Welcome readers, and thank you for subscribing! The Altcoin Roundup e-newsletter has become created by Cointelegraph’s resident e-newsletter author Big Smokey. Within the next couple of days, this e-newsletter is going to be renamed Crypto Market Musings, an every week e-newsletter that gives ahead-of-the-curve analysis and tracks emerging trends within the crypto market.

The publication date from the e-newsletter will stay the same, and also the content will still convey a heavy focus on the technical and fundamental analysis of cryptocurrencies from the more macro perspective to be able to identify key shifts in investor sentiment and market structure. Hopefully you like it!

DeFi includes a problem, pump and dumps

Once the bull market was under way, purchasing decentralized finance (DeFi) tokens was like shooting fish inside a barrel, however that inflows towards the sector pale as compared to the market’s heyday, it’s more difficult to recognize good trades within the space.

Throughout the DeFi summer time, protocols could lure liquidity providers by providing three- to four-digit yields and mechanisms like liquid staking, lending via asset collateralization and token rewards for staking. The large issue was a number of these reward choices were unsustainable, and emissions from some protocols brought liquidity providers to auto-dump their rewards, creating constant sell pressure on the token’s cost.

Total value locked (TVL) wars were also faced by DeFi protocols, which in fact had to constantly vie for investor capital to be able to maintain the amount of “users” prepared to lock their inside the protocol. This produced a predicament where mercenary capital from whales along with other cash-flush investors basically airdropped funds to platforms providing the greatest APY rewards for a while of your time, before eventually dumping rewards on view market and shifting an investment funds towards the greener pastures.

For platforms that guaranteed series funding from vc’s, exactly the same kind of activity required place. VCs pledge funds in return for tokens, which entities live in the ranks from the largest tokenholders within the best liquidity pools. The looming threat of token unlocks from early investors, high reward emissions and also the steady auto-dumping of stated rewards brought to constant sell pressure and clearly was when it comes to any investor deciding to create a lengthy investment according to fundamental analysis.

Combined, all these scenarios produced a vicious circle where protocol TVL and also the platform’s native token would essentially launch, pump, dump after which put on obscurity.

Rinse, wash, repeat.

So, how do you really look past the candlepower unit chart to find out if a DeFi platform may be worth “investing” in?

Let’s have a look.

Can there be revenue?

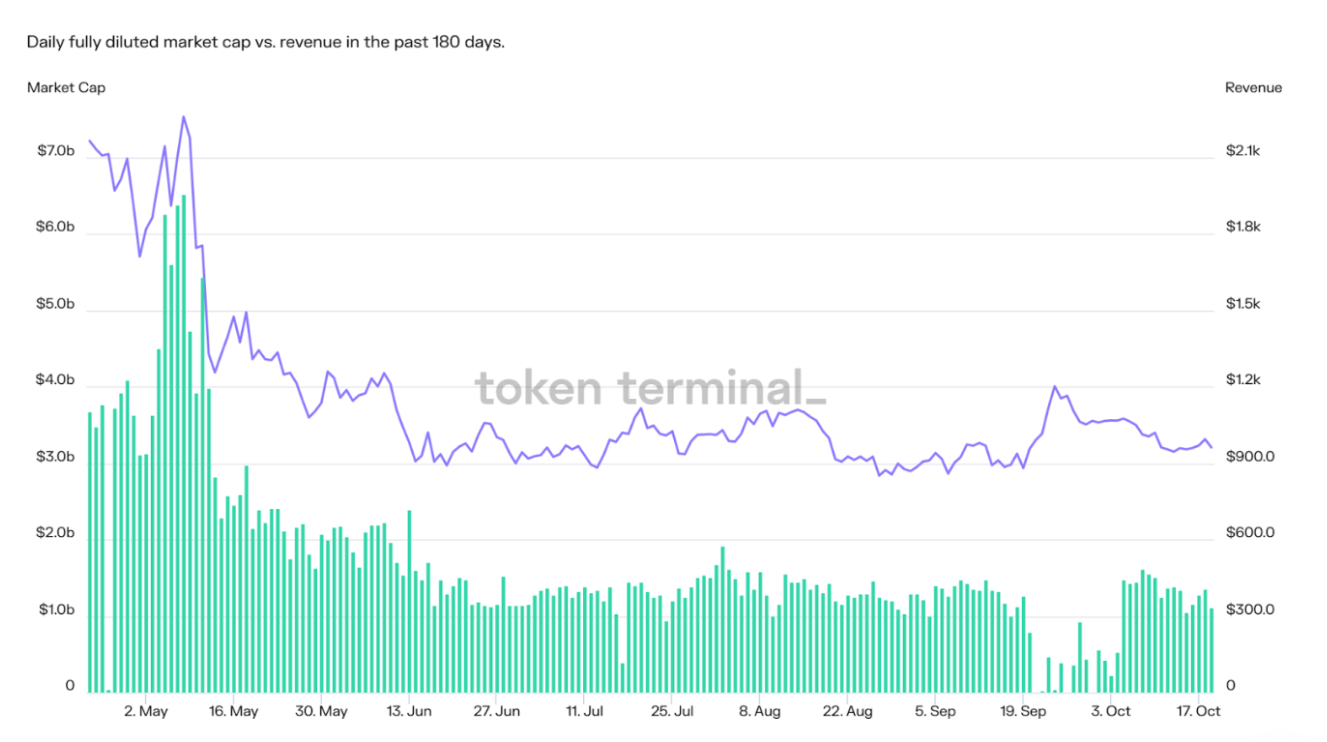

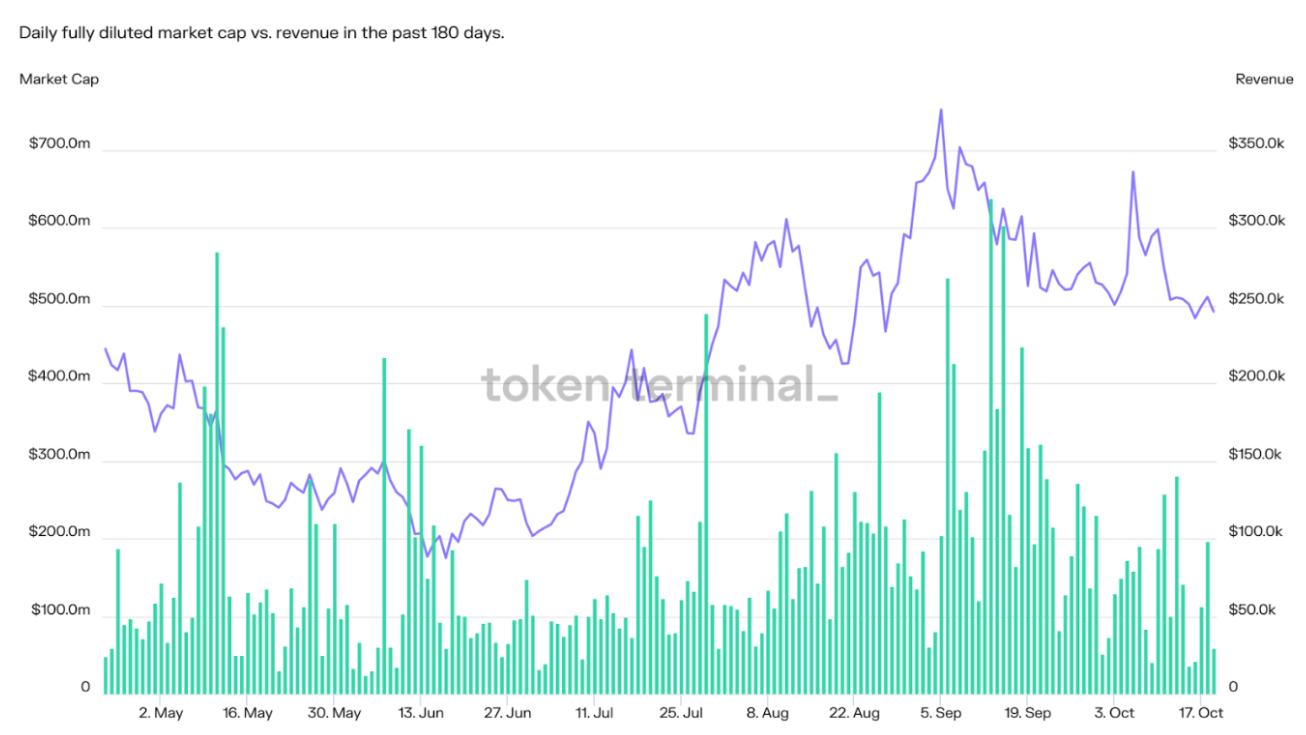

Listed here are two charts.

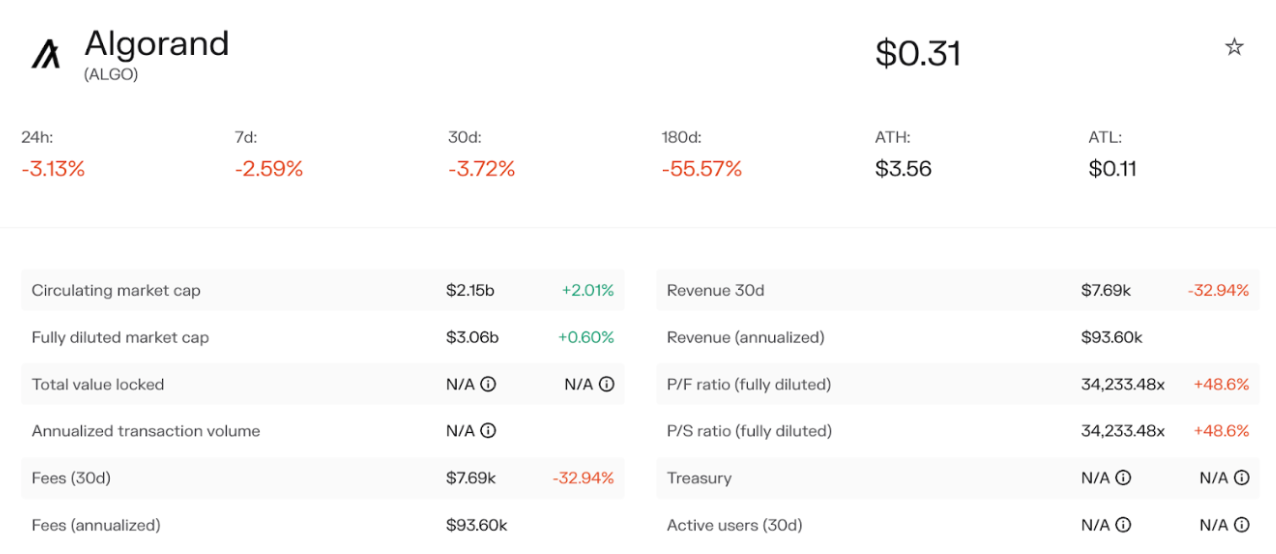

Yes, the first is rising and yet another goes lower (LOL). Obviously, that’s the very first factor investors search for, but there’s more. Within the first chart, you will observe that Algorand (ALGO) includes a $2.15-billion circulating market cap along with a fully diluted market cap of $3.06 billion. Yet its 30-day revenue and annualized revenue are $7,690 and $93,600, correspondingly. Eye-raising, is it not?

Circling to the very first chart, we are able to observe that while keeping a $2.15-billion circulating market cap and supporting a large ecosystem of varied decentralized applications (DApps), Algorand only were able to produce $336 in revenue on March. 19.

Unless of course there’s a problem using the data or some metrics associated with Algorand and it is ecosystem aren’t taken by Token Terminal, this really is shocking. Searching in the chart legend, you will also note there are no token incentives or supply-side charges given to liquidity providers and token stakers.

Related: 3 emerging crypto trends to keep close track of while Bitcoin cost consolidates

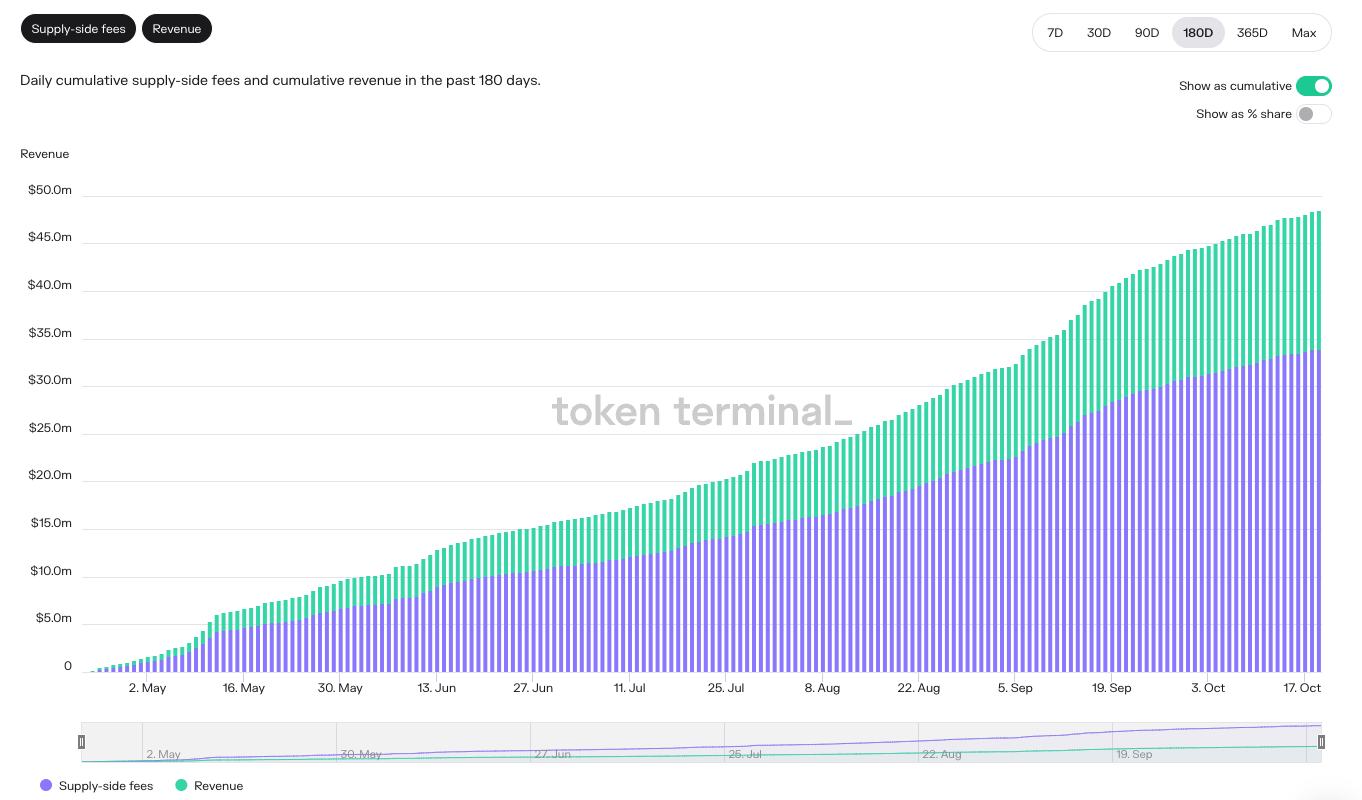

GMX, however, informs another story. While keeping a circulating market cap of $272 million as well as an annualized revenue of $28.92 million, GMX’s cumulative supply-side charges have continuously elevated towards the tune of $33.9 million since April 24, 2022. Supply-side charges represent the proportion of charges which go to providers, including liquidity providers.

Issuance and inflation

Before buying a DeFi project, it’s wise to have a look in the token’s total supply, circulating supply, inflation rate and issuance rate. These metrics measure the number of tokens are presently circulating on the market and also the forecasted increase (issuance) of tokens in circulation. With regards to DeFi tokens and altcoins, dilution is one thing that investors should concern yourself with, therefore, the allure of Bitcoin’s (BTC) supply cap and occasional inflation.

As proven below, when compared with BTC, ALGO’s inflation rate and forecasted total supply are high. ALGO’s total supply is limited to 10 billion, with data showing 7 billion tokens in circulation today, but because of the current revenue produced by charges and also the amount distributed to tokenholders, the availability cap and inflation rate don’t inspire much confidence.

Before you take up a situation in ALGO, investors need to look for additional growth and daily active users of Algorand’s DApp ecosystem, there clearly must be an uptick in charges and revenue.

Active addresses and daily active users

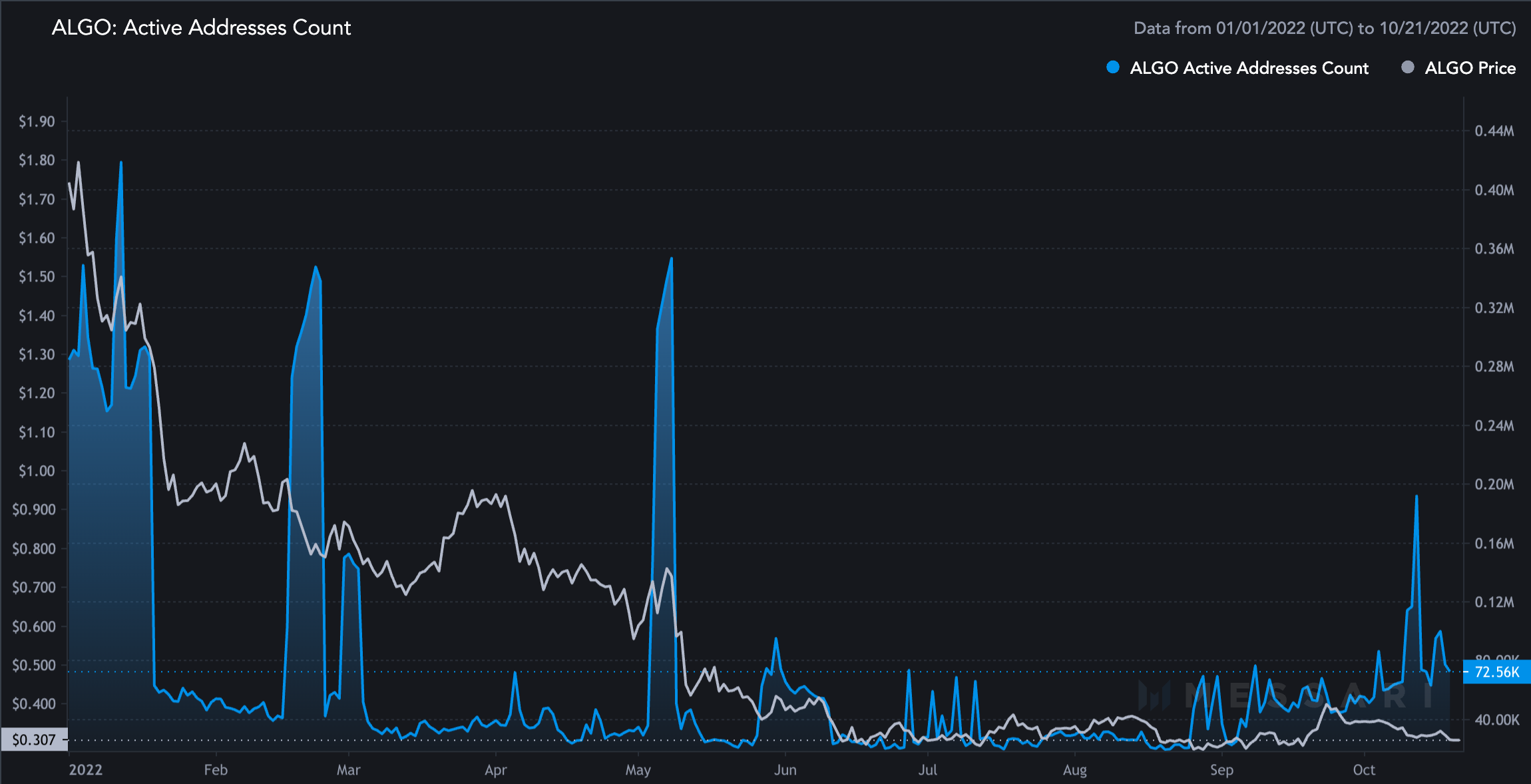

Whether revenues are low or high, two other important metrics to check on are active addresses and daily active users when the information is available. Algorand includes a multi-billion-dollar market cap along with a 10-billion ALGO max supply, but low annual revenue and couple of token incentives present the issue of if the ecosystem’s growth is anemic.

Viewing the chart below, we are able to observe that ALGO active addresses are rising, but generally, the development is flat, and active address spikes seem to follow cost surges then sell-offs. By March. 14, there have been 72,624 active addresses on Algorand.

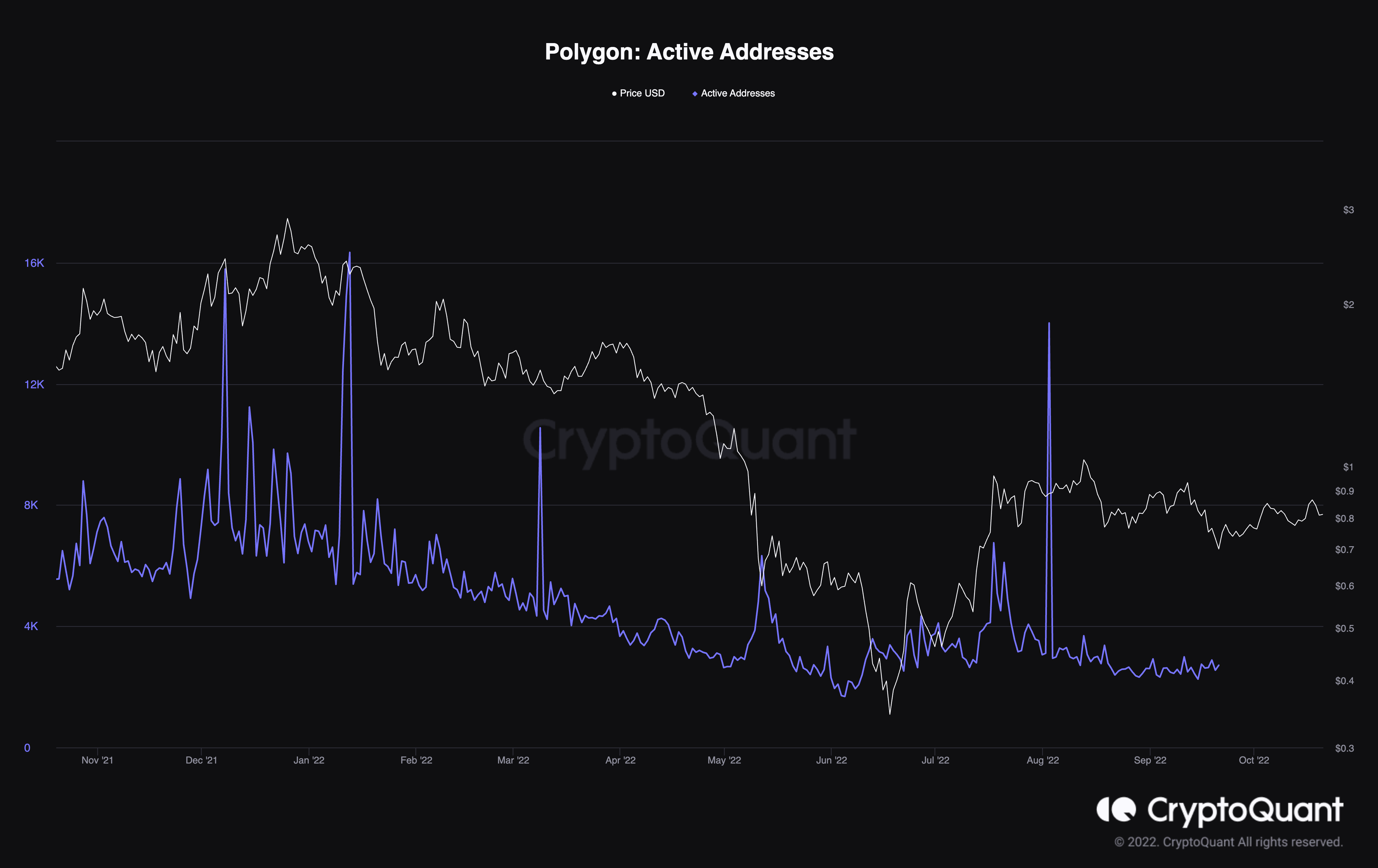

Like the majority of DeFi protocols, the Polygon network has additionally seen a stable loss of daily active users and MATIC’s cost. Data from CryptoQuant shows 2,714 active addresses, which pales as compared to the 16,821 seen on May 17, 2021.

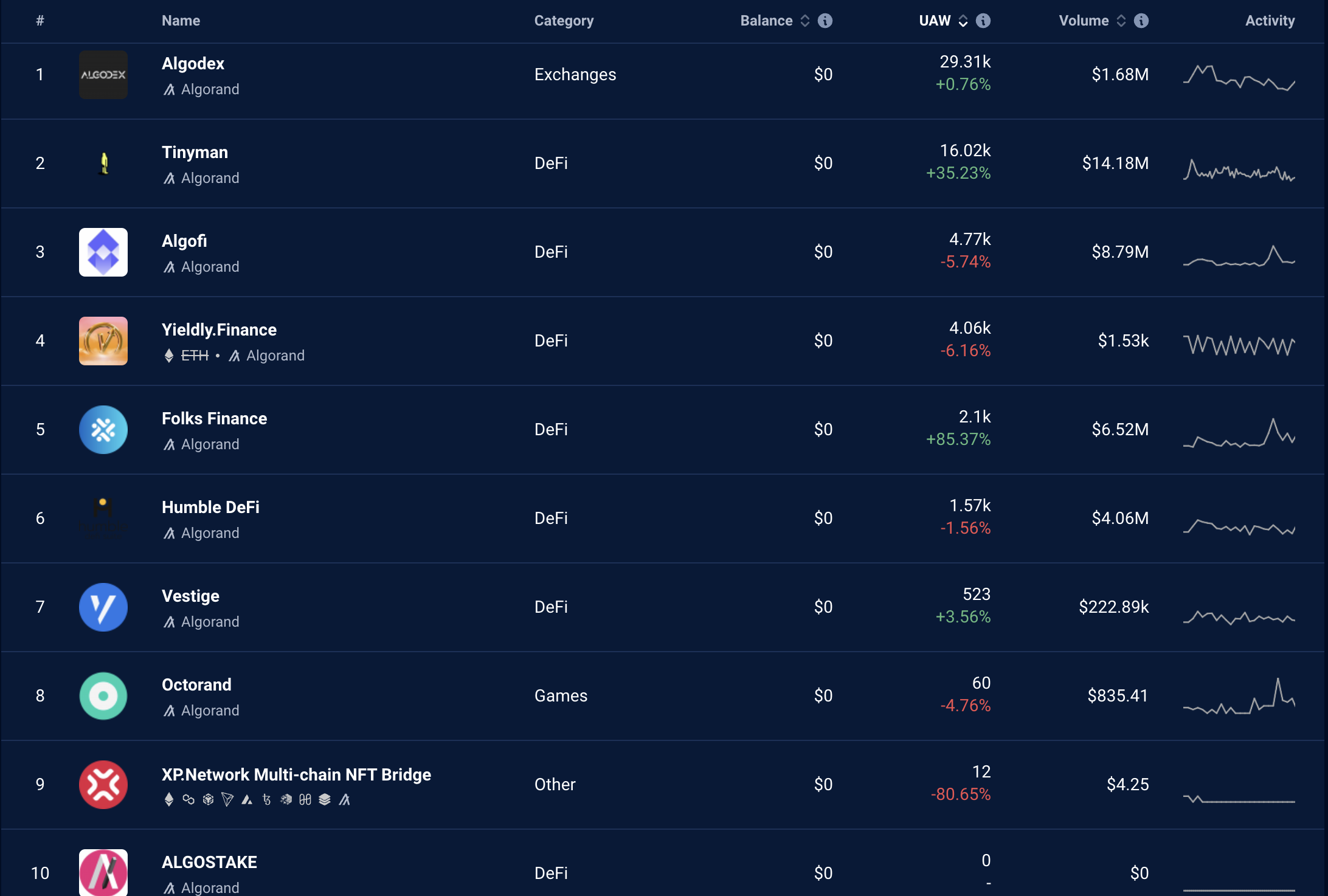

Still, regardless of the decline, data from DappRadar shows a large amount of user activity and volume spread across various Polygon DApps.

Exactly the same can’t be stated for that DApps on Algorand.

At this time, the crypto marketplace is inside a bear market, which complicates buying and selling for many investors. Right now, investors should most likely take a seat on their hands rather of taking hug-and-a-prayer moon shots at each small breakout that happens to be bull traps.

Investors may be better offered just by located on their hands and tracking the information to determine when new trends emerge, then searching much deeper in to the fundamentals that may back the sustainability from the new trend.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.