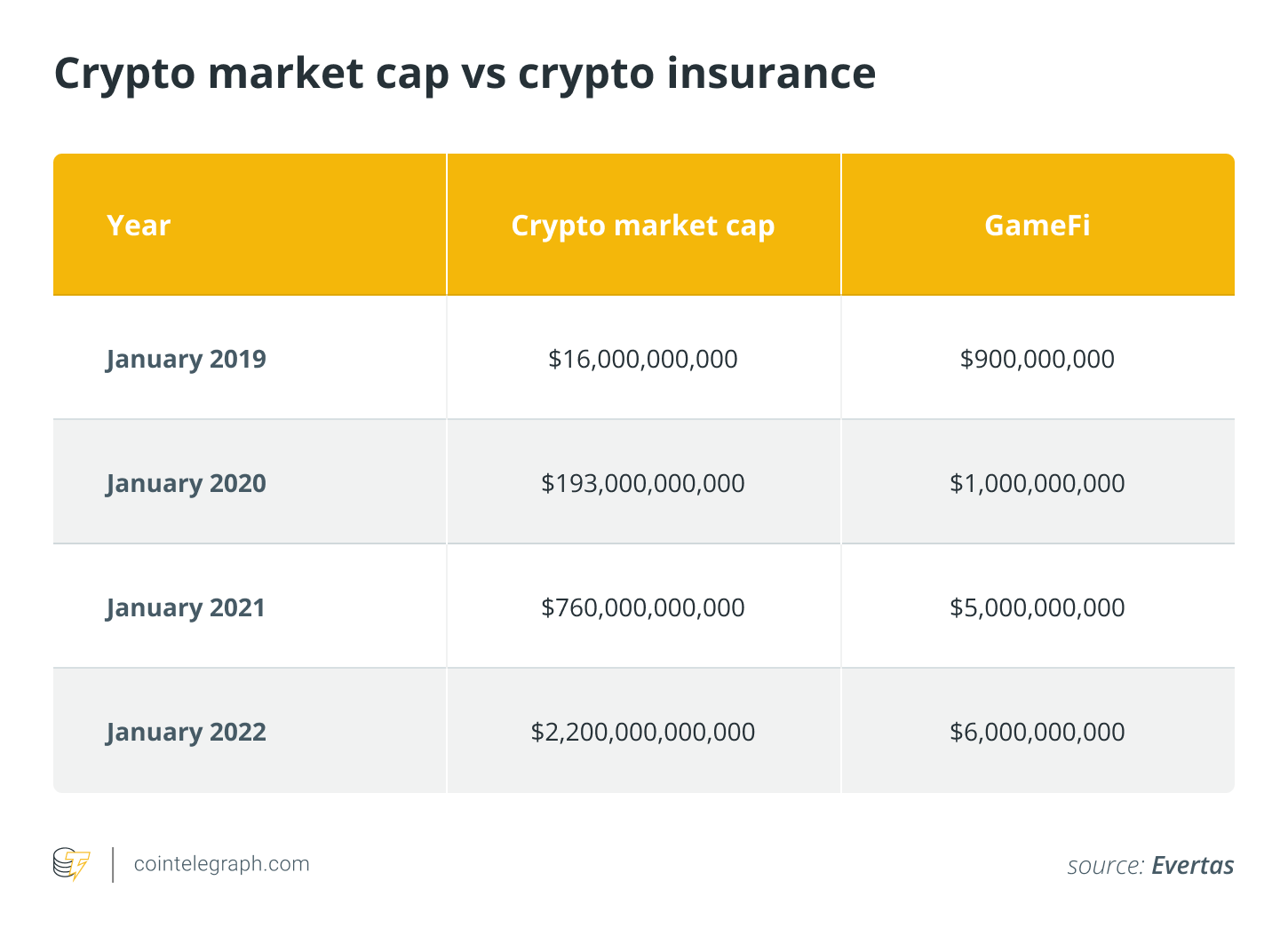

Yet, thinking about current crypto insurance capacity is believed to become about $6 billion — a stop by the bucket to have an asset class having a roughly $2-trillion market capital — it’s obvious the insurance market is failing to maintain and play its vital role.

This striking insufficient insurance protection for digital assets was particularly referenced in December’s House Financial Services Committee proceedings around the condition from the market. If this should condition of matters persist, it will so at the chance of impeding future growth and adoption.

Why have traditional insurers prevented entering this space regardless of the apparent need and chance?

Related: The significant shift from Bitcoin maximalism to Bitcoin realism

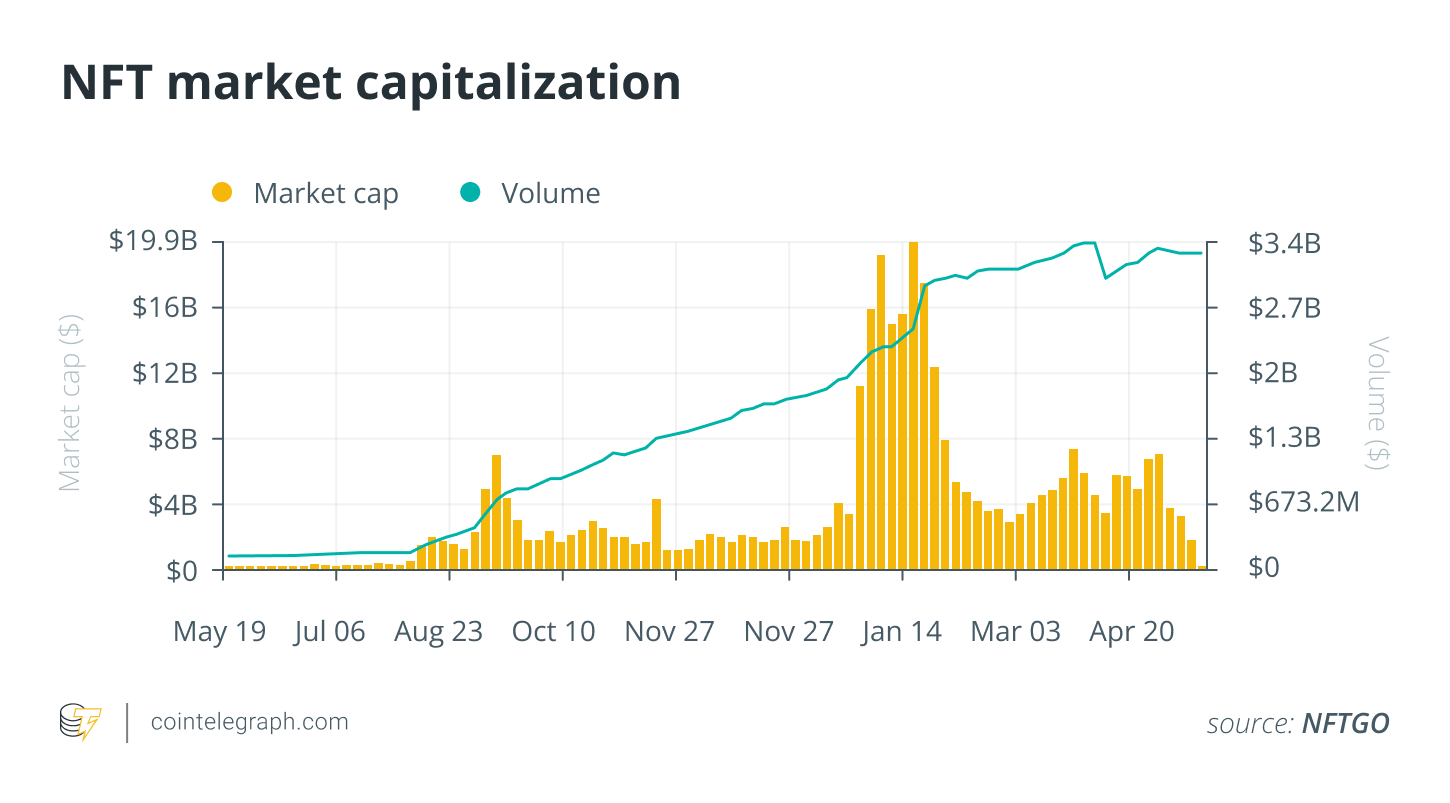

Traditional insurers face several fundamental impediments in answering the brand new risk class presented by crypto. Probably the most fundamental could well be too little knowledge of this frequently counterproductive technology. Even if your technical understanding exists, challenges for example correctly classifying new and nuanced risk types — e.g., individuals connected with hot, cold and warm wallets and just how myriad technology, business and operational factors bear upon all these — remain. The issue is further compounded by rapid change in the market, possibly best exemplified through the apparently overnight emergence of recent and from time to time confounding risk classes, for example nonfungible tokens (NFT).

Not to mention, many insurers continue to be licking their wounds inflicted by their hurry to create cybersecurity policies in early us dot-com days without fully understanding individuals risks and also the enormous losses that often resulted.

Meanwhile, according to Chainalysis, about $3.2 billion in crypto was stolen in 2021. Even without the risk minimization options, time is sufficient to give any responsible lender thinking about real participation within this space serious acid reflux. In comparison, U.S. banks generally lose under $15 million to fiat robberies every year. One good reason why bank robberies are extremely rare and unproductive (having a success rate of just about 20% while netting the perpetrator typically just around $4,000 per incident) is the fact that to be able to operate, most U.S. banks must be eligible for a blanket bond insurance, which requires safety measures made to limit these losses. In this manner, insurance not just manages the chance of losses because of robbery but creates an atmosphere by which individuals losses tend to be less inclined to occur, to start with.

Related: In defense of crypto: Why digital currencies deserve a much better status

The requirement for crypto insurance

Exactly the same pertains to insurance against losing crypto assets. The products kept in insured wallets are not only seen protected but they are much less inclined to be lost, to start with, because the underwriting process imposes such an advanced of multidisciplinary expert scrutiny and compliance needs.

The requirement for and advantage of crypto asset insurance coverage is apparent. But because of the conditions, it’s obvious that traditional insurance coverage is unlikely to step-up to resolve the crypto asset risk problem on the reasonable timeline. Rather, the answer will have to result from within. We want crypto-native solutions tailored towards the industry’s needs, using the versatility to pay for the entire spectrum of crypto asset risks, services and products, including NFTs, decentralized finance protocols, and infrastructure.

The benefits of home-grown risk solutions are manifold.

Mainly, dedicated crypto insurance providers possess greater industry understanding and expertise, enabling greater quality coverage, which, consequently, means greater safety and security for that crypto industry in general. With all this degree of understanding, crypto-native insurance agencies could craft risk minimization products using the versatility to satisfy the initial and quickly altering needs of the profession. Then, once in position, these lenders could expand insurance capacity around the order of trillions of dollars by working together with the standard insurance market. Finally, a passionate crypto insurance sector will better meet legal and regulatory needs, making certain that the possible lack of insurance doesn’t stall adoption or even the development of crypto.

Considering all of this, what’s keeping crypto-native insurance solutions from walking as much as solve the issue?

Ironically, within the situation of crypto asset insurance, the is overwhelmingly selecting to direct its investment sources in direction of the crypto projects whose future viability is going to be negatively influenced by the possible lack of insurance capacity caused by the possible lack of purchase of that space.

That we’re in the middle of a brand new technological revolution is indisputable. So, too, is always that insurance has performed an important role in assisting past technological revolutions meet their full potential. The ultimate insufficient crypto asset risk protection in position today is unsustainable and poses an unacceptable threat. It is essential that the crypto community recognize the risk resulting from the established order using its severe insufficient crypto asset insurance options.

The good thing is we’ve got to this point by solving apparently impossible technological and economic problems ourselves, so we believe are going to it again.

This short article was co-created by Sofia Arend and J. Gdanski.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Sofia Arend presently may be the communications and content lead in the Global Blockchain Business Council (GBBC). Just before joining the GBBC, Sofia labored for that Atlantic Council, a high 10 global think tank for defense and national security. Sofia received her Bachelor of Arts in Worldwide Relations and Global Studies rich in honors in the College of Texas at Austin, where she competed being an NCAA Division-I-employed rower.

J. Gdanski is really a privacy, security and risk-management expert, a vital leader within the enterprise blockchain space and also the Chief executive officer and founding father of Evertas — the very first company focused on insurance of crypto assets and blockchain systems.